Electronic Materials and Chemicals Market Report Scope & Overview:

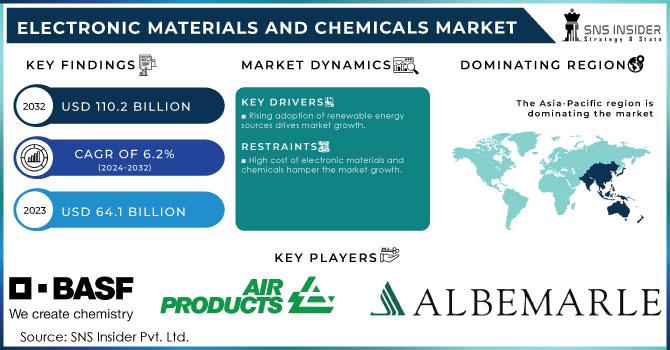

The Electronic Materials and Chemicals Market Size was valued at USD 64.1 billion in 2023 and is expected to reach USD 110.2 billion by 2032 and grow at a CAGR of 6.2% over the forecast period 2024-2032.

Get E-PDF Sample Report on Electronic Materials and Chemicals Market - Request Sample Report

Rapid development in the electronic industry is driving the demand for electronic materials and chemicals market. Moreover, with the increasing adoption of smart devices and the Internet of Things (IoT), the market is expected to grow in upcoming years. New technologies also drive an increase in demand for advanced electronic materials and chemicals. The emergence of such technologies as 5G and artificial intelligence, contribute to the development of this market.

Additionally, factor such as, as miniaturization and the necessity of providing an improved performance of electronic devices also influence the market greatly. These technologies contribute to the development of materials and chemicals with enhanced conductivity, strength, and thermal stability. These factors drive research and development in the industry and lead to the development of new products.

Increasing demand of silica from other end-use industries is expected to impact raw material availability over the projected period. However, the growing trade disputes between China, the U.S., and the European Union are expected to result in continued price volatility of silica over the projected period.

The electronic materials and chemicals is expected to witness significant growth over the projected period owing to its rising demand in the electronics industry. Electronic chemicals are highly demanded due to their application abilities mostly in manufacturing electronic components, silicon wafers, and integrated circuits. They are primarily used for cleaning and polishing internal parts of electronic devices. The growth of demand for electronic solvents to offer uniform thickness and shape to electronic chips and wafers is likely to drive demand for these products.

In 2023 Samsung introduced its latest Galaxy smartphones, featuring 200 MP cameras and next-gen processors. To achieve these advancements, Samsung has relied on high-performance materials such as flexible displays and advanced chip materials. The company’s focus on innovation has driven the demand for chemicals needed in semiconductor fabrication and display technology.

Market Dynamics

Drivers

- Rising adoption of renewable energy sources drives market growth.

One of the significant factors contributing to the market is the increased adoption of renewable energy sources, such as solar, wind, and hydropower, among others. This tendency is driven primarily by the global emphasis on carbon reduction that has become a priority in many countries. The trend is supported by some of the latest events, such as the record investments in renewable energy sources worldwide that are reported to have reached USD 495 billion in 2022, according to the International Energy Agency. It is further supported by international and domestic policies, such as the U.S. Inflation Reduction Act of 2022 allocating USD 369 billion of its budget toward clean energy and climate policies.

In Europe, the European Union’s Green Deal is a similar initiative with an even more ambitious goal for renewables to meet 32% of energy consumption by 2030. The market is further fuelled by the activities of the major players who contribute to increasing the development of renewable energy sources, such as the introduction of the most powerful offshore wind turbine by Siemens Gamesa in 2023. The company’s action is paralleled by the USD 1.1 billion investment announced by First Solar for the expansion of its manufacturing capacity in the U.S. The positive forecast is reflective of these developments that receive both governmental support and alternative energy market acceleration by global investments.

Restrain

- High cost of electronic materials and chemicals hamper the market growth.

The high cost of electronic materials and chemicals is a noteworthy factor hindering the development of the market. Notably, such advanced materials as high-purity semiconductors, specialized photoresists, and chemical mechanical planarization slurries are necessary for the production of cutting-edge electronics, and high production costs are likely to result from the complicated production processes required to reach the necessary degree of precision and quality. For instance, the development of modern consumer electronics, such as smartphones and laptops, is reliant on the production of these items. In addition, the need to continue miniaturizing semiconductors and make them smarter by adding new features is also likely to expand the range of necessary technologies and materials, pushing their prices up.

Market segmentation

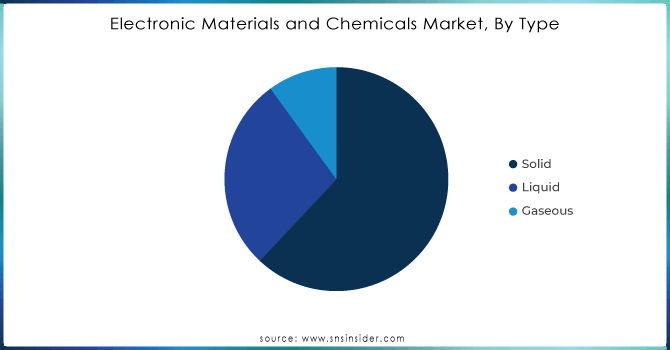

By Type

Solid materials and chemicals were the product segment with the highest revenue share in 2023, representing over 55.23%. The demand for solid electronic materials in semiconductor industry is predicted to increase over the forecast period, as they can be used for the production of various end-use products, such as computers, laptops, and smartphones.

The liquid segment is expected to have the highest CAGR, with an estimated value of 6.1%, over the forecast period. The demand for liquid electronic materials is currently increasing, as they are used for cleaning and polishing the internal parts of electronic devices.

Furthermore, the gaseous electronic materials and chemicals sector also held a significant share in 2023. Because they can be used to manufacture semiconductors and PCBs. LEDs, solar photovoltaics, and flat panel displays are some of the applications that are also forecasted to increase over the projected period.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

Silicon wafers are the leading application segment. Its’ adoption can be attributed to the advanced properties of silicon. The material is utilized to produce semiconductors that can be adapted by in turn are used in the manufacturing of integrated circuits and chips in virtually all current electronic gadgets such as smartphones, personal computers, cars, and other automotive systems, internet of things devices, and many others. With the growing demand for semiconductors all over the world, the silicon application, particularly silicon wafers’ market, tends to excel. This is encouraged by 5G and internet of things devices, electric cars which are all built on high performance chips and require the use of silicon wafers making them irreplaceable.

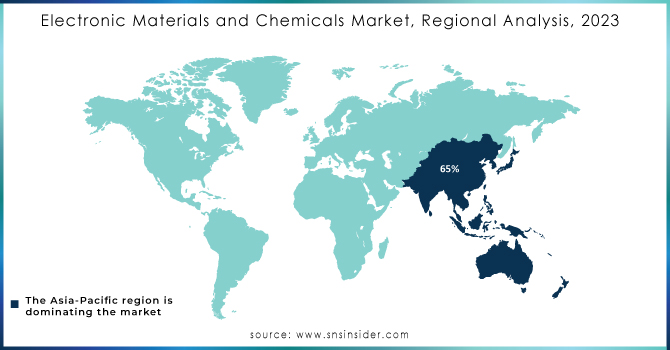

Regional Analysis

Asia-Pacific held the largest share of about 65% in the global electronic materials and chemicals market and is projected to experience a significant growth rate during the forecast period. This growth is attributed to rapid industrialization and the presence of numerous electronic device manufacturers in Asian countries such as China, Japan, and South Korea. The dominance of the Asia-Pacific region in this market is primarily due to the high demand for printed circuit boards. These boards are essential components in various industries, including electronic gaming, consumer goods, telecommunications, and IT. As a result, the region has witnessed significant developments in these industries, further driving the demand for electronic materials and chemicals. China, India, and Japan are the major contributors to the growth of this market in the Asia-Pacific region.

North America is projected to experience a Compound Annual Growth Rate (CAGR) of 6.7% throughout the forecast period. This growth is attributed to the presence of numerous electronic device manufacturers in the region, including industry giants such as Micron, Intel, Fairchild, Texas Instruments, and Avago. These companies are actively involved in the production of digital and analog semiconductor technologies for end-users, which in turn drives the demand for their products. Furthermore, North America plays a significant role in the specialty gases sector and is poised for future growth.

Key Players

The major key players are BASF, Air Products & Chemicals Inc., Albemarle Corporation, Air Liquide Holdings Inc., Ashland Inc., Bayer Ag, Linde Group, Honeywell International Inc., Cabot Microelectronics Corporation, Dow Chemical Company, Monsanto Electronic Materials Co., Hitachi Chemical Company, Brewer Science, Sumitomo Chemical, Shin-Etsu, Covestro, AZ Electronic Materials Plc, HD Microsystems, Drex-Chem Technologies, and other key players are mentioned in the final report.

Recent Development:

-

In August 2023, BASF announced plans to relocate its Electronic Materials Research and Development (R&D) Center from Suwon to the company's Ansan site in South Korea. This strategic move aims to enhance research and development efficiency, showcasing BASF's commitment to innovation and technological advancement.

-

In June 2023, Air Liquide made a significant investment of close to 200 million US dollars in two advanced material production centers located in Taiwan and South Korea. This investment is aimed at accelerating the development and manufacturing of new advanced materials, while also increasing reliability and improving the sustainability of its supply chain. By localizing production close to semiconductor customers, Air Liquide aims to strengthen its position in the market.

-

In August 2022, Albemarle Corporation announced a realignment of its Bromine and Lithium global business units (GBU) into a new corporate structure. This strategic decision is driven by the company's commitment to meeting customer needs and fostering talent in a highly competitive global environment. This move follows the recent announcement of the company's decision to reorganize Catalyst under a yet-to-be-named, wholly-owned subsidiary.

- In April 2021, Cabot Microelectronics Corporation made an acquisition of International Test Solution, expanding its electronic materials business division.

| Report Attributes | Details |

| Market Size in 2023 | US$ 64.1 Bn |

| Market Size by 2032 | US$ 110.2 Bn |

| CAGR | CAGR of 6.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Solid, Liquid, and Gaseous) • By Application (Silicon wafers, Specialty gases, Wet chemicals and solvents, Photoresists, PCB Laminates, and Other Applications) • By End-use (Semiconductors & Integrated Circuits and Printed Circuit Boards) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF, Air Products & Chemicals Inc., Albemarle Corporation, Air Liquide Holdings Inc., Ashland Inc., Bayer Ag, Linde Group, Honeywell International Inc., Cabot Microelectronics Corporation, Dow Chemical Company, Monsanto Electronic Materials Co., Hitachi Chemical Company, Brewer Science, Sumitomo Chemical, Shin-Etsu, Covestro, AZ Electronic Materials Plc, HD Microsystems, Drex-Chem Technologies |

| Key Drivers | • Growing demand for electronic devices and components • Technological advancements in the electronics industry • Rising adoption of renewable energy sources drives market growth. |

| Market Restraints |

• High cost of electronic materials and chemicals hamper the market growth. |