AdTech Market Market Report Scope & Overview:

Get More Information on AdTech Market - Request Sample Report

The AdTech Market Size was recorded at USD 583.54 Billion in 2023 and is expected to reach USD 1958.4 Billion in 2032, growing at a CAGR of 14.4% over the forecast period 2024-2032.

A number of major developments are reshaping and changing the industry as the market changes at a rapid rate. Connected TV (CTV), hyper-personalization, geotargeting, augmented and virtual reality, integrated consumer journeys, and vernacularization are a few prominent AdTech market developments. Additionally, programmatic advertising targets and delivers adverts using data and algorithms, making it possible to run more successful and efficient advertising campaigns. According to the published report the annual spending on the advertisements is around USD 1077 Billion in 2024, and the the market volume of TV & digital advertising is USD 337 Bn on 2024. In 2023, it is recorded that from the total revenue generated by Ads, Google holds the major share of around 26% and is the largest digital ad publisher in the U.S.

The advertising tech sector is ever-evolving, with platforms and ad formats seeing continual innovation. The introduction of social media, video advertising, and interactive ad formats has significantly changed the market. Platforms are evolving to satisfy the demands of marketers who are always seeking for fresh approaches to draw in viewers. The integration of advance software is booming the advertising fields that gain customer’s interest and revenue to market growth. Some popular software’s are AdTechFX (that help to boost the sales by targeting the right audience), AdRoll (that help to promote ads through different platforms), Amazon DSP, Adobe Advertising Cloud, etc. For Instance, In August of 2023, PadSquad announced a ground-breaking project in which they partnered with Amazon Ads to incorporate their well-established interactive ad formats into the Amazon Ad Server. Through this unique partnership, advertisers will be able to use Amazon DSP (demand-side platform) to programmatically deliver PadSquad's customized and interactive ad formats.

Since native advertising incorporates sponsored material into the layout and appearance of websites, it is also becoming more and more popular. Native advertising facilitates effective consumer engagement because it is a less obtrusive technique than typical banner adverts. The top native advertising companies are, smartly, Taboola, Outbrain, MGID, etc. For Instance, U.S. advertisers had also invested around $97 Billion on Native Display advertising.

The raid adoption of AI and programming software has opened the investment and expansion opportunities in the field of Mobile Advertising, Personalization and Artificial Intelligence that help market to generate ROI and help make better decisions in creative advertising, ads placement and targeting customers. The 54% of the business reported that their cost of advertising is saved by using AI, and 40% of the budgets they invest in AI campaign. The best Ai tool for AdTech is Criteo, Skai, Albet etc.

Market Dynamics

Drivers

-

Growing demand for Creative advertising by Large and small Enterprises.

The market is growing due to increasing demand from the large versus small-to-medium enterprises. The 65% of the market is of large enterprises. Large companies buy end-to-end ad tech solutions and negotiate best prices and access to premium ad inventories through their scale. There are some top large enterprises that booming the advertising tech market, like Amazon advertising, The Trade Desk, Google Ads, Meta Platform etc. However, small and medium enterprises holds the small market share of around 23-24 % and the influence and purchasing power of small-to-medium enterprises is growing due to affordability and universal access to easy-to-use platforms. In addition, they can monetize targeted and local advertising better than corporations. Key contributors to this growth are increased digital advertising spending, AI evolution, and overwhelming mobile and video advertising.

Restraints

-

Increasing Security concern related data breaches and strict regulation by government.

Billions of dollars lost to ad fraud, largely the result of malicious bots Fraudulent clicks, impressions or fake domains which are referred to frauds that happen when cyberattackers use advanced bots. These bots are able to do what seems like real user actions, which makes it hard for anyone else watching them. The Web2 landscape is decentralized and opaque, creating an environment where bot presence can easily go undetected. For Instance, Federal Trade Competition (US), had made strict regulation regarding fraudulent activities, unfair practices in AdTech Market. In Addition with that, European Commission, also work in safeguarding the unfair practices.

Opportunities

-

Adoption of Web3 Technologies to avoid data breach and provide effective and efficient services.

Challenges

-

Lack of transparency, Ad blocking, increasing concern of connected TV (CTV), hinders the market growth.

Market Segmentation

By Offering

With a more than 32% revenue share, the services sector led the market in 2023. The growth is partially due to the rise in data-driven marketing strategies. Businesses want to find their niche audience, so service providers sell the solutions like campaign management, data analysis and ad optimization. On top of this, the emergence of new technologies such as AR/VR enables more immersive formats for ads - something that demands dedicated services in developing and putting into action these ad experiences. Therefore, increasing demand in addition to rising popularity of audio advertising and mobile optimization is driving growth for the service segment leading it to dominate revenue contribution within this market. According to study the mobile advertising had grown to 36% in 2023, compared to 2022.

By Advertising Type

With around 80% of market share, the programmatic advertising segment led the competition in 2023. Programmatic advertising uses algorithms to simplify ad placements’ purchase and sale, thereby removing the need for manual negotiations. As a result, both advertisers and publishers receive a number of benefits. The former reach a larger number of relevant audiences, which becomes possible at the best prices and the latter fill the available ad inventory in a more effective manner. The prominent development of mobile advertising and the growing importance of data drive further development of the approach. As the contemporary market is highly keen on data-driven targeting and campaign management, programmatic platforms are the powerful solution. Therefore, it has become an active player in the modern market.

By Advertising Format

In 2023, the text advertising segment led the market with around 30% revenue share in 2023. The foundation of text advertising, search engine marketing (SEM), is expanding as long as users' reliance on search engines is strong. Moreover, improvements in programmatic purchasing methods enable more accurate audience targeting by strategically employing keywords and contextually appropriate placements. The increasing popularity of voice search means that text material needs to be optimized for spoken inquiries in order to stay relevant in this changing environment. Because text advertising is so successful at attracting new users and converting them, it continues to exist in the AdTech space and has a strong value proposition.

By Platform

The mobile segment dominated the market in 2023, accounting for almost 53% of the total market share. There are numerous ad types available for mobile advertising, including display ads, in-app purchases, and video commercials. These ads can be customized for specific audiences and devices. New technologies that enable firms to target customers based on their location have emerged as a result of the development of mobile advertisements.

By Enterprise Size

Large enterprises, or companies with substantial marketing budgets, global reach, and deep wallets, make up the next major consumer sector. It enables big businesses to implement more complex and integrated advertising strategies that use many ad formats and channels. As a large business, which typically focus on increasing brand recognition and establishing brand to attract attention and influence the market and demographics. This gives them the money they need to invest in fresh, impactful marketing and advertising initiatives that will help them maintain and grow their market share. For Instance, the major large enterprises of the U.S. market are Google, Amazon, Meta platform, PunMatic, etc. which had gained the customers attraction towards their brand.

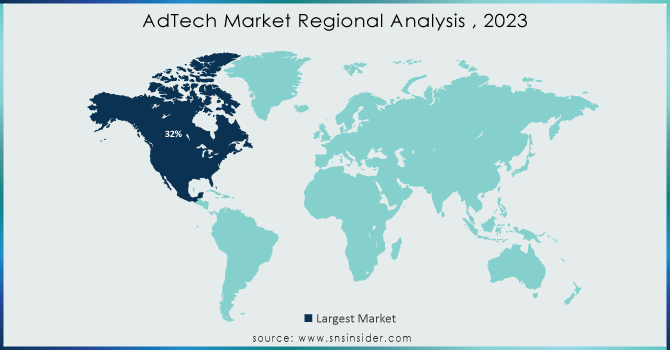

Regional Analysis

North America dominate the advertising tech market with major share of more than 32% of revenue share in 2023, due to pioneering technological platform associated with high digital literacy rates coupled with widespread consumer engagement. Interesting Startups in the Region that Shape Market Trends and Continuing to Utilize Technology for Successful Traditional Advertising And Marketing Campaigns. North America is home to a mature digital advertising ecosystem defined by stiff competition and rapid expansion of new trends & strategies.

U.S. accounts for over 71% share of the North American market in 2023. The biggest digital advertising market in the world and, Projected to increase as consumers migrate online / mobile. Ads-tech space has been ruled by technology companies like Google, Facebook and Amazon for several years now. There are many start-ups has taken place in recent years in U.S Advertising tech market such as, Prizeout (Chicago), Arrow (New York), Kevel, VidMob, etc.

The Europe AdTech market is growing rapidly with others. The affordability of programmatic advertising, which automates the buying and placement of ads through technological platforms that conduct transactions based on selected targeting criteria is one key cause. This enables advertisers to target specific demographics more efficiently and publishers in maximizing their inventory. So, an emerging sector in the world of advertising is digital out-of-home (DOOH), with large electronic displays proliferating everywhere from airports to subways. In addition, the successes of mobile web and connected TV (CTV) create more opportunities to reach audiences with powerful and interactive video advertising.

Asia Pacific is a large and growing market with lots of processing going on. It is a home for a vast and varied customer base; high internet penetration rates along with mobile-first mentality are helping the region create valuable prospects for growth.

Need any customization research on AdTech Market - Enquiry Now

Key Players

The major key players are Alibaba Group Holding Limited, Amazon.com, Inc., Facebook Incorporation, Google Incorporation, Microsoft Incorporation, SpotX, Verizon, Adobe, Meta, Criteo, Twitter Incorporation, Yahoo, Zeta, Luna, NextRoll, Quantcast, Criteo, Demandbase and others in final Report.

Recent Developments:

-

In March 2024, A partnership has been announced by Mediaocean, the mission-critical platform for omnichannel advertising, and Magnite, the largest independent sell-side advertising company, to bring more supply path efficiency and deeper automation to Mediaocean's Prisma buyers for online video (OLV) and connected TV (CTV). Through this agreement, Prisma users may utilize Magnite's ClearLine solution to immediately initiate streaming campaigns with premium video sellers.

-

In June 2023, Alphabet Inc. also launched with Demand Gen and Video View: two AI-powered advertising technologies. These instrumental products are designed to help marketers create rather than satisfy demand and engage the markets they want. These changes from Google fall in line with the tech giant's ongoing push to add in more artificial intelligence (AI) features into advertising.

AdTech Market Report Scope Report Attributes Details Market Size in 2023 US$ 583.54 Billion Market Size by 2031 US$ 1958.4 Billion CAGR CAGR of 14.4 % From 2023 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By offerings • By Advertising Type • By Advertising Format • By Advertising Channel • By Platform • By Enterprise Size • By Industry Vertical Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Alibaba Group Holding Limited, Amazon.com, Inc., Facebook Incorporation, Google Incorporation, Microsoft Incorporation, SpotX, Verizon, Adobe, Meta, Criteo, Twitter Incorporation, Yahoo, Zeta, Luna, NextRoll, Quantcast, Criteo, Demandbase Key Drivers • Growing demand for Creative advertising by Large and small Enterprises. RESTRAINTS •Increasing Security concern related data breaches and strict regulation by government