Retinal Vein Occlusion Treatment Market Size Analysis

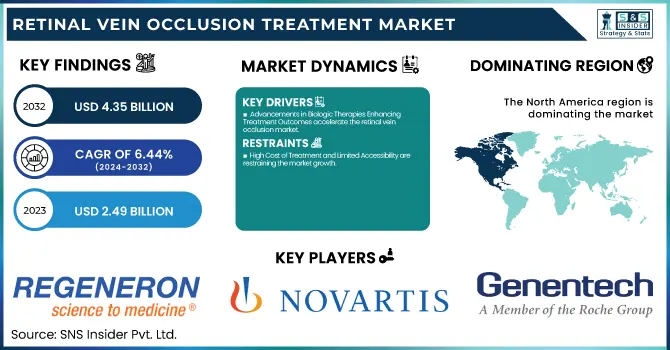

The Retinal Vein Occlusion Treatment Market was valued at USD 2.49 billion in 2023 and is expected to reach USD 4.35 billion by 2032, growing at a CAGR of 6.44% from 2024 to 2032.

To Get more information on Retinal Vein Occlusion Treatment Market - Request Free Sample Report

The report offers an in-depth Retinal Vein Occlusion (RVO) Treatment Market analysis based on primary statistical trends. It contains a comprehensive incidence and prevalence analysis based on region and demographics for CRVO and BRVO cases. It also investigates prescription trends across regions with an emphasis on physician preferences between anti-VEGF drugs and corticosteroid medications. The report also includes treatment volume trends, which outline the rising uptake of intravitreal injections and laser treatments worldwide. It includes a healthcare expenditure analysis, which separates government, private, and out-of-pocket spending. These determinants guarantee a holistic data-driven outlook for strategic decision-making.

Retinal Vein Occlusion Treatment Market Dynamics

Drivers

-

The rising prevalence of retinal vein occlusion (RVO) is a key driver for the market.

The increasing incidence of retinal vein occlusion (RVO) is one of the major drivers for the market, with an aging population and growing risk factors like hypertension, diabetes, and cardiovascular diseases leading to a greater number of cases of the condition. RVO has been estimated to affect around 16 million individuals globally, with branch retinal vein occlusion (BRVO) occurring more frequently than central retinal vein occlusion (CRVO), according to recent research. As the burden of RVO increases, the need for effective treatments like anti-vascular endothelial growth factor (Anti-VEGF) therapy and corticosteroid medications remains on the rise. Recent developments, including Roche's Vabysmo (faricimab), which in clinical trials has demonstrated prolonged treatment intervals, and Regeneron's EYLEA HD, which in the QUASAR trial showed robust efficacy, further reinforce the evolving treatment paradigm.

-

Advancements in Biologic Therapies Enhancing Treatment Outcomes accelerate the retinal vein occlusion market.

Continued research into biologic therapies, most notably anti-VEGF and gene therapy-derived treatments, continues to enhance patient outcomes in RVO management. Anti-VEGF treatments like aflibercept (EYLEA) and ranibizumab (Lucentis) are the current gold standard for treating macular edema secondary to RVO, achieving dramatic vision gains. Emerging technology in biosimilars, including Samsung Bioepis' SB11 (biosimilar to Lucentis), is increasing treatment availability. Moreover, gene therapy treatments, for example, Adverum Biotechnologies' ADVM-022, will provide sustained treatment effects from one intravitreal injection, diminishing patient burden. Regulatory approvals and ongoing clinical innovation in such treatments reflect compelling market momentum, stimulating broader use and enhancing the treatment of RVO patients worldwide.

Restraint

-

High Cost of Treatment and Limited Accessibility are restraining the market growth.

One of the significant barriers in the Retinal Vein Occlusion (RVO) Treatment Market is the high expense of cutting-edge therapies, restricting access, especially in low- and middle-income nations. Anti-VEGF treatments, like EYLEA and Lucentis, entail repeated intravitreal injections, resulting in hefty long-term expenditures for patients and healthcare systems. For example, a single dose of ranibizumab (Lucentis) costs more than USD 2,000 and may need to be administered multiple times a year in treatment. Moreover, such treatment is not readily available for patients living in areas that lack proper ophthalmology infrastructure and third-party reimbursement policies, further generating inequities in patient care. Although biosimilars and novel agents may offer a lower-cost alternative, affordability remains a challenge. Such cost acts as a deterrent to premature intervention, whose failure can lead to permanent blindness and an increasingly unmet requirement for affordable remedy.

Opportunities

-

The increasing exploration of gene and cell therapies presents a significant opportunity in the Retinal Vein Occlusion (RVO) Treatment Market.

The growing research on gene and cell therapies is a major opportunity in the Retinal Vein Occlusion (RVO) Treatment Market. Firms are investing in gene-editing technologies and stem cell-based treatments to offer long-term or even curative treatments for RVO. For instance, Adverum Biotechnologies is working on ADVM-022, a single intravitreal gene therapy that is designed to decrease the treatment burden of frequent anti-VEGF injections. The promise of regenerative medicine to restore retinal function and enhance vision outcomes renders it a hopeful path. In addition, existing clinical trials and supportive regulation for novel ophthalmic therapies instill additional momentum. With commercial success, these treatments have the potential to transform RVO treatment, providing long-term treatment responses and enhanced patient compliance, particularly in areas with limited access to intravitreal injections administered frequently.

Challenges

-

Complexity in Disease Diagnosis and Treatment Compliance is challenging the market to grow.

One of the major challenges in the Retinal Vein Occlusion Treatment Market is early diagnosis complexity and long-term compliance with treatment. RVO tends to present with signs overlapping those of other retinal conditions, causing late diagnosis and advancement of the disease. Furthermore, treatment is stopped by most patients because of the pain of frequent intravitreal injections, which are needed for the best management with anti-VEGF drugs. Research has shown that close to 30–40% of patients withdraw from therapy in the first year due to pain and cost associated with frequent injections. In addition, poor awareness and the lack of screening programs in the developing world further compound the problem. These problems can be addressed through better diagnostic tools, patient education, and the creation of longer-lasting treatments to promote compliance and clinical success.

Retinal Vein Occlusion Treatment Market Segmentation Analysis

By Type

The Central Retinal Vein Occlusion (CRVO) segment dominated the Retinal Vein Occlusion (RVO) Treatment Market with 67.12% market share in 2023 because of its greater prevalence and more severe visual impact than Branch Retinal Vein Occlusion (BRVO). CRVO is caused by the obstruction of the central retinal vein, resulting in extensive vision loss, macular edema, and a higher risk of complications like neovascularization and glaucoma. Based on research, CRVO represents about half of all RVO cases, yet its severity frequently requires urgent and long-term therapy. The popularity of anti-VEGF treatments like Eylea and Lucentis in treating macular edema linked to CRVO has fueled high treatment penetration levels. Moreover, the presence of corticosteroid implants and laser treatments also reinforces the segment's market leadership.

By Treatment

The anti-vascular endothelial growth factor (Anti-VEGF) market dominated the retinal vein occlusion treatment market with a 65.40% market share in 2023 because it has been proven to be very effective in controlling macular edema, one of the chief complications of RVO. Anti-VEGF drugs like Eylea (aflibercept) and Lucentis (ranibizumab) are heavily prescribed as a first-line medication, restoring eyesight to great heights and suppressing swelling in the retina. Clinical trials have proven that continuous anti-VEGF injections can restore or preserve vision in most RVO patients. The subsequent approval of longer-dose regimens, like Roche's Vabysmo (faricimab), that provide more intervals between treatment has also boosted adoption. The immense favor for such biologics, coupled with the rising number of regulatory approvals and insurance reimbursement, has consolidated the Anti-VEGF segment's market dominance.

The Corticosteroid Drugs segment is projected to grow significantly in forecast years with a view of decreased inflammation and improved visual outcomes for non-responder patients with regards to anti-VEGF treatment. Corticosteroids, like Ozurdex (dexamethasone intravitreal implant), provide drug delivery over a longer period, providing less frequency for injections compared to anti-VEGF treatments. It benefits most, particularly elderly patients or those with challenged compliance with more frequent intravitreal injections. In addition, future improvements in biodegradable steroid implants, as well as in combination treatments, promise improved efficacy as well as augmented market penetration. Clinical trial after clinical trial continues to reaffirm the value of corticosteroids for refractory diseases, with concomitant mounting physician acceptance.

By End-user

The Hospitals & Clinics segment dominated the retinal vein occlusion treatment market with a 43.12% market share in 2023 because of the presence of advanced diagnostic and treatment centers, specialized ophthalmologists, and multidisciplinary care strategies. Hospitals and eye specialist clinics are main locations for intravitreal anti-VEGF injection, corticosteroid implant, and laser treatment delivery, which plays an important role in controlling complications of RVO. Moreover, these centers are provided with advanced imaging technologies such as optical coherence tomography (OCT) and fluorescein angiography to ensure proper diagnosis and tracking of disease progression. The increasing number of hospitalizations for RVO, along with insurance coverage and reimbursement policies, also helped in the dominance of this segment. Additionally, partnerships between drug firms and hospitals for new drug launches and clinical trials have cemented their position as the first choice for treatment in this market.

Retinal Vein Occlusion Treatment Market Regional Insights

North America dominated the retinal vein occlusion treatment market with a 42.25% market share in 2023 because of the established healthcare infrastructure, rate of advanced therapies adoption, and availability of dominant pharmaceutical companies. The region is favored by robust regulation, with the U.S. Food and Drug Administration (FDA) accrediting numerous innovative treatments, such as anti-VEGF injections like Eylea and Lucentis, which are the current standard of care. Furthermore, a more prevalent incidence of lifestyle diseases like diabetes and hypertension—both primary risk factors for RVO—is responsible for driving disease incidence. RVO has been estimated by the American Academy of Ophthalmology to afflict more than 2.2 million adults in the U.S., creating enormous demand for efficacious treatments. In addition, positive reimbursement policy and high patient awareness also serve to drive regional market dominance.

Asia Pacific is experiencing the fastest growth in the RVO treatment market with 7.54% CAGR throughout the forecast period because of the increasing prevalence of retinal diseases, growing healthcare infrastructure, and improving access to sophisticated ophthalmic treatments. The region has a huge and aging population, and the increasing prevalence of diabetes and hypertension is adding to the number of RVO cases. Asia, home to almost 60% of the world's diabetic population, as per the International Diabetes Federation, poses an increased risk for complications related to RVO. Furthermore, better healthcare spending, government efforts in upgrading ophthalmic services, and the participation of multinational drug companies in up-and-coming markets such as China and India are driving the market forward. The presence of affordable biosimilars and increasing numbers of specialized eye care centers also play a role in the accelerating adoption of RVO treatments in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Retinal Vein Occlusion Treatment Market

-

Regeneron Pharmaceuticals, Inc. (Eylea, ZALTRAP)

-

Bayer AG (Eylea, VEGF Trap-Eye)

-

Novartis International AG (Beovu, Lucentis)

-

F. Hoffmann-La Roche Ltd. (Lucentis, Susvimo)

-

Genentech, Inc. (Lucentis, Faricimab)

-

Allergan plc (Acquired by AbbVie) (Ozurdex, Dexamethasone Intravitreal Implant)

-

AbbVie Inc. (Ozurdex, Durysta)

-

Pfizer Inc. (Rapamune, Xalatan)

-

Bausch + Lomb (Vyzulta, Lotemax)

-

Santen Pharmaceutical Co., Ltd. (Eylea Biosimilar, Tafluprost)

-

Alcon Inc. (Simbrinza, Travatan Z)

-

Ophthotech Corporation (Fovista, Zimura)

-

Kodiak Sciences Inc. (KSI-301, KSI-501)

-

Adverum Biotechnologies, Inc. (ADVM-022, Gene Therapy for RVO)

-

Outlook Therapeutics, Inc. (ONS-5010, Lytenava)

-

Samsung Bioepis Co., Ltd. (SB11, SB15)

-

Biogen Inc. (BYOOVIZ, Fumarate Biosimilar)

-

Mitsubishi Tanabe Pharma Corporation (MT-6548, MT-7117)

-

Graybug Vision, Inc. (GB-102, GB-401)

-

Xbrane Biopharma AB (Xlucane, Biosimilar to Lucentis)

Suppliers (These suppliers support the RVO treatment market through drug formulation, biologic production, biosimilar manufacturing, and clinical research services.) in Retinal Vein Occlusion Treatment Market.

-

Lonza Group AG

-

WuXi AppTec

-

Samsung Biologics

-

Catalent, Inc.

-

Boehringer Ingelheim BioXcellence

-

FUJIFILM Diosynth Biotechnologies

-

Thermo Fisher Scientific Inc.

-

Ajinomoto Bio-Pharma Services

-

Piramal Pharma Solutions

-

Eurofins Scientific

Recent Development in the Retinal Vein Occlusion Treatment Market

-

Dec. 2024– Regeneron Pharmaceuticals, Inc. announced that the Phase 3 QUASAR trial of EYLEA HD (aflibercept) Injection 8 mg achieved its primary endpoint in the treatment of macular edema due to retinal vein occlusion (RVO). The trial showed that EYLEA HD dosed every eight weeks was comparable to the marketed monthly dosing of EYLEA (aflibercept) Injection 2 mg. Regulatory filings, including to the U.S. FDA in Q1 2025, are to be conducted, with results to be reported at an upcoming medical congress.

-

Feb. 2024 – Basel – Roche announced 72-week Phase 3 BALATON and COMINO study data for Vabysmo (faricimab) in macular edema secondary to branch and central retinal vein occlusion (BRVO & CRVO). Results indicated that as many as 60% of patients in BALATON and 48% in COMINO were able to stretch treatment intervals to three or four months while preserving vision gains and retinal drying through one year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.49 billion |

| Market Size by 2032 | US$ 4.35 billion |

| CAGR | CAGR of 6.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Central Retinal Vein Occlusion [CRVO), Branch Retinal Vein Occlusion (BRVO]) • By Treatment (Anti-vascular Endothelial Growth Factor (Anti-VEGF), Corticosteroid Drugs, Others) • By End-user (Hospital & Clinics, Retail Pharmacy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Regeneron Pharmaceuticals, Inc., Bayer AG, Novartis International AG, F. Hoffmann-La Roche Ltd., Genentech, Inc., Allergan plc (Acquired by AbbVie), AbbVie Inc., Pfizer Inc., Bausch + Lomb, Santen Pharmaceutical Co., Ltd., Alcon Inc., Ophthotech Corporation, Kodiak Sciences Inc., Adverum Biotechnologies, Inc., Outlook Therapeutics, Inc., Samsung Bioepis Co., Ltd., Biogen Inc., Mitsubishi Tanabe Pharma Corporation, Graybug Vision, Inc., Xbrane Biopharma AB, and other players. |