Finance Cloud Market Report Scope & Overview:

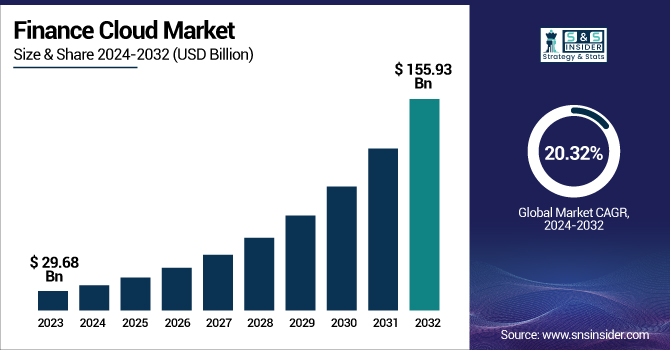

The Finance Cloud Market was valued at USD 29.68 billion in 2023 and is expected to reach USD 155.93 billion by 2032, growing at a CAGR of 20.32% from 2024-2032.

To Get more information on Finance Cloud Market - Request Free Sample Report

This report includes comprehensive insights into security and compliance statistics, disaster recovery and business continuity metrics, data volume and analytics utilization, carbon footprint reduction stats, third-party API usage and open banking trends, and data sovereignty trends. As financial institutions accelerate their digital transformation journeys, cloud adoption is being driven by regulatory agility, scalable data infrastructure, environmental goals, and the need for resilient, real-time operations.

In 2024, Amazon Web Services (AWS) launched a sovereign cloud for Europe, fully operated by EU personnel, to meet strict EU data privacy regulations highlighting rising demand for regional data control amid growing regulatory scrutiny.

Open banking frameworks and third-party integrations are also reshaping financial service delivery, while regional compliance pressures and data sovereignty concerns increasingly influence cloud strategies across markets.

U.S. Finance Cloud Market was valued at USD 8.15 billion in 2023 and is expected to reach USD 42.49 billion by 2032, growing at a CAGR of 20.14% from 2024-2032.

This growth is fueled by rising demand for scalable, secure cloud infrastructure to support evolving regulatory requirements, real-time data processing, and advanced analytics in the financial sector. Increased adoption of AI-driven financial tools, open banking initiatives, and a shift toward hybrid and multi-cloud strategies are further accelerating market expansion.

Additionally, U.S.-based institutions are prioritizing cyber resilience, compliance automation, and ESG alignment, which are increasingly dependent on agile cloud platforms. According to a Nutanix study, implementing AI strategies and minimizing costs are driving IT decision-makers' infrastructure priorities, often linked to broader ESG objectives.

This trend reflects the growing importance of sustainable practices in technology investments. These factors, combined with a highly competitive fintech landscape, are making cloud capabilities central to strategic differentiation.

Market Dynamics

Drivers

- Cost Efficiency and Flexibility in Operations are Key Drivers of Cloud Adoption in Financial Services

Cloud is emerging as a strong enabler for cost savings and productivity in financial services. The move to cloud means financial institutions no longer have to deal with sophisticated, costly on-premises infrastructure. This transition allows organizations to better manage their operational resources while more effectively scaling as cloud providers manage the hardware, software, and maintenance. Because of the cost-saving potential of cloud technology, organizations can reallocate money towards business expansion and innovation.

A notable example is Muthoot FinCorp, which selected Oracle Cloud Infrastructure to modernize its core systems and finance operations resulting in a 50% performance boost, enhanced scalability, and reduced costs across its 5,400 branches.

It shows how the cloud platforms are assisting businesses meeting business demands, increase profitability, and embark on large-scale transformation initiatives. And cloud platforms also offer scalability, enabling financial institutions to quickly scale their operations up/down to meet shifting market demands in an efficient manner. Cloud adoption gives the flexibility to deliver these solutions, as financial businesses are demanding faster time-to-market for new services. This simplifies the ability to stay innovative, but also to run operations seamlessly and at a fraction of the cost.

Restraints

- Data Security and Privacy Issues Create Barriers to Cloud Adoption in Financial Services

Data security and privacy remain major hurdles to cloud adoption for financial institutions. Financial data is particularly sensitive, and organizations prefer to be on the safer side when it comes to storing this information; they would not want third-party cloud servers to be breaches or face a compliance issue. In addition to everything mentioned above, regulatory pressures like GDPR and other local data protection laws make shifting to the cloud even more complex. Under strict laws and regulations governing them, financial institutions must ensure strong security protocols to protect sensitive client data. This reluctance to embrace the cloud is spurred by concerns over potential reputational harm, legal action, or costs from data breaches. While cloud platforms offer many benefits, these security challenges are still an important hurdle to widespread adoption.

Opportunities

- Cloud Solutions Provide Financial Institutions with Opportunities for Innovation and Enhanced Customer Experiences

Cloud platforms provide financial institutions with a rare opportunity to transform into customer-facing innovation, delivering new personalized, data-driven services. Access to advanced analytics, artificial intelligence, and machine learning technologies is being given priority in the financial services sector, and this is possible with the adoption of the cloud.

A prime example of this is Bain & Company, which deployed SAP S/4HANA Cloud Public Edition across 40 countries to standardize global finance operations. This cloud ERP system has enhanced agility, compliance, and efficiency, enabling faster, data-driven decision-making in a highly competitive consulting environment.

Using cloud-based tools, financial institutions can analyze customer behaviors, preferences, and transaction trends to create more personalized products and services for their customers. Cloud solutions also mean that new features and updates can be implemented faster, leading to more agile service solutions. Not only does it allow for fast and economical scaling, but it also empowers financial organizations to adapt to new customer expectations to retain sustainable growth in a rapidly changing market.

Challenges

- Cloud Migration Complexity and High Costs Pose Challenges for Financial Institutions Transitioning

The migration process very complex and costly for financial institutions to change their on-premises infrastructure to cloud solutions. That transition can be costly because it takes a lot of time, expertise, and knowledge. Furthermore, migration needs to be implemented carefully so that while the shift to new things is taking place, it does not interrupt the continuation of business as usual and the experience of services rendered. Even the costs of migrating to the cloud can be a barrier, especially for smaller financial institutions with tighter budgets. But there can be additional expenses associated with ongoing cloud use, like subscription fees, data transfer fees, or the continued need for training and support. The intricacy and costs of migrating, however, is a key hurdle to adoption for many financials institutions which clouds any hopes of a wide spread rollout.

Segment Analysis

By Components

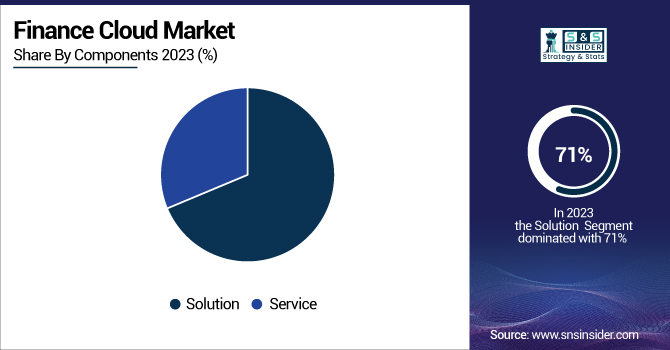

The solution segment dominated the Finance Cloud Market in 2023, capturing a 71% share due to they provide comprehensive, end-to-end solutions to address evolving financials institutions needs. They increase operational efficiency, minimize costs, and improve data security. The adoption of the BAPs is further propelled due to their capability of enhancing decision-making through real-time analytics, automating processes, and supporting regulatory compliance, which has made them central to the sector.

The service segment is expected to grow at the fastest CAGR of 21.97% from 2024 to 2032, driven by increasing demand for cloud-based support and consulting services. The rise of continuous maintenance, optimization, and integration services has made the transition of financial institutions to cloud technologies. They are crucial for guiding firms through intricate deployments, increasing operational scalability, and facilitating smooth user journeys. This accelerated growth is being driven by the increasing dependence on experts and managed services.

By Enterprise

The large enterprises segment dominated the Finance Cloud Market with a 69% revenue share in 2023, primarily due to their significant investment capacity and complex infrastructure needs. Big corporations utilize the Cloud to improve overall functional capacity, decrease overheads, and analyze large data sets. Having significant finances on their side, they can now implement the latest cloud technologies that can add scalability, flexibility, and allow you to go global to every possible business function.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR of 21.54% from 2024 to 2032, driven by increasing cloud adoption among SMEs seeking cost-effective and scalable solutions. SMEs make the transition to the cloud for operational efficiency, security and access to enterprise-level applications without the big-ticket solutions. Cloud providers have customized offerings for SMEs that make them affordable and accessible. This is proving to be a big growth driver for the cloud market.

By End-Use

The banking and financial services segment dominated the Finance Cloud Market in 2023, with a 67% share, owing to the high dependency of the banking and financial services industries on Cloud Technologies to improve operational efficiency, maintain regulatory compliances, and enhance customer experiences. Real time transaction processing, better data analytics, and secure handling of sensitive financial data of the lifecycle of financial data (from generation to destruction) are some of the reasons that banking and financial institutions are widespread– adopting the cloud as security and scale is king in this domain.

The insurance segment is expected to grow at the fastest CAGR of 22.00% from 2024 to 2032, insurers increasingly adopt cloud technology about policy management, claims processing, and data analytics. Increased need for better customer experiences, operational business agility, and data security against the backdrop of evolving risks and regulations is driving cloud adoption by insurers. In addition, the cloud platforms ensure that the scalability and cost effectiveness that is essential for the transformation of traditional insurance models and the scaling of digital propositions.

By Application

The wealth management segment dominated the Finance Cloud Market in 2023 with a 25% share, driven by the increasing need for digital platforms equipped to serve modern market demands with tailored investment strategies, real-time insights, and portfolio management. Cloud solutions allow firms to quickly process large sets of data, make secure transactions, and have an enriched user experience for their clients. WealthTech platforms have developed into valuable players of the wealth management industry, thanks to their capacity to sharpen operations and delivery of insights based on data, resulting to being an indispensable part for assets management companies that aim to stay competitive in a rapidly changing market.

The asset management segment is expected to grow at the fastest CAGR of 23.20% from 2024 to 2032, as firms seek cloud solutions to enhance investment strategies and operational performance. Additionally, the increasing use of cloud-based systems which incorporate dashboards driven by data analytics and high-level analytics supported by artificial intelligence (AI) within platforms helps Asset Managers to manage portfolios and risk evaluation more automated and better. This rapid rate of growth in the asset management space is being driven by the increasing emphasis on processing high volumes of data and deriving timely and relevant insights to clients.

By Deployment

The public cloud segment dominated the Finance Cloud Market with a 52% share in 2023, due to the scalability, cost-effectiveness, and flexibility offered by the cloud service. Enterprise-grade financial tools and applications are made available to organizations at scale quickly, and public cloud providers drive down IT infrastructure costs while fostering collaboration across teams. Its dominance has been reinforced by the increasing use of public cloud services by financial institutions, which is fueled by the rising needs of digital transformation and innovation.

The private cloud segment is expected to grow at the fastest CAGR of 21.11% from 2024 to 2032, because companies can have more control over their data and security but still take advantage of cloud technologies. Private cloud-based systems offer more customizations and are the go-to best bet for financial institutions and other industries with high regulatory requirements. One of the major driving forces for this rapid growth in the private cloud segment, especially for sectors that deal with sensitive data, is the capability to offer additional security features on top of the flexibity offered by the cloud.

Regional Analysis

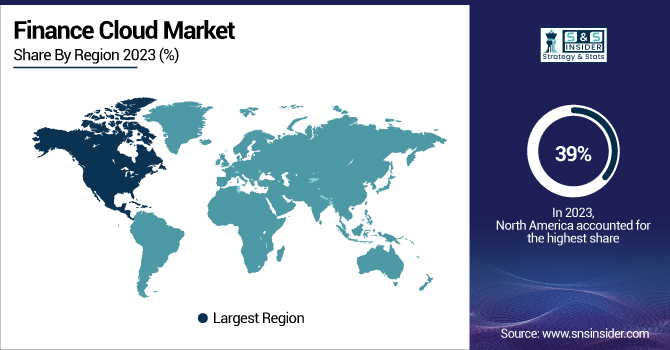

North America dominated the Finance Cloud Market in 2023, accounting for 39% of the global revenue share, due to its early adoption of advanced cloud technologies and a mature financial services infrastructure. The presence of leading cloud service providers, strong regulatory frameworks, and high digital literacy across the financial sector have driven widespread implementation. Additionally, large-scale investments in cybersecurity and innovation, along with a focus on data-driven decision-making, have solidified the region’s leadership in cloud-based financial services.

Asia Pacific is projected to grow at the fastest CAGR of 22.51% from 2024 to 2032, driven by rapid digital transformation across emerging economies, increased fintech adoption, and supportive government initiatives. Rising demand for scalable financial infrastructure, growing smartphone penetration, and expanding internet access are encouraging financial institutions to embrace cloud technologies. As regional markets modernize, cloud solutions are being leveraged to enhance efficiency, security, and customer engagement, fueling unprecedented growth in the Asia Pacific finance cloud landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AWS (AWS Financial Services Cloud, Amazon QuickSight)

-

Microsoft (Dynamics 365 Finance, Azure Synapse Analytics)

-

Google (Looker, BigQuery)

-

IBM (IBM Cognos Analytics, IBM Cloud for Financial Services)

-

Tencent Cloud (Tencent Distributed Database TDSQL, Cloud Virtual Machine)

-

Salesforce (Financial Services Cloud, Tableau)

-

Oracle (Oracle Financials Cloud, Oracle Analytics Cloud)

-

Alibaba Cloud (MaxCompute, Quick BI)

-

Workday (Workday Financial Management, Workday Adaptive Planning)

-

SAP (SAP S/4HANA Finance, SAP Analytics Cloud)

-

HPE (HPE GreenLake, Ezmeral Data Fabric)

-

VMware (VMware Cloud, VMware vRealize Operations)

-

Cisco (Cisco Cloudlock, AppDynamics)

-

Huawei (FusionInsight, Huawei Cloud GaussDB)

-

ServiceNow (Financial Services Operations, Now Platform)

-

DXC Technology (DXC Finance and Accounting BPS, DXC Cloud Services)

-

SAGE Group (Sage Intacct, Sage 50cloud)

-

Snowflake (Snowflake Data Cloud, Financial Services Data Exchange)

-

Nutanix (Nutanix Cloud Platform, Beam)

-

Acumatica (Acumatica Financial Management, Acumatica Cloud ERP)

-

RapidScale (CloudDesktop, CloudServer)

-

AtemisCloud (Atemis Finance, Atemis ERP)

-

Rambase (RamBase Cloud ERP, RamBase Financial Management)

-

OVHcloud (Hosted Private Cloud, OVHcloud Public Cloud)

-

FreeAgent (FreeAgent Accounting Software, FreeAgent Mobile App)

-

FreshBooks (FreshBooks Invoicing, FreshBooks Accounting)

-

Kashoo (Kashoo Classic, TrulySmall Accounting)

-

Wave (Wave Accounting, Wave Invoicing)

Recent Developments:

-

2024 – At Google Cloud Next ’24, Google launched AI-powered updates to BigQuery and Looker. BigQuery now supports multimodal data, Gemini AI integration, and streaming analytics, while Looker enables conversational data analysis and auto-generated visual reports.

-

2024 – HPE introduced next-gen data management innovations, enhancing HPE GreenLake with software-defined storage and AI-driven automation. These upgrades aim to simplify hybrid cloud operations, boost performance, and unify data management across on-premises and public cloud environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 29.68 Billion |

| Market Size by 2032 | US$ 155.93 Billion |

| CAGR | CAGR of 20.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Service) • By Deployment (Public Cloud, Private Cloud, Hybrid Cloud) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Application (Revenue Management, Wealth Management, Account Management, Customer Relationship Management, Asset Management, Others) • By End-Use (Banking & Financial Services, Insurance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AWS, Microsoft, Google, IBM, Tencent Cloud, Salesforce, Oracle, Alibaba Cloud, Workday, SAP, HPE, VMware, Cisco, Huawei, ServiceNow, DXC Technology, SAGE Group, Snowflake, Nutanix, Acumatica, RapidScale, AtemisCloud, Rambase, OVHcloud, FreeAgent, FreshBooks, Kashoo, Wave |