Hormonal Contraceptives Market Size Analysis:

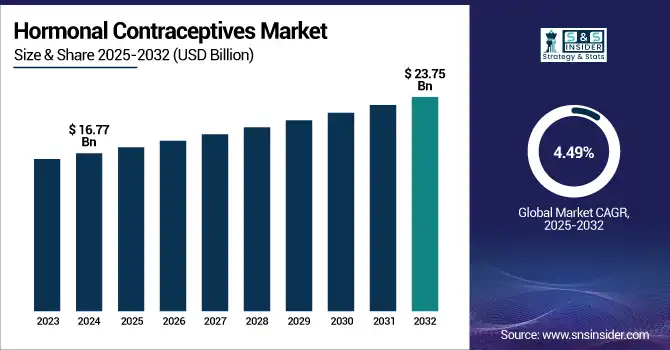

The Hormonal Contraceptives Market size was valued at USD 16.77 billion in 2024 and is expected to reach USD 23.75 billion by 2032, growing at a CAGR of 4.49% over the forecast period of 2025-2032.

The global hormonal contraceptives market has been growing steadily, fueled by increasing awareness towards reproductive health, improving female workforce participation, and support from government services toward family planning. The adoption is being propelled by advancements in delivery methods low-dose patches, implants, hormone-free alternatives, etc.

To Get more information on Hormonal Contraceptives Market - Request Free Sample Report

The U.S. Hormonal Contraceptives Market size was valued at USD 6.75 billion in 2024 and is expected to reach USD 9.24 billion by 2032, growing at a CAGR of 4.03% over the forecast period of 2025-2032. The North American hormonal contraceptives market is dominated by the U.S. owing to high awareness regarding reproductive health, easy access to insurance, and access to health services. Its dominance is further justified by the key pharmaceutical firms afoot with constant innovation in the birth control methods.

Hormonal Contraceptives Market Dynamics:

Drivers

-

Increasing Awareness of Family Planning is Driving the Market Growth

There has been a notable increase in awareness programs and health campaigns that educate the population about reproductive health and family planning in the past few years. This experience provides insights to women and couples for understanding the advantage of spacing/limiting pregnancies through contraception, thereby helping to improve maternal and child health indicators. The global rise of hormone-based contraceptives can be attributed to improved media, healthcare providers, and community program access to information, giving women the power to choose their contraception.

An estimated 82% of women aged 18-49 in the U.S. used a contraceptive method in the past 12 months, and oral contraceptives are one of the most widely used contraceptive methods.

Almost 39% of women of reproductive age said they had seen social media posts about birth control in the past year, showing how family planning has remained more front-of-mind, as well.

-

Technological advancements in contraceptive methods are fuelling the market growth.

Hormonal contraceptives have been made safer, more convenient, and more effective through technological innovation. Alternative delivery methods, including low-dose patches, long-acting implants, rings, and non-hormonal methods, have minimized adverse effects and improved adherence. These innovations appeal to different preferences and lifestyles and should make contraception palatable and available to a wider population. Ongoing R&D improves formulators with lesser hormonal doses integrated into affected individuals, lowers its health hazard, and further attracts additional users. This continuous innovation is largely driving the market growth.

Australia's Therapeutic Goods Administration has approved the use of the Mirena intrauterine device up to eight years, following evidence that the device is effective beyond the initial five-year window.

Adam works as a non-hormonal male contraceptive implant and has already been proven to effectively work for at least two years in clinical trials. The implant is reversible, making it a viable substitute for traditional (male) contraceptives.

Restraint

-

Side Effects and Health Concerns are Restraining the Market from Growing.

The hormonal contraceptives market is also challenged by the side effects and health risks associated with the usage of hormonal contraception, which is among the primary factors affecting the growth of the hormonal contraceptives market. Hormonal contraceptives (such as pills, patches, and implants) can have side effects that include nausea, headaches, weight gain, mood swings, and irregular bleeding. Other serious but rarer risks include thrombosis, hypertension, cardiovascular issues, and stroke, particularly in women who smoke or those who have underlying medical issues. Because of these potential negative side effects, some women are reluctant to begin or continue hormonal contraception. Other users look for other non-hormonal alternatives as they are worried about the long-term safety, which also restricts significant market uptake. Hormonal contraceptives, while safe and effective, require a detailed history to assess risk factors, sometimes even contraindications, which may slow the uptake of contraception.

Hormonal Contraceptives Market Segmentation Analysis:

By Product

The pills segment dominated the hormonal contraceptives market in 2024 with a 48.7% market share. Due to its longer standing, extensive availability, and convenience in usage, Oral contraceptive pills are the first choice in a general practice; some even have high awareness and acceptance of these in reproductive-aged women. Both retail and hospital pharmacy accessibility, coupled with demand-side coverage offered by health insurance in developed regions, all contribute to a further increase in adoption. Pills have the leading share in the market, as their varying combinations and dosing options also allow for a broad range of user types.

The fastest growing segment during the forecast period is anticipated to be hormonal implants due to the long-lasting effects of the product, which have minimal user intervention and maximal compliance. While the daily pill necessitates regular monitoring, the implants offer easily installed, multi-year contraception, making them perfect for women searching for a low-maintenance and highly effective contraceptive. An increase in public health campaigns supporting adoption of the technology, increasing availability in emerging markets, and recommendations from global health organizations are increasing their adoption. The hormonal implant is anticipated to experience the most growth as awareness increases and access expands in low–and middle-income countries.

By Contraceptive Hormone

The combined hormone contraceptives segment led the hormonal contraceptives market in 2024 with a 74.56% market share, owing to their wide clinical acceptability, double hormonal effect, and broad application of different delivery forms such as pills, patches, and vaginal ring. These contraceptives are combination pills (estrogen + progestin) and provide excellent cycle control and relief of many menstrual-associated symptoms, features which many users of the pill find highly desirable. This segment also accounts for the bulk of the market, due to the availability of a large number of branded and generic segments, patient and physician preference, as well as long-term familiarity with the product type, particularly in developed markets such as North America and Western Europe with high access to healthcare facilities.

Progestin-Only segment anticipated to register the fastest growth during the forecast period, owing to rising preference for estrogen-free alternatives among women unable to tolerate estrogen, as well as those who also have associated health risks such as high blood pressure or past incidence of blood clots. Progestin-only birth control—pills, injections, and implants—are another option, as they are also favored while breastfeeding and for women looking for long-term, low-maintenance birth control. Global growth for this segment continues to be further propelled by expanding clinical recommendations, more widespread product availability, and increased uptake in lower-resource settings.

In March 2024, the US FDA greenlit over-the-counter sales of the progestin-only pill called Opill, in a landmark move for contraceptive availability.

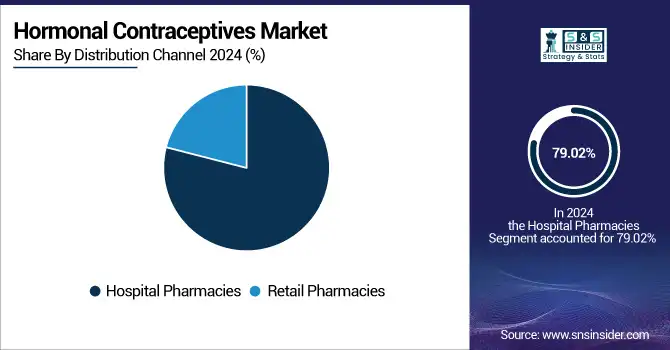

By Distribution Channel

The hormonal contraceptives market was dominated by the hospital pharmacies segment in 2024, with a 79.02% market share due to the authenticity of hospital-based prescribing and dispensing for first-time users, along with long-acting reversible contraceptives such as implants and IUDs. Family planning services are often provided at hospitals, which can be a first point of care for diagnosis, counselling, and prescription. Moreover, in many countries, contraceptives are subsidized or covered 100% in a hospital setting within the framework of the public health scheme, which also increases the availability of the methods and increases adherence in patients who have been prescribed a method.

The retail pharmacies segment is expected to be the fastest growing during the forecast period due to the promise of increased convenience, wider over-the-counter (OTC) availability in some areas, and growing use of telemedicine and online pharmacy services. With the increased knowledge of all forms of contraception, along with reduced stigma regarding the purchasing of birth control, women are utilizing a retail pharmacy to obtain pills, patches, and emergency contraceptives in a timely fashion. This distribution channel is rapidly growing, driven by the major expansion of pharmacy networks in both urban and semi-urban areas, coupled with supporting regulations for easier access.

Regional Insights:

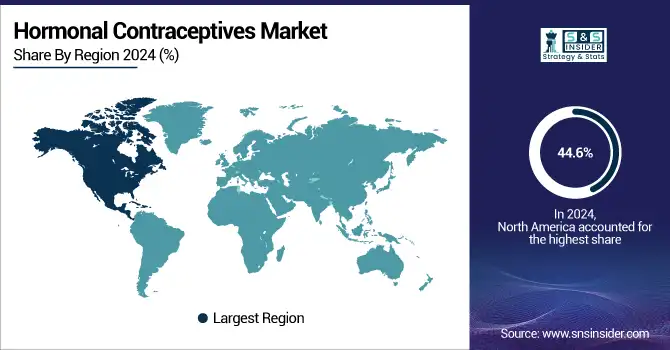

North America dominated the hormonal contraceptives market with a 44.6% market share due to high awareness and knowledge regarding reproductive health, and well-established healthcare infrastructure, and many options available in the market. The provision of government-funded programs, insurance reimbursement policies, and access to different types of hormonal contraceptives available through hospital and retail pharmacies are major factors contributing to the region leading the charge. In addition, the presence of established pharmaceutical companies and frequent product innovation (e.g., low-dose and long-acting reversible contraceptives) continues to strengthen North America as the major region in the global contraceptive market.

The hormonal contraceptives market in Asia Pacific is anticipated to grow at the fastest rate, due to the high geriatric population in the region, the greater demand for parenting decision-making, improved disposability of suburban living and increasing family income, and growing urbanization. The economic development of countries, such as India and China, wherever directly contributed to the easy availability of health care facilities and contraceptive products. In addition, conducive government initiatives, increasing healthcare infrastructure are boosting adoption rates by NGOs for reproductive health. In addition, changing cultural attitudes towards contraception, coupled with more affordable generic options, are providing significant market growth opportunities for the region.

The hormonal contraceptives market is growing significantly in Europe due to the affordable healthcare policy, growing awareness towards reproductive health, and rising demand for modern contraceptive methods. Governments are implementing initiatives to improve contraceptive access. For instance, in January 2023, a law was passed in Luxembourg to make the contraceptive pill, as well as all other methods of hormonal contraception - such as patches and vaginal rings - free of charge up to the age of 25 and reimbursed by the National Health Fund (CNS). Also, the adoption rates and governmental support for family planning plans in the various European countries, including Germany, France, and the United Kingdom, are pushing the growth.

Technology advances, with higher research and development investment, are also driving the growth of the market. Bayer has announced the opening of a new manufacturing facility in Finland to increase production capacity for long-acting reversible contraceptives (LARCs) that include hormonal IUDs and implants, for which it recently invested USD 267.5 million (Euro 250 million) in September 2023 Additionally, the increasing incidence of STDs and unplanned pregnancies in the region drives the demand for contraceptives, which in turn is propelling the market growth.

Latin America has moderate growth in the hormonal contraceptives market, as Latin America is undergoing an increasing awareness related to family planning, increasing adoption of family planning, and changing perception regarding contraception practices. In addition, the market is growing due to government initiatives to promote reproductive health and increasing cases of sexually transmitted infections (STIs). The key challenge is due to the cultural and societal barriers, fear of side effects, and expense of the neural implant at the initial development stage, and also the unavailability of local healthcare services in rural areas.

The hormonal contraceptives market in the Middle East and Africa (MEA) is also exhibiting moderate growth. The market is being accelerated by the growing awareness about family planning, governments promoting contraception, and a developing healthcare infrastructure. Nevertheless, cultural and /or religious customs, as well as limited access to health and medical services in some regions, can be barriers to market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hormonal Contraceptives Market Key Players

Bayer AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Organon & Co., Mylan N.V. (Viatris Inc.), Allergan (AbbVie Inc.), Johnson & Johnson Services Inc., Gedeon Richter Plc, Afaxys Inc., Cipla Limited, and other players.

Recent Developments in the Hormonal Contraceptives Market

-

May 2025 – A global health care company reported encouraging results of its Phase 3 clinical trial evaluating the contraceptive safety and efficacy of its investigational product, XULANE LO. The once-weekly, low-dose dermal patch provides 150 mcg of norelgestromin and 17.5 mcg of ethinyl estradiol per day and is intended for women of childbearing age. The findings affirm the product's potential to be both safe and effective as a hormonal contraceptive option.

-

February 2024 – Bayer announced a strategic partnership with US-based biotechnology company Daré Bioscience to develop a new, hormone-free monthly contraceptive. The product, a vaginal ring, provides up to three weeks of pregnancy protection without any user action during sex. This alliance is set to increase the array of contraception for women by adding a non-hormonal option.

Hormonal Contraceptives Market Report Scope:

Report Attributes Details Market Size in 2024 USD 16.77 Billion Market Size by 2032 USD 23.75 Billion CAGR CAGR of 4.49% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Pills, Skin Patches, Intrauterine Devices, Hormonal Implants, Vaginal Rings, Others)

• By Contraceptive Hormone (Progestin Only, Combined Hormone Contraceptives)

• By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Bayer AG, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Organon & Co., Mylan N.V. (Viatris Inc.), Allergan (AbbVie Inc.), Johnson & Johnson Services Inc., Gedeon Richter Plc, Afaxys Inc., Cipla Limited, and other players.