Hydrogen Energy Storage Market Report Scope & Overview:

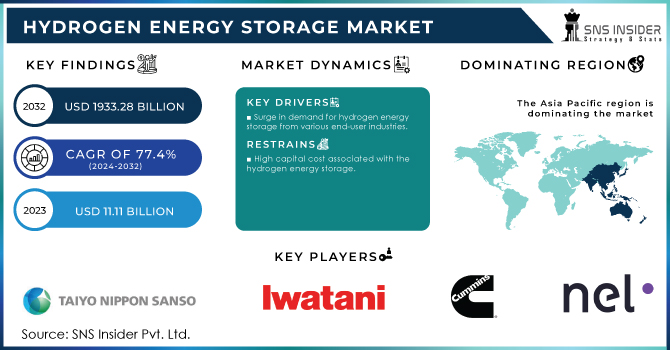

The Hydrogen Energy Storage Market Size was valued at USD 11.11 billion in 2023 and is expected to reach USD 1933.28 billion by 2032 and grow at a CAGR of 77.4 % over the forecast period 2024-2032.

To Get More Information on Hydrogen Energy Storage Market - Request Sample Report

Hydrogen Energy storage is a critical technology that enables the advancement of hydrogen and fuel cell technologies in various applications, including stationary power, portable power, and transportation. No other fuel can match the energy per mass of hydrogen. However, its low ambient temperature density leads to a low energy per unit volume. Therefore, the development of advanced storage methods with the potential for higher energy density is necessary.

Electrolysis is a process that can convert electricity into hydrogen, which can then be stored and later re-electrified. Despite its lower efficiency, hydrogen energy storage has the potential to revolutionize the way we store and use energy. With its high storage capacity, it could provide a reliable and sustainable source of energy for a variety of applications.

The storage of hydrogen can be accomplished through two primary methods: as a gas or as a liquid. However, the storage of hydrogen as a gas requires high-pressure tanks with a pressure range of 350-700 bar (5,000-10,000 psi). On the other hand, if hydrogen is to be stored as a liquid, it must be kept at cryogenic temperatures. This is because the boiling point of hydrogen at one-atmosphere pressure is a frigid -252.8°C. These techniques offer unique advantages, such as increased storage capacity and improved safety. These alternative storage methods offer promising solutions for achieving higher energy density and overcoming the limitations of traditional storage methods.

Market Dynamics

Drivers

-

Surge in demand for hydrogen energy storage from various end-user industries

-

Increasing adoption of fuel-cell vehicles

-

Shifting consumer preference towards low-emission fuels

-

Increasing adoption of renewable energy sources

The hydrogen energy storage market is experiencing a surge in demand from various end-user industries, which is the primary driving factor behind its growth. This trend is indicative of a growing interest in sustainable energy solutions that can help reduce carbon emissions and promote a cleaner environment. As more and more industries recognize the benefits of hydrogen energy storage, the market is expected to continue its upward growth. This technology offers a reliable and efficient way to store energy, making it an attractive option for a wide range of applications.

Restrain

-

High capital cost associated with the hydrogen energy storage

-

Presence of other alternatives

Opportunities

-

Increasing investment in the R&D activities related to the storage system

-

Development of full-scale storage projects

Challenges

-

Rising investment in battery storage technology over hydrogen energy storage

-

Stringent regulation imposed by the government associated with the production of hydrogen

The hydrogen energy storage market faces a significant challenge due to the strict regulations imposed by the government on the production of hydrogen through electrolysis. These regulations make it difficult for companies to produce and store hydrogen efficiently and cost-effectively.

Impact of COVID-19

The pandemic has caused disruptions in the supply chain, reduced demand, and forced companies to adapt to new ways of doing business. The covid-19 pandemic affected the hydrogen energy storage market in several ways. Firstly, the supply chain has been disrupted due to the closure of factories and transportation restrictions. This has led to delays in the delivery of components and equipment, which has affected the production of hydrogen energy storage systems.

Secondly, the pandemic has reduced demand for hydrogen energy storage systems. Many industries have been affected by the pandemic, and as a result, they have reduced their energy consumption. This has led to a decrease in the demand for hydrogen energy storage systems. Finally, the pandemic has forced companies to adapt to new ways of doing business. Many companies have had to shift to remote work, which has affected their ability to collaborate and innovate. This has slowed down the development of new hydrogen energy storage technologies.

Impact of Russia-Ukraine War:

The Russian invasion of Ukraine affected various industries including the hydrogen energy storage market. This market has been experiencing steady growth in recent years, with the increasing demand for clean energy solutions. The hydrogen energy storage market is crucial for the development of renewable energy sources, as it provides a means of storing excess energy generated by wind and solar power. This stored energy can then be used during periods of low energy production, ensuring a consistent and reliable energy supply. However, the conflict between Russia and Ukraine has disrupted the supply of critical materials used in the production of hydrogen storage technologies, such as platinum and palladium.

Impact of Recession:

The recession affected the energy sector significantly. The hydrogen energy storage market, in particular, has been affected by the economic downturn. This market is crucial for the development of renewable energy sources, as it provides a means of storing excess energy generated by wind and solar power. However, the recession has led to a decrease in investment in the hydrogen energy storage market. This has resulted in a slowdown in the development of new technologies and a decrease in the number of projects being undertaken. As a result, the growth of the market has been stunted, and the potential benefits of hydrogen energy storage have not been fully realized.

Key Market Segmentation

By Technology

-

Compression

-

Liquefaction

-

Material based

By Physical State

-

Solid

-

Liquid

-

Gas

By End-user

-

Residential

-

Commercial

-

Industrial

By Application

-

Stationary Power

-

Transportation

Regional Analysis

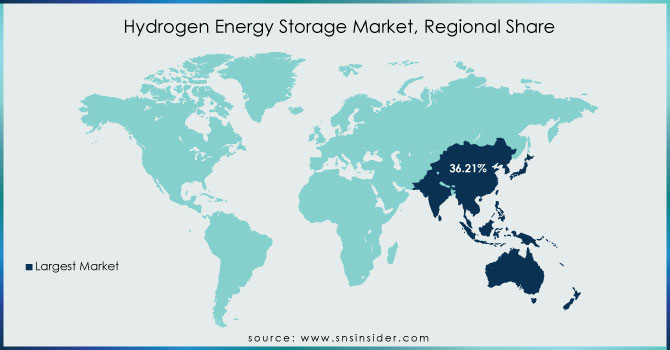

In 2021, the Asia Pacific region dominated the hydrogen energy storage industry with a revenue share of about 36.21%. The hydrogen energy storage industry is experiencing an unexpected surge in demand from various end-users, including industrial and commercial institutions. This demand is driven by the need for hydrogen generation, which is a crucial component in many industries. The increasing importance of hydrogen energy storage in the Asia Pacific region is also contributed to the shifting consumer focus toward renewable energy sources.

North America holds a significant market share in the hydrogen energy industry and is expected to show significant growth during the forecast period. This growth is attributed to the large presence of major players in both the United States and Canada. Furthermore, the presence of regulatory bodies, such as the Energy Storage Association, which actively promotes the application of hydrogen energy drives the hydrogen energy storage market.

Europe is also predicted to show notable growth during the forecast period due to the large-scale hydrogen energy storage projects that are currently under construction for example Orsted, a Danish corporation.

Do You Need any Customization Research on Hydrogen Energy Storage Market - Enquire Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Taiyo Nippon Sanso Corporation, Iwatani Corporation, Cummins Inc., Nel ASA, Steelhead Composites Inc., Air Products Inc., Linde plc, Air Liquide, ITM Power, Nedstack Fuel Cell Technology BV, Engie, GKN Sinter Metals Engineering GmbH, PlugPower Inc., Hygear. and Other Players

| Report Attributes | Details |

| Market Size in 2023 | US$ 11.11 Bn |

| Market Size by 2032 | US$ 1933.28 Bn |

| CAGR | CAGR of 77.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Compression, Liquefaction, Material based) • By Physical State (Solid, Liquid, Gas) • By End-user (Residential, Commercial, Industrial) • By Application (Stationary Power, Transportation) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Taiyo Nippon Sanso Corporation, Iwatani Corporation, Cummins Inc., Nel ASA, Steelhead Composites Inc., Air Products Inc., Linde plc, Air Liquide, ITM Power, Nedstack Fuel Cell Technology BV, Engie, GKN Sinter Metals Engineering GmbH, PlugPower Inc., Hygear. |

| Key Drivers | • Surge in demand for hydrogen energy storage from various end-user industries • Increasing adoption of fuel-cell vehicles |

| Market Opportunities | • Increasing investment in the R&D activities related to the storage system • Development of full-scale storage projects |