HSV Testing Market Report Scope & Overview:

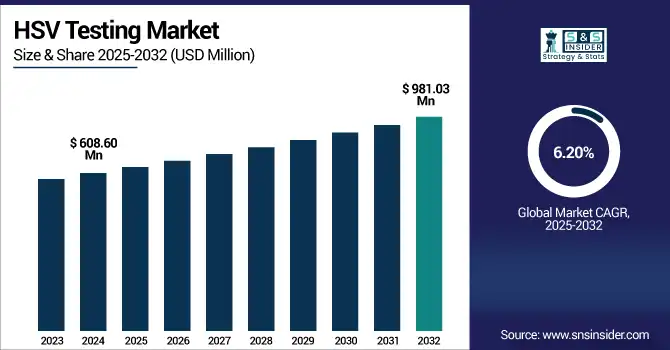

The HSV testing market size was valued at USD 608.60 million in 2024 and is expected to reach USD 981.03 million by 2032, growing at a CAGR of 6.20% over the forecast period of 2025-2032.

To Get more information on HSV Testing Market - Request Free Sample Report

The global HSV testing market is growing steadily on account of increasing infection incidences, awareness levels, and development in early disease diagnosis techniques. The need for fast, accurate, and accessible testing, particularly PCR-based and point-of-care solutions, is driving adoption. There is also an increasing presence of self-collection systems, which are extending reach by reaching privacy-sensitive and underserved communities. Ongoing public health efforts and technological advancements are anticipated to drive the HSV testing market growth over the forecast years.

The U.S. HSV testing market size was valued at USD 181.14 million in 2024 and is expected to reach USD 284.22 million by 2032, growing at a CAGR of 5.84% over the forecast period of 2025-2032.

The U.S. is a dominant country in HSV testing in North America, due to the rigorous screening programs, well-established public health infrastructure, and early implementation of advanced diagnostic platforms. Its preeminence is reinforced by CDC-endorsed testing protocols, incorporation of HSV testing into sexual health pathways, and the increasing emergence of point-of-care nucleic acid testing platforms.

Market Dynamics:

Drivers

-

Increasing Prevalence of HSV Infections is Driving the Market Growth

The expanding global prevalence of HSV-1 (oral herpes) and HSV-2 (genital herpes) is a leading cause of testing. Many carriers have no symptoms, but are still infectious, leading public health systems and individual citizens to focus on early detection. Increasing awareness of sexual health and the normalization of STI testing is driving a shift in people coming forward for regular checks. The association of HSV-2 with augmented HIV transmission risk has also raised the profile of HSV testing in these populations.

An April 2024 modelling study projected 25.6 million new HSV-2 infections globally among individuals aged 15–49 years in 2020; there were an estimated 188 million cases of HSV-2 genital ulcer disease.

According to the WHO fact sheet, an estimated 13% of the global population aged 15-49 are HSV-2 seropositive, and HSV-2 infection increases the likelihood of HIV acquisition two to threefold.

-

A Boost in Diagnostic Testing Technology is Boosting Market Growth

The market is currently seeing rapid advances in the field of HSV diagnostics, such as highly sensitive PCR-based tests, multiplex molecular assays, and type-specific serological tests. These methods enable more rapid and sensitive detection of both HSV types, also in asymptomatic phases. The use of automation systems and digital reporting solutions is reducing turnaround and implementation time factors in clinical laboratories. These developments are allowing testing to become more scalable and available, including even in decentralized, resource-constrained environments.

A ScienceDirect article recently published an on-site LAMP-Cas12 gold nanoparticle point-of-care diagnosis with high sensitivity and a naked-eye readout in the absence of laboratory equipment.

Another group described an ultra-sensitive electrochemical device for the detection of HSV-2 antigens in <9 min, produced for ~USD 1 per test, highlighting the future value of next-gen rapid diagnostics in terms of both time and cost suitability.

Restraint

-

Limited Access in Low-Resource Settings is Restraining the Market from Growing

In low and middle-income countries (LMICs), many face limited access to HSV testing owing to deficiencies in healthcare structure, limited numbers of skilled laboratory personnel, and unreliable diagnostic supply chains. More advanced tests, such as PCR and type-specific serology, are expensive and necessitate infrastructure to conduct sophisticated tests, which, of course, are not available in rural clinics and community health centers.

Thus, populations in these areas are dependent on syndromic management instead of confirmed diagnosis, which is associated with underreporting, delayed treatment, and sustained HSV transmission. This discrepancy is obstructing the overall expansion and global availability of HSV testing services.

Segmentation Analysis:

By Type

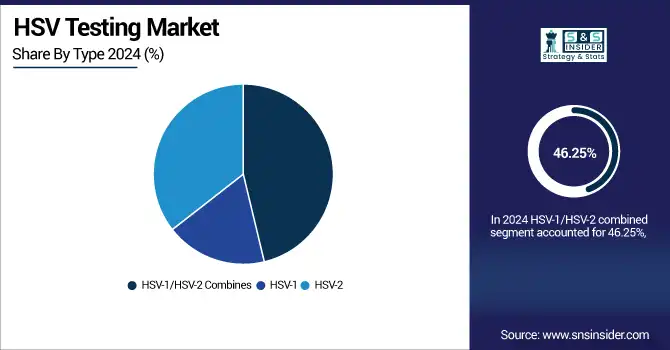

The HSV-1/HSV-2 combined segment accounted for the largest share of the HSV testing market in 2024, with a 46.25%, as the multiplex assay, which detects both types of virus in patients simultaneously, is increasingly being adopted by hospitals and laboratories. Compiled tests are increasingly preferred by clinicians and laboratories due to their ease of use and ability to give an all-inclusive result in a single test, leading to increased diagnostic efficiency and patient care. More recently, awareness of asymptomatic HSV infection and cross-infection between the orofacial and genital sites has led to routine combined testing in both clinical and public health settings.

The HSV-2 segment is anticipated to witness the highest growth over the forecast years, owing to the high prevalence of genital herpes globally and a surge in demand for STI diagnosis. HSV-2 is more closely linked to sexually transmitted infections; however, people are increasingly being tested for it due to a greater appreciation of its intrinsic role in enhancing susceptibility to HIV. Advances in type-specific serological and nucleic acid tests, and the expansion of screening efforts on high-risk populations, are likely contributing to the rapid uptake of HSV-2-specific diagnostics.

By Sample Type

Blood segment dominated the HSV testing market share in 2024, with around 60% due to blood-based serologic tests being the most commonly utilized and readily available test for detection of HSV–1 and HSV–2 antibodies. The non-invasive and low-cost testing approach is appropriate for large-scale screening and regular clinical application. Their ability to detect active or past infection, including in people showing no symptoms, also makes them an ideal test for diagnostic labs, prenatal screening, public health programs, and more.

The Cerebrospinal fluid segment is expected to register the highest growth during the forecast period, owing to the rising prevalence of HSV-associated neurological disorders, including herpes simplex encephalitis. CSF examination is important for a precise diagnosis in hospitalized patients with acute CNS symptoms. Due to increasing sensitization, refinement of PCR-based diagnostic accuracy, and the more widespread use of lumbar puncture in tertiary care centers, CSF-based HSV testing is currently being established in neurology and infectious disease departments.

By Test Type

The serological tests segment accounted for the larger share of the HSV testing market in 2024, owing to the wide usage of serological tests for the screening of asymptomatic individuals for HSV, and as a confirmatory element in distinguishing between HSV-1 and HSV-2. These are inexpensive tests that need minimal resources and are well established in hospitals, clinics, and antenatal care. Their role in identifying past and present infections with a blood sample has made them the linchpin of extensive testing programs across the globe.

The point-of-care tests segment is projected to grow at the highest CAGR during the forecast period due to the growing demand for instant testing as immediate results are delivered to administer proper diagnosis. There are many settings, such as remote or under-resourced sites, urgent care, and situations with individuals desiring privacy and convenience, where these tests are extremely useful. Advances in lateral flow technology and point-of-care molecular devices are expanding access to timely and actionable diagnosis without the requirement for centralized laboratory support.

By End Use

The hospitals segment held the largest share of the HSV testing market in 2024 with around 64.2% market share, owing to hospitals being the major facilities for providing the entire spectrum of diagnostic services, from routine serological screening an emergency PCR-based examination in severe HSV cases. They are resourced with advanced laboratory facilities and experienced staff and are often the first site of care for symptomatic patients, particularly for cases that concern neonatal herpes, encephalitis, and immunocompromised individuals. Hospitals are therefore a primary site of HSV testing in both the hospital and ambulatory settings.

The home care / self-testing segment is anticipated to register the highest CAGR over the forecast period, owing to growing consumer preferences for privacy, convenience, and immediate results. Increasing understanding of STIs, along with enhanced availability of FDA-cleared and CE-marked home tests, allows people to test for HSV from the comfort of their own home. Expansion in e-commerce, digital health platforms, and discreet delivery methods is also speeding up the uptake of self-testing options, especially among young and tech-savvy consumers.

Regional Analysis:

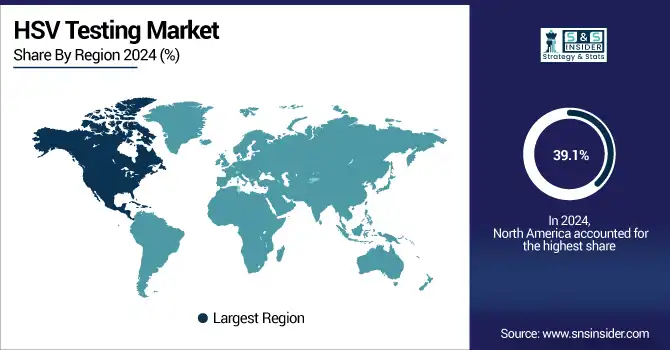

North America dominated the HSV testing market with a 39.1% market share in 2024, mainly due to its established healthcare system, high awareness of STIs, and incorporation of regular diagnostic procedures for HSV in public health and reproductive care services. The U.S. especially has robust CDC guidelines for early detection, easy access to type-specific serological and molecular testing, and insurance coverage for STI screening. Further, as leading diagnostic vendors, continued developments in rapid testing technologies also make the region retain its market leadership.

Asia Pacific is the fastest-growing region over the forecast period in the HSV testing market trend due to the growing HSV infection rates, an upsurge in the awareness of sexual health, and improving infrastructure of the diagnostic services in countries such as China, India, and Southeast Asian countries. The increasing pace of uptake is supported by economic growth, increased investment in health infrastructure, and government STI prevention campaigns. Furthermore, the area is also seeing increasing availability of low-cost PCR-based and point-of-care test kits that provide an opportunity for HSV testing to underserved and rural communities.

The global HSV testing market analysis is growing in Europe, spurred by the growing awareness of STIs (sexually transmitted infections), expanded public health screenings, and universal healthcare systems promoting preventive care. Leading markets, including Germany, France, and the UK, are also powering the adoption of tests through a mix of publicly funded initiatives, reimbursement, and the incorporation of HSV testing within multipathogen STI panels within clinics and sexual health centres. Advanced European diagnostic infrastructure, which is increasingly including CE-marked molecular and point-of-care testing platforms, is improving access in outpatient and decentralized settings. New applications, including non-invasive sampling and digital reporting tools, are driving patient involvement and continued market adoption in Western and Central Europe as well.

In Latin America, the HSV testing market trend is seen growing at a moderate pace, spurred by such countries, where advancing STI awareness and continued development in healthcare infrastructure and public health programs are ramping up the adoption of HSV diagnostics. Serological testing is currently the preferred approach, primarily for reasons of cost in rural and underprivileged areas where, as part of an overall sexual health screening approach, HSV testing is increasingly included. These trends are underpinning a solid pick-up across the region.

The Middle East & Africa (MEA) maintained a steady growth, which is fueled by an increase in public health awareness and NGO led initiatives for access to basic diagnostics. Countries such as South Africa, UAE, and Saudi Arabia have currently scaled up HSV testing as part of prenatal and sexual health programs, but infrastructure constraints and cost considerations hinder large-scale deployment. Ongoing health and outreach investments are progressively lifting penetration in these countries.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The HSV testing market companies are Roche, Abbott Laboratories, Becton Dickinson (BD), Thermo Fisher Scientific, Siemens Healthineers, bioMérieux, Danaher (Cepheid), Qiagen, Hologic, Bio-Rad Laboratories, Grifols, Meridian Bioscience, Luminex (DiaSorin), QuidelOrtho, Sekisui Diagnostics, OraSure Technologies, GenMark Diagnostics (Roche), ELITech Group, Teco Diagnostics, NovaTec Immundiagnostica, and other players.

Recent Developments:

-

In October 2023, Siemens unveiled the SINEC Security Inspector, a single software platform aimed at scanning comprehensive IT/OT environments within planned maintenance windows. It merges the best-in-class tools for asset discovery, compliance checking, malware scanning, and vulnerability detection, all in one user interface. Internally developed, the suite is now accessible to all industrial customers and supports third-party tools such as those offered by Tenable.

-

In May 2022, QIAGEN introduced its NeuMoDx HSV 1/2 Quant Assay, CE‑IVD certified for the detection and discrimination of herpes simplex virus types 1 and 2 on the NeuMoDx 96 and 288 PCR systems. The assay supports viral load monitoring of increased sensitivity—particularly for immunocompromised and transplant patients—and extends QIAGEN's NeuMoDx test portfolio to one of the widest offered on the market, with 15 CE‑IVD assays presently supported.

HSV Testing Market Report Scope:

Report Attributes Details Market Size in 2024 USD 608.60 million Market Size by 2032 USD 981.03 million CAGR CAGR of 60.20% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Virus Type (HSV-1/HSV-2 Combined, HSV-1, HSV-2)

• By Sample Type (Blood, Swabs, Cerebrospinal Fluid)

• By Test Type (Serological Tests, Direct Detection Tests, PCR, Viral Culture, Point-of-Care Tests)

• By End Use (Hospitals, Diagnostic Laboratories, Clinics and Sexual Health Centers, Home Care / Self-Testing)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles The HSV testing market companies are Roche, Abbott Laboratories, Becton Dickinson (BD), Thermo Fisher Scientific, Siemens Healthineers, bioMérieux, Danaher (Cepheid), Qiagen, Hologic, Bio-Rad Laboratories, Grifols, Meridian Bioscience, Luminex (DiaSorin), QuidelOrtho, Sekisui Diagnostics, OraSure Technologies, GenMark Diagnostics (Roche), ELITech Group, Teco Diagnostics, NovaTec Immundiagnostica, and other players