Industrial Valves Market Report Scope & Overview:

To get more information on Industrial Valves Market - Request Sample Report

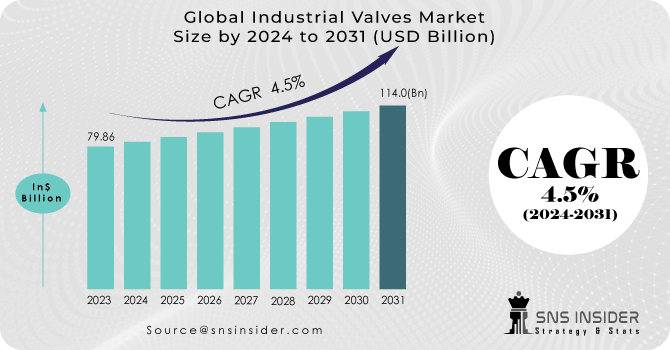

The Industrial Valves Market Size was estimated at USD 83.55 billion in 2023 and is expected to arrive at USD 125.68 billion by 2032 with a growing CAGR of 4.64% over the forecast period 2024-2032. This report on the Industrial Valves Market provides unique insights into the adoption of advanced valve technologies, focusing on regional trends and regulatory influences shaping market dynamics. It explores key technological advancements, such as the integration of smart control systems and automation in valve operations. The report also highlights changing demand patterns across industries like oil & gas, water treatment, and power generation. Additionally, it offers a comprehensive view of global trade movements and emerging trends in valve applications across various sectors.

MARKET DYNAMICS

DRIVERS

-

The industrial valves market is growing due to rising oil & gas exploration, automation, and stringent safety regulations.

The industrial valves market is witnessing significant growth, driven by the expanding oil & gas sector. With exploration and production activities on the rise, especially in offshore and shale gas fields, the demand for high-performance valves to control flow, pressure, and safety for critical and complex pipeline infrastructure continues to increase. Growth in the refining and petrochemical infrastructure investment market is also accelerating, amid an increase in global energy consumption. Smart valve installation with real-time monitoring to enhance operational efficiency and minimize downtime is boosted by the trend toward digitalization and automation in oil & gas operations. Strict safety and environmental regulations are increasingly attracting the need for the latest control valves with low emissions and leakage.

RESTRAINT

-

Industrial valves require high upfront costs for procurement and installation, along with ongoing expenses for maintenance and repairs to ensure optimal performance.

Industrial valves demand a high initial investment due to their complex design, precision engineering, and the use of high-quality materials like stainless steel, brass, and alloy-based components. Reduces Capital Cost Automated and smart valves and other advanced valve technologies also add costs to the valve due to integrated sensors and control systems. Beyond that, periodic maintenance is critical to optimized performance, leakage prevention, and meeting industry safety regulations. Routine inspections, part replacements, and system upgrades increase operational costs. In industries such as oil & gas, power generation, and chemicals, the cost of downtime and repairs caused by valve failure operating under adverse conditions can be huge. Besides, maintenance demands specialized labor and skilled technicians that contribute to long-term costs. Though high-quality valves provide long-term durability and efficiency, the high initial and ongoing costs incur a restraint, especially for small and medium enterprises, hence limiting the universal utilization by necessitating the planning of their budget around strategic direction.

OPPORTUNITIES

-

The adoption of smart valves and IoT integration enhances operational efficiency, predictive maintenance, and real-time monitoring, driving growth in the industrial valves market.

The adoption of smart valves and IoT integration is a key growth driver in the industrial valves market, fueled by the rise of Industry 4.0 and digital transformation. Smart valves come with integrated sensors and communication capabilities, enabling them to deliver real-time analytics and data to operators. This allows for more effective monitoring, controlling, and prediction of maintenance, minimizing downtime, and maximizing performance. The Internet of Things (IoT) has revolutionized how we interact with smart devices, and smart valves are no exception; by integrating with IoT technology, these valves can work alongside other devices and systems to create a connected network that promotes automation and allows operators to make more informed decisions. This trend stems from the growing need for energy effectiveness, lower functional expenses, and enhanced resource management in sectors such as oil & gas, water treatment, and power generation. Smart valves are likely to witness considerable market growth due to the increased adoption of digital technologies across industries, providing better control and data-driven decisions.

CHALLENGES

-

Supply chain disruptions, driven by geopolitical tensions, trade restrictions, and material shortages, lead to delays, increased costs, and operational challenges in industrial valve production and distribution.

Supply chain disruptions have become a significant challenge for the industrial valves market, primarily driven by geopolitical tensions, trade restrictions, and material shortages. Geopolitical factors like trade wars and sanctions or conflicts delay or increase the cost of procurement of raw materials and components that affect manufacturing schedules. Disruptions in key supplier countries can threaten the supply of critical materials, including steel and alloy, both vital in valve production, for example. Trade restrictions also complicate things, with international shipments experiencing higher tariffs or being stopped entirely. This has led to varying availability of products which open companies to both competitive disadvantages and customer dissatisfaction. Consequently, manufacturers have had to implement alternative sourcing strategies, and these can substantially drive up a business' overall operating costs.

SEGMENTATION ANALYSIS

By Type

The Ball Valves segment dominated with a market share of over 32% in 2023, due to their versatility and wide adoption across key industries, including oil and gas, water treatment, and chemical processing. They are appreciated for their durability and reliability, as well as for their sealing performance in harsh environments. They are especially well suited to high-pressure applications and high-flow systems, where they provide smooth, efficient control of the flow of liquid or gas. They are beneficial due to their ability to resist extreme pressures and temperatures, and their simple design makes them a popular option for a range of industrial purposes. With every passing year as the world becomes industrialized further, the need for excellent flow control systems in these industries gains momentum and ball valves remain ever popular.

By Material

The Steel valves segment dominated with a market share of over 34% in 2023, due to their exceptional durability, strength, and versatility. Steel valves are made to resist high-pressure, high-temperature, and severe working environment, so they are an ideal selection for industries including oil & gas, chemical, power, and water treatment. They are widely used because they provide consistent performance in critical applications where safety and efficiency are of utmost importance. Steel valves are also mostly used due to their long service life, are cost-effective in the long run, and can handle a variety of media from liquids to gases. Due to these characteristics, steel valves are often chosen in various industries that need strong and durable valve solutions.

By End-User

The Oil & Gas segment dominated with a market share of over 32% in 2023, due to the critical role valves play in exploration, production, and transportation processes. Upstream valves control the flow of oil and gas at every stage in transmission and storage, especially at sites in, out, and throughout a pipeline, refinery, or other facility. Valves are devices that regulate the pressure and flow of materials by safely opening or closing the pipeline in the oil & gas industries preventing leaks and accidents in exploration. They regulate the flow of raw materials and fluids from the reservoir to treatment units during production. Similarly, valves also enable the safe and effective transportation of oil and gas through pipelines. The rising energy demand globally and the complexity of oil and gas operations are driving the ongoing need for industrial valves in this vertical.

To Get Customized Report as per your Business Requirement - Request For Customized Report

KEY REGIONAL ANALYSIS

Asia-Pacific region dominated with a market share of over 36% in 2023, due to its robust industrial growth, particularly in manufacturing, oil and gas, and power generation sectors. The industrial valve market is another dynamic that is taking place in this region, as both urbanization and infrastructure in the region take place at a rapid pace and require industrial valves for controlling fluid flow, pressure, and temperature in industrial processes. China is the factory of the world and India is seeing significant growth in industrial sectors, thus both countries are major contributors. These countries have also grown energy and power industries, which will further increase the demand for industrial valves in pipelines, refineries, and power plants. Furthermore, with growing emphasis on enhancing infrastructure and implementing advanced technology across the region will boost industry demand for high-performance industrial valves, assuring its leading domain.

North America is experiencing rapid growth in the industrial valves market, largely due to continuous technological advancements and increased investments in infrastructure. The growth of oil and gas, water treatment, and chemicals in the region drives the demand for high-quality, reliable industrial valves for their operations. This growth is chiefly driven by investments in energy, utilities, and manufacturing in the U.S. and Canada. Other innovative technologies like smart valves, and automatizations are upgrading the functioning as well as efficiency of industrialized systems thus enhancing the demand of the market. With the modernization and expansion of industries, demand for sophisticated valve solutions is booming, making North America the fastest-growing market in the Valve industry.

Some of the major key players in the Industrial Valves Market

-

Emerson Electric (Control valves, pressure relief valves, flow control valves)

-

Schlumberger (Ball valves, gate valves, choke valves)

-

Flowserve Corporation (Globe valves, check valves, butterfly valves)

-

IMI plc (Pneumatic control valves, motorized valves, actuators)

-

Neles Corporation (Rotary valves, control valves, valve automation solutions)

-

Spirax Sarco Limited (Steam valves, pressure-reducing valves, trap valves)

-

Crane (Pressure relief valves, ball valves, gate valves)

-

Conbraco Industries Inc (Bronze ball valves, brass valves, check valves)

-

Kitz Corporation (Stainless steel valves, gate valves, ball valves)

-

Trillium Flow Technologies (Gate valves, check valves, globe valves)

-

Bray International (Butterfly valves, ball valves, control valves)

-

Emerson Process Management (Pressure relief valves, control valves, isolation valves)

-

Swagelok (Ball valves, check valves, needle valves)

-

Pentair (Ball valves, actuator valves, check valves)

-

Cameron (Schlumberger) (Wellhead valves, ball valves, gate valves)

-

Danfoss (Pressure relief valves, check valves, globe valves)

-

Tyco International (Ball valves, check valves, pressure regulating valves)

-

GE Oil & Gas (Actuated valves, control valves, isolation valves)

-

Honeywell (Pressure relief valves, control valves, pneumatic actuators)

-

Val-Matic Valve & Manufacturing Corporation (Butterfly valves, check valves, air valves)

Suppliers for (ball, gate, plug, needle, butterfly, and globe valves for oil, gas, chemical, power, and utility industries) on Industrial Valves Market

-

Citizen Metals Pvt. Ltd.

-

VIP Valves (India) Pvt. Ltd.

-

Delta Fittings

-

Sahyadri Industrial Traders

-

Ganesh Industries

-

Aira & Cair Valves Automation

-

Soltech Pumps & Equipment Pvt. Ltd.

-

Flowjet Valves Pvt. Ltd.

-

Freture Techno Pvt. Ltd.

-

KSB SE & Co. KGaA

RECENT DEVELOPMENT

In October 2024: Flowserve Corporation acquired MOGAS Industries, a leading manufacturer of severe service isolation valves for diverse end-markets. This acquisition strengthens Flowserve’s severe service portfolio and expands its presence in key growth sectors such as mining, mineral extraction, and process industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 83.55 Billion |

| Market Size by 2032 | USD 125.68 Billion |

| CAGR | CAGR of 4.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ball Valves, Butterfly Valves, Check Valves, Gate Valves, Globe Valves, Diaphragm Valves, Plug Valves, Safety Valves) • By Material (Alloy Based, Bronze, Cast Iron, Brass, Steel, Plastic, Cryogenic, Others) • By End-User (Oil & Gas, Energy & Power, Chemicals, Pulp & Paper, Metals & Mining, Agriculture, Water & Wastewater Treatment, Food & Beverages, Building & Construction, Pharmaceuticals & Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric, Schlumberger, Flowserve Corporation, IMI plc, Neles Corporation, Spirax Sarco Limited, Crane, Conbraco Industries Inc, Kitz Corporation, Trillium Flow Technologies, Bray International, Emerson Process Management, Swagelok, Pentair, Cameron (Schlumberger), Danfoss, Tyco International, GE Oil & Gas, Honeywell, Val-Matic Valve & Manufacturing Corporation. |