Doppler Ultrasound Market Report Scope & Overview:

Get more information on Doppler Ultrasound Market - Request Sample Report

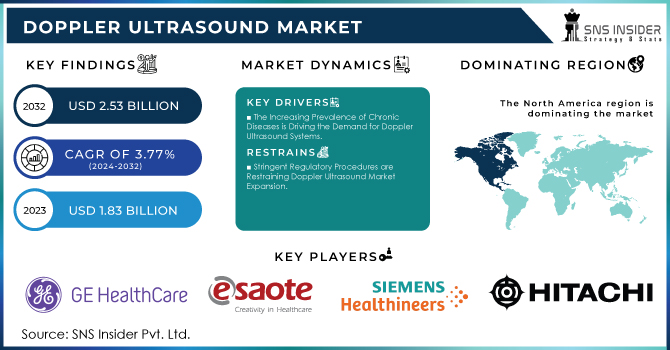

The Doppler Ultrasound Market Size was valued at USD 1.83 Billion in 2023 and is expected to reach USD 2.53 Billion by 2032 and grow at a CAGR of 3.77% Over the Forecast Period of 2024-2032.

The primary drivers for the market include the rising prevalence of chronic diseases coupled with the aging population, growing healthcare spending in developed nations, an increase in healthcare providers, and healthcare spending on diagnosis. The development of advanced Doppler ultrasound diagnostic technologies is another essential element propelling the market growth. Throughout the world, there an ever-increasing incidences of chronic diseases like cancer, and cardiovascular, gastrointestinal, and kidney ailments, that are leading to several deaths. For instance, the American Cancer Society estimated that there would be 106,180 new cases of colon cancer and 44,850 new cases of rectal cancer in the United States in 2023. Moreover, a report published by the American Cancer Society in 2021, also reported that the lifetime risk of developing colorectal cancer was about 1 in 23 for men and 1 in 25 for women.

Doppler ultrasound is one of the essential requirements for the diagnosis of cancer and this steady increase in the number of cases will lead to increased demand for Doppler ultrasound systems. Additionally, many researchers are conducting studies to discover the diagnostic use of Doppler ultrasound in different diseases. For example, in July 2021, a team of researchers from Dalian Medical University in China launched a study to determine the diagnostic use of Doppler ultrasound in patients with early chronic renal disease. Moreover, in April 2022, a different team of researchers published a research study from the University of British Columbia in Vancouver, Canada. The research study states that Doppler imaging is widely used in imaging transplanted kidneys. It is used to evaluate renal vascular flow and patency.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Prevalence of Chronic Diseases is Driving the Demand for Doppler Ultrasound Systems.

-

Rising Adoption of Doppler Ultrasound Devices among End-Users for Efficient Diagnostic Imaging is Driving the Market Demand.

Restraints:

-

The High Cost of Doppler Ultrasound Systems limits the Growth of the Doppler Ultrasound Market.

-

Stringent Regulatory Procedures are Restraining Doppler Ultrasound Market Expansion.

Opportunity:

-

Advances in Ultrasound Diagnostic Technologies Poses a Lucrative Growth Opportunity for the Doppler Ultrasound Systems Market.

-

Increasing Healthcare Expenditure in Developed Countries will Drive the Growth of the Doppler Ultrasound Systems Market During the Forecast Period.

Doppler Ultrasound Market Segment Analysis

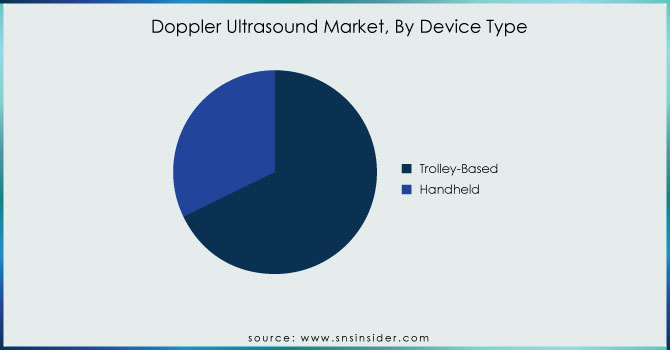

By Device Type

In 2023, the handheld devices will hold 68 %. There is a high demand for the devices and the major players are entering into new product launches may drive the growth of the segment. For example, GE Healthcare, a part of General Electric, announced a new generation wireless handheld ultrasound device, the Vscan Air, in March 2021. The Vscan Air is a pocket-sized, wireless, and battery-operated, colored Doppler that is driven by customer innovation and is designed to offer more customized patient care in several parts of the world. In addition to that, Royal Philips made an addition of enhanced hemodynamic assessment and measurement capabilities in its portable Lumify Pulse Wave Doppler, which is also an addition to its Doppler ultrasound device line in February 2022. These factors are expected to fuel the market growth of the segment shortly. It is also expected that the market growth of the segment will be soon supported by the growing prevalence of peripheral artery disease and deep vein thrombosis.

The estimated number of people affected by DVT or PE each year is unclear; however, according to the most recent updated data from the CDC as of April 2022, DVT and PE collectively result in up to 900,000 individuals in the U.S. each year. Furthermore, At the close of 2021, WHO suggested that approximately 2.3 million women were diagnosed with breast cancer in 2021. At the same time, the demand for portable and handheld Doppler ultrasonography devices for convenient detection applications is increasing with the rising number of chronic diseases.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-User

The hospital segment led the market by accounting for 47.2% of the total revenue share in 2023. As a result of the increasing applicability of Doppler ultrasound in various hospital settings, coupled with the rising number of visits by patients with lifestyle-related disorders, the hospital segment holds the leading position. Moreover, the market is driven by the rising demand for handheld Doppler ultrasound devices in OPDs and in-patient departments as a result of their portable nature.

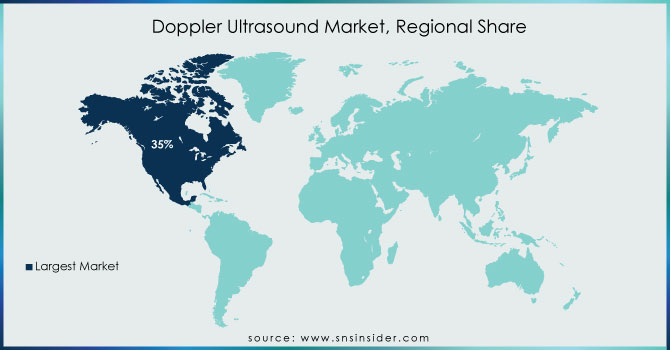

Doppler Ultrasound Market Regional Overview

In terms of shares, North America dominated the market, with a 35% share in 2023. The expansion of the market for Doppler ultrasound systems in North America is attributed to an increase in the use of imaging technologies for the diagnosis and treatment of various diseases. For example, in March 2022, the Canadian startup Flosonics Medical introduced a wearable, wireless Doppler ultrasound system on the market. Therefore, it is expected that the expansion of the market will be driven by innovation in the region. Another factor contributing to the growth of the market is the increase in the number of hospitals, clinics, and ambulatory surgery centers and investment in the healthcare sector throughout the region. For instance, the Canadian and Quebec governments partnered in July 2021 to invest in 209 infrastructure projects to modernize, rebuild, and upgrade Quebec’s health and social services institutions, including hospitals and other care centers. The information was available in a press release by the Canadian government. The investment for 209 infrastructure projects is worth 188.3 million, according to the announcements from the federal ministers of infrastructure, communities, health, and social services. Therefore, the investment would require the hospitals to have modern medical devices, including the Doppler ultrasound systems.

Additionally, the US hospital sector is growing. For example, a report released by the American Hospital Association in 2022 indicated that the number of operating hospitals in the United States in 2021 was over 6,073. Key product launches high concentration of market players or manufacturers’ presence acquisition and partnerships among major players and news hospitals in the United States drive the growth of the Doppler ultrasound systems market in the United States. For example, in September 2022, Philips received FDA 510 for an ultrasound compact system for optimal performance and portability.

KEY PLAYERS:

The Major players are GE Healthcare, Esaote SpA, Siemens Healthineers, Toshiba Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi Ltd., Mindray Medical International Limited, Koninklijke Philips N.V., Analogic Corporation, Samsung Medison Co., Ltd and Other players.

RECENT DEVELOPMENTS

-

In March 2022, a Medical Device Licence was granted to NovaSignal Corp., a provider of data and medical technology, by Health Canada for their NovaGuide Intelligent Ultrasound. The only autonomous transcranial Doppler ultrasound that has been given Canadian approval is called NovaGuide.

-

Royal Philips announced a global launch at the Radiological Society of North America in November 2022 for a next-generation compact portable ultrasound solution. The new series, which is the Compact 5000, seeks to deliver the diagnostic quality that is typically associated with premium cart-based ultrasound systems to more patients.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 1.83 Billion |

|

Market Size by 2032 |

US$ 2.53 Billion |

|

CAGR |

CAGR of 3.77% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Device Type (Trolley-based, Handheld) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

GE Healthcare, Esaote SpA, Siemens Healthineers, Toshiba Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi Ltd., Mindray Medical International Limited, Koninklijke Philips N.V., Analogic Corporation, Samsung Medison Co., Ltd and Other players |

|

Key Drivers |

•The Increasing Prevalence of Chronic Diseases is Driving the Demand for Doppler Ultrasound Systems. |

|

RESTRAINTS |

•The High Cost of Doppler Ultrasound Systems limits the Growth of the Doppler Ultrasound Market. |