Suspension Ride Height Sensor Market Report Scope & Overview:

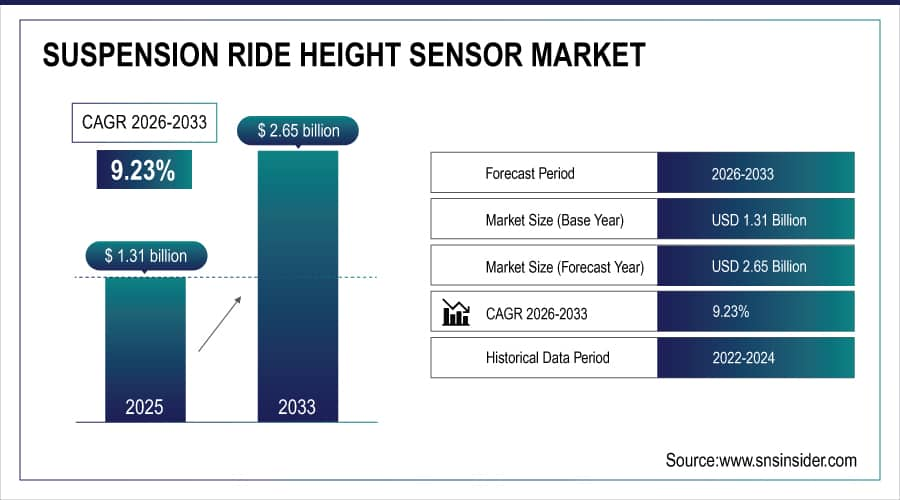

The Suspension Ride Height Sensor Market size was valued at USD 1.31 Billion in 2025E and is projected to reach USD 2.65 Billion by 2033, growing at a CAGR of 9.23% during 2026–2033.

The suspension ride height sensor market is expanding rapidly as modern vehicles require precise chassis data to support advanced safety, comfort, and performance functions. These sensors provide real-time measurement of vehicle height, enabling systems such as adaptive suspension, air-leveling control, headlamp leveling, and load compensation. Growth is driven by rising adoption of electric vehicles, premium SUVs, and luxury sedans that demand enhanced ride stability and dynamic handling. Increasing integration of electronic suspension systems, lightweight sensor designs, and software-driven control modules is further accelerating market development. Regulatory emphasis on road safety and ride comfort also continues to boost global demand.

July 1, 2025 – ZF began series production of its Smart Chassis Sensor with Cadillac’s all-electric CELESTIQ, integrating sensor technology directly into suspension ball joints to measure ride height with superior accuracy and reliability.

Suspension Ride Height Sensor Market Size and Forecast:

-

Market Size in 2025E: USD 1.31 Billion

-

Market Size by 2033: USD 2.65 Billion

-

CAGR: 9.23% (from 2026 to 2033)

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Suspension Ride Height Sensor Market - Request Free Sample Report

Suspension Ride Height Sensor Market Highlights:

-

Increasing adoption of active ride control and intelligent suspension systems is boosting demand for high-precision ride height sensors across luxury vehicles, EVs, and next-generation platforms.

-

Real-time suspension data enabling millisecond damping adjustments is strengthening the role of advanced accelerometer- and Hall-effect-based sensing technologies.

-

High integration costs, complex calibration, and stringent durability requirements pose key restraints, particularly in cost-sensitive and mid-range vehicle segments.

-

Lack of standardization, wiring complexities, and electronic module failures continue to limit large-scale adoption in global automotive markets.

-

Growing opportunities are emerging from predictive chassis systems, software-defined vehicles, electrified powertrains, and connected-vehicle architectures.

-

Increasing use of intelligent sensors for air suspension, adaptive headlight leveling, pothole detection, and fleet chassis-health monitoring is accelerating long-term market expansion.

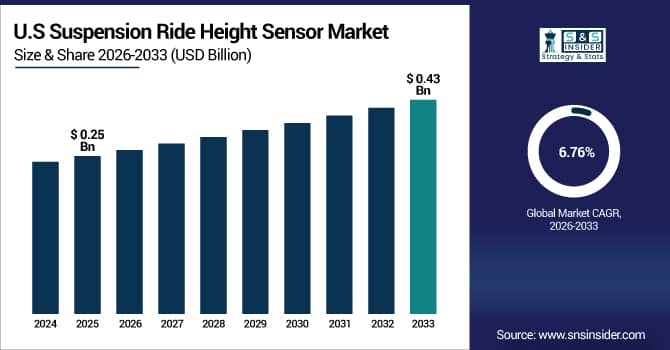

The U.S. Suspension Ride Height Sensor Market size was valued at USD 0.25 Billion in 2025E and is projected to reach USD 0.43 Billion by 2033, growing at a CAGR of 6.76% during 2026–2033, driven by rising adoption of advanced driver assistance systems (ADAS), growing demand for electronically controlled suspension systems, and the shift toward premium and electric vehicles requiring precise ride-height monitoring. Increasing integration of smart chassis technologies, stricter safety and headlamp-leveling regulations, and the need for improved ride comfort and vehicle stability further support market expansion.

Suspension Ride Height Sensor Market Drivers:

-

Advancement of Active Ride Control and Intelligent Suspension Systems Driving Market Growth

Growing adoption of active ride control and electronically adjustable suspension systems is a key driver for the Suspension Ride Height Sensor Market. Modern vehicles rely on high-precision ride-height sensors to deliver real-time chassis data, enabling millisecond damping adjustments for improved stability, comfort, and safety. As OEMs increasingly integrate accelerometers, Hall-effect sensors, and adaptive damping technologies, demand for accurate ride-height sensing continues to rise. The shift toward intelligent suspensions, pothole detection features, and premium driving dynamics is accelerating sensor adoption across EVs, luxury cars, and next-generation platforms.

Oct 29, 2025 – Ride-height sensors supply real-time suspension position and movement data to active ride control systems, enabling precise damping adjustments within milliseconds. Modern electronically adjustable shocks use inputs from accelerometers and stability systems to improve handling, comfort, and road-surface response.

Suspension Ride Height Sensor Market Restraints:

-

Challenges Limiting Adoption of Advanced Suspension Ride Height Sensors

The Suspension Ride Height Sensor Market faces restraints driven by high integration costs, complex calibration requirements, and the need for compatibility with advanced electronic control systems. Tier-1 suppliers and OEMs must address stringent durability expectations, especially under harsh environments such as dust, moisture, and temperature fluctuations. Additionally, failures in electronic ride-control modules or wiring harnesses can lead to expensive repairs, slowing mass adoption. Limited standardization across vehicle platforms, data-signal inconsistencies, and the need for frequent validation testing further restrict widespread deployment, particularly in mid-range passenger vehicles and cost-sensitive markets.

Suspension Ride Height Sensor Market Opportunities:

-

Next-Gen Predictive Chassis Technologies Unlock New Opportunities for Ride Height Sensors

Growing adoption of intelligent chassis systems, electrified powertrains, and predictive suspension technologies is creating strong opportunities for advanced ride height sensors. Automakers are increasingly integrating smart, compact, and high-precision sensors to support active damping, air suspension, adaptive headlight leveling, and road-surface recognition features. The shift toward software-defined vehicles, along with rising EV and luxury vehicle production, is boosting demand for sensors capable of real-time data processing and connected-vehicle functions. Additionally, opportunities are expanding in commercial vehicles and fleet applications, where predictive maintenance and chassis-health monitoring can significantly reduce downtime and improve operational efficiency.

July 7, 2025 – Cadillac’s Celestiq now features ZF’s Smart Chassis Sensor, integrated into suspension ball joints to replace traditional ride height sensors with a more accurate, compact, and weather-protected system. The sensor enhances air-suspension control, adaptive damping, pothole detection, and headlight leveling for superior ride comfort and safety.

Suspension Ride Height Sensor Market Segment Highlights:

-

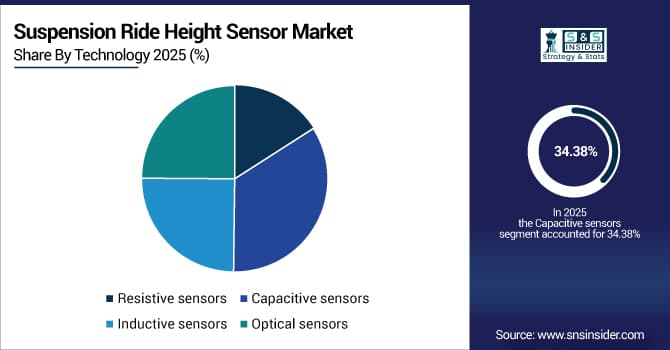

By Technology: Dominant – Capacitive Sensors (34.38% in 2025 → 30.63% in 2033); Fastest-Growing – Optical Sensors (CAGR 14.87%)

-

By Vehicle Type: Dominant – Passenger Cars (49.13% in 2025 → 43.88% in 2033); Fastest-Growing – Heavy-Duty Trucks (CAGR 13.35%)

-

By Application: Dominant – Suspension Control Systems (29.25% in 2025 → 24.75% in 2033); Fastest-Growing – Adaptive Suspension Systems (CAGR 10.75%)

-

By Distribution Channel: Dominant – OEMs (50.38% in 2025 → 52.63% in 2033); Fastest-Growing – Physical Auto-Parts Stores (CAGR 10.21%)

Suspension Ride Height Sensor Market Segment Analysis:

By Technology, Capacitive Sensors Dominating and Optical Sensors Fastest-Growing

Capacitive sensors remain the dominant technology due to their high precision, durability, and strong suitability for applications requiring accurate displacement and height measurement in automotive suspension and ride-control systems. Their reliability under varying environmental conditions makes them the preferred choice for OEMs. Optical sensors, meanwhile, are emerging as the fastest-growing technology, supported by advancements in light-based detection, enhanced sensitivity, and the shift toward more intelligent, software-driven suspension systems.

By Vehicle Type, Passenger Cars Dominating and Heavy-Duty Trucks Fastest-Growing

Passenger cars continue to dominate due to large-scale adoption of suspension monitoring technologies across mid-range and premium segments. Growing focus on comfort, stability, and safety drives consistent integration by automakers. Heavy-duty trucks, however, represent the fastest-growing segment as the commercial transport industry increasingly adopts advanced ride-height sensors to improve load management, enhance driving stability, and meet tightening fleet safety and performance regulations.

By Application, Suspension Control Systems Dominating and Adaptive Suspension Systems Fastest-Growing

Suspension control systems remain the leading application, supported by their widespread use in maintaining optimal vehicle height, stability, and road-handling performance across all major vehicle categories. Adaptive suspension systems are expanding rapidly, fueled by rising demand for intelligent, real-time suspension adjustment in luxury, electric, and high-performance vehicles, where ride comfort and dynamic control are key differentiators.

By Distribution Channel, OEMs Dominating and Physical Auto-Parts Stores Fastest-Growing

OEMs dominate the distribution landscape as most ride-height sensors are factory-installed to meet vehicle safety standards, performance requirements, and warranty compliance. Physical auto-parts stores are emerging as the fastest-growing channel due to increasing aftermarket replacement needs, aging vehicle fleets, and greater consumer preference for accessible, quick-purchase solutions for maintenance and repair.

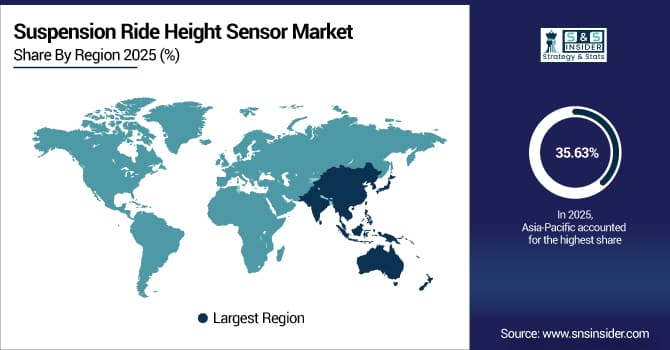

Suspension Ride Height Sensor Market Regional Highlights:

-

Asia-Pacific: In 2025E 35.63% → 39.38%, Dominating Region (CAGR 10.60%)

-

North America: In 2025E 29.25% → 25.60%, Significant Market (CAGR 7.41%)

-

Europe: In 2025E 24.88% → 24.13%, Stable & Mature Market (CAGR 8.81%)

-

South America: In 2025E 5.13% → 5.45%, Steady Growth (CAGR 10.07%)

-

Middle East & Africa: In 2025E 5.13% → 5.45%, Stable Share (CAGR 10.07%)

Suspension Ride Height Sensor Market Regional Analysis:

Asia-Pacific Suspension Ride Height Sensor Market Insights:

Asia-Pacific dominates the Suspension Ride Height Sensor Market, supported by rapid vehicle production growth, increasing adoption of advanced suspension technologies, and strong investments in EVs and premium vehicles. Expanding manufacturing bases, rising demand for comfort and safety features, and accelerated integration of smart chassis systems further strengthen the region’s leadership, making it the fastest-advancing hub for suspension sensor innovation and deployment.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Suspension Ride Height Sensor Market Insights:

China leads the Suspension Ride Height Sensor market due to massive automotive production, rapid EV adoption, strong local manufacturing capabilities, and growing demand for advanced suspension technologies across passenger and premium vehicles.

North America Suspension Ride Height Sensor Market Insights:

North America is the fastest-growing region in the Suspension Ride Height Sensor market, driven by strong demand for advanced driver-assistance systems, premium vehicle adoption, and rapid integration of adaptive and air suspension technologies. Growing EV production, technological innovation by leading OEMs, and rising investments in smart chassis systems further accelerate market expansion across the U.S. and Canada.

U.S. Suspension Ride Height Sensor Market Insights:

The U.S. dominates the Suspension Ride Height Sensor market, supported by strong automotive production, rapid ADAS adoption, and high demand for premium vehicles equipped with advanced suspension and chassis technologies.

Europe Suspension Ride Height Sensor Market Insights:

The Europe Suspension Ride Height Sensor Market is witnessing emerging trends driven by the rapid integration of advanced suspension technologies, increasing EV production, and strict vehicle safety regulations. Automakers are focusing on adaptive and electronically controlled suspension systems, boosting demand for high-precision height sensors. Additionally, growing investments in lightweight materials, smart chassis systems, and autonomous-driving features are shaping the region’s evolving market landscape.

Germany Suspension Ride Height Sensor Market Insights:

Germany dominates the European Suspension Ride Height Sensor market, driven by its strong automotive manufacturing base, high adoption of advanced suspension systems, and continuous innovation in premium and luxury vehicle technologies.

Latin America Suspension Ride Height Sensor Market Insights:

The Latin America Suspension Ride Height Sensor Market is steadily expanding, supported by improving vehicle production, growing demand for safer and more comfortable driving experiences, and the gradual adoption of advanced suspension technologies. Economic growth, rising sales of SUVs and light trucks, and increased aftermarket activity are further contributing to market development across key countries such as Brazil, Mexico, and Argentina.

Brazil Suspension Ride Height Sensor Market Insights:

Brazil dominates the Latin America Suspension Ride Height Sensor market, driven by its large automotive manufacturing base, rising demand for SUVs, and increasing adoption of advanced suspension technologies in both OEM and aftermarket segments.

Middle East & Africa Suspension Ride Height Sensor Market Insights:

The Middle East and Africa Suspension Ride Height Sensor Market is witnessing moderate growth, supported by rising vehicle production, increasing adoption of premium SUVs, and growing investment in road infrastructure. Expanding aftermarket demand, along with gradual integration of advanced suspension technologies in passenger and commercial vehicles, is further contributing to market progress. However, growth remains steady rather than rapid due to varying economic conditions across the region.

UAE & Saudi Arabia Suspension Ride Height Sensor Market Insights:

The UAE and Saudi Arabia dominate the Middle East Suspension Ride Height Sensor market, driven by strong luxury vehicle demand, rapid adoption of advanced suspension systems, and expanding automotive service networks supporting premium and high-performance vehicles.

Suspension Ride Height Sensor Market Competitive Landscape:

KYOCERA AVX, established in 1972, is a global manufacturer of high-reliability electronic components for automotive, industrial, and communication markets. The company develops advanced sensors, antennas, capacitors, and connectivity solutions, supporting next-generation mobility with innovations such as mmWave sensing, chassis-level sensors, and automotive-grade components engineered for safety, performance, and durability.

-

January 7, 2025 – KYOCERA AVX co-exhibited with Kyocera Corporation at CES 2025, showcasing advanced automotive, sensing, and next-generation electronic component technologies.

Delphi Technologies establish year in 1994 is a global provider of advanced automotive systems specializing in powertrain, electronics, and aftermarket components. The company delivers high-reliability steering, suspension, braking, and EV-ready solutions, supporting workshops with diagnostics, training, and high-quality replacement parts engineered to enhance vehicle performance, safety, and long-term durability across global markets.

-

March 27, 2024 – Delphi announced major expansion of its Steering & Suspension range, adding 1,000+ new SKUs annually through 2026, covering 180 million EMEA vehicles and supporting EV platforms.

Suspension Ride Height Sensor Market Key Players:

-

Continental

-

KYOCERA AVX

-

Delphi

-

Hella

-

Aisin Seiki

-

NGK

-

Tokyo Cosmos Electric

-

Transtron

-

EFl Automotive

-

KSR International

-

Arnott

-

Kendrion

-

Dorman Products

-

Wenzhou Qilong Automotive Electronic

-

CENWAN Sensing Technology

-

ZF Friedrichshafen

-

Sensata Technologies

-

Hitachi Astemo (Hitachi Automotive Systems)

-

Mando Corporation

-

KYB Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.31 Billion |

| Market Size by 2033 | USD 2.65 Billion |

| CAGR | CAGR of 9.23% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology(Resistive sensors, Capacitive sensors, Inductive sensors and Optical sensors) • By Vehicle Type(Passenger cars, Commercial vehicles, Two-wheelers and Heavy-duty trucks) • By Application(Suspension control systems, Ride quality improvement, Vehicle stability control and Adaptive suspension systems) • By Distribution Channel(OEMs (Original Equipment Manufacturers, Aftermarket, Online retailers and Physical auto-parts stores) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Continental, KYOCERA AVX, Delphi, Hella, Aisin Seiki, NGK, Tokyo Cosmos Electric, Transtron, EFl Automotive, KSR International, Arnott, Kendrion, Dorman Products, Wenzhou Qilong Automotive Electronic, CENWAN Sensing Technology, ZF Friedrichshafen, Sensata Technologies, Hitachi Astemo, Mando Corporation, and KYB Corporation. |