Robotic Nurse Assistant Market Report Scope & Overview

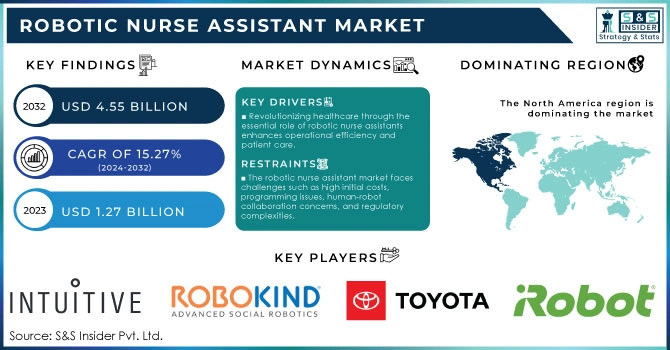

The Robotic Nurse Assistant Market Size was valued at USD 1.27 Billion in 2023 and is expected to reach USD 4.55 Billion by 2032 and grow at a CAGR of 15.27% over the forecast period 2024-2032

The robotic nurse assistant market is experiencing a transformative shift, driven largely by an aging global population and advancements in robotics technology. The United Nations has reported that many countries are unprepared for the significant challenges associated with this demographic shift, creating substantial opportunities for innovative solutions in elder care and healthcare delivery. For instance, a 2024 report noted that 50% of the global population will be over the age of 65 by 2050, leading to increased demand for healthcare services. Innovations such as the new nursing robot developed by the University of Texas at Arlington aim to enable nurses to focus more on patient care by automating routine tasks, effectively addressing the shortage of healthcare workers. Mental health considerations are also increasingly essential for the elderly, as studies indicate that aging individuals are more prone to mental health challenges, with approximately 20% experiencing some form of mental health issue. According to U.S. News, healthcare ranks among the top 25 best job sectors for growth, indicating a critical need for enhanced healthcare solutions like robotic assistants. Reports from Wisconsin reveal the urgent need for effective care solutions as the baby boomer population ages, highlighting the growing pressure on healthcare systems. Advancements in robotics, exemplified by products like Elon Musk’s Optimus robot, demonstrate how automation can revolutionize caregiving. This integration of technology into healthcare has the potential to reshape approaches to elder care, making robotic nurse assistants an essential component in addressing future healthcare challenges.

Get More Information on Robotic Nurse Assistant Market - Request Sample Report

The growth of robotic nurse assistants is driven by healthcare systems striving to meet the challenges of an aging population and the rising demand for efficient care solutions. Recent reports reveal that 80% of healthcare executives acknowledge the role of automation in enhancing operational efficiency. As a result, many hospitals are adopting robotic technologies, with one university hospital experiencing a 30% boost in workflow efficiency due to this shift. The urgency for comprehensive healthcare strategies is highlighted by findings from the Scripps Gerontology Centre, which estimates that by 2030, approximately 20% of the U.S. population will be aged 65 and older, underscoring the necessity for improved elder care. Innovative applications of robotics, including the distribution of over 4,000 robotic pets aimed at reducing loneliness among seniors, showcase significant advancements in enhancing the quality of life for elderly individuals. Advanced robotic surgical systems like the Horizon Surgical platform are revolutionizing surgical procedures, leading to enhanced patient safety and accuracy. With 20% of healthcare providers planning to incorporate robotic solutions by 2025, the integration of AI and robotics promises to transform conventional care models. As automation continues to evolve, robotic nurse assistants will play a vital role in alleviating staffing shortages and improving patient care, highlighting the importance of ongoing investment in this sector.

Rising Demand for Robotic Solutions in Healthcare

Globally, over 4.2 million robots are now in operation, marking a 10% increase. In 2023, more than 541,000 new units were installed, with China accounting for 51% of these installations. This upward trend in robotics is set to significantly benefit the healthcare sector, especially nursing, as hospitals increasingly adopt robotic technologies to improve efficiency and tackle workforce shortages. Consequently, the demand for robotic nurse assistants is anticipated to surge, fostering innovation and attracting investments in healthcare robotics.

Robotic Nurse Assistant Market Dynamics

Drivers

-

Revolutionizing healthcare through the essential role of robotic nurse assistants enhances operational efficiency and patient care.

As healthcare facilities confront rising operational costs, the adoption of robotic nurse assistants has emerged as a strategic solution. These robots efficiently manage repetitive tasks like medication delivery, patient monitoring, and data entry, allowing human staff to focus on essential patient care. This transition not only enhances care quality but also reduces labour costs and boosts productivity, enabling better resource allocation Financial pressures are significant, particularly highlighted by studies showing that Medicaid payments frequently fall short of covering actual costs, intensifying the need for operational efficiency. Additionally, the rise of robotic surgical technologies reflects a broader shift toward automation in healthcare, promising further cost reductions. The success of digital coworkers, like those developed by Roots Automation for the insurance industry, illustrates the transformative potential of automation. These intelligent software robots can be fully trained in just 4–6 weeks and demonstrate impressive results, such as a 90% increase in claims capacity and a remarkable 1250% return on investment. As robotic nurse assistants continue to gain traction, their capacity to enhance operational efficiency while addressing the healthcare workforce shortage positions them as a critical driver in the market, making them a vital focus for future investments in healthcare technology.

Restraints

-

The robotic nurse assistant market faces challenges such as high initial costs, programming issues, human-robot collaboration concerns, and regulatory complexities.

One major challenge is the high initial investment required for purchasing and integrating these robotic systems into healthcare facilities, which can be prohibitive, especially for smaller institutions. For example, female-led robotics startup Diligent raised USD 3.15 million in seed funding to deploy its hospital assistant robot, Moxi, in Texas hospitals, highlighting the substantial financial backing needed for successful implementation. Integration costs can escalate due to the complexity of programming required for robots to operate effectively in diverse hospital environments. Concerns regarding human-robot interaction further complicate matters, as ensuring reliability and safety is crucial for maintaining patient care quality. Additionally, studies indicate that healthcare staffing shortages have led to heightened fears of job displacement among nursing assistants and support staff, leading to resistance against adopting robotic solutions. Real-world experiences with humanoid robots have shown that, while these machines can assist in certain roles, seamless collaboration with human caregivers is essential for optimal patient interactions and safety. Furthermore, regulatory challenges and the evolving landscape of healthcare policies add layers of complexity to market dynamics. Together, these factors limit the speed and scale at which robotic nurse assistants can be adopted, underscoring the importance of addressing these restraints for future growth.By focusing on overcoming financial barriers, enhancing human-robot collaboration, and navigating regulatory landscapes, stakeholders can better position themselves in the expanding robotic nursing market.

Robotic Nurse Assistant Market Segment Overview

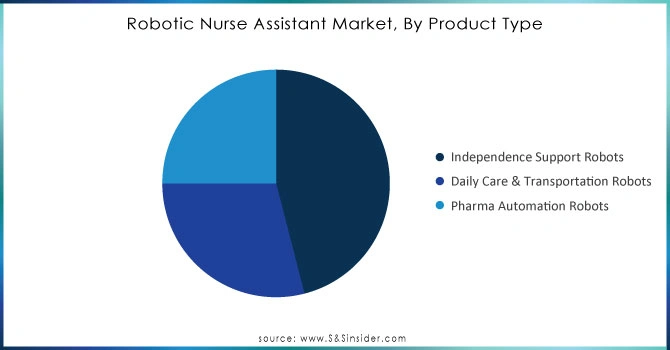

By Product Type

In 2023, Independence Support Robots led the robotic nurse assistant market, capturing around 46% of total revenue due to high demand for wearable robotic solutions that enhance patient mobility and autonomy. Companies like Cyberdyne and Ekso Bionics introduced advanced exoskeletons, such as Cyberdyne’s HAL and EksoNR, catering to the needs of paralyzed and elderly patients. These innovations support rehabilitation by aiding movement and reducing caregiver strain, particularly in North America and Europe, where healthcare systems prioritize autonomous mobility solutions. In Asia-Pacific, government backing for robotic solutions in eldercare aligns with rising demographic needs, further accelerating growth in this segment. Products like SuitX and ReWalk are also making strides, showcasing the sector’s commitment to improving care efficiency across regions with varied healthcare landscapes.

Need Any Customization Research On Robotic Nurse Assistant Market - Inquiry Now

By End-Use

In 2023, the Hospitals & Clinics segment dominated the robotic nurse assistant market, capturing approximately 49% of revenue, driven by healthcare providers' urgent need for automation to tackle workforce shortages and improve patient care. Companies like Diligent Robotics and SoftBank Robotics have made significant strides in this area. Diligent's Moxi robot is designed for hospital tasks, enabling nurses to devote more time to patient care, while SoftBank's Pepper robot has been upgraded to enhance patient engagement and check-in processes. Intuitive Surgical has evolved its da Vinci robotic system, expanding its applications from surgeries to include patient monitoring and mobility support. Toyota's Human Support Robot (HSR) has also seen enhancements in patient interaction capabilities, reflecting a broader trend toward multifunctional robots that streamline various hospital operations, including supply transportation and real-time data collection. Demand remains particularly strong in North America and Europe due to aging populations, while Asia-Pacific is witnessing growth supported by government initiatives in healthcare automation. These advancements illustrate the industry's commitment to developing robotic solutions that enhance care quality, safety, and operational efficiency across hospital settings. The integration of AI and ongoing educational programs, like those at Miami University, further underscore the importance of a tech-savvy workforce in the evolving landscape of healthcare robotics.

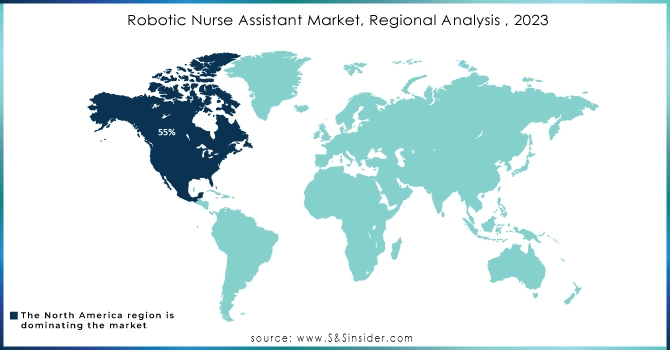

Robotic Nurse Assistant Market Regional Analysis

In 2023, North America captured a substantial 55% share of the robotic nurse assistant market, underscoring the region's commitment to integrating advanced robotics in healthcare settings. This dominance is driven by a confluence of factors, including an aging population, escalating healthcare costs, and a persistent shortage of healthcare workers. The U.S. healthcare system is increasingly turning to automation to enhance operational efficiency and maintain high standards of patient care. Prominent companies, such as Diligent Robotics and Intuitive Surgical, have led the charge with innovative solutions like the Moxi robot, which assists nursing staff with routine tasks, thereby freeing them for direct patient interactions. Furthermore, ongoing investments in research and development are fostering advancements in AI and machine learning, improving robotic capabilities and functionality. The regulatory environment in North America is also conducive to the growth of robotic nurse assistants, with agencies increasingly recognizing the benefits of automation in healthcare. Government initiatives and funding programs aim to support the integration of technology in hospitals and clinics, promoting a seamless transition toward robotic solutions. Collaborations between healthcare providers and technology firms are on the rise, enhancing the development of tailored robotic solutions for diverse healthcare settings. As awareness of the benefits of robotic assistance continues to grow, North America's market for robotic nurse assistants is expected to expand, driven by the urgent need to improve patient outcomes while addressing workforce challenges. This trend positions North America as a leader in healthcare automation and robotic solutions, with a promising outlook for the future.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for robotic nurse assistants, fueled by advancements in several key countries. China is at the forefront, making significant investments in robotics, particularly for eldercare solutions, in response to its aging population. The government is actively promoting robotics integration in healthcare, leading to innovative hospital systems. Japan is advancing its robotics technology to enhance patient care, focusing on assistive robots for the elderly to address demographic challenges. Meanwhile, India is rapidly automating healthcare, with increased adoption of robotic solutions in hospitals, supported by government initiatives aimed at improving healthcare infrastructure. This focus on healthcare automation across Asia-Pacific is attracting significant investments, solidifying the region's leadership in the robotic nurse assistant market. Such developments reflect a broader shift towards technology-driven healthcare solutions, prioritizing improved patient outcomes and addressing demographic changes throughout the region.

Key Players in Robotic Nurse Assistant Market

Some of the Major key players in Robotic Nurse Assistant market with their product:

-

Intuitive Surgical (da Vinci Surgical System)

-

RoboKind (Zora Robot)

-

Cyberdyne (HAL - Hybrid Assistive Limb)

-

Toyota Engineering Society (T-HR3)

-

Nuro (Delivery Robots)

-

iRobot (Roomba)

-

Adept Technology (Adept Viper)

-

Ameda (Ameda Mya Breast Pump)

-

Suturo (Suturo Surgical Robot)

-

KUKA (LBR iiwa)

-

Diligent Robotics (Moxi)

-

Fetch Robotics (Fetch Mobile Robot)

-

Blue Frog Robotics (Buddy)

-

Rethink Robotics (Baxter)

-

Amazon Robotics (Kiva Systems)

-

Furhat Robotics (Furhat)

-

Savioke (Relay Robot)

-

InTouch Health (RP-VITA)

-

Zebra Technologies (Zebra Robotic Solutions)

-

Myomo (Myomo Myoelectric Orthosis)

List suppliers that supply components and raw materials for the Robotic Nurse Assistant market:

-

ABB Robotics

-

Fanuc Corporation

-

Siemens AG

-

Omron Corporation

-

Mitsubishi Electric

-

Texas Instruments

-

Rockwell Automation

-

Kollmorgen

-

Parker Hannifin

-

STMicroelectronics

-

Robot System Products AB

-

Digi-Key Electronics

-

Mouser Electronics

-

Allied Electronics & Automation

-

Vishay Intertechnology

Recent Development

-

On February 15, 2024, Intuitive Surgical announced the launch of the da Vinci SP Surgical System, a next-generation robotic surgical platform designed to enhance precision and flexibility in minimally invasive surgeries, significantly improving workflow and patient outcomes in healthcare settings.

-

At CES 2024 on January 10, Enchanted Tools presented Miroki and Miroka, humanoid healthcare assistant robots with friendly expressions and advanced AI capabilities. Designed to enhance efficiency in Hospitals & Clinics, nursing homes, and hotels, these robots can navigate their surroundings and achieve a 97% success rate in grasping items, responding to prompts like "On Monday at 9:00 a.m., take your trolley back to the pharmacy."

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.27 Billion |

| Market Size by 2032 | USD 4.55 Billion |

| CAGR | CAGR of 15.27 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Independence Support Robots, Daily Care & Transportation Robots, Pharma Automation Robots) • By End-Use (Hospitals & Clinics & Clinics, Senior Care Facilities, Homecare Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Intuitive Surgical, RoboKind, Cyberdyne, Toyota Engineering Society, Nuro, iRobot, Adept Technology, Ameda, Suturo, KUKA, Diligent Robotics, Fetch Robotics, Blue Frog Robotics, Rethink Robotics, Amazon Robotics, Furhat Robotics, Savioke, InTouch Health, Zebra Technologies, Myomo. |

| Key Drivers | • Revolutionizing healthcare through the essential role of robotic nurse assistants enhances operational efficiency and patient care. |

| RESTRAINTS | • The robotic nurse assistant market faces challenges such as high initial costs, programming issues, human-robot collaboration concerns, and regulatory complexities. |