Health Insurance Exchange Market Size Analysis:

Get more information on Health Insurance Exchange Market - Request Sample Report

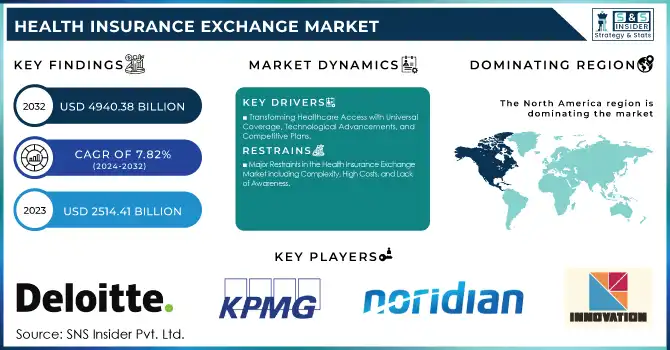

The Health Insurance Exchange Market size was valued at USD 2514.41 billion in 2023 and is expected to reach USD 4940.38 billion by 2032, growing at a CAGR of 7.82% over 2024-2032.

The health insurance exchange market is undergoing rapid transformation, driven by a convergence of policy support, technological advancements, and shifting consumer demands. These digital marketplaces simplify the process of purchasing health insurance by offering a transparent platform to compare plans, thereby empowering individuals, families, and small businesses to make informed decisions.

Government policies, particularly the Affordable Care Act (ACA) in the United States, have played a critical role in driving adoption. As of 2024, over 49.4 million Americans have gained coverage through ACA exchanges since their inception, with a record 20.8 million individuals enrolled in marketplace plans. Subsidies provided under the ACA have been pivotal, with approximately 89% of marketplace enrollees receiving financial assistance to offset premium costs.

Rising healthcare costs further underscore the importance of health insurance exchanges. Premiums for ACA marketplace plans are projected to increase by a median of 7% in 2025, driven by factors such as escalating prescription drug costs and hospital consolidation. Health insurance exchanges enable consumers to mitigate these costs by offering competitive plan options. For instance, more than 95% of exchange users have access to plans from three or more insurers, fostering competition and expanding choice.

The COVID-19 pandemic highlighted the critical role of these platforms in providing coverage to millions who lost employer-sponsored insurance. An estimated 12 million individuals transitioned to health insurance exchanges during the pandemic, showcasing their capacity to address sudden coverage gaps.

Technological advancements are reshaping the landscape, with artificial intelligence (AI) and data analytics improving risk assessment, fraud detection, and personalized plan recommendations. For example, several leading exchanges now employ AI-driven chatbots to guide users through enrollment, enhancing accessibility and user experience.

Increased competition among private insurers is another growth driver. The expansion of diverse plans tailored to consumer needs has made exchanges preferred for those seeking affordable and flexible insurance options. Initiatives to integrate digital tools, making exchanges more accessible to tech-savvy consumers, further support this trend.

Health Insurance Exchange Market Dynamics

Drivers

-

Transforming Healthcare Access with Universal Coverage, Technological Advancements, and Competitive Plans

One significant driver is the global push for universal health coverage. Policies like the U.S. Affordable Care Act (ACA) have been instrumental, in establishing state and federal marketplaces that have facilitated over 49.4 million enrollments since their launch in 2014. Similarly, countries such as Germany and Japan have implemented comparable systems with high participation rates, showcasing their success in broadening healthcare access.

Escalating healthcare costs and the growing prevalence of chronic illnesses are also raising awareness about the importance of comprehensive health insurance. According to the World Health Organization (WHO), chronic diseases account for 71% of global deaths annually, highlighting the critical need for insurance to support preventive care and treatment. This has particularly influenced younger demographics, with millennials representing nearly 40% of new enrollments in U.S. exchanges in 2024. Innovations like artificial intelligence (AI) and big data analytics have enhanced the efficiency and accessibility of health insurance exchanges. For example, AI-powered chatbots now guide users through the enrollment process, reducing errors by 25%, as reported by McKinsey in 2023.

Additionally, the growing competition among private insurers has led to a wider variety of affordable plans, giving consumers more choices. In the U.S., 95% of exchange users now have access to plans from three or more insurers. The increased adoption of mobile and online platforms has further improved accessibility, with 70% of enrollments in 2024 completed through digital channels, according to the Centers for Medicare & Medicaid Services (CMS).

Restraints

-

Major Restraints in the Health Insurance Exchange Market including Complexity, High Costs, and Lack of Awareness

The health insurance exchange market faces several challenges that limit its expansion. One major restraint is the complexity of the enrollment process, which can be daunting for consumers, especially those with limited digital skills. Despite advancements in technology, many users still struggle with navigating the platforms, leading to incomplete or incorrect applications. Another key issue is the high cost of premiums. Although subsidies are available, many consumers still find the premiums and out-of-pocket expenses to be unaffordable, especially in regions where there are fewer insurer options. This limited competition can result in higher prices for coverage.

The potential reduction or elimination of federal subsidies poses another concern. If subsidies under the Affordable Care Act (ACA) are reduced or phased out, millions of individuals could face significant increases in premiums, leading to a decline in enrollment. Additionally, a lack of awareness about the benefits of health insurance exchanges, particularly among low-income and marginalized groups, is hindering market growth. Many individuals are unaware of available financial assistance, which may prevent them from enrolling in plans that could significantly reduce their healthcare costs.

Health Insurance Exchange Market Segmentation Analysis

By Type

In 2023, Public Exchanges dominated the health insurance exchange market, holding a significant share due to the widespread implementation of government-driven platforms like the U.S. Affordable Care Act (ACA). These exchanges provide subsidized health insurance plans, offering essential access to affordable coverage, particularly for lower-income individuals and families. Public exchanges accounted for 75% of the market share in 2023. Their dominance is driven by strong government support, regulatory frameworks, and the focus on increasing access to healthcare. With continued emphasis on universal health coverage globally, public exchanges are expected to remain the dominant segment, playing a vital role in helping governments meet coverage goals.

Private Exchanges While Public Exchanges remained dominant, Private Exchanges emerged as the fastest-growing segment over the 2024-2032. Private exchanges are gaining traction, particularly among employers and private insurers, due to their ability to offer more customized and flexible healthcare plans. These exchanges cater to a higher-income demographic and allow for a broader range of plan options, appealing to consumers seeking more tailored solutions. This segment is expanding as more businesses leverage private exchanges to provide employees with affordable and personalized health coverage.

By Phase

In 2023, the Operations and Maintenance (O&M) phase led the market, accounting for 45% of the market share. This phase is essential for ensuring the smooth operation of health insurance exchanges, focusing on maintaining security, system updates, user support, and overall platform functionality. As exchanges continue to grow and evolve, the demand for reliable and consistent operations becomes more critical, making O&M a key segment for both public and private exchanges.

The Implementation/Exchange Infrastructure Delivery phase is experiencing the fastest growth throughout the forecast period, driven by the increasing need for scalable, secure, and efficient infrastructure to support the growing volume of users. As exchanges expand and adopt advanced technologies, including AI and big data, the need for a robust infrastructure to support these platforms is intensifying. This segment is rapidly gaining attention as governments and private organizations invest in modernizing and upgrading their exchange systems to handle larger datasets and improve the user experience.

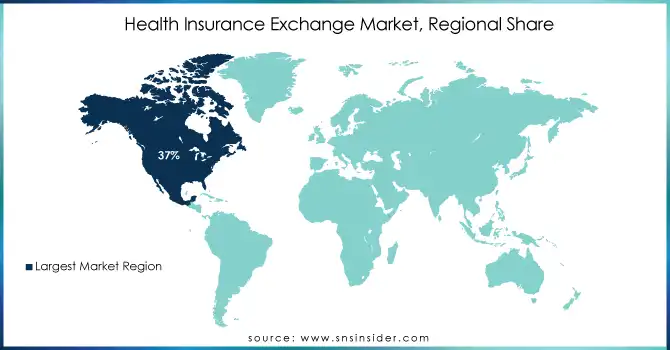

Regional Analysis

In 2023, the North American region led the health insurance exchange market with a 37% share, driven primarily by the United States, where the Affordable Care Act (ACA) has established a robust framework for both state and federal exchanges. The U.S. has seen over 49 million enrollments through public exchanges since the ACA's inception, reflecting the high adoption of subsidized health insurance plans. The expansion of Medicaid in many states has further boosted the market, contributing to its dominance in North America. Canada also shows significant interest in digital health platforms, although its health system is primarily publicly funded, leading to slower adoption of private exchanges.

In Europe, countries like Germany, France, and the UK have a growing market for private exchanges, with high levels of insurance penetration driven by universal healthcare models. The European Union’s regulations around healthcare insurance have stimulated the growth of digital and private exchanges, though public systems remain dominant in many countries. Germany, in particular, is witnessing a rise in the adoption of private exchanges due to reforms that encourage more flexible insurance models.

The Asia-Pacific region is the fastest-growing market, with countries like India, China, and Japan rapidly digitizing their health insurance systems. Government-backed public exchanges in these countries are expanding, aiming to provide coverage for a larger portion of their populations. In Japan, private exchanges are growing, especially for supplementary insurance plans.

Need any customization research on Health Insurance Exchange Market - Enquiry Now

Key Players

Technology and Consulting Companies

-

Innovation Inc.

-

Health Exchange Solutions, Digital Transformation Tools

-

-

-

Medicaid and Medicare Solutions, Exchange Enrollment Systems

-

-

-

Health Insurance Exchange Advisory Services, Digital Strategy Solutions

-

-

HP (Hewlett-Packard)

-

IT Infrastructure Services, Cloud Solutions

-

-

Hexaware Technologies

-

Digital Transformation Solutions, Cloud Platforms, IT Services for Health Exchanges

-

-

-

Health Exchange Consulting, Regulatory Compliance Solutions, Digital Healthcare Solutions

-

-

Xerox Corporation

-

Healthcare Solutions, Claims Processing Systems, Enrollment Services

-

-

Oracle Corporation

-

Cloud Solutions, Data Management Systems, and Analytics for Health Exchanges

-

-

Maximus

-

Eligibility and Enrollment Solutions, Health Exchange Management Services

-

-

Infosys

-

IT Services for Health Exchanges, Cloud Solutions, Data Analytics

-

-

Hcentive, Inc.

-

Health Exchange Platforms, Eligibility and Enrollment Systems

-

-

Cognosante, LLC

-

Healthcare IT Solutions, Enrollment Systems, Eligibility Determination Services

-

-

Connecture Inc.

-

Online Health Insurance Marketplaces, Plan Comparison Tools

-

-

Accenture Plc

-

Healthcare Exchange Consulting, Digital Healthcare Platforms, Data Analytics

-

-

CGI Group, Inc.

-

Health Exchange Solutions, Enrollment and Claims Management Systems

-

-

IBM Corporation

-

AI and Blockchain Solutions for Health Exchanges, Cloud-Based Services

-

-

Microsoft Corporation

-

Cloud Computing Solutions, Data Analytics, AI Tools for Health Exchanges

-

-

Tata Consultancy Services (TCS)

-

IT Solutions, Data Analytics, Cloud Platforms for Health Insurance Exchanges

-

-

Wipro Limited

-

Digital Transformation Services, Cloud and IT Solutions for Health Exchanges

-

Health Insurance Providers

-

UnitedHealth Group

-

UnitedHealthcare Marketplace Plans, Medicaid Plans, Medicare Advantage Plans

-

-

Anthem Inc.

-

Anthem Individual and Family Plans, Medicaid Plans, Health Exchange Plans

-

-

Cigna

-

Cigna Individual and Family Plans, Marketplace Health Plans, Dental and Vision Plans

-

-

Humana Inc.

-

Humana Individual Plans, Medicaid Plans, Medicare Advantage Plans

-

-

Aetna Inc.

-

Aetna Marketplace Plans, Medicaid Plans, Dental and Vision Coverage

-

-

CVS Health

-

Aetna Individual Health Plans, Medicare Advantage Plans, Marketplace Coverage

-

-

Centene Corporation

-

Medicaid Plans, Marketplace Plans, Health Exchange Solutions

-

-

Molina Healthcare

-

Molina Marketplace Plans, Medicaid Coverage, Health Exchange Plans

-

-

WellCare Health Plans

-

WellCare Marketplace Plans, Medicaid Plans, Medicare Advantage Plans

-

-

Health Net Inc.

-

Health Net Individual and Family Plans, Medicaid Plans, Marketplace Health Plans

-

-

BCBS (Blue Cross Blue Shield)

-

Blue Cross Blue Shield Marketplace Plans, Medicaid and Medicare Advantage Plans

-

-

Kaiser Permanente

-

Kaiser Permanente Health Exchange Plans, Medicaid, and Medicare Advantage Plans

-

-

Amerigroup Corporation

-

Amerigroup Medicaid and Health Exchange Plans

-

-

Healthfirst

-

Health Medicaid Plans, Marketplace Health Plans, Medicare Advantage Plans

-

-

Kaiser Permanente and Health Net Inc.

-

Joint Health Exchange Plans, Medicaid, and Medicare Advantage Plans

-

Recent Developments

In October 2024, Idaho's health and dental insurance exchange, Your Health Idaho, opened for new enrollments and policy changes and ran until December 16. Residents can enroll in or modify their plans, with coverage beginning January 1, 2025. Those already enrolled will be automatically renewed, while new enrollees can benefit from improved customer experience tools for a smoother process.

In July 2024, 33 major health insurance companies joined the National Health Claims Exchange (NHCX), a government-developed centralized platform for exchanging insurance claims-related information. This ensured quicker claim settlements for policyholders.

| Report Attributes | Details |

| Market Size in 2023 | USD 2514.41 billion |

| Market Size by 2032 | USD 4940.38 billion |

| CAGR | CAGR of 7.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Public Exchange (State-based Exchange, Federally Facilitated Exchange (FFE), State Partnership Model), Private Exchange (Multi-carrier Exchange, Single-carrier Exchange) • By Phase [Pre-implementation Services, Implementation/Exchange Infrastructure Delivery (System Development and Deployment, System Integration and Interfacing, System Software Components), Program Management and Independent Verification and Validation (IV&V) /Quality Assurance (QA), Operations and Maintenance] • By Component [Services, Software, Hardware] • By End User [Government Agencies, Third Party Administrators (TPAs), Brokerage Firms, and Consultancies, Health Plans/Payers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Innovation Inc., Noridian Healthcare Solutions, KPMG, HP, Hexaware Technologies, Deloitte, Xerox Corporation, Oracle Corporation, Maximus, Infosys, Hcentive, Inc., Cognosante, LLC, Connecture Inc., Accenture Plc, CGI Group, Inc., IBM Corporation, Microsoft Corporation, Tata Consultancy Services (TCS), Wipro Limited, UnitedHealth Group, Anthem Inc., Cigna, Humana Inc., Aetna Inc., CVS Health, Centene Corporation, Molina Healthcare, WellCare Health Plans, Health Net Inc., BCBS, Kaiser Permanente, Amerigroup Corporation, Healthfirst, Kaiser Permanente and Health Net Inc. |

| Key Drivers | • Transforming Healthcare Access with Universal Coverage, Technological Advancements, and Competitive Plans |

| Restraints | • Major Restraints in the Health Insurance Exchange Market including Complexity, High Costs, and Lack of Awareness |