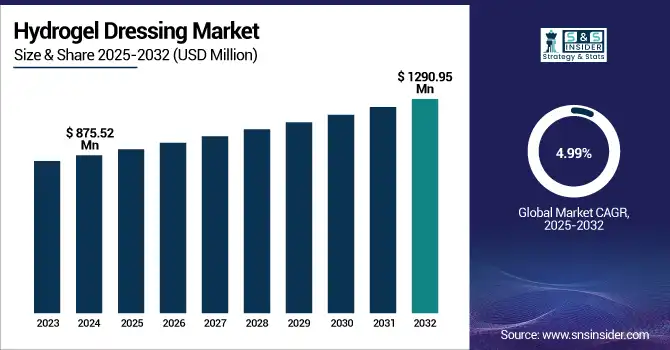

Hydrogel Dressing Market Size Analysis:

The Hydrogel Dressing Market size was valued at USD 875.52 million in 2024 and is expected to reach USD 1290.95 million by 2032, growing at a CAGR of 4.99% over the forecast period 2025-2032.

Rising frequency of chronic wounds, diabetic foot ulcers, and pressure ulcers, along with growing healthcare costs and government programs encouraging advanced wound care, are driving the global hydrogel dressing market.

To Get more information on Hydrogel Dressing Market - Request Free Sample Report

The U.S. Centers for Disease Control and Prevention (CDC) estimates that over 6.7 million Americans suffer from chronic wounds yearly, greatly increasing demand for hydrogel wound dressings that offer moist wound healing conditions fit for speedier recovery.

Reflecting its leadership in advanced wound care acceptance and innovation, the U.S. hydrogel dressing market is predicted to reach USD 478.32 million by 2032 with a CAGR of 4.93%. Its value in 2024 was USD 326.01 million. To promote trauma wound treatment and chronic wound management, government regulatory authorities have sped approvals of FDA-approved wound dressings incorporating bioactive and infection control dressings. Programs such as Australia's Chronic Wound Consumables Scheme (CWCS) also seek to highlight worldwide policy support by covering prices, therefore easing patient access to hydrogel bandages and other innovative wound care treatments.

The hydrogel dressings show an increasing inclination for medical hydrogel dressings because of their better capacity to preserve moist wound healing, lower pain, and avoid infections. With institutions such as the NIH sponsoring research into antimicrobial hydrogel dressings to fight antibiotic-resistant infections, governments all around are stressing chronic wound management as a public health priority. Technological advancements in wound treatment include polyurethane and silicone dressings combined with bioactive chemicals, hence improving healing results. For example, the U.S. FDA has declared plans to classify several solid wound dressings, including hydrogel wound dressings with antimicrobial agents, therefore simplifying regulatory routes for safer and more effective treatments. The global hydrogel dressing market trends also show growing acceptance of smart hydrogel bandages, allowing remote patient care and digital wound monitoring. Rising diabetic foot ulcers and demand for burn treatment options, along with these developments, are driving market expansion and the worldwide hydrogel dressing market size increase.

Hydrogel Dressing Market Dynamics

Drivers

-

Rising Prevalence of Chronic Diseases and Wound Healing Needs Influence Hydrogel Dressing Adoption Worldwide

One of the main drivers of the need for hydrogel dressings globally is the rising frequency of chronic disorders, including diabetes and obesity. Because of their chronic character and demand for advanced wound treatment, diabetic foot ulcers predominate in the application segment of hydrogel dressings. For the management of difficult-to-cure chronic wounds, hydrogel dressings offer a moist healing environment that stimulates tissue regeneration and lowers infection risk. Moreover, the aging global population, especially in developed areas such as North America, increases the prevalence of venous leg ulcers and pressure ulcers, therefore driving market demand even more.

Modern scientific developments have brought bioactive hydrogels loaded with growth factors and antibacterial agents, therefore improving healing effectiveness and patient outcomes. For sophisticated wound care products, regulatory agencies have also simplified approval processes, therefore hastening market availability and acceptance. The COVID-19 epidemic first interfered with wound care treatments but has now normalized with more patient visits and hydrogel dressing use. These elements highlight the increasing clinical necessity as well as the technical advancement driving the expansion of the hydrogel dressing market.

Restraints

-

High Manufacturing Costs and Regulatory Obstacles Limit Hydrogel Dressing Market Growth

Hydrogel dressings have great clinical advantages, but their high production costs and complicated regulatory constraints place major limitations. Specialized polymers and technologies used in the manufacturing process reduce costs and retail prices, therefore restricting access in areas sensitive to cost-cutting. In developing nations where healthcare expenditures are limited and hence limit general adoption, this cost obstacle is especially evident. Strong regulatory systems for medical devices also slow down product approvals and raise compliance costs, therefore hindering innovation and market entrance. Further impeding development is the ignorance among healthcare professionals and patients in developing countries about hydrogel dressings.

Furthermore, challenging the market share of hydrogel dressings is competition from less expensive wound care options such as foam and alginate dressings. Raw material shortages and supply chain interruptions further influence production delays, therefore influencing timely availability. Rising clinical demand notwithstanding these combined economic and regulatory obstacles limit the potential of the hydrogel dressing business.

Hydrogel Dressing Market Segmentation Overview

By End Use

With the great amount of patients needing advanced wound care in clinical environments, the hospital segment led the hydrogel dressing market in 2024 and accounted for the greatest share. Established reimbursement policies and infrastructure that help to use FDA-approved wound dressings, including hydrogel dressings for burns and chronic wound management, help hospitals. With almost 6 million patients treated yearly for pressure ulcers and diabetic foot ulcers, the U.S. Department of Health and Human Services noted that hospital admissions linked to such wounds have been gradually rising. With government wound care product expenditure surpassing USD 50 billion in 2023, hospitals' vital influence in the market for wound healing is underlined. Furthermore, the driving demand for hydrogel bandages and infection control dressings in trauma wound treatment and surgical wound management is the rising number of operations worldwide, including the 31,057 cosmetic surgeries carried out in the UK in 2022 (a 102% rise from 2021).

During the forecast period, the home healthcare sector is expected to show the fastest CAGR. Rising senior population choosing home-based care for cost-effectiveness and management of chronic wounds fuels this increase. In 2024, 17.8% of Americans were 65 years of age or older, a group prone to pressure ulcers and diabetic foot ulcers needing constant wound care, according to the U.S. Census Bureau. Government programs include Medicare's increased reimbursement of home wound care goods in 2023, which has encouraged the use of hydrogel wound dressings at home.

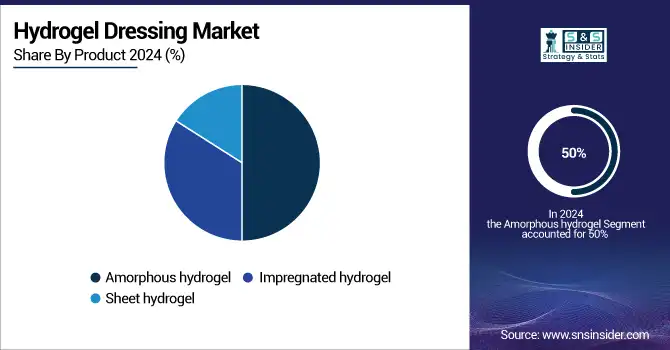

By Product

Due mostly to its ability to preserve moist wound healing settings and soothe painful wounds, including burns and necrotic tissue, the amorphous hydrogel segment dominated the market and held the largest revenue share of 50% in 2024. According to the American Burn Association, there are around 400,000 burn injuries treated in the United States every year; many of them call for amorphous hydrogel dressings as part of burn treatment. Government health departments support these dressings in clinical guidelines, therefore supporting ongoing market demand. Also, biodegradable dressings, amorphous hydrogels fit the trends in environmental sustainability in the wound care industry.

Impregnated hydrogel dressings are expected to show a significant growth over the projection period. These cutting-edge wound care treatments provide exceptional infection control and rapid healing, utilizing antibacterial medicines or growth factors. Reflecting great government support for innovation, the NIH grants in 2023 to research antimicrobial hydrogel dressings aiming at antibiotic-resistant illnesses. Leading hydrogel dressing companies, including 3M and Advanced Medical Solutions, have introduced new impregnated hydrogel solutions with bioactive dressings in line with FDA-approved wound dressings criteria and reimbursement regulations.

By Application

The chronic wounds segment dominated the hydrogel dressing market in 2024, driven by the rising prevalence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers. The International Diabetes Federation projects that 537 million adults globally will have diabetes in 2023; many of them will have chronic wounds that call for sophisticated hydrogel wound dressings. Government healthcare initiatives, such as the U.S. CMS reimbursement incentives for hydrogel dressings, have increased acceptance in the treatment of chronic wounds. A major load on healthcare systems, chronic wounds drive initiatives including Australia's Chronic Wound Consumables Scheme (CWCS) to increase patient access to hydrogel bandages and infection control dressings.

Driven by growing surgical operations and trauma cases worldwide, the category of acute wounds is expected to show the fastest CAGR. Millions of surgical site infections reported by the World Health Organisation annually create demand for enhanced wound care solutions that speed healing and infection control. Encouragement of greater hospital and outpatient usage follows from recent government-supported clinical research showing the effectiveness of hydrogel dressings in acute wound treatment.

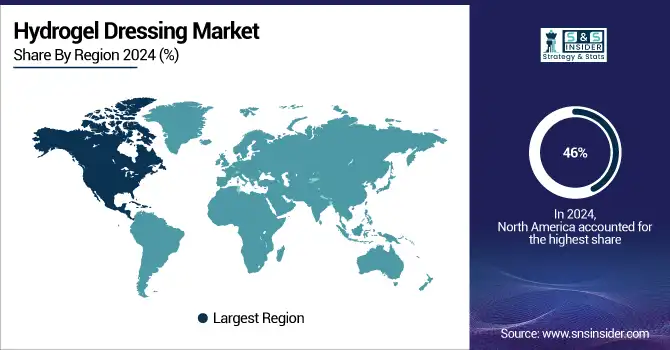

Hydrogel Dressing Market Regional Insights

With over 46% of the worldwide hydrogel dressing market share in 2024, North America is the major market. The U.S. hydrogel dressing market dominates this region because of its advanced healthcare infrastructure, high frequency of chronic wounds such as diabetic foot ulcers and pressure ulcers, and strong government backing through reimbursement policies and research funding. Maintaining this leadership posture has been much aided by the U.S. government's rising healthcare expenditure on advanced wound care products, particularly FDA-approved wound dressings and infection control dressings. Major hydrogel dressing firms such as 3M, Smith & Nephew, and Coloplast Corp. also help to confirm North America's industry leadership.

With a noteworthy CAGR over the predicted period, Asia-Pacific is becoming the fastest-growing area. Rising disposable budgets, more awareness of healthcare issues, and a growing patient group with diabetes and chronic wounds all help to drive this fast expansion. The International Diabetes Federation estimates that South Asia alone had 82 million diabetes patients in 2017, likely to climb to 151 million by 2045, hence driving demand for hydrogel dressings for diabetic foot ulcers and burn treatment options. Supported by government programs endorsing improved wound care treatments, nations such as China and India are seeing large expenditures in the healthcare infrastructure and industry expansion.

Driven by aging populations and increasing chronic disease rates, Europe demonstrates a consistent increase. The European Commission noted that demand for advanced wound care products has risen since over 20% of EU members are 65 years of age or above. To reduce hospital loads, European governments encourage home healthcare and outpatient wound management, therefore encouraging the growth of the market for hydrogels.

Rising healthcare awareness, government funding, and diabetes and ulcer incidence are driving the LAMEA area, which is becoming a high-growth market. emerging as the leading region with government projects enhancing wound treatment availability and healthcare infrastructure is Brazil. Supported by hospital and homecare environments, the LAMEA hydrogel dressing market is predicted to expand at a CAGR of over 9% during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hydrogel Dressing Market Key Players

The key Hydrogel Dressing companies are McKesson Medical-Surgical, Cardinal Health, AMERX Health Care Corp., 3M, Coloplast Corp., ConvaTec Group PLC, Medline Industries, Integra LifeSciences Corp., Smith & Nephew, DermaRite Industries, LLC, and others

Recent Developments in the Hydrogel Dressing Market

-

In March 2025, 3M launched a new line of FDA-approved bioactive impregnated hydrogel dressings in the U.S., supported by streamlined regulatory pathways and government reimbursement policies promoting advanced wound care products.

-

In January 2025, the NIH announced funding for clinical trials on antimicrobial hydrogel dressings targeting antibiotic-resistant infections in chronic wounds, underscoring the government's commitment to innovation in hydrogel wound dressing technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 875.52 million |

| Market Size by 2032 | USD 1290.95 million |

| CAGR | CAGR of 4.99% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Amorphous hydrogel, Sheet hydrogel, and Impregnated hydrogel • By Application (Acute Wounds, and Chronic Wounds) • By End-use (Hospitals, Home Healthcare, Specialty Clinics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | McKesson Medical-Surgical, Cardinal Health, AMERX Health Care Corp., 3M, Coloplast Corp., ConvaTec Group PLC, Medline Industries, Integra LifeSciences Corp., Smith & Nephew, DermaRite Industries, LLC, and others |