Hexane Market Size & Overview:

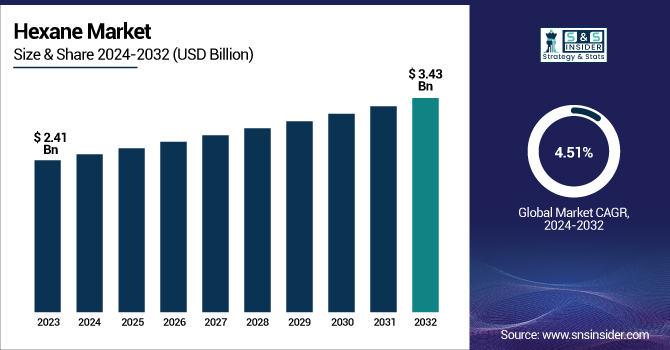

The Hexane Market size was USD 2.41 billion in 2024 and is expected to reach USD 3.43 billion by 2032 and grow at a CAGR of 4.51% over the forecast period of 2025-2032.

To Get more information on hexane market - Request Free Sample Report

Hexane market analysis indicates that the expansion of industrial and chemical manufacturing sectors significantly contributes to driving hexane market growth. It is due to hexane being a common solvent found in many industrial processes, such as the manufacturing of adhesives, textiles, and rubber, and also in the cleaning industry. With manufacturing activities scaling up globally, particularly in fast industrializing regions, the need for viable solvents, including hexane, is also on the rise. Hexane is used in synthesis processes and purification steps, and its high importance in the chemical industry means that it is one of the most important bulk solvents used on an industrial scale. Moreover, rising demand from the automotive, construction, and packaging industries for industrial-grade solvents further drives hexane consumption.

According to the Ministry of Statistics and Programme Implementation (MoSPI), the Index of Industrial Production (IIP) for the manufacturing sector grew by 5.0% in January 2025, up from 3.2% in December 2024. This growth underscores the increasing demand for industrial solvents including hexane, which are integral in various manufacturing processes including the production of adhesives, textiles, rubber, and cleaning agents.

Hexane Market Dynamics:

Drivers:

-

Rise in Rubber and Polymer Production Drive Market Growth

Increasing production of rubber and polymer is emerging as a key factor, as this solvent finds extensive use in the production of these products. Polymerization is done through the use of Hexane as it provides better viscosity control and makes the production process more efficient. Hexane is utilized for extracting natural rubber and in the processing of synthetic rubber, which is crucial in rubber manufacturing for automotive tires, and also in footwear and industrial goods. With increasing demand for rubber products globally, especially in the automotive and construction industries, hexane consumption in rubber production is also on the rise.

The U.S. Environmental Protection Agency (EPA) has studied fluorotelomer-based polymer manufacturing plants vital for making fluoropolymers. While these studies (volatile and semi-volatile perfluoroalkyl substances in industrially contaminated soils) provide data related to industrial processes that may use solvents, such as hexane, which they can indicate where environmental solvents could co-occur with other POHCs.

Additionally, the U.S. Geological Survey (USGS) provides comprehensive data on mineral commodities, including rubber and polymer materials, through its Mineral Commodity Summaries. These resources can offer valuable context for understanding the industrial applications and demand for hexane in the U.S.

Restraints:

-

Risk of Overproduction and Supply Chain Issues may Hamper Market Growth

The restraints that can affect a few aspects of the hexane market include the increasing risk of overproduction and supply chain issues that can create an imbalance between demand and supply, and subsequently inhibit the growth of the hexane market by destabilizing the market. Excess production capacity or an inaccurate forecast of market demand may lead to overproduction of hexane that might potentially lead to price drops and loss of manufacturer profitability. On the other hand, if there are supply chain disruptions, such as slow design and procurement of raw materials or transport bottlenecks, or geopolitical tensions, it can lead to shortages, and these markets are short of hexane supply, but they are rarely completely devoid of hexane.

Opportunities:

-

Innovation in Edible Oil Extraction Creates an Opportunity for Market Expansion

Innovation in edible oil extraction opens opportunities in the hexane market by improving the oil extraction process’ efficiency and yield. Hexane is extensively utilized as a solvent for the commercial removal of oils from seeds, such as soybeans, sunflower, and canola, since it can easily dissolve oils and separate them from the solid seed matter. With population and dietary changes establishing a greater demand for this edible oil globally, the innovation and enhanced extraction techniques must continue to strive for excellence and drive the hexane market trends. Technological advances, including solvent recovery systems and more energy-efficient extraction processes, are likely to offer lucrative avenues for growth for players in the hexane market.

In October 2023, the U.S. Department of Energy announced USD 375 million in funding for the Eastman Chemical Company's molecular recycling project. The funding, which comes from the Bipartisan Infrastructure Law and the Inflation Reduction Act, will be used to build a second molecular recycling plant in Longview, Texas. The project is anticipated to create more than 200 permanent, full-time jobs and nearly 1,000 temporary construction jobs locally.

Hexane Market Segmentation Analysis:

By Grade

Extraction held the largest hexane market share, around 54%, in 2024 as it is used in the process of efficiently extracting vegetable oils from seeds including soybeans, canola, and sunflower. Hexane, as it can dissolve oils so readily, is the solvent of choice for commercial oil extraction. It consists of the seeds soaked in hexane, which absorbs the oil but cannot pass through the solid parts of the seed. The most economical, high-oil-yield method that is scalable.

Polymerization holds a significant market share due to the use in the production of various polymers that are vital to several industries, such as automotive, construction, packaging, and consumer goods. As a hexane solvent in the polymerization process of many polymers, such as polyethylene, polypropylene, and others, where viscosity control and smooth reaction are required. The polymerization process relies on the use of solvents to facilitate the homogeneous distribution of catalysts and monomers, in which hexane, being non-polar, is found to be a suitable candidate.

By Application

In 2024, the industrial solvents held the largest market share of around 38%. The segment’s growth is driven by their versatile and crucial role in many industrial uses. Hexane is used as an industrial solvent in the chemical manufacturing, coatings, adhesives, and paints sector, and also due to its good solvent ability for oil, resin, and polymer. That is why it is often used in low-volatility processes and to dissolve PN substances where a precisely formulated and high-quality output is needed. Furthermore, other solvent properties of hexane make it suitable and overused in cleaning, degreasing, and extraction operations, all of which are essential in various industries, from automotive to electronics.

The edible oil treatment held a significant market share as it is essential for the extraction and purification of edible oils from seeds, including soybeans, canola, and sunflower. The solvent extraction of oil from these seeds is carried out using hexane, as it is a highly efficient solvent for dissolving oils while insolubilizing protein and carbohydrate solid residues from the seed. An important step for the mass production of edible oils, which can be applied to cooking, processed food, and other consumer goods.

Hexane Market Regional Analysis:

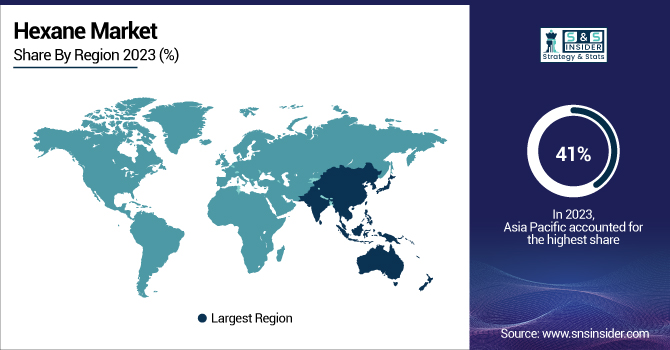

Asia Pacific held the largest market share, which was around 41%, in 2024. The region’s growth is driven by the presence of a well-established industrial base, which in turn has been driving urbanization in the region, along with the increasing contributions from agricultural and food processing industries. China, India, and Indonesia are large producers and consumers of edible oils, and hexane has been widely used for oil extraction among oil-producing countries. Besides this, the growth of the chemical, plastic, and pharmaceutical industry in the region also largely contributes to the demand for hexane for industrial solvent and polymerization.

According to the Asian Development Bank's Key Indicators for Asia and the Pacific 2024, the region's GDP by industrial origin has shown significant growth, reflecting the expansion of sectors that heavily utilize hexane including edible oil extraction and polymer production. This industrial upsurge, coupled with the region's large population and increasing demand for consumer goods, has solidified Asia Pacific's leading position in the global industrial hexane market.

North America held a significant market share and is the fastest-growing region during the forecast period. The growth is driven by the continuous development of chemical processing technologies in the region. Hexane has major applications in petrochemicals, food processing, pharmaceuticals, and adhesives, and a large population of manufacturers present in the region, particularly the U.S. Additionally, the rising demand for ready-to-eat meals and food-grade oils has driven the adoption of hexane in oil extraction applications. The U.S. is gaining further production strength due to the existence of several key market players, combined with government investments in manufacturing and chemical industries.

The U.S hexane market size was worth USD 43 million in 2024 and is expected to reach USD 67 million by 2032 and grow at a CAGR of 4.51% over the forecast period of 2025-2032. It is due to its wide use as a solvent and extraction agent, making it one of the common ingredients in many manufacturing markets. Such as chemical manufacturing, food processing, and polymer manufacturing, which are well-developed in the country, and hexane companies also focus on the market strategy to increase its expansion and development. Hexane, for instance, is an ingredient in the processing of oils obtained from soybeans and other seeds, and here again, the U.S. is among the leading producers of edible oils globally.

In May 2024, ExxonMobil announced the acquisition of Pioneer Natural Resources Company. The plan is likely to strengthen ExxonMobil's upstream business via the Permian Basin, leading to assured feedstock supply for hexane and increased foothold in the petrochemical business.

Europe held a significant market share during the forecast period due to the well-developed industrial ecosystem, a high number of chemical manufacturing hubs, and growing demand from food processing and pharmaceutical industries, which are expected to propel growth during the forecast period. The industries are well developed in countries including Germany, France, the Netherlands, and a few others that use hexane in edible oil extraction, polymerization, and solvent in adhesives and coatings.

In 2023, TotalEnergies invested in bio-based hexane production technologies, namely catalytic reforming of vegetable oils. This approach not only provides a renewable source for hexane but also reduces greenhouse gas emissions compared to traditional petroleum-based methods.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The key players operating in the market are Shell plc, ExxonMobil Corporation, Phillips 66 Company, Chevron Phillips Chemical Company LLC, Rompetrol Rafinare S.A., Sumitomo Chemical Co., Ltd., Honeywell International Inc., Junyuan Petroleum Group, Merck KGaA, Indian Oil Corporation Limited.

Recent Developments:

-

In October 2024, ExxonMobil announced an expansion of its Singapore refinery to provide high-purity hexane to meet growing demand in chemical synthesis and for food-grade applications.

-

In March 2022, Phillips 66 announced a merger with Phillips 66 Partners. The merger also provided Phillips 66 with the opportunity to acquire any outstanding limited partnership interests in PSXP not already owned by the company and its affiliates.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.41 Billion |

| Market Size by 2032 | USD 3.43 Billion |

| CAGR | CAGR of 4.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Polymerization, Extraction, Others) •By Application (Edible Oil Treatment, Industrial Solvent, Adhesives Formulation, Leather Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Shell plc, ExxonMobil Corporation, Phillips 66 Company, Chevron Phillips Chemical Company LLC, Rompetrol Rafinare S.A., Sumitomo Chemical Co., Ltd., Honeywell International Inc., Junyuan Petroleum Group, Merck KGaA, Indian Oil Corporation Limited |