Industrial and Institutional Cleaning Chemicals Market Report Scope & Overview:

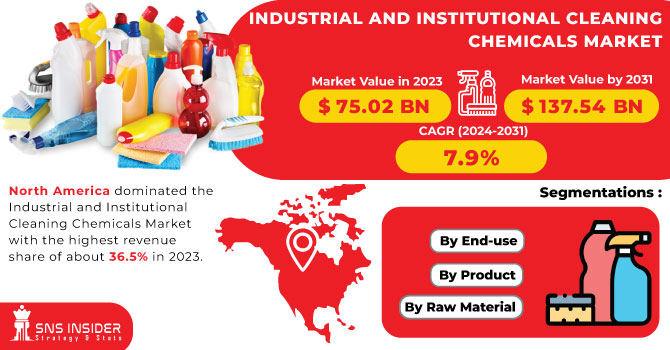

The Industrial and Institutional Cleaning Chemicals Market size was valued at USD 75.02 billion in 2023. It is estimated to hit USD 137.54 billion by 2031 and grow at a CAGR of 7.9% over the forecast period of 2024-2031.

The industrial and institutional cleaning chemicals market is driven by several factors. Firstly, the increasing awareness regarding the importance of cleanliness and hygiene has led to a surge in demand for effective cleaning solutions. Moreover, stringent regulations and guidelines imposed by regulatory bodies further propel the market growth, as businesses strive to comply with these standards. The market offers a wide array of cleaning chemicals, including disinfectants, sanitizers, degreasers, and detergents, each tailored to address specific cleaning requirements. These chemicals are formulated to effectively eliminate dirt, grime, bacteria, and other contaminants, ensuring a clean and safe environment.

Get E-PDF Sample Report on Industrial and Institutional Cleaning Chemicals Market - Request Sample Report

Furthermore, the market is witnessing a shift towards eco-friendly and sustainable cleaning chemicals. With growing environmental concerns, businesses are increasingly opting for products that minimize their ecological footprint. This trend has led to the development of innovative and environmentally friendly cleaning solutions, which not only provide effective cleaning but also align with sustainability goals.

Market Dynamics

Drivers

-

Increasing awareness of hygiene and cleanliness

The growing emphasis on maintaining cleanliness and hygiene in industrial and institutional settings is a significant driver for the cleaning chemicals market. This trend is driven by the need to prevent the spread of diseases and maintain a healthy environment.

-

Stringent regulations and standards

Governments and regulatory bodies are implementing stringent regulations and standards to ensure the safety and well-being of workers and the environment. Compliance with these regulations necessitates the use of effective cleaning chemicals, driving the demand for such products.

-

The outbreak of the COVID-19 pandemic

Restraint

-

Volatile raw material prices

Fluctuations in the prices of raw materials used in cleaning chemicals production can impact the market. The volatility of prices poses challenges for manufacturers in maintaining profitability and pricing stability.

-

Environmental concerns associated with these cleaning agents

The use of certain cleaning chemicals can have adverse effects on the environment. The increasing awareness of environmental issues and the demand for eco-friendly alternatives pose a restraint on the market. Manufacturers need to focus on developing sustainable and environmentally friendly cleaning solutions to overcome this challenge.

Opportunities

-

Increasing adoption of organic chemicals

The rising awareness of environmental sustainability and the demand for eco-friendly products create opportunities for manufacturers to develop and market green cleaning chemicals. This shift towards sustainability creates opportunities for green cleaning chemicals.

Challenges

-

Increasing demand for environmentally friendly cleaning products

With growing awareness about the harmful effects of traditional cleaning chemicals on human health and the environment, consumers are now seeking safer and more sustainable alternatives. This shift in consumer preferences poses a significant challenge for companies that have traditionally relied on conventional cleaning chemicals.

Impact of Russia-Ukraine War:

The Russia-Ukraine war has caused a disruption in the supply chain of cleaning chemicals, leading to a shortage in the market. This shortage has resulted in increased prices and limited availability of essential cleaning products. Industries and institutions heavily reliant on these chemicals have faced challenges in maintaining their cleanliness standards, which has had a detrimental effect on their operations. In addition to the supply chain disruption and lack of investment, the war has also impacted the demand for cleaning chemicals. With the ongoing conflict, many industries and institutions have experienced a decline in their activities, leading to reduced cleaning requirements. This decrease in demand has further exacerbated the challenges faced by manufacturers and suppliers in the market.

Impact of Recession:

During a recession, businesses and consumers alike tend to tighten their belts, reducing their spending on non-essential goods and services. This shift in behavior directly affects the demand for industrial and institutional cleaning chemicals, as companies and institutions cut back on their cleaning budgets. Consequently, the market experiences a decline in sales and revenue, posing significant challenges for manufacturers and suppliers in this sector. Furthermore, the recession may also lead to a decrease in construction activities, as companies delay or cancel projects due to financial constraints. This, in turn, affects the demand for cleaning chemicals, as new buildings and facilities require a substantial amount of cleaning products. As a result, manufacturers and suppliers face a double blow, with reduced demand from existing customers and a decline in potential new customers.

Market Segmentation

By Product

-

Disinfectants And Sanitizers

-

General Purpose Cleaners

-

Laundry Care Products

-

Vehicle Wash Products

-

Ware washing

-

Others

By Raw Material

-

Surfactant

-

Chlor-alkali

-

Solvents

-

Biocides

-

Phosphates

-

Others

By End-use

-

Manufacturing

-

Commercial

-

Institutional & Government

Regional Analysis

North America dominated the Industrial and Institutional Cleaning Chemicals Market with the highest revenue share of about 36.5% in 2023. This market encompasses a wide range of products used for cleaning and maintaining various commercial and industrial facilities. These chemicals play a crucial role in ensuring cleanliness, hygiene, and safety in workplaces, hospitals, schools, and other public spaces. One of the key reasons for North America's dominance in this market is its robust industrial sector. The region boasts a highly developed manufacturing industry, which generates a significant demand for cleaning chemicals. With numerous factories, warehouses, and production facilities operating across the continent, the need for effective cleaning solutions is paramount. Furthermore, North America's stringent regulations and standards regarding workplace safety and hygiene have also contributed to the market's growth.

Asia Pacific is expected to grow with the highest CAGR of about 8.3% during the forecast period. The Asia Pacific region, comprising countries such as China, India, Japan, and South Korea, is witnessing a significant surge in industrial and institutional activities. This can be attributed to the region's rapid economic development, urbanization, and increasing disposable income. As a result, there is a growing demand for cleaning chemicals in various sectors, including manufacturing, healthcare, hospitality, and commercial spaces. Furthermore, the Asia Pacific region is witnessing a shift towards stringent regulations and standards for cleanliness and hygiene. Governments and regulatory bodies are emphasizing the importance of maintaining high cleanliness standards in industries, institutions, and public spaces. This has led to an increased adoption of cleaning chemicals to ensure compliance with these regulations.

Moreover, the rising awareness among consumers regarding the importance of cleanliness and hygiene has further fueled the demand for industrial and institutional cleaning chemicals. With a growing middle-class population and changing lifestyles, individuals are becoming more conscious of maintaining clean and sanitized environments. This has resulted in increased usage of cleaning chemicals in households, offices, and public spaces. Additionally, the presence of a large number of manufacturing facilities and industrial complexes in the Asia Pacific region has contributed to the demand for cleaning chemicals. These facilities require effective cleaning solutions to maintain a safe and hygienic working environment, thereby driving market growth.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are 3M, BASF SE, Clariant, Procter & Gamble, Dow, SOLVAY, Sasol, Reckitt Benckiser Group plc, Eastman Chemical Corporation, Kimberly-Clark Corporation, Huntsman International LLC, Croda International PLC, Clorox Company, Inc., and other key players mentioned in the final report.

Clariant-Company Financial Analysis

Recent Development:

-

In December 2022, Clariant AG announced its plans to expand its business by making new investments to enhance its ethoxylation plant in China. The company will invest a total of USD 86.7 million to increase the capacity for its existing products and introduce new products by the end of 2024.

-

In October 2022, BASF and Hannong Chemicals planned to establish a production joint venture called "BASF Hannong Chemicals Solutions Ltd." In this joint venture, BASF will hold a majority share of 51%, while Hannong Chemicals will hold a minority share of 49%.

-

In March 2022, Sasol Chemicals, a business unit of Sasol Ltd., and Holiferm Limited announced a partnership to collaborate on the development of new biosurfactants and facilitate the widespread commercialization of sophorolipids.'

| Report Attributes | Details |

| Market Size in 2023 | US$ 75.02 Bn |

| Market Size by 2031 | US$ 137.54 Bn |

| CAGR | CAGR of 7.9% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disinfectants And Sanitizers, General Purpose Cleaners, Laundry Care Products, Vehicle Wash Products, Ware washing, and Others) • By Raw Material (Surfactant, Chlor-alkali, Solvents, Biocides, Phosphates, and Others) • By End-use (Manufacturing, Commercial, and Institutional & Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AK Scientific Inc., Alfa Aesar, MP Biomedicals, DPX Fine Chemicals, Virox, Thermo Fisher Scientific Inc., Parchem Fine & Specialty Chemicals, TCI America, Merck Millipore Corporation, Sigma-Aldrich Co. LLC |

| Key Drivers | • Increasing awareness of hygiene and cleanliness • Stringent regulations and standards • The outbreak of the COVID-19 pandemic |

| Key Restraints | • Volatile raw material prices • Environmental concerns associated with these cleaning agents |