Industrial Gearbox Market Report Scope & Overview:

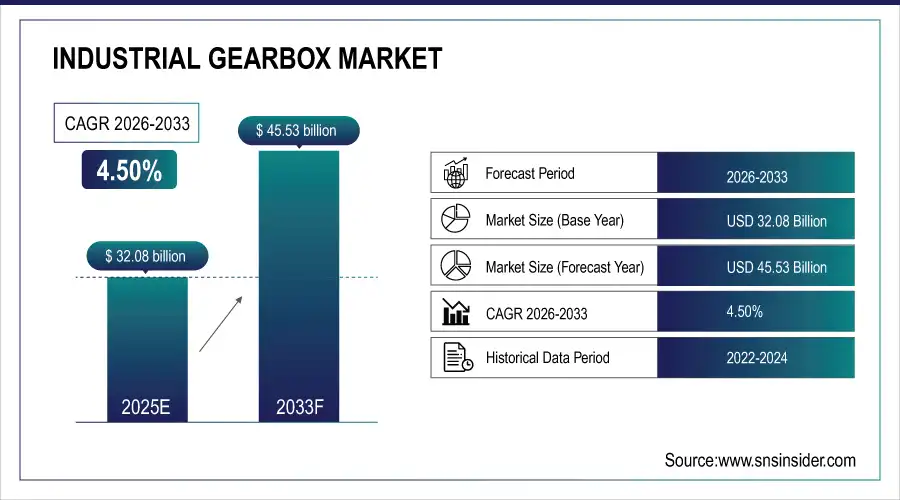

The Industrial Gearbox Market was valued at USD 32.08 Billion in 2025E and is projected to reach USD 45.53 Billion by 2033, growing at a CAGR of 4.50% during the forecast period 2026–2033.

The Industrial Gearbox Market analysis highlights the growing demand for efficient power transmission, driven by rising industrial automation, modernization of manufacturing processes, and expansion in energy, mining, and material handling sectors. These factors are collectively supporting global market growth.

The Industrial Gearbox Market reached 32,000 units in 2025, driven by growing adoption of automation, material handling, and power transmission across manufacturing and mining.

Market Size and Forecast:

-

Market Size in 2025: USD 32.08 Billion

-

Market Size by 2033: USD 45.53 Billion

-

CAGR: 4.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Industrial Gearbox Market - Request Free Sample Report

Industrial Gearbox Market Trends:

-

Growing industrial automation and smart manufacturing initiatives are driving the demand for high-efficiency gearboxes across manufacturing, energy, and material handling sectors.

-

Advances in gear design, precision machining, and lubrication technologies are improving gearbox durability, energy efficiency, and load-handling capabilities.

-

Rising adoption of renewable energy and electric vehicles is fueling the need for specialized gearboxes in power generation and automotive applications.

-

Industry 4.0 integration and predictive maintenance using IoT sensors are enabling real-time monitoring, reducing downtime, and extending gearbox lifecycle.

-

Increasing investments in mining, construction, and infrastructure projects are broadening market opportunities, particularly for heavy-duty and high-power industrial gearboxes.

U.S. Industrial Gearbox Market Insights:

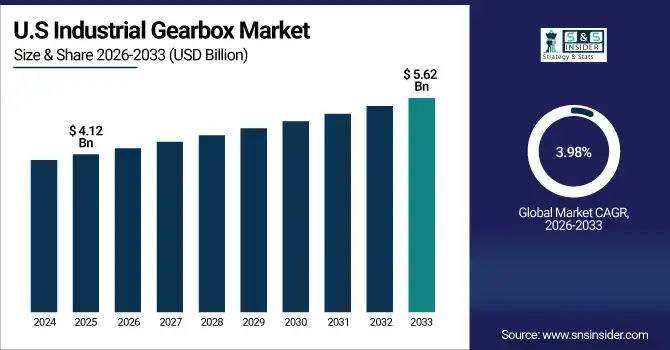

The U.S. Industrial Gearbox Market is projected to grow from USD 4.12 Billion in 2025E to USD 5.62 Billion by 2033 at a CAGR of 3.98%. Growth is driven by manufacturing automation, material handling, and energy sector modernization, supported by adoption of high-efficiency gear systems and industrial IoT solutions.

Industrial Gearbox Market Growth Drivers:

-

Booming smart manufacturing and automation trends are turbocharging demand for high-performance, energy-efficient industrial gearboxes.

Rising adoption of smart manufacturing and industrial automation is accelerating demand for high-performance gearboxes, boosting Industrial Gearbox Market growth. By 2025, over 32,000 industrial gearboxes were deployed globally across manufacturing, mining, and energy sectors. Countries such as China, Germany, and the U.S. are investing heavily in automated production lines and renewable energy projects, integrating advanced gear systems and IoT-enabled monitoring. These initiatives boost efficiency, reduce downtime, and expand opportunities for innovative gearbox technologies.

Industrial gearbox shipments exceeded 28,500 units in 2025, fueled by rising automation in manufacturing, energy, and mining sectors.

Industrial Gearbox Market Restraints:

-

High manufacturing costs and complex installation requirements are restricting widespread adoption of advanced industrial gearboxes.

High manufacturing costs and complex installation requirements are key factors limiting Industrial Gearbox market growth. In 2025, 35% of small-to-medium manufacturing units could not adopt advanced gearboxes due to budget and technical constraints. Smaller plants often lack skilled technicians and infrastructure to install high-power or precision gear systems. Additionally, long lead times for customized gearboxes, high maintenance costs, and supply chain bottlenecks restrict widespread adoption despite increasing demand from automation and renewable energy projects.

Industrial Gearbox Market Opportunities:

-

Adoption of IoT and predictive maintenance in industrial gearboxes offers significant efficiency and lifecycle optimization opportunities.

Integration of IoT and predictive maintenance technologies is driving the Industrial Gearbox sector. By 2025, over 12,000 gearboxes were equipped with smart sensors for real-time monitoring, with projections of 35,000+ units by 2033. Manufacturing plants, mining operations, and energy facilities are increasingly using these systems to optimize performance, reduce downtime, and extend equipment lifespan. Enhanced data analytics and remote monitoring are making gearbox operations more efficient, reliable, and cost-effective.

IoT-enabled and sensor-equipped industrial gearboxes accounted for 18% of new deployments in 2025, driven by smart factories, energy, and mining sectors.

Industrial Gearbox Market Segmentation Analysis:

-

By Type, Helical Gearbox held the largest market share of 38.42% in 2025, while Planetary Gearbox is expected to grow at the fastest CAGR of 7.56%.

-

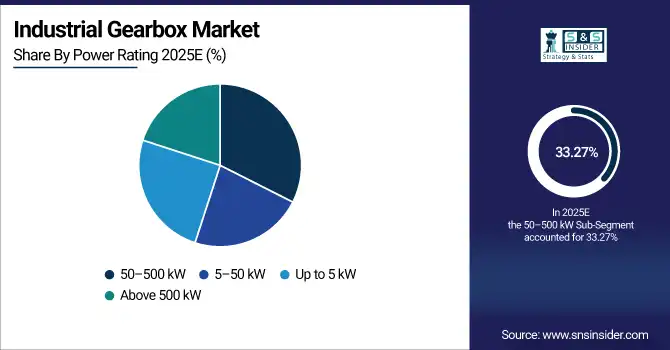

By Power Rating, the 50–500 kW segment dominated with a 33.27% share in 2025, while Above 500 kW is projected to expand at the fastest CAGR of 6.89%.

-

By Application, Material Handling accounted for the highest market share of 29.64% in 2025, and Power Generation is projected to record the fastest CAGR of 8.12%.

-

By End User, the Manufacturing Sector held the largest share of 41.73% in 2025, while Energy & Utilities are expected to grow at the fastest CAGR of 7.94%.

By Type, Helical Gearbox Dominates While Planetary Gearbox Expands Rapidly:

The Helical Gearbox segment dominated the market due to its suitability for manufacturing lines, conveyors, and heavy machinery requiring smooth torque transmission and low noise, with 12,400 units deployed in 2025. Its dominance is supported by durability, energy efficiency, and widespread applicability in conventional industries. Meanwhile, the Planetary Gearbox segment is the fastest growing in the market, with around 5,100 units deployed. Growth is driven by robotics, precision machinery, and compact automation systems where high torque density, lightweight design, and performance reliability are essential.

By Power Rating, 50–500 kW Segment Dominates While Above 500 kW Expands Rapidly:

he 50–500 kW segment dominated the market due to its suitability for mid-scale industrial, automotive, and production environments requiring consistent torque and speed control, with about 10,600 installations in 2025. Its dominance is due to versatility and ease of integration in conveyors, mixers, and crushers. The Above 500 kW segment is the fastest-growing in the market, with 3,800 units deployed, fueled by large-scale wind farms, mining equipment, and power plants that demand robust, high-capacity gear systems capable of handling extreme loads efficiently.

By Application, Material Handling Dominates While Power Generation Expands Rapidly:

The Material Handling segment dominated the market due to automation in logistics, warehouses, and production lines, ensuring uninterrupted operation of conveyors, cranes, and hoists, with 9,500 gearboxes deployed in 2025. Its widespread adoption reflects consistent industrial demand and low maintenance requirements. In contrast, Power Generation segment is the fastest-growing in the market, with around 4,100 units deployed. This growth is powered by renewable energy expansion, including wind turbines and hydro plants, where efficient torque conversion and long-term reliability are essential.

By End User, Manufacturing Sector Dominates While Energy & Utilities Expand Rapidly:

he Manufacturing segment dominated the market due to modernization of production lines, industrial robots, and automated assembly systems, with 13,400 units in 2025. Its dominance is reinforced by ongoing industrial automation projects in Asia Pacific and Europe. The Energy & Utilities segment is the fastest growing in the market with around 6,200 gearboxes deployed, driven by renewable energy projects, grid modernization, and power plant upgrades. High-capacity, durable gear systems are critical for ensuring continuous operations in these energy-intensive applications.

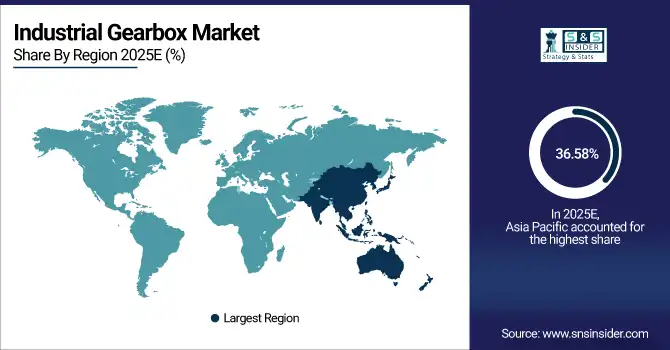

Industrial Gearbox Market Regional Analysis:

Asia-Pacific Industrial Gearbox Market Insights:

Asia Pacific dominates the Industrial Gearbox Market with a 36.58% share in 2025, driven by rapid industrialization, manufacturing modernization, and automation adoption. China deployed over 11,000 gearboxes across automotive, material handling, and energy sectors, while India accounted for nearly 4,500 units. Growth is supported by infrastructure expansion, smart factory implementation, and renewable energy projects, making the region a critical hub for high-performance and efficient industrial gearbox technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Industrial Gearbox Market Insights:

China’s industrial gearbox market growth is driven by government industrial modernization programs, automation adoption, smart factory implementations, renewable energy projects, and infrastructure expansion, deploying more than 7,200 units in 2025, including over 4,500 in manufacturing and nearly 2,700 in energy and material handling sectors.

North America Industrial Gearbox Market Insights:

North America is a key market for Industrial Gearboxes in 2025, with over 6,500 units deployed across manufacturing, material handling, and energy sectors. The U.S. contributed more than 4,200 units, and Canada around 2,300 units. Steady growth is supported by automation in factories, renewable energy projects, and modernization of industrial infrastructure. Increasing adoption of high-efficiency gear systems and predictive maintenance solutions is driving market expansion and technological advancement.

U.S. Industrial Gearbox Market Insights:

The U.S. industrial gearbox market growth is driven by industrial automation, smart factory integration, renewable energy projects, and predictive maintenance adoption, with over 4,200 units deployed in 2025, including 2,500 in manufacturing and 1,700 in material handling and energy sectors.

Europe Industrial Gearbox Market Insights:

Europe’s industrial gearbox market growth is driven by manufacturing modernization, automation adoption, and infrastructure projects, deploying over 7,200 units in 2025, including 2,900 in Germany, 1,800 in France, and 1,400 in Italy, primarily in manufacturing, followed by material handling and energy sectors. Growth is driven by industrial automation, renewable energy integration, infrastructure modernization, and smart factory initiatives, supported by government industrial policies, adoption of high-efficiency gear systems, and technological upgrades across key regional markets.

Germany Industrial Gearbox Market Insights:

Germany’s industrial gearbox market growth is driven by industrial automation, smart factory adoption, renewable energy projects, and infrastructure modernization, supported by government industrial initiatives and technological upgrades, deploying over 2,900 units in 2025, including 1,600 in manufacturing and 900 in material handling and energy sectors, with Helical gearboxes dominating the market.

Middle East and Africa Industrial Gearbox Market Insights:

The Middle East & Africa industrial gearbox market, the fastest-growing with a CAGR of 6.70%, is driven by infrastructure expansion, mining and oil & gas projects, and adoption of high-efficiency and smart gear systems, deploying over 1,400 units in 2025, including 400 in UAE and 300 in South Africa, primarily in manufacturing, energy, and material handling sectors.

Latin America Industrial Gearbox Market Insights:

Latin America’s industrial gearbox market growth is driven by industrial automation, infrastructure expansion, smart factory initiatives, and renewable energy projects, deploying approximately 2,100 units in 2025, including 52% in Brazil, 30% in Argentina, and 18% in Colombia, with manufacturing and material handling dominating installations and energy sector adoption rising rapidly.

Industrial Gearbox Market Competitive Landscape:

Siemens AG, an industrial automation leader, dominates the industrial gearbox market with over 150,000 units deployed across manufacturing, energy, and transportation sectors. Its gear units, including helical, bevel, and planetary types, undergo rigorous load and quality testing. Siemens’ strong R&D, innovative product portfolio, partnerships, and focus on efficiency and reliability have solidified its market leadership, making it a preferred choice for industrial applications.

-

In March 2025, Siemens AG introduced the SIMOGEAR Generation X.e series, a next-generation industrial gearbox platform. This series offers 23 sizes with torque ranges from 6.8 to 475 kNm, featuring modular designs, single/split housing options, and enhanced performance capabilities.

SEW-Eurodrive is a key player in the industrial gearbox market, delivering over 120,000 gear units to automotive, logistics, food processing, and material handling industries. Known for innovation, modular design, and custom solutions, the company emphasizes energy efficiency and operational reliability. Its service network, strong customer relationships, and continuous technological advancements have established SEW-Eurodrive as a dominant and trusted industrial gearbox provider.

-

In August 2025, SEW-Eurodrive launched external oil cooling and supply systems for heavy industry gearing. These systems are engineered to support high-torque gearboxes, addressing thermal limitations that often determine gearbox size.

Flender GmbH specializes in high-performance mechanical drive systems, deploying over 95,000 gear units across cement, mining, energy, and power generation industries. Its product range includes bevel, helical, and planetary gearboxes designed for durability and precision. Flender’s technological expertise, customer-focused solutions, and robust service network drive its market dominance, making it a preferred provider of industrial gear solutions across critical heavy industries globally.

-

In July 2024, Flender GmbH introduced the FLENDER ONE gearbox platform, featuring single- and multi-stage solutions with integrated AIQ Core sensors for digital monitoring and smart analysis, providing efficient, flexible, and intelligent industrial drive solutions.

Industrial Gearbox Market Key Players:

Some of the Industrial Gearbox Market Companies are:

-

Siemens AG

-

SEW-Eurodrive GmbH & Co. KG

-

Flender GmbH

-

Bonfiglioli Riduttori S.p.A.

-

NORD Drivesystems GmbH & Co. KG

-

Sumitomo Heavy Industries, Ltd.

-

ABB Ltd.

-

Schaeffler Group

-

Rexnord Corporation

-

Watt Drive Antriebstechnik GmbH

-

Bauer Gear Motor GmbH

-

Renold plc

-

David Brown Santasalo

-

Elecon Engineering Company Limited

-

Hyosung Heavy Industries Corporation

-

Johnson Electric Holdings Limited

-

Kumera Corporation

-

Parsons Peebles Ltd

-

GearTec

-

PG Drive

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 32.08 Billion |

| Market Size by 2033 | USD 45.53 Billion |

| CAGR | CAGR of 4.50% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Helical, Bevel, Worm, Planetary, Others) • By Power Rating (Up to 5 kW, 5–50 kW, 50–500 kW, Above 500 kW) • By Application (Material Handling, Automotive, Power Generation, Mining & Construction, Others) • By End User (Manufacturing, Automotive, Energy & Utilities, Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Siemens AG, SEW-Eurodrive GmbH & Co. KG, Flender GmbH, Bonfiglioli Riduttori S.p.A., NORD Drivesystems GmbH & Co. KG, Sumitomo Heavy Industries, Ltd., ABB Ltd., Schaeffler Group, Rexnord Corporation, Watt Drive Antriebstechnik GmbH, Bauer Gear Motor GmbH, Renold plc, David Brown Santasalo, Elecon Engineering Company Limited, Hyosung Heavy Industries Corporation, Johnson Electric Holdings Limited, Kumera Corporation, Parsons Peebles Ltd, GearTec, PG Drive |