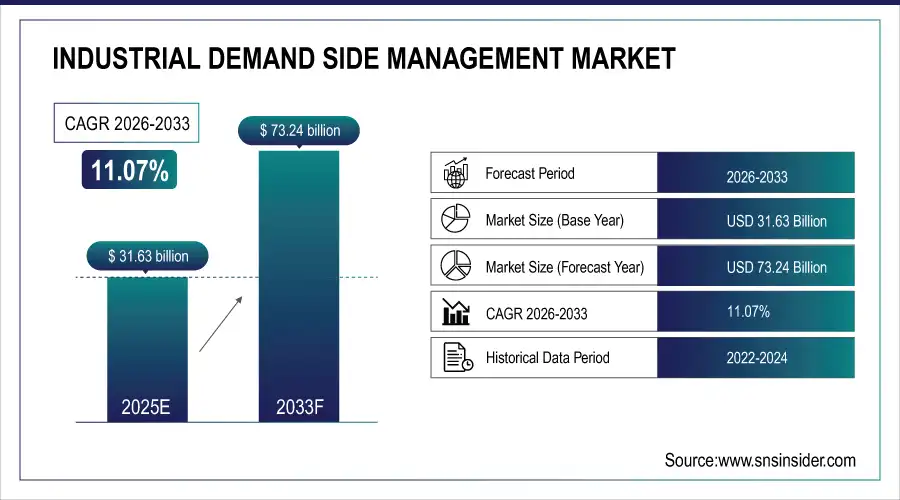

Industrial Demand Side Management Market Size Analysis:

The Industrial Demand Side Management Market Size was valued at USD 31.63 billion in 2025E and is expected to reach USD 73.24 billion by 2033, growing at a CAGR of 11.07% over the forecast period of 2026-2033.

The Industrial Demand Side Management Market is witnessing significant growth, driven by the rising need for energy optimization and cost reduction across industries. Increasing integration of smart grids, IoT-based monitoring, and automated demand response programs is enhancing efficiency. The market supports grid stability, peak load management, and sustainability in industrial operations.

Market Size and Growth Projection:

-

Industrial Demand Side Management Market Size in 2025E: USD 31.63 Billion

-

Industrial Demand Side Management Market Size by 2033: USD 73.24 Billion

-

CAGR: 11.07% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

o Get more information On Industrial Demand Side Management Market - Request Free Sample Report

Key Industrial Demand Side Management Market Trends

-

Growing adoption of automated demand response (ADR) solutions for real-time energy control and optimization.

-

Rising integration of IoT, AI, and cloud-based platforms to enhance data analytics and predictive load management.

-

Increasing focus on energy efficiency programs and sustainable industrial operations.

-

Expansion of smart grid infrastructure supporting dynamic energy pricing and flexible load balancing.

-

Growing collaboration between utilities and industrial consumers for peak load reduction and incentive-based participation.

-

Emergence of energy management systems (EMS) for centralized monitoring and control of industrial power usage.

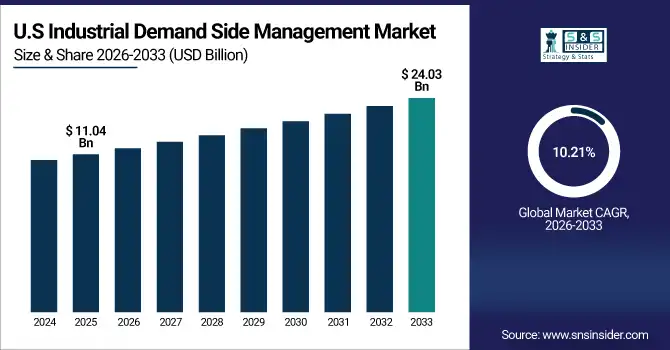

U.S. Industrial Demand Side Management Market Size Outlook

The U.S. Industrial Demand Side Management Market size was USD 11.04 billion in 2025 and is expected to reach USD 24.03 billion by 2033 growing at a CAGR of 10.21% over the forecast period of 2026-2033. The growing industrialization and surging electricity demand are driving the adoption of smart grid technologies and automated demand response programs. As industries aim to reduce peak load pressure and operational costs, the implementation of IoT-enabled monitoring systems and advanced energy management solutions is accelerating nationwide.

Industrial Demand Side Management Market Growth Driver

-

Growing Integration of Smart Grids and IoT Solutions Accelerates Industrial Demand Side Management Market Growth

Increased industrial energy demand and the push for efficiency have fueled the integration of smart grid systems and IoT-based technologies. According to a development announced in May 2024, Siemens AG launched an AI-driven industrial energy management platform enabling predictive load control and real-time data optimization. This advancement allows industries to participate in automated demand response (ADR) programs, reducing operational costs and minimizing grid stress. The rise in energy digitization is transforming traditional management systems into smart, interconnected networks that enable flexible load balancing, optimized energy usage, and improved grid reliability. Moreover, the growing adoption of data analytics and machine learning algorithms supports better forecasting and decision-making, ensuring more sustainable industrial operations. As industrial facilities increasingly seek to lower carbon emissions, these smart solutions play a crucial role in driving adoption across manufacturing, utilities, and heavy industries.

For instance, ABB Ltd collaborated with an energy technology startup in August 2024 to implement an IoT-powered load management system in European manufacturing plants. This collaboration reduced peak energy costs by nearly 15%, demonstrating how smart grid and IoT integration directly enhance industrial efficiency and profitability.

Industrial Demand Side Management Market Restraint

-

High Implementation and Integration Costs Restrict Industrial Demand Side Management Market Expansion

Despite rising awareness, the high cost of implementation and integration of demand-side management systems remains a significant barrier. Establishing automated demand response programs and smart metering infrastructure requires substantial upfront investment, particularly in developing economies. According to industry findings, many mid-sized manufacturers struggle to justify the cost of hardware, software integration, and skilled workforce training required for full-scale adoption. These expenses often delay decision-making and limit deployment to large enterprises. Additionally, interoperability challenges between legacy systems and modern technologies increase overall complexity. Without adequate financial incentives or government support, the return on investment (ROI) period remains lengthy, discouraging smaller players from adopting such solutions. This cost-related restraint slows market penetration, especially across cost-sensitive industries like textiles, automotive, and small-scale manufacturing units.

For example, in January 2025, several SMEs in Southeast Asia postponed their participation in regional energy demand response programs due to high initial setup costs and technical skill shortages. This highlights how economic constraints and lack of standardization limit broader market adoption.

Industrial Demand Side Management Market Opportunity

-

Growing Shift Toward Renewable Energy Integration Creates Lucrative Opportunity in Industrial Demand Side Management Market

The global transition toward renewable energy sources has opened vast opportunities for industrial demand-side management solutions. As renewable power generation becomes more widespread, the need for flexible load balancing and energy optimization grows stronger. In June 2024, Schneider Electric SE introduced an integrated renewable demand response solution combining solar, wind, and battery storage systems with smart analytics. This innovation enables industries to dynamically manage power consumption based on renewable availability, supporting grid stability while reducing dependency on fossil fuels. The increasing alignment of DSM programs with clean energy initiatives promotes grid resilience, peak load reduction, and enhanced cost savings. Moreover, supportive government policies encouraging industrial decarbonization further boost the adoption of intelligent demand management technologies across high-energy sectors.

For instance, in September 2024, Enel X partnered with a leading steel manufacturer to deploy a renewable-powered DSM system using real-time data analytics. The project successfully offset grid pressure during peak hours and improved renewable utilization by 18%, showcasing the vast opportunity in green energy integration.

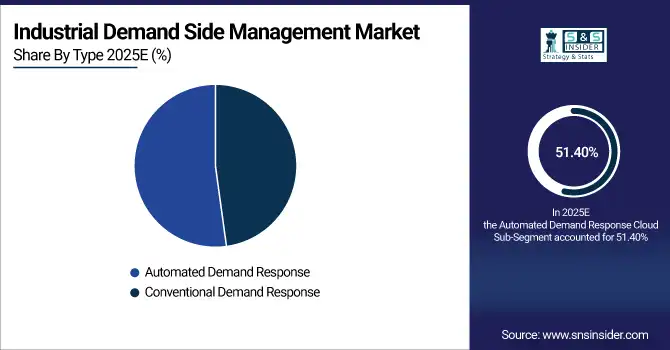

Industrial Demand Side Management Market Segment Highlights:

-

By Type: Conventional Demand Response – 48.60%, Automated Demand Response – 51.40% (largest)

-

By Service: Demand Response – 40% (largest), Energy Efficiency – 35%, Load Management – 25%

-

By Technology: AMI Meters – 30%, Smart Thermostats – 32%, Energy Management Systems (EMS) – 38% (largest)

By Type

The Automated Demand Response (ADR) segment dominates the market with a 51.40% share, driven by its ability to enable real-time energy optimization and load management without manual intervention. ADR systems leverage IoT, sensors, and AI analytics to automate peak demand control, improving efficiency and grid reliability. The Conventional Demand Response segment, holding 48.60%, continues to serve industries with limited digital infrastructure but is gradually transitioning toward automation as technology costs decline and grid modernization efforts expand globally.

By Service

The Demand Response segment leads the market with a 40% share, fueled by growing participation of industrial consumers in utility-led programs aimed at peak load reduction and grid stability. Energy Efficiency services, accounting for 35%, are gaining traction as industries aim to lower operational costs and carbon emissions through smart energy audits and optimization. The Load Management segment, holding 25%, is expanding steadily due to the integration of intelligent control systems that help balance energy consumption patterns in energy-intensive sectors such as manufacturing and mining.

By Technology

The Energy Management Systems (EMS) segment holds the largest market share of 38%, driven by rising adoption of centralized control platforms that monitor, analyze, and optimize industrial power consumption. Smart Thermostats, with a 32% share, are increasingly used for precise temperature control and energy savings in manufacturing environments. Meanwhile, AMI Meters, at 30%, continue to play a key role in enabling real-time energy monitoring and dynamic pricing strategies, supporting grid modernization and data-driven decision-making across industrial facilities.

Industrial Demand Side Management Market Regional Analysis

North America Industrial Demand Side Management Market Insights

North America dominates the Industrial Demand Side Management Market with a 45.00% share in 2025, driven by advanced grid infrastructure, favorable energy regulations, and strong utility participation in demand response programs. The U.S. leads the region with widespread deployment of smart meters, automated demand response (ADR) platforms, and industrial energy management systems. The region’s focus on decarbonization, peak load reduction, and renewable integration supports continuous adoption across manufacturing, utilities, and commercial sectors. Strategic partnerships between technology providers, government incentives, and utility-based DSM programs enhance operational efficiency and cost savings, making North America a key innovation hub in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Industrial Demand Side Management Market Insights

Europe accounts for 22.00% of the Industrial Demand Side Management Market in 2025, supported by stringent energy efficiency policies, carbon neutrality goals, and investments in digital grid modernization. Countries such as Germany, France, and the U.K. are leading adopters, focusing on smart grid integration and industrial automation. EU-led initiatives promoting clean energy transitions, coupled with regulatory incentives for demand response participation, drive regional growth. Growing collaborations between utilities and industrial consumers further accelerate the adoption of intelligent load management systems, supporting Europe’s ambition to achieve net-zero energy targets by 2050.

Asia-Pacific Industrial Demand Side Management Market Insights

Asia-Pacific holds a 20.00% share in 2025 and is the fastest-growing region, driven by rapid industrialization, energy demand surges, and government-backed smart grid projects. Major contributors include China, India, Japan, and Australia, where policy frameworks emphasize energy conservation and digital transformation. Public-private partnerships for grid modernization, deployment of AMI meters, and expansion of renewable energy sources strengthen regional growth. Increasing awareness among industrial consumers, coupled with incentives for peak load management and real-time monitoring, is propelling the widespread adoption of DSM technologies across the region.

Latin America and Middle East & Africa (MEA) Industrial Demand Side Management Market Insights

Latin America holds 5.00% and MEA accounts for 8.00% of the Industrial Demand Side Management Market in 2025, emerging as high-potential regions. Brazil, Mexico, UAE, and Saudi Arabia are key contributors, investing heavily in grid modernization, demand response programs, and industrial automation. Government initiatives promoting energy diversification and public-private partnerships are fostering regional adoption. Expansion of industrial infrastructure, rising awareness about energy efficiency, and integration of IoT-based monitoring solutions are enabling faster uptake of DSM technologies. As renewable energy investments rise, both regions are poised to experience steady market expansion over the forecast period.

Competitive Landscape for Industrial Demand Side Management Market:

Honeywell International Inc.

Honeywell International Inc. is a global technology and manufacturing company, providing energy-efficient solutions and automation systems for various industries.

-

In May 2024, Honeywell partnered with Enel North America to enhance building automation and demand response solutions for commercial and industrial organizations. This collaboration aims to stabilize power grids and increase operational efficiency by automating energy load management within facilities.

Enel X

Enel X is a global leader in advanced energy services, offering demand response and energy management solutions to optimize energy consumption and enhance grid stability.

-

In May 2024, Enel North America partnered with Honeywell to provide a turnkey building automation offering, enabling organizations to participate in demand response programs. This collaboration supports energy flexibility and grid stability through automated energy load management.

ABB Ltd.

ABB Ltd. is a multinational corporation specializing in electrification, automation, and digitalization technologies, including solutions for energy management and demand response.

-

In December 2024 ABB announced the acquisition of the power electronics business of Gamesa Electric from Siemens Gamesa. This acquisition strengthens ABB's position in the renewable power conversion technology market and enhances its offerings for demand-side management applications.

Industrial Demand Side Management Companies are:

-

Schneider Electric SE

-

Siemens AG

-

Honeywell International Inc.

-

ABB Ltd

-

Eaton Corporation PLC

-

General Electric Company (GE)

-

IBM Corporation

-

Johnson Controls International PLC

-

Rockwell Automation, Inc.

-

AutoGrid Systems Inc.

-

Itron Inc.

-

Enel X

-

EnerNOC Inc.

-

GridPoint

-

SkyFoundry

-

Telkonet, Inc.

-

Dexma Sensors SL

-

eSight Energy

-

Optimum Energy LLC

-

Emerson Electric Co.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 31.63 Billion |

| Market Size by 2033 | USD 73.24 Billion |

| CAGR | CAGR of11.07% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type: (Conventional Demand Response, Automated Demand Response) • By Service: (Demand Response, Energy Efficiency, Load Management) • By Technology: (AMI Meters, Smart Thermostats, Energy Management Systems (EMS)) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Schneider Electric SE, Siemens AG, Honeywell International Inc., ABB Ltd, Eaton Corporation PLC, General Electric Company (GE), IBM Corporation, Johnson Controls International PLC, Rockwell Automation, Inc., AutoGrid Systems Inc., Itron Inc., Enel X, EnerNOC Inc., GridPoint, SkyFoundry, Telkonet, Inc., Dexma Sensors SL, eSight Energy, Optimum Energy LLC, Emerson Electric Co. |