India Capability Centers Market Size & Overview:

Get More Information on India Capability Centers Market - Request Sample Report

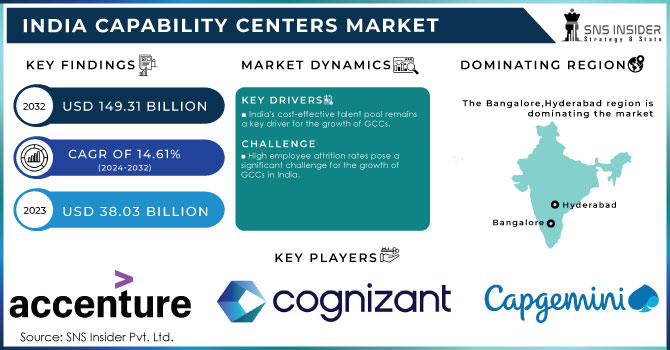

The India Capability Centers Market will reach USD 149.31 billion by 2032 and was valued at USD 38.03 billion in 2023. The estimated CAGR is 14.61% for 2024-2032.

The India GCC market is growing rapidly, following a few key demand drivers. Its scale in major proportion is backed by an enormous skilled workforce; India holds over 5 million technology professionals. It houses about 70% of the world's GCCs, hence playing strategically in this sector. Another significant driving factor is the cost efficiency search since international companies will go to all extent to reduce overheads and keep them in locations where operation costs are 40-60% less as compared to Western countries. The high adoption of more advanced technologies such as AI, data analytics, and cloud computing has also been driving growth for the GCC market. About 35% of Indian GCCs is focusing on building innovation centers and using cutting-edge technologies to drive transformation. Plus, the support of the government regarding the positive policies and incentives such as Digital India is driving foreign investments.

In addition, the post-pandemic growth in hybrid work models has also driven the requirement for GCCs in India since companies seek to utilize the IT infrastructure and telecom advancements that exist in India. Interestingly, about half of the newly set-up GCCs after 2020 are operating in a hybrid or fully remote setup; this shift reflects operational trends. It is the cost advantages, technological innovation, and skilled workforce that has positioned India as a dominant player in the world GCC market, which in turn drives its robust demand.

The major trend being digital transformation, wherein over 40% of GCCs in India are looking to leverage innovation through technologies like AI, ML, and data analytics. This trend has allowed global companies to leverage India's vast IT expertise in developing new-age solutions. Hybrid and work-from-anywhere is the other notable trend; nearly half of the new GCCs formed following the pandemic fall into this hybrid genre. This flexibility in operation continues to enhance productivity levels while bringing operational costs down; these companies are also benefiting from advanced telecommunication infrastructure in India supporting the work-from-anywhere model.

There has been a strong trend toward developing CoEs within GCCs. Approximately 30 percent of Indian GCCs are now involved in high-value services with specialized areas in cybersecurity, product development, and advanced research. Such CoEs help firms harness innovation and gain a competitive edge worldwide. Sustainability is another emerging trend wherein companies integrate environmental-friendly practices into their GCC operations. The trend of green technologies and sustainable business practices has widely penetrated Indian GCCs, and around 25% of these pursue carbon neutrality goals.

India Capability Centers Market Dynamics:

Drivers:

- India's cost-effective talent pool remains a key driver for the growth of GCCs.

In terms of cost-effective talent pool, the GCCs have been attracted to the country. In turn, India has become an ideal solution for global companies while optimising their operational costs without sacrificing quality output. With over 5 million IT professionals and a growing base of STEM graduates, India affords a large, skilled workforce at a fraction of the cost compared to Western markets. Labor is reported to cost about 40-60% less than that of the U.S. or Europe and thus is an attractive location for companies seeking to realize enhancements in profitability through offshore operations.

Besides the cost advantage, the Indian talent pool excels in the areas of software development, analytics, artificial intelligence, and digital transformation. This has been a great opportunity that most multinational companies have capitalized on by shifting their GCC operations to India and establishing centers of excellence for innovation, R&D, and business process optimization. Availability of English-speaking professionals further enhances India's appeal to most international companies to reduce barriers in communication.

Indian GCCs have been able to evolve from being simplistic transactional, back-office functions to being highly strategic contributors, generators of innovation, and keys to upgrading the customer experience. This has helped change the role of GCCs from one based on cost savings toward a value-generation engine focused on providing sustainable solutions to business that reinforces India's position as one of the global leaders in the GCC market. This is leading to even more investments and growth within the sector.

Challenge:

- High employee attrition rates pose a significant challenge for the growth of GCCs in India.

One of the significant challenges for GCCs in India is attrition. Attrition levels in the IT and business process outsources segment, under which GCCs primarily function, have been estimated to be between 15% and 25% by the industry, and this continuous change creates serious operational disruptions and also increases the cost of talent acquisition, onboarding, and training. High cost and time consumption. Sometimes, keeping the workforce stable is expensive and can take a long time due to delays in the project timelines and a lowered general level of productivity.

Attrition is primarily due to a host of factors, with perhaps the most important one being the highly competitive job market in India. Multifarious firms-domestic and international-are bidding for skilled professionals and well-expert professionals in new technologies, including AI, machine learning, and cloud computing. This creates employees' bargaining power to switch jobs periodically for higher remuneration, better benefits, or better prospects of career advancement.

There is also burnout and dissatisfaction with the job causing the attrition rate. Many professionals in GCCs work on demanding, high-pressure projects that sometimes lead to a work-life imbalance. It gets very hard for the companies to keep the employees who look for less stress-inducing environments or work conditions to be better.

India Capability Centers Market Segments:

By Service Type:

The Indian Global Capability Centers (GCC) market can be bifurcated based on service type and is dominated by IT Services, holding around 40% market share at the moment. The steady process of digital transformation in finance, healthcare, and retail businesses leads to increased demand for cloud computing and software development. The second best one in this series is Business Process Management, as companies are looking into this kind of solution for efficiency enhancement and cost-cutting. This accounts for a market share of around 30% of the Global Capability Centers. KPO makes up about 15% of this market, offering specialized processes that require expertise, like market research. This space is growing, as companies move towards data-driven decision making. The last one is Engineering and R&D Services, which make up about 15% of the market and are growing fast because companies are now focusing more on innovation, in particular within the automotive and manufacturing areas. This classification demonstrates how GCCs in India support multiple needs within industry groups, further simplifying operations. objectives.

By Industry Vertical

The BFSI sector leads in the GCC market in India, accounting for about 35% of the market share by demands from regulatory compliance and risk management. Healthcare and Life Sciences account for approximately 25% with needs for data management and clinical research. Retail and Consumer Goods account for about 20%, as companies optimize supply chains and enhance customer experiences. The Manufacturing & Automotive sectors approximately account for 15% by process optimization and in-depth capabilities in engineering. Telecom & IT is around 5% looking to improve the delivery of services in a more efficient manner. Segmentation depicts how GCCs address different sector requirements to drive operational efficiencies and growth.

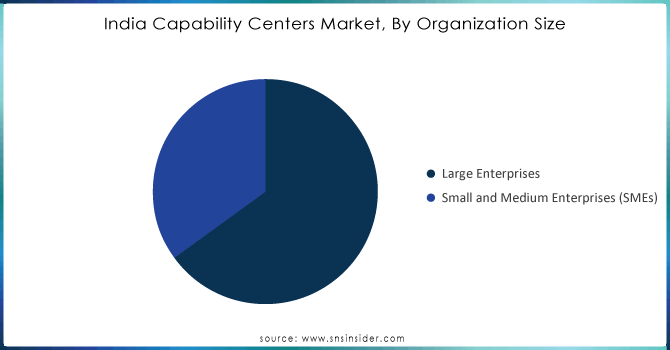

By Organization Size

GCC market by organization size splits in the Indian market pretty much to 70% for Large Enterprises which utilize GCC services to handle complex operations and enhance scalability, while approximately 30% of SMEs are gaining ground on understanding that GCC services can help access technology and expertise with minimal capital investments. Most SMEs initiate shifting attention to IT services and KPO as growth drivers. The new digital landscape compels them to adopt GCC services in order to overcome challenges while grasping opportunities.

Need any customization research on India Capability Centers Market - Enquiry Now

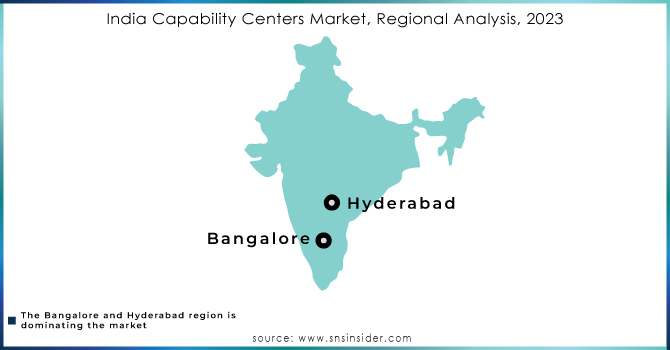

Regional Analysis:

The India Capability Centers (GCC) landscape in India showcases a distinct blend of dominating Tier-1 cities and emerging Tier-2 cities, each contributing to the market's growth. Dominating cities like Bangalore and Hyderabad remain at the forefront due to their established IT infrastructure, robust talent pool, and innovative ecosystems. Bangalore, often dubbed the Silicon Valley of India, is home to numerous GCCs, while Hyderabad is emerging as a hub for digital transformation and technology services. Together, these cities account for a significant share of the GCC market, primarily driven by their operational efficiencies and advanced technological capabilities.

In contrast, the Tier-2 cities are rapidly gaining traction as viable alternatives for GCC operations. Cities like Coimbatore, Jaipur, and Chandigarh offer compelling advantages, including a cost of operations that is 20-30% lower than their Tier-1 counterparts. These regions are increasingly recognized for their burgeoning talent pools, with numerous technical institutes producing graduates in fields such as IT, engineering, and data science. This influx of skilled professionals allows GCCs to benefit from reduced attrition rates, often experiencing 10-15% less turnover compared to major metropolitan areas. Moreover, government incentives, such as tax breaks and special economic zones (SEZs), are further bolstering the attractiveness of these emerging cities, positioning them as competitive hubs for sustainable long-term growth in the GCC sector.

Recent Developments:

Lubrizol Corporation: A significant development in this landscape has been the launch of a new Global Capability Center by The Lubrizol Corporation in the Hinjewadi location in Pune, India. The new Global Capability Center is testament to the growing foreign investments in India's GCC sector while reflecting the continued expansion of high-value services seeded by innovation and efficiency.

Accenture: Accenture is focusing on its digital capabilities in India through investments in AI and cloud computing technologies. In 2023, they inaugurated their AI Innovation Hub at Bengaluru to help clients with their AI and machine learning projects, thus making the company a digital solutions leader.

Tata Consultancy Services (TCS): Tata Consultancy Services is the other firm that extends its research and development initiatives across India, GCCs. In 2023, TCS has inaugurated its new innovation lab on cybersecurity and blockchain technologies in Pune, driving the industry-wide adoption of digital trust.

Cognizant: It is investing in significant reskilling of Indian workforce. The company intends to upskill more than 100,000 employees in digital technologies by 2024. This is all part of its larger strategy to improve expertise in AI, data analytics, and cloud services.

Key Players:

Some of the major India-specific GCC market key players are:

-

Accenture: (AI Innovation Hub, Accenture Cloud Platform)

-

Tata Consultancy Services (TCS): (TCS BaNCS, TCS iON)

-

Cognizant: (TriZetto Healthcare Products, Cognizant Digital Systems & Technology)

-

Infosys: (Infosys Finacle, Infosys Cobalt)

-

Wipro: (Wipro Holmes, Wipro Smart i-Connect)

-

Capgemini: (Capgemini Cloud Choice, Capgemini Insights & Data)

-

HCL Technologies: (HCL DRYiCE, HCL Commerce)

-

Wells Fargo India Solutions: (Wells Fargo Digital Solutions, Risk & Compliance Solutions)

-

Goldman Sachs Services India: (Transaction Banking Platform, Digital Wealth Management Platform)

-

JPMorgan Chase India: (Chase Payment Solutions, Markets Execution)

-

HSBC Global Technology: (HSBCnet, Global Banking and Markets IT solutions)

-

Deutsche Bank Group India: (Autobahn, DB Secure Authenticator)

-

Morgan Stanley India: (MS Market Analytics, Wealth Management Solutions)

-

UBS Business Solutions India: (UBS Neo, Wealth Management Platforms)

-

Barclays Global Service Centre: (Barclays Mobile Banking App, Barclaycard Payment Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 38.03 billion |

| Market Size by 2032 | USD 149.31 Billion |

| CAGR | CAGR of 14.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type: (Information Technology (IT) Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO), Engineering and R&D Services) • By Industry Vertical: (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and Consumer Goods, Manufacturing and Automotive, Telecom & IT) • By Organization Size: (Large Enterprises, Small and Medium Enterprises (SMEs)) |

| Regional Analysis/Coverage | India: (North, South, East, West) |

| Company Profiles | Accenture, Tata Consultancy Services (TCS), Cognizant, Infosys, Wipro, Capgemini, HCL Technologies, Wells Fargo India Solutions, JPMorgan Chase India |

| Key Drivers | • India's cost-effective talent pool remains a key driver for the growth of GCCs. |

| RESTRAINTS | • High employee attrition rates pose a significant challenge for the growth of GCCs in India. |