Hyaluronidase Market Report Scope & Overview:

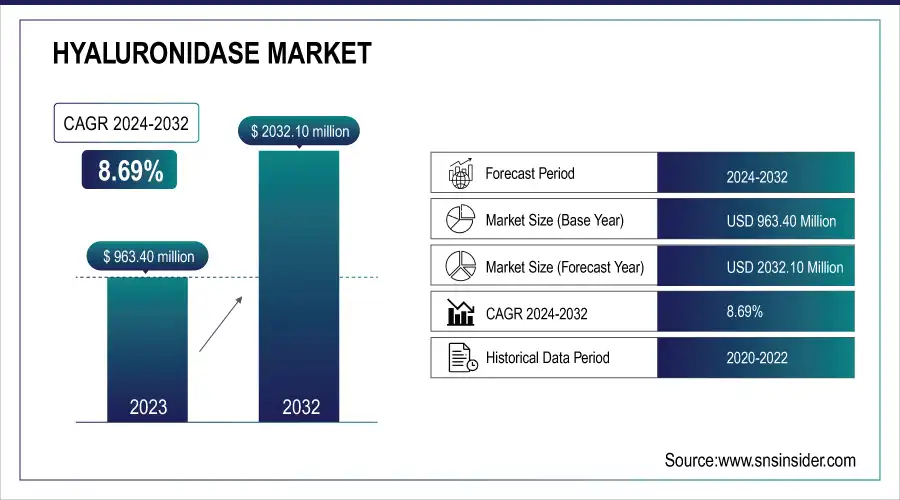

The Hyaluronidase Market was valued at USD 963.40 million in 2023 and is expected to reach USD 2032.10 million by 2032, growing at a CAGR of 8.69% from 2024 to 2032.

This report identifies critical statistical aspects of the Hyaluronidase Market typically neglected in traditional analysis. It contains 2023 regional patterns in hyaluronidase utilization and prescription rates by therapeutic and aesthetic uses. It also provides a disaggregation of healthcare and cosmetic procedure expenditures by payer type government, commercial, private, and out-of-pocket providing financial insight for stakeholders. The report also captures regional regulatory clearances and existing market penetration rates of new formulations. Finally, it addresses levels of R&D investments and pipeline innovations, which allow for forward-looking insights on technology integration and competitive preparedness in this shifting enzymatic therapeutics landscape.

To Get more information on Hyaluronidase Market - Request Free Sample Report

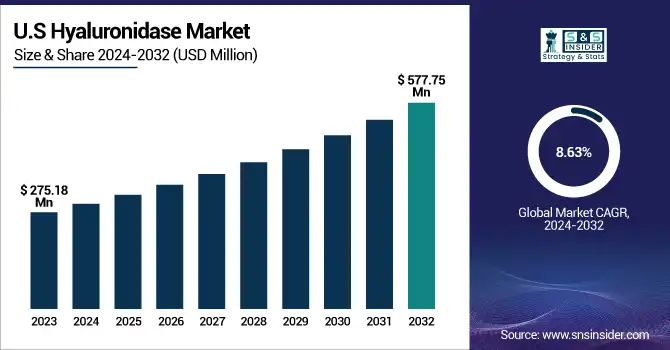

The U.S. Hyaluronidase Market was valued at USD 275.18 million in 2023 and is expected to reach USD 577.75 million by 2032, growing at a CAGR of 8.63% from 2024 to 2032. The U.S. leads the North American hyaluronidase market, due to an elevated volume of aesthetic treatments, oncology biologics, and FDA clearance of combination regimens. There is also an established pharmaceutical R&D infrastructure and pervasive clinical use in support of its market dominance.

Market Dynamics

Drivers

-

The growing application of hyaluronidase in combination with monoclonal antibodies and other biologics is a principal driver of market expansion.

Hyaluronidase augments the dispersion and absorption of concurrently administered drugs, significantly enhancing therapeutic effect and patient convenience, most notably in oncology. A significant development is the September 2024 FDA approval of Tecentriq Hybreza atezolizumab combination with hyaluronidase-tqjs by Roche, enabled by Halozyme's ENHANZE technology. This subcutaneous formulation enables drug administration in approximately seven minutes, as opposed to 30–60 minutes for IV infusion, enhancing workflow and patient outcomes. Such advancements are propelling healthcare systems towards institutionalizing subcutaneous drug delivery as the norm. While cancer incidence continues to increase on a global scale, the role of hyaluronidase in effective biologic delivery is increasingly taking on greater clinical and commercial significance.

-

The increasing popularity of cosmetic enhancement and corrective dermatological procedures is driving the widespread use of hyaluronidase, especially to dissolve dermal fillers and treat complications.

Hyaluronidase is an essential enzyme in aesthetic medicine to counteract hyaluronic acid (HA) filler injections in conditions of overcorrection or vascular occlusion. In May 2023, the FDA cleared SKINVIVE by JUVÉDERM, the first HA intradermal microdroplet injectable to enhance cheek smoothness, which emphasizes the growing incorporation of HA products into cosmetic treatment. With the global population becoming increasingly beauty-aware and minimally invasive procedures becoming more popular, clinics are noticing increasing prescriptions of hyaluronidase as a safety and corrective adjunct. This trend is strongest in areas such as North America and South Korea, where aesthetic treatments are socially accepted and commonly done.

Restraint

-

One of the major restraints in the Hyaluronidase Market is the restricted accessibility and irregular regulatory frameworks in underdeveloped and developing countries.

Most nations in Asia, Africa, and Latin America are inclined to experience difficulties in making quality-approved hyaluronidase products available since they have fragmented drug approval processes, poor supply chain infrastructure, and low public healthcare investment. Secondly, the expensive nature of recombinant hyaluronidase products and a lack of reimbursement guidelines usually discourage their uptake in the public health system. Local producers are also discouraged from seeking biosimilar approval, hence further restricting competition and access. In other areas, a lack of knowledge among doctors regarding new therapeutic uses of hyaluronidase compounds the problem. These impediments limit the wider global penetration of hyaluronidase-based treatments, hindering overall market growth beyond developed economies.

Opportunities

-

One of the key market opportunities is the increasing use of hyaluronidase in subcutaneous (SC) biologic drug delivery, particularly for chronic and cancer therapies.

Hyaluronidase allows high-molecular-weight biologics to be dispersed, allowing them to be administered subcutaneously rather than intravenously. This has the effect of significantly decreasing administration time, improving patient comfort, and reducing hospital resource utilization. Recent launches such as Roche's Tecentriq Hybreza and Phesgo, both on the back of Halozyme's ENHANZE technology, have shown the commercial viability of hyaluronidase-enabled SC formulations. With pharmaceutical companies increasingly turning to outpatient care and home therapies, hyaluronidase has the potential to become key to reformulating currently available IV drugs for SC application. This creates new avenues of revenue for biopharma companies and sets up a strong growth trajectory for hyaluronidase use outside of aesthetics and ophthalmology.

Challenges

-

Potential for Allergic Reactions and Product Variability is challenging the market growth.

The major challenge is the allergic or immunologic reaction hazard, especially of animal-derived preparations. While not usually harmful, hypersensitivity by some patients, especially to enzymes derived from animals, can trigger side effects ranging from rash, swelling, to anaphylaxis. This restricts the extensive adoption of these formulations, particularly across sensitive populations. In addition, heterogeneity in enzyme activity between product batches may affect therapeutic effectiveness, introducing variability in clinical response. Regulatory agencies are becoming more critical in evaluating the quality and consistency of hyaluronidase products, and this puts even greater pressure on manufacturers to provide high-purity and uniformly active products. These issues can result in a preference for recombinant human forms, which are more expensive and not readily available in all markets, creating a challenge to affordable and uniform global distribution.

Segmentation Analysis

By Type

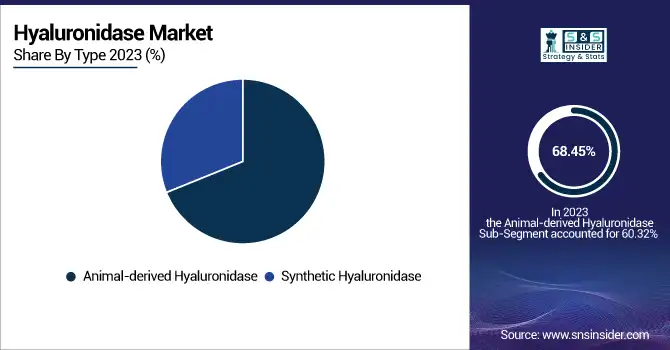

The Animal-derived Hyaluronidase segment dominated the Hyaluronidase Market with a 68.45% market share in 2023 because of its extensive clinical application, cost-effectiveness, and well-established safety profile in therapeutic and aesthetic use. They are derived mainly from bovine and ovine sources and have been used for decades. They are widely integrated into treatments for drug absorption enhancement, reversal of dermal fillers, and post-operative edema management. Their presence in both developed and emerging economies, as well as simplified production processes and less expensive manufacture than recombinant forms, has helped make them dominant. Regulatory experience and doctor' preference for tried-and-true animal-derived products continue to propel their use, especially in areas with limited healthcare budgets. Despite increasing interest in synthetic and recombinant products, the widespread availability, affordability, and established efficacy of animal-derived hyaluronidase made it the top segment in 2023.

By Application

The Dermatology segment dominated the Hyaluronidase Market with 46.28% market share in 2023, as hyaluronidase is used extensively in aesthetic and reconstructive surgeries. Hyaluronidase is commonly employed in dermatology to resorb hyaluronic acid-based dermal fillers, reverse overfilling, and treat vascular occlusion-related complications. With the increase in minimally invasive beauty treatments around the world, particularly in markets such as the U.S., South Korea, and certain regions of Europe, the need for hyaluronidase as a reverser has increased dramatically. In addition, growing consumer knowledge, the emergence of medical aesthetic clinics, and the routine off-label administration of hyaluronidase by dermatologists for filler correction have enhanced its role in the field of dermatology. The safety profile and high frequency of such procedures made the segment the most significant in 2023.

The Chemotherapy segment is expected to be the fastest growing over the forecast years with 9.50% CAGR, because of the growing application of hyaluronidase in facilitating the subcutaneous delivery of oncology drugs. Biopharmaceutical firms are taking advantage of hyaluronidase, namely recombinant ones, to reformulate intravenous chemotherapeutic drugs as subcutaneous injections, enhancing patient compliance and decreasing the burden on healthcare systems. Approval of combination therapies such as Tecentriq Hybreza, and Phesgo by regulators in the U.S. is a crucial development in cancer treatment delivery. With increasing rates of cancer prevalence globally, particularly among older adults, and health systems urging increased outpatient and home-based treatment, hyaluronidase-facilitated subcutaneous therapies will witness rapid growth, propelling significant growth in this segment.

By Formulation

The Liquid Formulations segment dominated the Hyaluronidase Market with a 68.55% market share in 2023 as a result of its ease of use, ease of administration, and preference in emergency and outpatient procedures. Liquid formulations have numerous advantages over lyophilized (powdered) products, such as shorter preparation time, lower risk of contamination upon reconstitution, and greater dosing precision. These qualities are especially worth their weight in gold in fast-paced medical settings such as clinics and hospitals, where hyaluronidase can be quickly required for applications such as extravasation therapy, aesthetic filler correction, or as an adjuvant to subcutaneous drug delivery. Most commercial hyaluronidase products—both those applied in aesthetic medicine and oncology—are liquid, which makes them easier to use and more popular among medical professionals. The growing popularity of liquid formulations in aesthetic dermatology and combination treatments (e.g., Phesgo, Herceptin Hylecta) further cemented this segment's top position in 2023. Their ease of use, clinical effectiveness, and extensive use in both therapeutic and cosmetic fields helped make them the market leaders.

By End-Use

The Hospitals & Clinics segment dominated the Hyaluronidase Market in 2023 with 72.51% market share because of its pivotal position in providing both therapeutic and cosmetic procedures that involve the use of hyaluronidase. Such healthcare facilities are point-of-care locations for cancer therapy, ophthalmologic surgery, plastic and reconstructive surgery, and emergency services—treatment areas in which hyaluronidase is often employed to aid in drug diffusion, treat extravasation, or break down hyaluronic acid-derived fillers. Hospitals and clinics possess the facilities, trained staff, and availability of a variety of drug preparations, both animal-derived and recombinant hyaluronidase, and thus are the most frequent end-users of the enzyme The availability of expert departments such as oncology, dermatology, and ophthalmology in the same building aids in integrated treatment and stimulates increased volumes of usage of hyaluronidase. In parts of North America and Europe, the prevalence of broad access to sophisticated medical services and the deployment of combination drugs like Herceptin Hylecta and Rituxan Hycela—each of which comprises hyaluronidase—also supported the dominance of this segment in 2023.

Regional Analysis

North America dominated the Hyaluronidase Market with a 40.62% market share in 2023, owing to its developed healthcare infrastructure, high rate of adoption of aesthetic treatments, and strong presence of major pharmaceutical and biotechnology firms. The region enjoys a huge patient base for chemotherapy, dermatological procedures, and ophthalmic surgeries, where hyaluronidase has a supportive role. The U.S. FDA's supportive regulatory environment and regular approvals for hyaluronidase-combination treatments, including subcutaneous biologics, further solidify North America's dominance. Key partnerships and investment by companies such as Halozyme and AbbVie further add to vigorous clinical use and market penetration.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is the fastest-growing region with 9.42% CAGR throughout the forecast period in the hyaluronidase market, driven by growing medical tourism, growing awareness of minimally invasive cosmetic treatments, and increasing healthcare access in nations such as China, India, and South Korea. The region is experiencing a surge in aesthetic dermatology and oncology treatment, driving greater demand for recombinant and animal-based hyaluronidase. Government encouragement for domestic pharmaceutical manufacturing, rising disposable incomes, and a burgeoning middle-class population are also driving market growth. Furthermore, local players are investing actively in biosimilars and low-cost variants, which is fueling the rapid adoption of hyaluronidase treatments.

Key Market Players

-

Halozyme Therapeutics, Inc. (Hylenex Recombinant, ENHANZE Drug Delivery Technology)

-

Bausch & Lomb Incorporated (Vitrase, Bausch + Lomb Vitrase Injection)

-

Amphastar Pharmaceuticals, Inc. (Amphadase, Amphastar Hyaluronidase Injection)

-

AbbVie Inc. (Zaluronidase, Humira Combination with Hyaluronidase)

-

Sun Pharmaceutical Industries Ltd. (Sun Hyaluronidase Injection, Sun Enzyme Therapy)

-

Shreya Life Sciences Pvt Ltd. (Hydase, Hyalase Injection)

-

STEMCELL Technologies Inc. (Animal-Free Recombinant Hyaluronidase, Hyaluronidase Solution)

-

Merck KGaA (Sigma-Aldrich Hyaluronidase, Hyaluronidase from Bovine Testes)

-

Thermo Fisher Scientific Inc. (Hyaluronidase Enzyme Solution, Gibco Hyaluronidase)

-

Biosyn Arzneimittel GmbH (Hylase "Dessau", Hylase Injection)

-

PrimaPharma, Inc. (Human Hyaluronidase Injection, Hyaluronidase Compounding API)

-

Roche Holding AG (Phesgo (with Hyaluronidase), Herceptin Hylecta (with Hyaluronidase))

-

Alteogen Inc. (ALT-B4 (Hyaluronidase), Hybrozyme)

-

Chongqing Fuan Pharmaceutical Co., Ltd. (Fuan Hyaluronidase, Recombinant Human Hyaluronidase)

-

CPC Scientific Inc. (Recombinant Hyaluronidase Enzyme, Hyaluronidase API)

-

Creative Enzymes (Bovine Testes Hyaluronidase, Recombinant Human Hyaluronidase)

-

Worthington Biochemical Corporation (Hyaluronidase Type I-S, Hyaluronidase Type IV-S)

-

Qilu Pharmaceutical Co., Ltd. (Qilu Hyaluronidase Injection, Qilu Recombinant Enzyme)

-

Genentech, Inc. (Rituxan Hycela (with Hyaluronidase), Herceptin Hylecta)

-

Zydus Lifesciences Limited (Zyhyalase, Zydus Hyaluronidase Injection)

Suppliers (These suppliers primarily provide recombinant enzymes, fermentation-based active pharmaceutical ingredients (APIs), and formulation-grade excipients necessary for hyaluronidase production.) in the Hyaluronidase Market.

-

Lonza Group AG

-

WuXi AppTec

-

Thermo Fisher Scientific Inc.

-

Sigma-Aldrich (Merck KGaA)

-

Bio-Techne Corporation

-

Creative Enzymes

-

CordenPharma

-

Cambrex Corporation

-

Piramal Pharma Solutions

-

Ajinomoto Bio-Pharma Services

Recent Development

-

September 2024, Halozyme Therapeutics, Inc. reported that the U.S. Food and Drug Administration (FDA) has approved Tecentriq Hybreza (atezolizumab and hyaluronidase-tqjs), which was developed by Roche using Halozyme's ENHANZE drug delivery technology. Tecentriq Hybreza is a subcutaneous formulation of Tecentriq that can be administered in about 7 minutes, a much shorter treatment time than the 30–60 minutes needed for intravenous (IV) infusion. The newly approved treatment will be accessible in the U.S. for all adult indications of IV Tecentriq, such as specific lung, liver, skin, and soft tissue cancers.

-

May 2023, Allergan Aesthetics part of AbbVie, reported that the U.S. FDA has approved SKINVIVE by JUVÉDERM, the first and sole hyaluronic acid (HA) intradermal microdroplet injection intended to improve cheek skin smoothness in adults aged 21 and older. Clinical trials have demonstrated that best-in-class treatment outcomes can be maintained for up to six months, and SKINVIVE is a key innovation in the U.S. aesthetics market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 963.40 Million |

| Market Size by 2032 | US$ 2032.10 Million |

| CAGR | CAGR of 8.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Animal-derived Hyaluronidase, Synthetic Hyaluronidase) • By Application (Dermatology, Chemotherapy, Ophthalmology, Plastic Surgery, Others) • By Formulation (Liquid Formulations, Lyophilized Formulations) • By End-Use (Ambulatory Surgical Centers, Hospitals & Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Halozyme Therapeutics, Inc., Bausch & Lomb Incorporated, Amphastar Pharmaceuticals, Inc., AbbVie Inc., Sun Pharmaceutical Industries Ltd., Shreya Life Sciences Pvt Ltd., STEMCELL Technologies Inc., Merck KGaA, Thermo Fisher Scientific Inc., Biosyn Arzneimittel GmbH, PrimaPharma, Inc., Roche Holding AG, Alteogen Inc., Chongqing Fuan Pharmaceutical Co., Ltd., CPC Scientific Inc., Creative Enzymes, Worthington Biochemical Corporation, Qilu Pharmaceutical Co., Ltd., Genentech, Inc., Zydus Lifesciences Limited, and other players. |