Hybrid Devices Market Report Scope & Overview:

Get more information on the Hybrid Devices Market - Request Sample Report

The Hybrid Devices Market Size was valued at USD 46.96 billion in 2023 and is expected to reach USD 189.04 billion by 2032, growing at a CAGR of 16.80% from 2024-2032.

The hybrid devices market has witnessed remarkable growth in recent years, driven by a shift in consumer preferences toward multifunctional and versatile products. As consumers seek devices that blend the capabilities of smartphones, tablets, and laptops, hybrid devices have emerged as a key solution to meet diverse needs. This shift is particularly evident as the demand for seamless integration between personal and professional tasks has intensified, with users increasingly valuing devices that offer both productivity and entertainment features. As a result, hybrid devices have gained significant traction in both consumer and business markets, further fueling their growth.

This surge in demand is largely attributed to the evolving work and lifestyle patterns, particularly with the rise of remote work and mobile computing. Hybrid devices have proven ideal for users who need the flexibility to transition between various tasks, whether for business or personal use. Industries such as education and corporate sectors are embracing these devices, given their ability to support multitasking and offer connectivity across platforms. Moreover, technological advancements such as improved battery life, faster processors, and enhanced 5G capabilities are further elevating the appeal of hybrid devices, ensuring they remain relevant in an increasingly digital and connected world.

Looking ahead, the hybrid devices market is set to continue its upward trajectory, driven by emerging opportunities and ongoing technological innovations. As industries increasingly adopt AI, augmented reality, and cloud computing, hybrid devices are expected to integrate these technologies, offering even greater functionality. A prime example of such innovation is Huawei's Mate XT, unveiled in September 2024. This world's first tri-fold smartphone features a 10.2-inch OLED display when fully unfolded, combining both inward and outward folding designs, demonstrating the potential for new hybrid device forms. As digital transformation accelerates across emerging markets, the demand for flexible and high-performance devices will expand, creating new avenues for growth.

Hybrid Devices Market Dynamics

DRIVERS

-

The Shift Toward Remote Work and Online Education Is Driving the Growth of Hybrid Devices

The growing trend of remote work and online education has drastically changed how people interact with technology. As professionals and students alike require tools that cater to a wide range of activities video conferencing, content creation, document editing, and multimedia consumption there is an increasing demand for versatile devices that seamlessly combine the functionality of a laptop and tablet. Hybrid devices offer the flexibility to switch between work and leisure modes, providing convenience for those juggling multiple tasks throughout the day. With features like touchscreens, detachable keyboards, and long battery life, these devices enable enhanced productivity in various environments, making them essential for both individual and corporate use. This shift in how people work and learn continues to drive the popularity of hybrid devices.

-

Technological Advancements Are Enhancing Hybrid Devices' Performance, Battery Life, and User Experience

The rapid advancements in key technologies are significantly enhancing the capabilities of hybrid devices. Improvements in processors enable faster performance, allowing users to handle demanding applications and multitask efficiently. Meanwhile, innovations in battery technology have extended the battery life of these devices, ensuring they last longer on a single charge an essential factor for users on the go. Furthermore, advancements in touchscreen technology are providing more responsive and immersive displays, which enhance user interactions whether in tablet or laptop mode. With these technological improvements, hybrid devices are now more powerful, reliable, and user-friendly, making them a compelling choice for a broad range of consumers, from professionals to students. This progress continues to drive the demand for these versatile, all-in-one solutions.

RESTRAINTS

-

Software Compatibility Issues and Their Impact on the Growth of the Hybrid Devices Market

Hybrid devices combine the functionality of laptops and tablets, but not all applications or operating systems are optimized to work seamlessly across both modes. Many apps are specifically designed for either touchscreen tablets or traditional laptops and when used in hybrid mode, they may experience limitations or performance issues. This can lead to an inconsistent user experience, with certain features not functioning as expected or requiring additional configuration. Additionally, software developers may prioritize optimization for traditional device categories, leaving hybrid device users with fewer choices or reduced functionality. This lack of tailored software support hampers the user experience and can limit the appeal of hybrid devices, ultimately affecting their market growth.

Hybrid Devices Market Segments Analysis

BY TYPE

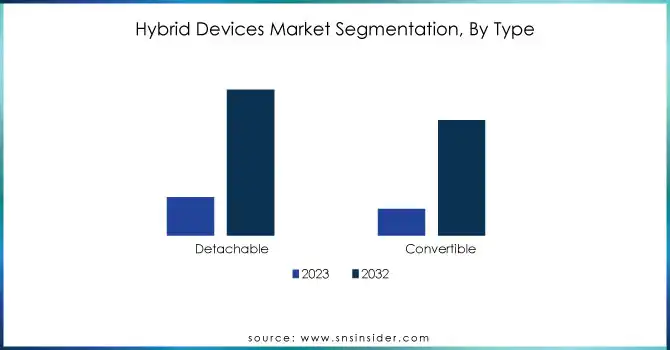

The Detachable segment dominated the hybrid devices market in 2023, accounting for approximately 59% of the revenue share. Its popularity stems from the growing demand for versatile, lightweight devices that combine laptop and tablet functionalities. Detachable offers unmatched flexibility for both work and personal use, appealing to a broad range of consumers. This adaptability has made them a top choice in various industries, driving their market leadership.

The Convertible segment is projected to grow at the fastest CAGR of 17.75% from 2024 to 2032, fueled by rising demand for flexible, all-in-one devices. With the ability to switch between laptop and tablet modes, convertibles cater to users seeking both performance and portability. Businesses, in particular, are gravitating toward these devices for their versatility and space-saving design. This trend is expected to accelerate as technology advances and consumer needs evolve.

BY SCREEN SIZE

The 12-15 Inches segment dominated the hybrid devices market in 2023, accounting for approximately 64% of the revenue share. This size range strikes the ideal balance between portability and screen real estate, appealing to both professionals and consumers. Devices within this range offer a comfortable viewing experience while remaining compact enough for mobility, making them the preferred choice for those seeking a versatile hybrid solution.

The Less Than 12 Inches segment is expected to grow at the fastest CAGR of 19.14% from 2024 to 2032. The increasing demand for ultra-portable devices, particularly among students and frequent travelers, is driving this growth. With a focus on lightweight design and enhanced portability, devices under 12 inches offer a convenient solution for on-the-go users. As mobile workforces expand and consumer preferences shift toward compact, efficient technology, this segment is poised for rapid expansion.

BY END USER

The IT and Telecom segment led the hybrid devices market in 2023, capturing about 38% of the revenue share. This is due to the growing need for high-performance, versatile devices in these industries. Hybrid devices offer IT and telecom professionals the flexibility to switch between office and fieldwork, enhancing productivity. Their ability to meet the demands of mobile and remote work has made them a preferred choice in these sectors.

The Personal Use segment is projected to grow at the fastest CAGR of 18.49% from 2024 to 2032. As remote work and digital connectivity increase, consumers are seeking portable, all-in-one devices. Hybrid devices provide the perfect blend of work, entertainment, and personal use. This growing demand for versatile technology is expected to drive rapid growth in the Personal Use segment.

Hybrid Devices Market Regional Overview

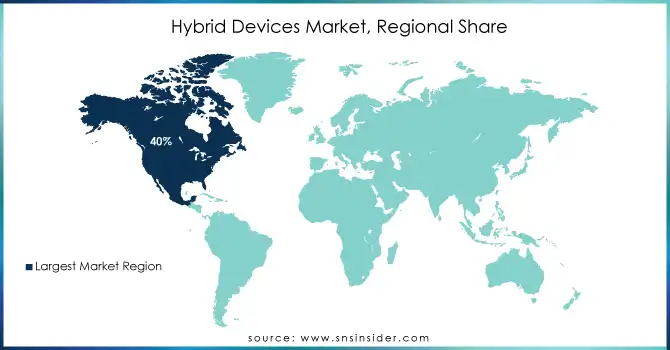

North America dominated the hybrid devices market in 2023, capturing approximately 40% of the revenue share. This dominance is driven by the high demand for advanced, multifunctional devices in sectors like IT, education, and business. North America’s strong infrastructure, high disposable income, and tech-savvy population further fuel the adoption of hybrid devices. The region's focus on innovation and productivity has solidified its leading position in the market.

Looking ahead, Asia Pacific is expected to grow at the fastest CAGR of 18.88% from 2024 to 2032. This growth is driven by rapid digital transformation, a growing middle class, and increasing demand for affordable, versatile devices. The region’s expanding tech ecosystem and rise in remote working further boost the adoption of hybrid devices. As businesses and consumers seek cost-effective, all-in-one solutions, Asia Pacific is poised for significant market expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

LATEST NEWS

-

In 2024, Asus will release the Zenbook 17 Fold OLED, a hybrid device with a 17.3-inch foldable OLED screen. Offering multiple configurations, it features an Intel i7-1250U processor, 16GB of RAM, and a 1TB SSD.

-

In October 2024, Lenovo revealed a new hybrid AI portfolio at the Global Tech World event, featuring solutions like the Lenovo Hybrid AI Advantage for enterprises and products such as the ThinkPad X1 2-in-1 AI laptop.

-

In 2024, Google and HP announced a partnership to revolutionize hybrid meetings with their XR video solution, Project Starline.

KEY PLAYERS

-

Fujitsu Limited (Lifebook U939X, Stylistic Q7312)

-

LG Corporation (LG Gram 2-in-1, LG Tab-Book)

-

ASUSTeK Computer Inc (ASUS ZenBook Flip, ASUS Chromebook Flip)

-

Lenovo (Lenovo Yoga, Lenovo IdeaPad Flex)

-

HP Development Company (HP Spectre x360, HP Envy x360)

-

Microsoft Corporation (Surface Pro, Surface Laptop Studio)

-

Dell Inc. (Dell XPS 13 2-in-1, Dell Inspiron 14 2-in-1)

-

Toshiba Corporation (Toshiba Dynabook RZ Series, Toshiba Portege X30W-J)

-

Samsung Electronics Co. (Samsung Galaxy Book Flex, Samsung Galaxy Tab S8 Book Cover Keyboard)

-

Acer Inc. (Acer Spin 5, Acer Chromebook Spin 713)

-

Apple Inc. (iPad Pro with Magic Keyboard, MacBook Pro with Boot Camp)

-

Huawei Technologies Co., Ltd. (Huawei MateBook E, Huawei MatePad Pro)

-

Google LLC (Google Pixelbook, Google Pixel Slate)

-

Razer Inc. (Razer Blade Stealth 13, Razer Book 13)

-

Panasonic Corporation (Panasonic Toughbook CF-33, Panasonic Let's Note XZ)

-

Sony Corporation (Sony VAIO Z Flip, Sony Xperia Tablet Z)

-

Xiaomi Inc. (Xiaomi Mi Notebook Pro, Xiaomi Pad 5 with Keyboard)

-

Dynabook Inc. (Dynabook Tecra A40, Dynabook Portege X30)

-

VAIO Corporation (VAIO SX12, VAIO Z Canvas)

-

Chuwi Innovation Limited (Chuwi UBook Pro, Chuwi CoreBook X)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 46.96 Billion |

| Market Size by 2032 | USD 189.04 Billion |

| CAGR | CAGR of 16.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Detachable, Convertible) • By Screen Size (Less Than 12 Inches, 12-15 Inches, Greater than 15 Inches) • By End User (IT and Telecom, Personal Use, Educational Institutions, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fujitsu Limited, LG Corporation, ASUSTeK Computer Inc., Lenovo, HP Development Company, Microsoft Corporation, Dell Inc., Toshiba Corporation, Samsung Electronics Co., Acer Inc., Apple Inc., Huawei Technologies Co., Ltd., Google LLC, Razer Inc., Panasonic Corporation, Sony Corporation, Xiaomi Inc., Dynabook Inc., VAIO Corporation, Chuwi Innovation Limited. |

| Key Drivers | • The Shift Toward Remote Work and Online Education Is Driving the Growth of Hybrid Devices • Technological Advancements Are Enhancing Hybrid Devices' Performance, Battery Life, and User Experience |

| RESTRAINTS | • Software Compatibility Issues and Their Impact on the Growth of the Hybrid Devices Market |