Hydrogen Fuel Cell Vehicle Market Report Scope & Overview:

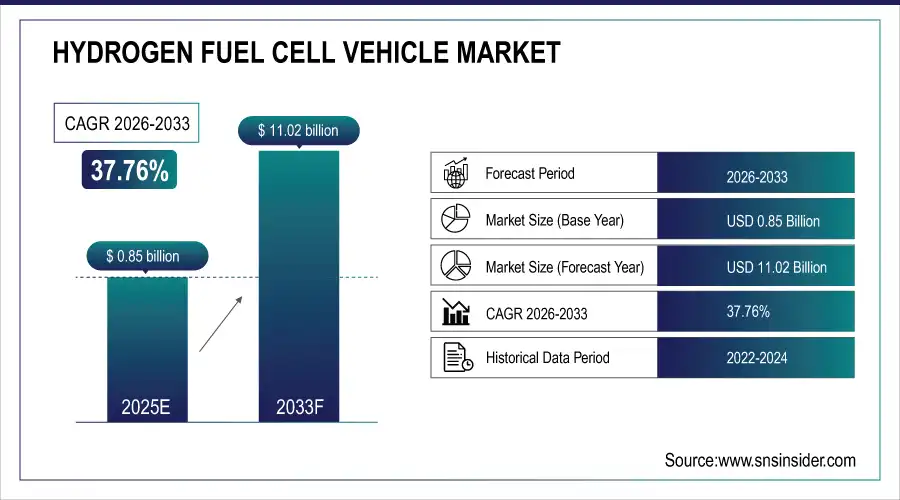

The Hydrogen Fuel Cell Vehicle Market Size was valued at USD 0.85 Billion in 2025E and is expected to reach USD 11.02 Billion by 2033 and grow at a CAGR of 37.76% over the forecast period 2026-2033.

The Hydrogen Fuel Cell Vehicle Market analysis growth is primarily driven by sustainable mobility solutions gain traction across the world. Growing government initiatives, free provisions in the form of subsidies, tax rebates, and favorable policies toward hydrogen adoption is prompting consumers and commercial fleet owners to migrate from the usage of conventional internal combustion engine (ICE) vehicles to fuel-cell vehicles. In addition to this, stringent emission laws in various parts of the world, especially in Europe, North America, and Asia Pacific, is encouraging automakers to spend a fortune on Hydrogen Fuel Cell Vehicle technology. Awareness toward the environment sustainability along with the increase in hydrogen refueling stations further contributes to the market entering market in both passenger and commercial vehicles. According to study, over 70% of global hydrogen adoption programs are concentrated in Europe, Asia Pacific, and North America, supporting consumer and fleet transition to HFCVs.

Market Size and Forecast:

-

Market Size in 2025: USD 0.85 Billion

-

Market Size by 2033: USD 11.02 Billion

-

CAGR: 37.76% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Hydrogen Fuel Cell Vehicle Market - Request Free Sample Report

Hydrogen Fuel Cell Vehicle Market Trends

-

Government incentives and subsidies drive rapid adoption of hydrogen fuel vehicles.

-

Stringent emission regulations push automakers to invest heavily in HFCV development.

-

Partnerships between OEMs and energy companies expand hydrogen infrastructure network.

-

Commercial fleets increasingly adopt hydrogen vehicles for long-haul and sustainable operations.

-

Green hydrogen production reduces operational costs and supports environmentally friendly transportation.

-

Passenger and commercial vehicle segments dominate market due to infrastructure availability.

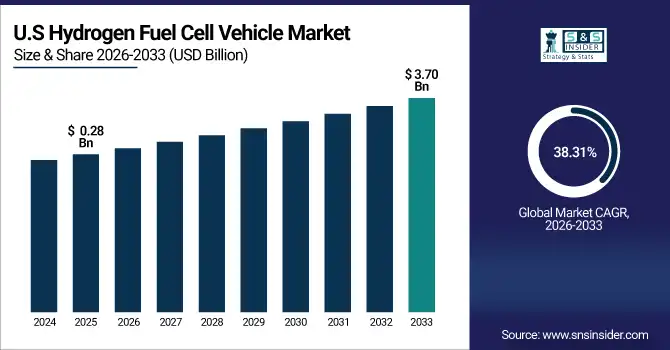

The U.S. Hydrogen Fuel Cell Vehicle Market size was USD 0.28 Billion in 2025E and is expected to reach USD 3.70 Billion by 2033, growing at a CAGR of 38.31% over the forecast period of 2026-2033, driven by government incentives, advanced fuel-cell technology, expanding refueling infrastructure, increasing adoption in passenger and commercial vehicles, and strong investments supporting sustainable and low-emission transportation solutions.

Hydrogen Fuel Cell Vehicle Market Growth Drivers:

-

Government Support and Regulations Accelerate Hydrogen Fuel Cell Vehicle Adoption

The Hydrogen Fuel Cell Vehicle is growing worldwide, driven by strong backing from governments worldwide, coupled with increasingly stringent environmental regulations. European, Asia Pacific and North American nations are providing incentives for manufacturers and consumers in the form of subsidies, tax credits and grants to advance hydrogen. Japan and South Korea have set national programs for hydrogen mobility to be part of the public and private transport; EU has its Hydrogen Strategy for a Climate-Neutral Europe for imposing hydrogen infrastructure.

Moreover, there are tougher emissions standards that require automakers to put millions of dollars into low-emission options. This dual support of policy focus and regulatory pressure drives both research and development and market adoption, especially with respect to passenger and commercial vehicles.

Countries like Japan and South Korea have dedicated programs covering nearly 80% of public and private transport hydrogen initiatives.

Hydrogen Fuel Cell Vehicle Market Restraints:

-

High Costs of Vehicles and Infrastructure Hinder Hydrogen Market Growth

Despite its advantages, Hydrogen Fuel Cell Vehicle Market faces challenges from high costs are the major restraint. Currently, fuel cell vehicles cost more to build than conventional internal combustion engine (ICE) vehicles and battery electric vehicles (BEVs), with the reason lying in the expensive used materials for fuel cells such as platinum catalysts and complex manufacturing process.

In addition, there are only a handful of hydrogen refueling stations available and it is extremely costly to develop these infrastructures, in the millions of dollars per station. A substantial up-front investment is required and since hydrogen is relatively expensive, it contributes to high service costs, making it unsuitable for mass consumers in areas with little government support or hydrogen supply.

Hydrogen Fuel Cell Vehicle Market Opportunities:

-

Commercial Fleets and Long-Haul Transport Drive Hydrogen Vehicle Expansion

The HFCV market presents a significant opportunity in commercial and heavy-duty vehicles, such as buses, trucks, and logistics fleets. With a longer range and faster refueling, hydrogen fuel cells are well-suited for public transport and long-haul freight applications as compared to battery-electric alternatives. HFCVs could allow fleet operators to achieve sustainability goals with lower tailpipe emissions, and OEMs are collaborating with energy companies to develop hydrogen infrastructure.

Furthermore, tapping into renewable energy for green hydrogen production is an opportunity to reduce operating costs and to enhance green credentials, potentially accelerating HFCV deployment in the commercial segments.

Renewable hydrogen production could reduce operational fuel costs by 20–25% for commercial HFCVs.

Hydrogen Fuel Cell Vehicle Market Segmentation Analysis:

-

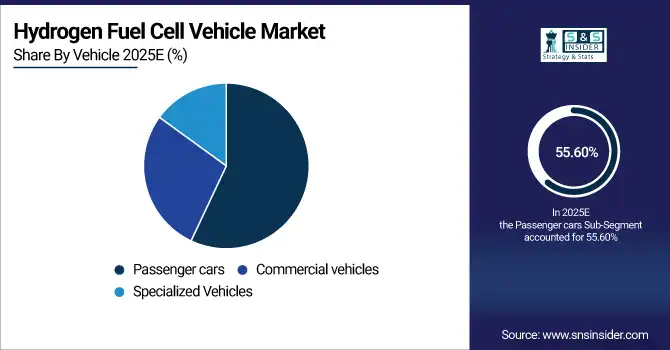

By Vehicle: In 2025, Passenger Cars led the market with a share of 55.60%, while Commercial Vehicles is the fastest-growing segment with a CAGR of 38.40%.

-

By Power Range: In 2025, 150–250 kW led the market with a share of 52.40%, while Above 250 kW is the fastest-growing segment with a CAGR of 39.80%.

-

By Range: In 2025, Medium Range (251–500 Miles) led the market with a share of 50.20%, while Long Range (Above 500 Miles) is the fastest-growing segment with a CAGR of 38.75%.

-

By Technology: In 2025, Proton Exchange Membrane Fuel Cells led the market with a share of 68.50%, while Solid Oxide Fuel Cells is the fastest-growing segment with a CAGR of 42.20%.

-

By Application: In 2025, Private Transportation led the market with a share of 58.40%, while Public Transportation is the fastest-growing segment with a CAGR of 40.25%.

By Vehicle, Passenger Cars Lead Market and Commercial Vehicles Fastest Growth

In the Hydrogen Fuel Cell Vehicle Market, the Passenger cars lead in 2025, owing to growing consumer acceptance, enhanced vehicle efficiency, and increasing hydrogen refueling infrastructure in major economies, such as Asia Pacific, Europe, and North America. Government subsidies, tax breaks, and stringent emission restrictions assist this segment to gain traction among individual consumers to switch from traditional ICE vehicles. Meanwhile, Commercial Vehicles are the fastest growing segment fueled by the rising penetration of hydrogen buses, trucks, and logistics fleets. With on-road HFCVs bringing long-range efficiency, low refueling times, and sustainability goals into the fold, fleet operators have adopted these elements into their long-term journeys and OEM partnerships with energy companies will help boost the ramp-up for commercial units.

By Power Range, 150–250 kW Leads Market and Above 250 kW Fastest Growth

In the Hydrogen Fuel Cell Vehicle Market, the 150-250kW leads in 2025, due to optimal performance, efficiency, and cost for both passenger and commercial vehicles. This means vehicles in this range have enough power for all daily commuting, urban transport, and medium-duty commercial applications, which makes them very appealing to both consumers and fleet operators. Meanwhile, Above 250 kW segment, the fastest growing during the forecast period, owing to the growing market for heavy-duty trucks and long-haul buses and special vehicle projects. Improvements in fuel cell technology and enabling government policies further accelerate the adoption of high-power HFCVs.

By Range, Medium Range (251–500 Miles) Leads Market and Long Range (Above 500 Miles) Fastest Growth

In the Hydrogen Fuel Cell Vehicle Market, the medium range (251-500 Miles) leads in 2025, owing to the ideal ratio of range, efficiency, and cost that can be achieved with this category suited for passenger cars, commercial vehicles, and urban fleet operations. These vehicle ranges give enough distance for everyday passenger vehicle, intercity freight, and medium-duty commercial use consistent with the developing hydrogen refueling infrastructure in major areas. Meanwhile, Long Range (Above 500 Miles) is the fastest-growing segment, largely due to demand for long-haul trucks, buses and specialized vehicles requiring long range capabilities. Further, continuous development in fuel cell technology and supply of green hydrogen at affordable prices pave the way for rapid acceptance of long-range HFCVs.

By Technology, Proton Exchange Membrane Fuel Cells Lead Market and Solid Oxide Fuel Cells Fastest Growth

In the Hydrogen Fuel Cell Vehicle Market, the Proton Exchange Membrane Fuel Cells leads in 2025, owing to their high efficiency, low start-up time, compact sizes, and suitability for use in passenger cars and light commercial vehicles. proton exchange membrane fuel cells technology is popular with leading automotive original equipment manufacturer due to its predictability, cost efficiency, and also compatibility with current hydrogen infrastructure in regions like Asia Pacific, Europe and North America. Meanwhile, Solid Oxide Fuel Cells (SOFCs) are the fastest growing class derived by demand for high-power long-duration applications, like heavy-duty trucks, buses and stationary energy systems, is growing while research continues to improve the durability, efficiency and commercial readiness of SOFC technologies.

By Application, Private Transportation Leads Market and Public Transportation Fastest Growth

In the Hydrogen Fuel Cell Vehicle Market, the Private transportation leads in 2025, derived by rapidly rising number of car buyers prefer hydrogen-based driving amid a slew of favorable policy measures and well-established Hydrogen refueling infrastructure, in the prime regional markets of Asia Pacific, Europe, and North America. Private users are becoming more popular with HFCVs due of their zero-emission benefits and longer driving range versus battery-electrics, as well as increasing environmental awareness. Meanwhile, Public Transportation is a fast-growing segment fueled by demand for hydrogen-powered buses and urban mobility fleets needing longer range, rapid refueling, and lower emissions. OEMs are also going hand in hand with energy providers to facilitate and speed up their deployment of HFCV in public transport networks across the globe.

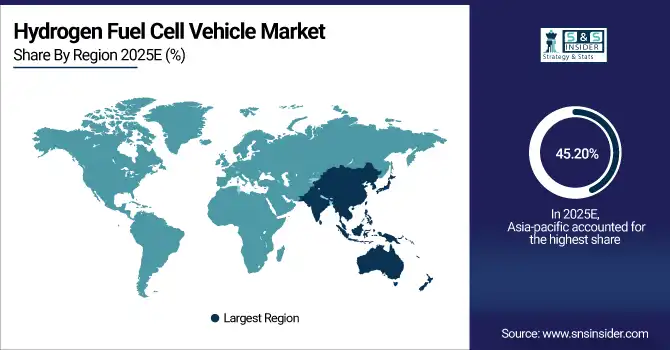

Hydrogen Fuel Cell Vehicle Market Regional Analysis:

Asia Pacific Hydrogen Fuel Cell Vehicle Market Insights:

The Asia Pacific dominated the Hydrogen Fuel Cell Vehicle Market in 2025E, with over 45.20% revenue share, due to greater government incentives to stimulate sales, increasing consumer adoption and significant growth in hydrogen refueling infrastructure. Indeed, supportive policies, encouragement subsidies, and R&D investments are already accelerating HFCV deployment-enabled by favorable conditions in passenger cars, commercial vehicles, and even public transport within the region. The ever-growing attention towards sustainable mobility in parallel with industrial and logistics applications will make Asia Pacific an extraordinarily attractive region for automakers and fleet operators and will help it create and retain market leadership.

Get Customized Report as per Your Business Requirement - Enquiry Now

Additionally, Asia Pacific market is also the fastest growing region with a high CAGR 38.45%, due to increasing demand for low emission transport solutions. The uptrend is driven by development of fuel cell systems, technological advancements in hydrogen storage and fuelling efficiency, and decline of operational costs. The region's status as a global implementation center for HFCVs is also due to raising cognizance on environmental sustainability and increasing focus on long-distance and long-lasting vehicles.

-

China and India Hydrogen Fuel Cell Vehicle Market Insights

China leads the Hydrogen Fuel Cell Vehicle market with strong government support, large-scale pilot projects, and investments in hydrogen infrastructure, aiming to accelerate adoption in commercial fleets and heavy-duty transport.

Europe Hydrogen Fuel Cell Vehicle Market Insights

The Europe Hydrogen Fuel Cell Vehicle market is witnessing steady growth, driven by emission regulatory measures, environmental policies, and investment in sustainable transportation. National and local government incentives, subsidies, funding programs are promoting the adoption of HFCVs for passenger cars, commercial vehicles, and public transport by automakers and fleet operators. Improvements in the hydrogen refueling network and in fuel cell systems are increasing vehicle efficiency and range.

Moreover, the increasing consumer awareness towards carbon emissions and environmental sustainability drives the market adoption. moderate growth continues in Europe, where long-term decarbonization plans are prioritizing pathways for HFCV deployment towards the end of the decade.

-

Germany and U.K. Hydrogen Fuel Cell Vehicle Market Insights

Germany and the U.K. lead the Hydrogen Fuel Cell Vehicle market, driven by government incentives, growing refueling infrastructure, technological advancements, and increasing adoption across passenger, commercial, and public transportation segments.

Latin America (LATAM) and Middle East & Africa (MEA) Hydrogen Fuel Cell Vehicle Market Insights

The Hydrogen Fuel Cell Vehicle market in Latin America (LATAM) and Middle East & Africa (MEA) is emerging steadily, supported by growing government initiatives and investments in sustainable transportation. Although these regions currently represent a smaller share of the market than Asia Pacific and Europe, they continue to grow gradually due to rising environmental awareness and increasing penetration of low-emission vehicles. Hydrogen refueling infrastructure is also developing rapidly, allowing the migration of passenger cars, commercial vehicles, and public transport fleet to HFCVs. Technological advances, combined with subsidies and collaboration between automakers and energy suppliers, will have a recognized impact with a positive assumption towards market penetration, making LATAM and MEA early movers with potential in the long-term market of Hydrogen Fuel Cell Vehicle.

Hydrogen Fuel Cell Vehicle Market Competitive Landscape

Hyundai Motor Company is a leading player in the HFCV market, focusing on both passenger and commercial vehicles. With innovations like the INITIUM fuel cell concept and XCIENT heavy-duty trucks, Hyundai emphasizes long-range performance, quick refueling, and sustainable mobility, aiming to expand hydrogen adoption across global markets.

-

In March 2025, Hyundai unveiled the INITIUM hydrogen fuel cell concept, showcasing a new design language for future fuel cell vehicles and highlighting improved efficiency, longer driving range, and advanced safety features for next-generation FCEVs.

Honda Motor Co. is advancing the HFCV market through collaborations and technology development. Its joint venture with General Motors enhances fuel cell efficiency and durability. Honda focuses on producing reliable and environmentally friendly passenger vehicles, promoting hydrogen infrastructure growth, and meeting increasing consumer demand for zero-emission transportation solutions.

-

In June 2025, Honda announced plans to build a new production plant in Moka City, Japan, dedicated to manufacturing next-generation fuel cell modules. The facility aims to increase annual production capacity and support global HFCV deployment targets.

BMW Group is actively developing next-generation fuel cell powertrains in collaboration with Toyota. The company plans to launch its first series production HFCV in 2028, targeting passenger vehicles with high efficiency, long driving range, and reduced emissions, positioning itself as a strong innovator in sustainable mobility solutions.

-

In September 2025, BMW began the prototype production of its third-generation hydrogen fuel cell system, a compact, highly integrated, and efficient system developed in collaboration with Toyota.

Hydrogen Fuel Cell Vehicle Market Key Players:

Some of the Hydrogen Fuel Cell Vehicle Market Companies are:

-

Toyota Motor Corporation

-

Hyundai Motor Company

-

Honda Motor Co.

-

BMW Group

-

Mercedes-Benz

-

General Motors

-

Nikola Corporation

-

Volvo Group

-

Kia Corporation

-

Renault Group

-

Ballard Power Systems

-

Plug Power

-

Bloom Energy

-

Cummins Inc.

-

Nel ASA

-

Doosan Fuel Cell

-

AFC Energy

-

Symbio

-

Air Liquide

-

Linde plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 0.85 Billion |

| Market Size by 2033 | USD 11.02 Billion |

| CAGR | CAGR of 37.76 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Vehicle (Passenger Cars, Commercial Vehicles, Specialized Vehicles) •By Power Range (Less than 150kW, 150–250kW, Above 250kW) •By Range (Short Range [0–250 Miles], Medium Range [251–500 Miles], Long Range [Above 500 Miles]) •By Technology (Proton Exchange Membrane Fuel Cells [PEMFCs], Solid Oxide Fuel Cells [SOFCs], Alkaline Fuel Cells, Phosphoric Acid Fuel Cells, Others) •By Application (Public Transportation, Private Transportation, Industrial, Military & Defense) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., BMW Group, Mercedes-Benz / Daimler, General Motors, Nikola Corporation, Volvo Group, Kia Corporation, Renault Group, Ballard Power Systems, Plug Power, Bloom Energy, Cummins Inc., Nel ASA, Doosan Fuel Cell, AFC Energy, Symbio, Air Liquide, Linde plc, and Others. |