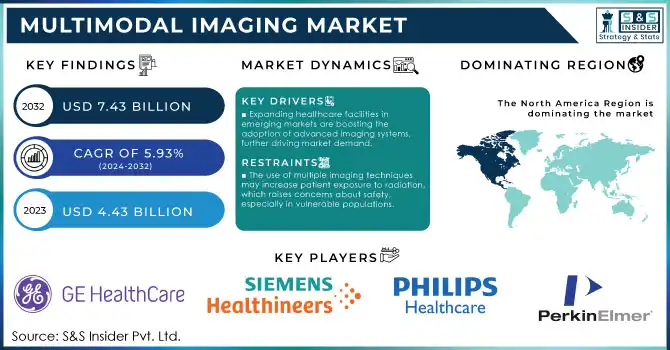

Multimodal Imaging Market Key Insights:

The Multimodal Imaging Market size was valued at USD 4.43 billion in 2023 and is expected to reach USD 7.43 Billion by 2032, growing at a CAGR of 5.93% during the forecast period of 2024-2032.

The growth of the multimodal imaging market is influenced by several factors, including technological advances and growing demand for accurate medical diagnosis. The increasing prevalence of chronic diseases such as cancer, heart disease, and neurological disorders is one of the main growth drivers. For instance, In 2024, approximately 2,001,140 new cancer cases are expected to be diagnosed in the United States, with 611,720 deaths attributed to the disease.

Get More Information on Multimodal Imaging Market - Request Sample Report

The market is also expected to grow due to technological innovations. AI/ml advances combined with imaging modalities facilitate quicker, more accurate diagnoses. The AI-powered algorithms are specifically useful for analyzing large amounts of imaging data, image correcting and automation processes and ultimately helping to mitigate human error. Specifically, research indicates that AI imaging can improve diagnostic accuracy by as much as 30% in fields such as oncology and neurology. In addition, demand for mobile and portable multimodal imaging systems is also pushing the growth of the market. By delivering imaging to the point of care, these systems enable greater access to quality diagnostics closer to the patient, ideal in rural or underserved regions. Rising investments in multimodal imaging technology development is another growth factor. As an example, hybrid imaging systems such as MRI-PET and SPECT-CT have enabled clinicians to obtain a more detailed understanding of disease mechanisms and therapeutic responses. The antibiotics are being adopted throughout the major healthcare markets, e.g. U.S., Europe, which are key growth areas for precision medicine. These developments are expected to expand the market with the continuous advancement in technology and the growing need for accurate, non-invasive, diagnostic tools.

Multimodal Imaging Market Dynamics

Drivers

-

Expanding healthcare facilities in emerging markets are boosting the adoption of advanced imaging systems, further driving market demand.

-

The growing elderly population worldwide, who are more susceptible to chronic diseases, increases the need for sophisticated diagnostic imaging techniques.

-

Multimodal imaging provides more comprehensive diagnostic information, leading to better clinical decision-making and improved patient outcomes.

Multimodal imaging incorporates multiple imaging modalities or image features, such as MRI, CT, PET, and ultrasound, into a single system, which enables a fuller analysis of a disease. It provides detailed information about organs and structures of the body, which can complement test-related decisions and thus enhance patient outcomes and clinical decision-making. This allows clinicians to garner critical information concerning the mechanisms of disease so that more precise treatment decisions can be made.

One such example is the PET/CT, which merges the anatomical detail of CT with the functional information provided by PET. Combining both of these images gives clinicians the ability to target precisely tumors, determine their metabolic activity, and monitor the effectiveness of their treatment. This type of imaging is especially important in cancer care, where assessment of structural (size, shape, location) and functional (tissue activity) features is critical for therapy decisions.

Multimodal imaging also reduces the number of tests needed, which can result in increased comfort for patients and decreased costs overall. The fewer the number of procedures, the quicker the diagnosis and the facilitation of targeted patient treatment planning while at the same time enabling healthcare providers to track disease progression and treatment responses through the integrated system providing a more holistic picture of the patient's health. Both of these modalities offer higher resolution than conventional imaging techniques, and the differential diagnostic capability further enhances with the incorporation of artificial intelligence (AI) into multimodal imaging. AI algorithms are able to compare various images and automatically identify abnormalities and give suggested diagnoses. This development helps the specialists to make quicker and accurate decisions which is crucial for early diagnosis for diseases such as cancer, cardiovascular diseases, and neurological disorders.

| Aspect | Benefit |

|---|---|

| Diagnostic Accuracy | Combines multiple imaging modalities to improve the precision of diagnosis. |

| Treatment Planning | Provides comprehensive data for planning surgeries or therapies. |

| Patient Comfort | Fewer procedures required, reducing patient discomfort. |

| Cost Efficiency | Reduces the number of separate tests needed, leading to lower costs. |

| Early Disease Detection | Improves the ability to detect diseases at earlier, more treatable stages. |

Restraints

-

The use of multiple imaging techniques may increase patient exposure to radiation, which raises concerns about safety, especially in vulnerable populations.

-

The approval and certification processes for advanced multimodal imaging systems can be lengthy, limiting the rapid introduction of new technologies into the market.

-

Integrating different imaging technologies and ensuring compatibility with existing healthcare IT infrastructure can be difficult, requiring significant investment in system upgrades.

Integrating multiple imaging technologies into cohesive multimodal systems presents significant challenges within the healthcare sector. Each imaging modality, including MRI, CT, PET, and ultrasound, operates with distinct hardware configurations, software ecosystems, and data protocols. Unifying these into a single system requires sophisticated compatibility efforts to merge, align, and display imaging outputs cohesively. This involves developing advanced software capable of reconciling differences in resolution, timing, and imaging methodologies to ensure seamless interoperability. One of the key hurdles is the need for healthcare facilities to modernize their IT infrastructure to support these advanced multimodal systems. Older systems often lack the necessary computational power, storage capacity, or compatibility for processing the large and complex datasets that multimodal imaging generates. For instance, merging PET and MRI images requires integrating detailed anatomical data with functional insights, which imposes heavy demands on data processing and storage infrastructure. To address these needs, healthcare providers must invest in high-speed networks, cloud-based storage solutions, and advanced analytics platforms.

The financial burden of these upgrades is a significant restraint, especially for smaller healthcare organizations or those in less developed regions. High costs can delay or even prevent the adoption of multimodal imaging technologies, despite their evident clinical benefits. Additionally, ensuring data security and adhering to healthcare regulations, such as HIPAA, further complicates the integration process and increases operational expenses. Another barrier lies in the lack of standardized protocols across the industry. Many vendors design systems with proprietary frameworks, making it difficult to achieve cross-platform interoperability. This lack of standardization necessitates customized solutions for individual healthcare facilities, which adds complexity and cost.

To overcome these challenges, collaboration between medical device manufacturers, healthcare IT developers, and regulatory authorities is essential. Establishing universal standards for interoperability, investing in cost-effective integration solutions, and providing financial incentives for technology adoption are crucial steps toward unlocking the full potential of multimodal imaging in healthcare. Addressing these issues will enable wider access to advanced diagnostic tools and ultimately improve patient outcomes across the globe.

Multimodal Imaging Market Segment Analysis

By Technology

In 2023, the PET/CT segment dominated the market and represented revenue share of 43.78%, which is mainly used in oncology diagnostics for identifying cancer, evaluating treatment responses, and staging the disease. PET/CT integrates anatomical and functional imaging in a single scan allowing accurate determination of the size, localization, and metabolic activity of tumours. Continuous technological advancements such as better resolution and minimal scan duration is fueling the dominance of the PET/CT technology segment. Over time, advances in automation are anticipated to improve the diagnostic accuracy and workflow efficiency of AI-enabled PET/CT systems. The use of PET/CT could also see a substantial increase since personalized medicine- and targeted therapies-driven oncology care have begun to trend.

The PET/MR segment is expected to grow at a higher CAGR of 7.47% from 2024-2032. The PET/MR systems allow for a precise imaging with the metabolic information of the PET and soft-tissue contrast of the MRI. The escalating adoption in imaging context of neurological and cardiovascular diseases as well as cancer diagnosis is driving rapid growth of this segment. As hybrid imaging technology continues to advance and operational overhead decreases, PET/MR systems are expected to expand in clinical as well as research applications. In addition, their capacity to reduce radiation exposure during the acquisition of exquisite images makes them appealing in paediatric and follow-up imaging contexts.

By End-User

In 2023, hospitals segment dominated the market and represented revenue share of 46.89%, owing to the focus of advanced diagnostics and management of complex diseases taking place. Dedicated imaging systems in the form of PET/CT, PET/MR and SPECT/CT have become indispensable tools in the hospital, allowing for an integrated diagnostic assessment for oncological, cardiovascular, and neurological pathologies. The hospitals experience high patient inflow along with strong financing in place, making them more likely to adopt the newest of the imaging modalities. Some may also require follow-up multi-modality imaging exams which are made easier with AI-enabled imaging systems for accurate diagnostics in a multidisciplinary approach to treatment, thus the allure of future growth primarily in this segment is strengthened by the way the segment is expected to evolve with increasing hospital infrastructure investments.

Diagnostic imaging centres are expected to register the highest CAGR of 6.27% during the forecast period, owing to the increasing adoption of cost-effective and advanced multimodal imaging systems. These outpatient centres provide specialized diagnostic imaging which keeps the hospitals free. Their growth is fueled by increasing trend of outsourcing diagnostic services and preference for standalone imaging facilities. Technological advancements in home-based imaging technologies, and increasing prevalence of chronic diseases requiring early diagnosis are anticipated to drive the future growth of diagnostic imaging centres.

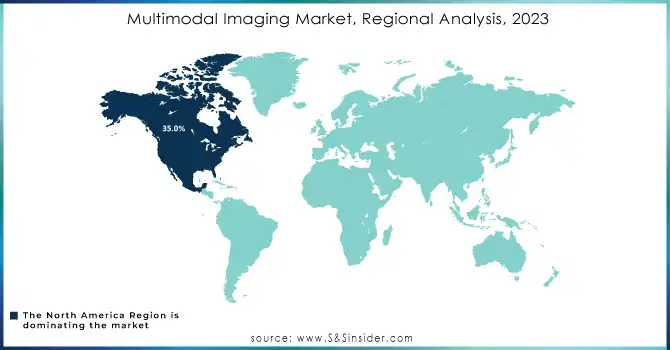

Multimodal Imaging Market Regional Overview

In 2023, North America held most of the multimodal imaging market share of 35.0%, which can be attributed to the established healthcare infrastructure, next-generation diagnostic technology adoption, and investments in research and development in this region. The country has advantage of a high prevalence of chronic diseases, including malignancies and cardiovascular diseases that require sophisticated imaging for diagnosis and treatment selection. The market, furthermore, benefits from being a focus area for the important players in the sector, accrued with favourable reimbursement policies. The North American market will continue growing in the foreseeable future due to rising prevalence of demand for integrated imaging systems with AI, initiatives taken by the government in support of healthcare innovation, and progress regarding personalized medicine.

Some of the factors contributing to the growth of the market in this region include rising healthcare expenditure, increased demand for CT angiography procedures, and rapid urbanization & economic development in emerging economies such as China and India, contributing to high regional long-term growth APAC is anticipated to witness the highest CAGR of 7.59% during the forecast period. Market growth is also being aided in countries with growing populations of the middle-class class by a growing push to access better healthcare and also the growing adoption of new and existing diagnostic technologies. The development of notable healthcare investments, infrastructure, and diagnostic centres along with a boom of medical tourism in APAC will accelerate the demand for multimodal imaging systems in the region.

Need Any Customization Research On Multimodal Imaging Market - Inquiry Now

Key Players in Multimodal Imaging Market

The major key payers along with one product

-

GE Healthcare - Discovery IQ PET/CT Scanner

-

Siemens Healthineers - Biograph Vision PET/CT System

-

Philips Healthcare - Ingenuity TF PET/MR

-

Canon Medical Systems - Cartesion Prime PET/CT

-

Hitachi Medical Systems - Oasis PET/MRI

-

Bruker Corporation - Albira PET/SPECT/CT

-

PerkinElmer, Inc. - Quantum GX micro-CT Imaging System

-

Mediso Medical Imaging Systems - nanoScan PET/MRI

-

Fujifilm Holdings Corporation - Synapse PACS for integrated imaging

-

Agfa-Gevaert Group - DR 800 Multimodality Imaging Solution

-

Carestream Health - OnSight 3D Extremity Imaging System

-

Shimadzu Corporation - Trinias series angiography systems

-

Hologic, Inc. - 3Dimensions Mammography System

-

Esaote SpA - MyLab X8 Ultrasound System

-

Samsung Medison - RS85 Prestige Ultrasound

-

Mindray Medical International - Resona I9 Ultrasound System

-

United Imaging Healthcare - uMI 780 PET/CT System

-

Positron Corporation - Attrius PET Scanner

-

Toshiba Medical Systems (now Canon) - Aquilion ONE CT Scanner

-

Neusoft Medical Systems - NeuViz Glory CT Scanner

Recent Developments

-

March 2024 – GE Healthcare: GE launched a next-generation PET/MR system with advanced image fusion technology, aiming to streamline workflows in diagnostic imaging centres.

-

January 2024 – Siemens Healthineers: The company unveiled an advanced multimodal imaging solution that integrates AI-driven features for enhanced diagnostic precision in oncology and cardiology applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.43 Billion |

| Market Size by 2032 | USD 7.43 Billion |

| CAGR | CAGR of 5.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (PET/CT Systems, PET/MR Systems, SPECT/CT Systems, Others) • By Application (Brain and Neurology, Cardiology, Oncology, Ophthalmology, Others) • By End-User (Hospitals, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Hitachi Medical Systems, Bruker Corporation, PerkinElmer, Inc., Mediso Medical Imaging Systems, Fujifilm Holdings Corporation, Agfa-Gevaert Group, Carestream Health |

| Key Drivers | • Expanding healthcare facilities in emerging markets are boosting the adoption of advanced imaging systems, further driving market demand. • The growing elderly population worldwide, who are more susceptible to chronic diseases, increases the need for sophisticated diagnostic imaging techniques. |

| Restraints | • The use of multiple imaging techniques may increase patient exposure to radiation, which raises concerns about safety, especially in vulnerable populations. • The approval and certification processes for advanced multimodal imaging systems can be lengthy, limiting the rapid introduction of new technologies into the market. |