Ultrasound Probe Disinfection Market Size Analysis:

To Get More Information on Ultrasound Probe Disinfection Market - Request Sample Report

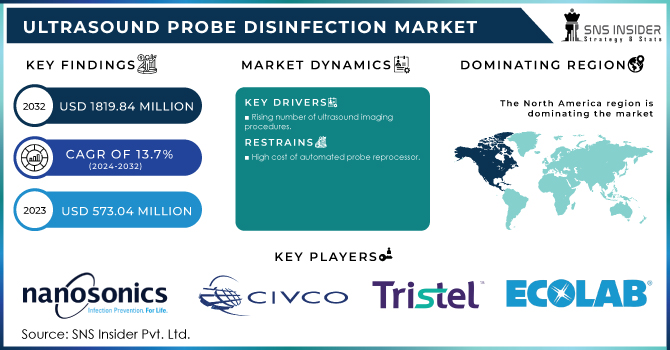

The Ultrasound Probe Disinfection Market size was valued at USD 573.04 million in 2023 and is expected to reach USD 1819.84 million by 2032, growing at a CAGR of 13.7% over the forecast period 2024-2032.

The ultrasound probe disinfection market is experiencing significant growth due to the increasing need for infection prevention in healthcare settings. Ultrasound is a widely used diagnostic tool due to its non-invasive nature, cost-effectiveness, and versatility in various medical fields, including obstetrics, cardiology, and musculoskeletal imaging. However, improper cleaning and disinfection of ultrasound probes can lead to the transmission of infections, especially when used for invasive procedures or in contact with high-risk patients.

For instance, a European Society of Radiology survey found that 29% of respondents did not disinfect ultrasound probes after every patient, and 11% failed to use probe covers for endo-cavity ultrasound exams. These findings underscore the critical need for standardized disinfection practices to mitigate infection risks in healthcare facilities. Inadequate cleaning of ultrasound probes can lead to transmitting pathogens such as Clostridium difficile, Salmonella, and MRSA, which are known to cause hospital-acquired infections (HAIs). This risk has led to growing concerns within the medical community, driving the adoption of more stringent disinfection protocols.

Additionally, the CDC and WHO have issued guidelines emphasizing the importance of high-level disinfection for ultrasound probes, particularly those used for internal or endocavitary procedures. These recommendations have accelerated the adoption of automated and chemical disinfection technologies, which are now recognized for their efficiency in ensuring thorough cleaning of ultrasound probes between patient uses. For example, automated disinfection systems can reduce human error and significantly decrease the time required for cleaning, making them particularly appealing in busy healthcare environments.

The rising adoption of Point-of-Care Ultrasound (POCUS) is also contributing to the market's growth. According to a report from the American Institute of Ultrasound in Medicine (AIUM), the use of POCUS is increasing significantly in emergency rooms, critical care units, and ambulatory surgical centers. This trend is driven by its ability to provide immediate, bedside diagnostic results, but it also increases the need for effective disinfection practices. 40% of hospitals reported increased use of POCUS over the past few years, further expanding the demand for ultrasound probe disinfection solutions.

Technological innovations in disinfection methods are playing a crucial role in this market's growth. Automated systems, such as those offered by GE Healthcare, are designed to ensure high-level disinfection while reducing manual intervention. Furthermore, the development of eco-friendly disinfectants is addressing concerns over the environmental impact of traditional cleaning chemicals, driving demand among environmentally-conscious healthcare facilities.

Ultrasound Probe Disinfection Market Dynamics

Drivers

-

Increased Healthcare-Associated Infections and Technological Advancements Propel Demand for Efficient Solutions

The ultrasound probe disinfection market is being driven by several critical factors that highlight the growing need for effective infection control in healthcare settings. One of the primary drivers is the increasing number of healthcare-associated infections (HAIs). According to the CDC, HAIs affect 1 in 31 hospital patients on any given day, underscoring the need for rigorous infection prevention measures, including the disinfection of ultrasound probes. As a result, healthcare providers are compelled to adopt advanced disinfection solutions to meet safety standards and reduce infection risks.

Another key driver is the rise in Point-of-Care Ultrasound (POCUS) usage. The AIUM reports that 40% of hospitals have increased their use of POCUS over the past few years, particularly in emergency and critical care environments. This has led to a higher frequency of ultrasound probe usage, thereby intensifying the demand for efficient and reliable disinfection technologies. Additionally, technological advancements in disinfection systems, such as automated cleaning devices and UV-C light technology, have revolutionized the market by providing quicker, more effective disinfection solutions. For example, automated systems can disinfect probes in as little as 2-5 minutes, reducing human error and increasing the overall efficiency of healthcare facilities.

Furthermore, stricter regulations by organizations like the FDA, CDC, and WHO are pushing healthcare providers to adhere to more rigorous disinfection protocols. The growing focus on patient safety and infection prevention is also encouraging healthcare facilities to invest in high-quality disinfection solutions, leading to sustained growth in the market. This combination of regulatory pressure, increased healthcare procedures, and technological improvements is fueling the demand for ultrasound probe disinfection solutions globally.

Restraints

-

High Costs, Lack of Standardization, and Regulatory Challenges Impede Market Expansion

One of the primary challenges is the high cost of advanced disinfection systems. Technologies such as automated cleaning devices and UV-C light systems require significant upfront investment, which can be a barrier for smaller healthcare facilities or those operating under tight budgets. Additionally, the lack of standardization in disinfection protocols can complicate the adoption of universal solutions across various healthcare settings. Without clear and universally accepted guidelines, healthcare providers may hesitate to implement new technologies or struggle to ensure compliance with infection control standards.

Another restraint is the limited awareness of the importance of proper ultrasound probe disinfection among some healthcare providers. This can result in inconsistent practices and an overreliance on manual cleaning methods, which may not be as effective as automated solutions. Furthermore, technical challenges related to the compatibility of disinfection technologies with various types of ultrasound probes can limit the adoption of certain systems. Lastly, regulatory hurdles in different regions, including the approval processes for new disinfection devices, may slow down market entry for innovative products. These factors collectively present challenges that could restrain the growth of the ultrasound probe disinfection market.

Ultrasound Probe Disinfection Market Segmentation Analysis

By Product Type

In 2023, instruments dominated the ultrasound probe disinfection market, accounting for around 45% of the total market share. This dominance can be attributed to the increasing demand for automated cleaning devices and UV-C light systems, which ensure quick, efficient, and standardized disinfection. These advanced instruments help healthcare facilities maintain high hygiene standards while reducing human error, thus improving the overall disinfection process. The focus on safety, efficiency, and infection prevention in healthcare settings has driven the continued reliance on these instruments.

The consumables segment, particularly disinfectant solutions, and single-use covers, has emerged as the fastest-growing segment. The increasing need for disposable and easy-to-use disinfectants, especially in high-volume healthcare environments, is pushing the demand for consumables. These products ensure that ultrasound probes are cleaned effectively and quickly, which is particularly important in high-frequency usage areas like emergency departments and critical care units.

By Process

In 2023, high-level disinfection captured around 60% of the market share, making it the dominant disinfection process. High-level disinfection is crucial for probes that come into contact with mucosal membranes or sterile tissues, as it ensures the thorough removal of pathogens. The increasing focus on patient safety and stringent infection control protocols in hospitals and clinics has driven the preference for high-level disinfection processes.

The low-level disinfection process has seen significant growth. It is primarily used for probes that come into contact with intact skin or non-critical areas, making it a more cost-effective and quicker solution. With the increasing adoption of ultrasound in point-of-care and outpatient settings, low-level disinfection processes are becoming more popular due to their efficiency and convenience.

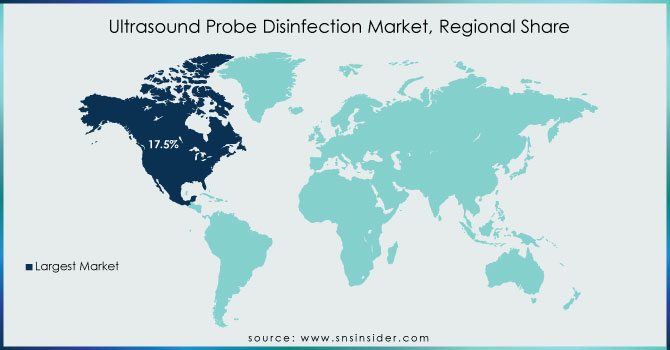

Regional Analysis

North America held the 46% share of the market, driven by stringent regulatory standards from agencies like the FDA and CDC, which enforce rigorous infection control practices in healthcare settings. The high incidence of hospital-acquired infections (HAIs) in the region has spurred a strong demand for reliable disinfection solutions. Additionally, the increasing use of Point-of-Care Ultrasound (POCUS), particularly in emergency and critical care environments, has amplified the need for effective probe disinfection practices.

Europe ranked second in the market region, with its healthcare systems focusing heavily on infection prevention and control. Regulatory bodies like the European Medicines Agency (EMA) promote high safety standards, encouraging the widespread adoption of advanced disinfection technologies such as automated cleaning systems and UV-C light solutions. Europe’s emphasis on patient safety and hygiene across hospitals and clinics fuels the growing demand for ultrasound probe disinfection products.

The Asia Pacific region is experiencing rapid growth, driven by expanding healthcare infrastructure, increased healthcare spending, and rising awareness of infection control. Countries like China, India, and Japan are seeing significant investments in healthcare facilities, leading to higher demand for ultrasound equipment and associated disinfection solutions. As these countries modernize their healthcare systems, the adoption of effective disinfection practices continues to rise.

Do You Need any Customization Research on Ultrasound Probe Disinfection Market - Enquire Now

Key Players

1. Nanosonics

-

Trophon

2. Tristel plc

-

Tristel Duo

3. STERIS plc

-

STERIS UV-C Disinfection Systems

4. Ecolab

-

ECOLAB High-Level Disinfection Solutions

5. Advanced Sterilization Products

-

V-Pro

-

CaviCide

7. CIVCO Medical Solutions

-

CIVCO Ultrasound Probe Covers and Disinfection Products

8. CS Medical LLC

-

CleanFix

9. Virox

-

Virox Disinfectant Solutions

10. Germitec

-

Germitec UV-C Disinfection System

11. Schülke & Mayr GmbH

-

Hygiene and Disinfection Solutions

12. Parker Laboratories, Inc.

-

Parker Ultrasound Disinfection Products

Recent Development

In Nov 2024, Nanosonics introduced a groundbreaking wireless ultrasound probe holder to improve disinfection processes and traceability. This innovative solution aims to streamline infection control practices in medical settings.

In Sept 2024, Germitec, a French medtech company, secured de novo clearance from the US Food and Drug Administration (FDA) for its Chronos device, a high-level disinfection (HLD) solution for ultrasound probes. This approval marks a significant milestone for the company's ultrasound probe disinfection technology.

| Report Attributes | Details |

| Market Size in 2023 | USD 573.04 million |

| Market Size by 2032 | USD 1819.84 million |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type [Instruments (Automated Reprocessors, Manual Reprocessors/ Soaking Stations, Ultrasound Transducer Storage Cabinets), Consumables (Disinfectants {By Formulation (Disinfectant Wipes, Disinfectant Liquid, Disinfectant Sprays), By Type (High-Level Disinfectants, Low-Level Disinfectants), Detergents (Enzymatic, Non-Enzymatic), Services}] • By Process [High-Level Disinfection, Low-Level Disinfection] • By Type of Probe [Linear Transducers, Convex Transducers, Phased Array Transducers, Endocavitary Transducers, TEE Transducers, Other Transducers] • By End User [Hospitals & Diagnostic Imaging Centers, Ambulatory Care Centers, Maternity Centers, Academic & Research Institutes, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nanosonics, Tristel plc, STERIS plc, Ecolab, Advanced Sterilization Products, Metrex Research, LLC., CIVCO Medical Solutions, CS Medical LLC, Virox, Germitec, Schülke & Mayr GmbH, Parker Laboratories, Inc. |

| Key Drivers | • Increased Healthcare-Associated Infections and Technological Advancements Propel Demand for Efficient Solutions |

| Restraints | • High Costs, Lack of Standardization, and Regulatory Challenges Impede Market Expansion |