Biolubricants Market Report Scope & Overview:

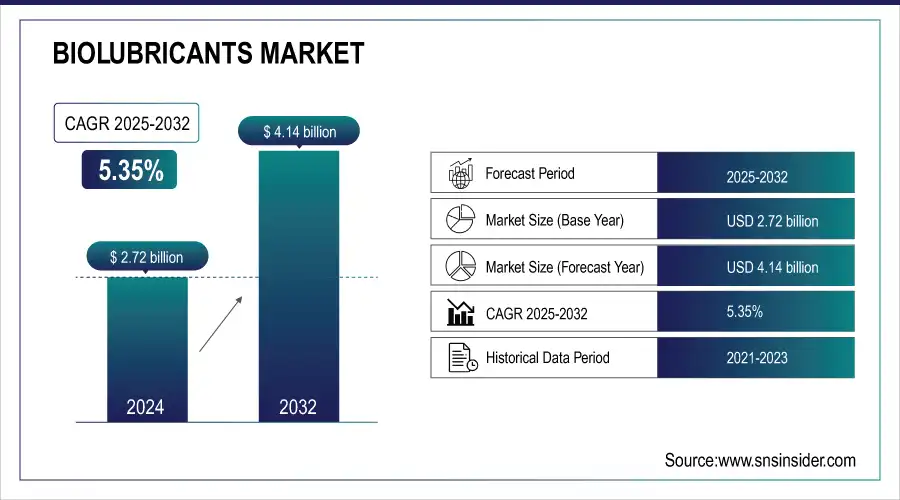

The Biolubricants Market Size was valued at USD 2.72 billion in 2024 and is expected to reach USD 4.14 billion by 2032 and grow at a CAGR of 5.35 % over the forecast period 2025-2032.

The biolubricants market is experiencing a surge in growth, fueled by a concern of environmental and economic forces. Biolubricants, derived from renewable sources and demonstrably biodegradable, perfectly align with this demand. Furthermore, as environmental regulations tighten around the world, the need for cleaner alternatives is intensifying and increase its demand in the market. Biolubricants, with their lower toxicity and biodegradability, are well-positioned to meet these stricter standards.

Get More Information onBiolubricants Market - Request Sample Report

For instance, in July 2023, a USD 2 million, five-year grant from the National Science Foundation was given to an interdisciplinary research team to create a new class of biosynthetic lubricants that may be used to cure arthritis and lessen the excruciating friction of artificial joints.

Key Biolubricants Market Trends

-

Growing demand for eco-friendly and biodegradable lubricants.

-

Rising adoption in automotive and industrial applications.

-

Increased focus on renewable and bio-based feedstocks.

-

Expansion of R&D in high-performance formulations.

-

Growing penetration in the marine and agriculture sectors.

-

Strategic collaborations and bio-based product launches.

-

Rising awareness of health and safety benefits.

Biolubricants Market Growth Drivers

-

The Increasing demand for environmentally friendly lubricants in a climate-conscious world drive the market growth.

The increasing demand for environmentally friendly lubricants in a climate-conscious world drive the market growth. The demand for eco-friendly lubricants is increasing due to traditional lubricants, typically petroleum-based, can come with environmental damage from potential pollution during production to spills that are especially difficult to clean up. Bio lubricants, crafted from renewable sources like plant oils, provide the best alternative that perfectly aligns with the evolving preferences of both consumers and industries. These biodegradable lubricants significantly reduce their environmental impact, making them a sustainable choice that paves the way for a greener tomorrow. Moreover, bio-lubricants can even outperform traditional lubricants in certain areas, further solidifying their position as a future-proof solution poised to dominate the lubricants market.

-

Growing Acceptance and Government Regulations have driven the market growth in bio lubricants market.

The concern by the environmental damage, governments are implementing regulations that require the use of eco-friendly lubricants in ecologically sensitive areas like forests, rivers, mountains, and farmlands. This push for sustainable practices stems from the well-documented risks that mineral-based oils pose to both the environment and the health of workers. Biolubricants, crafted from renewable resources, provide a compelling solution. Their biodegradability is rigorously evaluated by organizations like the OECD (Organization for Economic Co-operation and Development) to ensure minimal environmental impact. Nowadays, with sustainability becoming a top priority, and companies are increasingly turning to bio lubricants. In the European Union alone, an estimated 3 million tons of oil, including lubricants, are wasted each year. Biolubricants offer a clear path towards achieving sustainability goals, making them a win-win solution for the environment and businesses alike.

Biolubricants Market Restraints

-

Disruption in the Supply Chain may hinder the market growth.

The biolubricant market has faced a significant hurdle in its supply chain. Its dependence on readily available vegetable oils like palm, soy, or rapeseed creates a complex web of challenges. Firstly, these crops are subject to the impulses of nature. Fluctuations in agricultural yields due to weather patterns, pests, or diseases can lead to unpredictable harvests and shortage of biolubricant feedstock, driving up prices and disrupting the entire supply chain.

Biolubricants Market Segment Analysis

-

By Source

The vegetable oil segment held the largest market share approx. 87.12% in the source segment in 2024. Vegetable oils, a basic ingredient in biolubricants, patently outperform traditional mineral oil in terms of lubricity, leading to smoother operation and minimized attrition on machinery. Beyond exceptional lubricity, vegetable oils endow biolubricants with other favorable properties, including a high viscosity index and a high flash point, making them a versatile and compelling choice for a broad spectrum of industrial applications.

Biolubricants made with animal oil provide an earth-conscious alternative to petroleum-based lubricants. This shift not only lessens our reliance on dwindling fossil fuels but also unlocks the superior lubricating properties of animal oils. These biolubricants shine in a wide range of applications and equipment, offering exceptional lubrication, protection, and durability, which translates to optimal performance and minimized maintenance requirements.

-

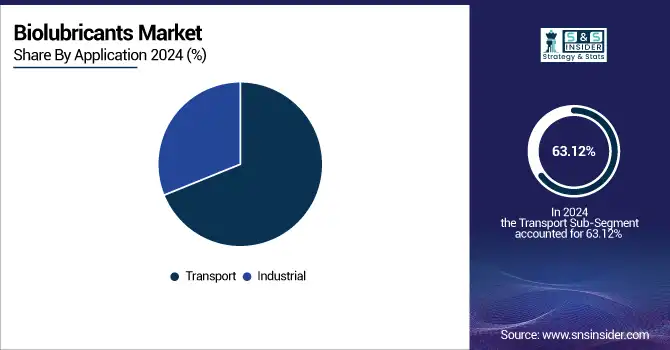

By Application

The transport segment held the largest market share approx. 63.12% in application segment 2024. It is due to confluence of environmental and economic forces that is creating a perfect storm that positions animal oil biolubricants for substantial growth within the transportation sector. As environmental regulations tighten and sustainability becomes a top priority, the transportation industry is actively seeking eco-friendly alternatives. Animal oil biolubricants address this need perfectly, offering a biodegradable solution that minimizes environmental impact compared to traditional lubricants.

-

By End-use

The commercial transport held the largest market share around 49.22% in 2024. The dominance of commercial transport in the animal oil biolubricant market can be attributed to a confluence of factors. The demanding lubrication needs of heavy-duty engines found in trucks and buses are perfectly addressed by animal oil biolubricants. Their exceptional lubricating properties minimize wear and tear, extending engine life and reducing maintenance costs.

Moreover, the economic considerations for commercial transport companies with large fleets favor biolubricants. While the upfront cost might be slightly higher, these lubricants boast a longer lifespan and the potential for improved fuel efficiency, leading to significant cost savings in the long run.

Furthermore, the sustainability benefits of animal oil biolubricants resonate well with the environmental goals of many transportation companies. These biolubricants contribute to a greener image and can enhance public perception of these companies. Biodegradable animal oil biolubricants provide a solution for compliance, solidifying commercial transport's position as a potential frontrunner in adopting this eco-friendly lubrication technology.

Biolubricants Market Regional Insights

North America Biolubricants Market Insights

North America dominated the market and held the largest market share approx. 36.22% in 2024. The resurgence of the U.S. and Canadian automotive industries creates a surge in demand for these environmentally friendly lubricants. Furthermore, stricter U.S. government regulations requiring a minimum renewable content in various products incentivize the use of bio-based options.

The U.S. Air Force's strategic shift towards plant-derived, biodegradable products as a cornerstone of national security adds another layer of support to the market's growth. Moreover, North America boasts a unique advantage: an abundance of soybean and rapeseed feedstock, which helps the region's high biodiesel production. This ready availability of raw materials positions North America as a leading market for explosive growth in the bio-based lubricant sector.

Need any customization research on Biolubricants Market - Enquiry Now

Asia Pacific Biolubricants Market Insights

Asia held the second largest market share in the biolubricant market. China's wind power industry is experiencing explosive growth, exemplified by the colossal Gansu wind farm project targeting a staggering 20 gigawatts (GW) by 2020. This ambitious target aligns perfectly with China's national goal of reaching 250 GW of wind power capacity. This rapid expansion has a significant downstream impact, fueling a surging demand for bio-lubricants.

Europe Biolubricants Market Insights

Europe will continue to lead biolubricants market through 2024 on account of stringent environmental laws, the European Green Deal, and robust demand from automotive, marine, and industrial applications. Germany, France, and the Nordic countries are leading the charge, encouraging the shift from traditional lubricants to bio-based versions as part of their commitments to sustainability and in the pursuit of emission reduction targets. Sustained R&D, development of advanced performance formulations, and the existence of major players make Europe dominant in the world biolubricants market.

LATAM (Latin America) and MEA (Middle East and Africa) Biolubricants Market Insights

Driven by the growing industrialization and farming sector, as well as the emerging industrial and vigorous adoption rate for bio-based products, the LATAM & MEA biolubricants are growing at a moderate pace in 2024. In Latin America, Brazil and Mexico are driving adoption, especially in automotive and agricultural equipment for bio-lubricants durability and low impact on the environment. At the same time, in MEA, Saudi Arabia, the UAE, and South Africa are developing markets due to government efforts to diversify away from oil and increasing awareness of sustainability playing a role in driving uptake. Still in the very early stages relative to Europe, LATAM and MEA combined provide a healthy growth market for biolubricants as industrial growth continues and environmental legislation is drawn up and enforced, which no longer allows certain categories of lubricants to be used, and this will be the biolubricants' time to shine.

Competitive Landscape for Biolubricants Market

Exxon Mobil Corporation

Exxon Mobil is a global leader in energy and chemical production, with a growing focus on meeting industrial lubricant demand in emerging economies.

- In April 2023, Exxon Mobil invested approximately USD 110 million in a lubricant production facility in India. The expansion, completed at the end of 2025, is designed to serve the rising domestic demand from sectors such as power, mining, steel, construction, and others.

Shell plc

Shell is among the world’s largest integrated oil and gas companies, actively transitioning toward sustainable energy solutions.

- In November 2022, Shell enhanced its eco-friendly product portfolio by acquiring the Panolin Group’s environmentally considerate lubricants (ECLs) business. This move, implemented through subsidiaries in Switzerland, the United Kingdom, the United States, and Sweden, introduced a range of biodegradable lubricants to address the increasing demand for sustainable solutions.

BP p.l.c.

BP is a global energy company, advancing its portfolio toward renewable energy and low-carbon technologies.

-

In February 2022, BP acquired Green Biofuels Ltd., strengthening its position in clean energy. This acquisition supports decarbonization in industries such as construction, freight, off-road operations, and maritime transport, leveraging renewable hydrogenated vegetable oil (HVO) fuels as a sustainable alternative to conventional diesel.

Biolubricants Market Key Players

-

Exxon Mobil Corporation

-

Castrol Limited (BP p.l.c.)

-

Chevron Corporation

-

FUCHS SE

-

TotalEnergies SE

-

Shell plc

-

PETRONAS Lubricants International

-

Emery Oleochemicals

-

Renewable Lubricants, Inc.

-

Panolin AG

-

Croda International Plc

-

Green Earth Technologies, Inc.

-

Binol Biolubricants

-

BP p.l.c. (Castrol brand included)

-

BioBlend Renewable Resources, LLC

-

Condat S.A.

-

Rowe Mineralölwerk GmbH

-

Quaker Houghton

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.72 Billion |

| Market Size by 2032 | USD 4.14 Billion |

| CAGR | CAGR of 5.35 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Vegetable Oil, Animal fat, and Others) •By Application (Transport, Industrial) •By End-use (Industrial, Commercial Transport, Consumer Automobile) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Exxon Mobil Corporation, CASTROL LIMITED, Kluber Lubrication, Chevron Corporation, FUCHS, Total Energies, Shell plc, PETRONAS Lubricants International, Emery Oleochemicals, Albemarle Corporation, and Others. |