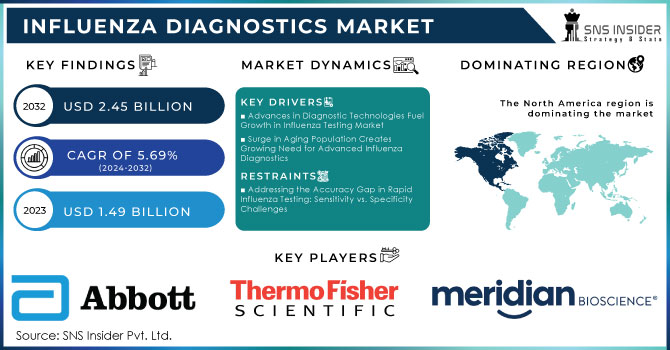

Influenza Diagnostics Market Size Analysis:

The Influenza Diagnostics Market was valued at USD 1.49 billion in 2023 and is expected to reach USD 2.45 billion by 2032, growing at a CAGR of 5.69% from 2024-2032.

Get More Information on Influenza Diagnostics Market - Request Sample Report

The ongoing rate of infectious diseases is fueling the influenza diagnostics market. According to the National Foundation for Infectious Diseases, pneumococcal infections trigger around 150,000 hospitalizations every year, which indicates a very high rate of requirement for effective diagnostic solutions. Moreover, approximately 133 million people in the United States suffer from different chronic diseases, increasing the demand for high-quality influenza testing and faster result delivery. The increasingly problematic burden of disease underlies the imperative driving the establishment of innovative diagnostic tools in efforts to improve patient care and healthcare delivery in general.

Preparedness toward pandemics and the importance of timely surveillance systems in controlling infectious diseases have become more critical. With annual direct medical costs in the United States estimated at USD 3.2 billion, addressing influenza’s financial and health burden is a priority for governments and healthcare institutions. The market for influenza diagnostics is anticipated to grow significantly, driven by increased investments toward improving diagnostic capabilities. New point-of-care tests and advanced molecular diagnostics technologies, developed by these firms, will also leverage this trend, which shall ensure faster and more accurate detections of influenza with stronger contributions to public health efforts and better management of respiratory diseases.

Influenza Diagnostics Market Dynamics

DRIVERS

-

Advances in Diagnostic Technologies Fuel Growth in Influenza Testing Market

Advancements in diagnostic technologies, such as PCR, and rapid antigen tests open a significant growth space for the influenza diagnostics market. These enhance speed and accuracy in diagnosis while rapid antigen tests would deliver a result within 15-30 minutes; PCR tests are more expensive on an average basis, compared to the average cost of a rapid test, about USD 62.15 per patient. However, large numbers of the Ag RDTs will be introduced to the LMICs in the next six months at a maximum of USD 5 cost per test, significantly increasing access. Such cost-efficient technologies are so rapidly becoming attractive to healthcare providers, allowing for better management of patients, quicker decisions, and thereby greater demand for their implementation in clinical settings. The integration of these newly diagnosed methods into healthcare systems will further improve health outcomes and add much to the market growth as the technology develops.

-

Surge in Aging Population Creates Growing Need for Advanced Influenza Diagnostics

This is because the elderly population is growing geometrically; therefore, even minor proportions of this population can easily become especially vulnerable to severe complications. The global population aged 65 years and above is predicted to be over 1.5 billion in 2050. Thus, the healthcare needs that are tailored for older adults are growing in urgency every day. As a consequence, in this aspect, timely and accurate diagnosis becomes highly crucial. Various chronic conditions affect many seniors that aggravate an influenza infection, hence emergent detection becomes very crucial. This demographic trend offers deep opportunities for the marketplace of influenza diagnostics as the service providers in healthcare seek new and innovative solutions for early identification and management. Companies specializing in diagnostic tools for use in older patients can now take advantage of an emerging market to contribute to better health outcomes and responses to influenza outbreaks.

RESTRAINTS

-

Addressing the Accuracy Gap in Rapid Influenza Testing: Sensitivity vs. Specificity Challenges

Variability in the accuracy of the test results complicates the influenza diagnostics market. Rapid tests, for instance, offer fast turnaround times but low to moderately-low sensitivity; most rapid tests stand at 50-70% whereas their specificity is higher but stands at 95-99%. Advanced technologies, on the other hand, such as molecular testing, have much higher sensitivity and less probability of false negatives. This makes them wrongly diagnosed, deny effective care to the patient, and even lose confidence in the available diagnostic solutions. Even though rapid tests are mostly available, healthcare providers may still be reluctant to rely on them since they are suspicious of the accuracy of the given diagnosis. Remedying these issues is critical in enhancing the reliability and adoption of influenza diagnosis in the clinical environment.

-

Overcoming Awareness and Training Gaps in Influenza Diagnostics to Improve Patient Care

A significant restriction to influenza diagnostics is limited awareness and training. In some regions, there is a lack of basic understanding regarding the critical role that influenza diagnostics plays in effective patient management. Such a lack of understanding commonly leads to underutilizing available testing options. Healthcare providers may also not be provided with sufficient preparedness in advanced diagnostic tools, which restrains them from effectively using such technologies. The entire implementation of influenza diagnostics might be hampered by this, thus impacting patient care and the growth prospects of the market. The gaps in education have to be addressed to ensure improved uptake and efficiency of influenza testing.

Influenza Diagnostics Market Segmentation Overview

BY PRODUCT

Test kits and reagents dominated the market share in 2023 for influenza diagnostics, at about 61%. This is primarily because they are highly accessible and user-friendly. Rapid Influenza Diagnostic Tests provide a highly essential advantage of point-of-care identification, ensuring timely management and treatment of influenza. They are cost-effective as well; hence, their popularity has led to vast use, particularly in resource-poor regions.

The instruments is expected to grow at the highest rate, with an estimated CAGR of 7.04% from 2024 to 2032. This mainly owes to the improvements in molecular diagnostics and automation technologies that increase both accuracy and throughput for any test. With higher accuracy and efficiency holding paramount importance in healthcare delivery, the demand for advanced diagnostic instruments will advance. Investments in the health infrastructure and further strengthening of these will strengthen growth in this segment further.

BY END USE

Hospitals and clinics continue to top the influenza diagnostics market with a 46% share of revenues that were accounted for in 2023 due to the full care of patients in these premises and readily available diagnostic testing. It is those premises with the capacity to admit patients in pretty large numbers and deliver the results of the test without any hesitation. Testing goes hand in hand with treatment as an avenue for improved patient management, which is then complemented by an improved healthcare outcome.

The diagnostic labs segment is likely to grow at the fastest rate of approximately 6.45% from 2024 to 2032. Growth in this segment is attributed to a heightened demand for specialized testing and improvements in technology that speed up and increase the accuracy of diagnoses. Enhancement of the scope of provider services based on the importance of raising precise and efficient performance in diagnostics is increasingly prompting healthcare providers to partner with diagnostic labs to further the advancements in this field. Additionally, the development of personalized medicine and custom treatment is also on the rise.

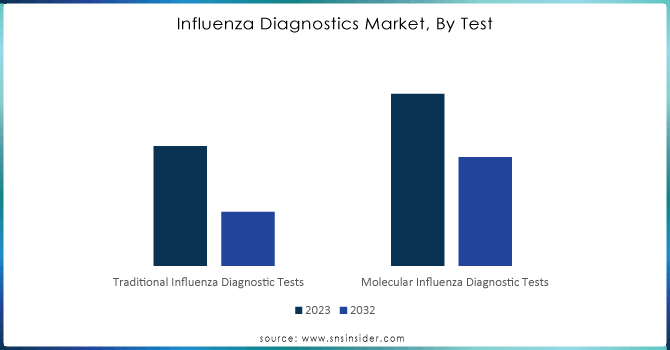

BY TEST

Traditional Flu testing diagnostics lead the market and accounted for about 65% of revenue in 2023 mainly because they are well-established and long-used, which tends to give them a preference by various healthcare providers. These tests include rapid influenza diagnostic tests and viral culture methods. They provide inexpensive results that are valid across different healthcare settings.

However, molecular influenza diagnostic tests are expected to grow at the highest CAGR of around 6.31% from 2024 to 2032, led by technological advancement, which provides greater sensitivity and specificity. Increasing recognition of the importance of accurate and timely diagnostics has vast opportunities for molecular tests. In light of that, with the current focus of healthcare systems on accurate diagnosis and prompt interventions, the demand for novel molecular testing solutions will only be able to grow further as a complement to conventional methods for improving general care for patients. This would, therefore, imply the effectiveness of a combination of treatment interventions and strategies for influenza management.

Need Any Customization Research On Influenza Diagnostics Market - Inquiry Now

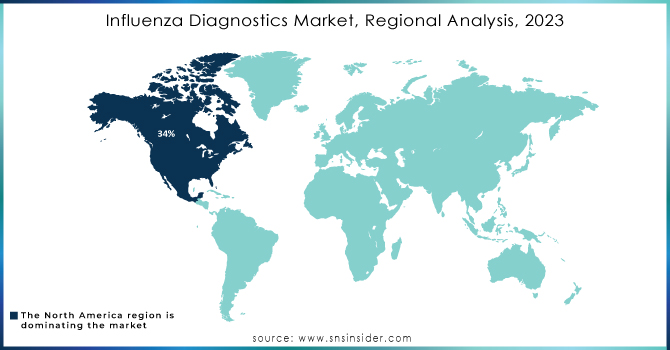

Influenza Diagnostics Market Regional Analysis

In 2023, North America dominated the market for influenza diagnostics with approximately 34% revenue. It is primarily because of its developed healthcare infrastructure and huge investments going on in the area of medical technology. Moreover, North America has extensive research activities along with strong networks of healthcare providers, driving the adoption and implementation of advanced diagnostic technologies. The economic burden of influenza on the healthcare system and society is significant, with estimated overall annual costs ranging from USD 6.3 billion to USD 25.3 billion and averaging at USD 11.2 billion annually. This sizeable financial burden translates to the importance of efficient diagnostic technologies in managing outbreaks of influenza.

On the other hand, the Asia Pacific is projected to grow with the highest CAGR of around 6.65% in the forecast period from 2024 to 2032, due to increments in health accessibility, higher awareness of infectious diseases, and initiatives by the government to develop public health infrastructure. There are chances for large companies to expand their business footprint in emerging markets due to rapid growth in the demand for effective flu diagnostics. With increasingly health-conscious populations in the Asia Pacific and a need for timely diagnostic services, both traditional and molecular diagnostic technologies have the potential to thrive side-by-side with North America's well-established supremacy.

LATEST NEWS-

-

In October 2024, the US FDA approved prescription- and- alternative over-the-counter home use of the Healgen Rapid Check COVID-19/Flu A&B Antigen Test, a test that uses a nasal swab that is intended for people who are having respiratory-type symptoms, identifying proteins from both SARS-CoV-2 and influenza A and B viruses within about 15 minutes.

-

On September 20, 2024 the FDA approved the flu vaccine given by nasal spray, FluMist for administration by a patient or patient's caregiver. It is a spray form of vaccine given intranasally and has already been approved for use in preventing influenza in patients aged between 2 and 49 years.

Key Players in Influenza Diagnostics Market

-

3M Company: 3M Molecular Diagnostics System

-

Abbott Laboratories: BinaxNOW Influenza A & B Card

-

Becton, Dickinson and Company (BD): BD Veritor System for Rapid Detection of Flu A & B

-

Meridian Bioscience, Inc.: ImmunoCard STAT! Flu A & B

-

Quidel Corporation: Sofia Influenza A+B FIA

-

F. Hoffmann-La Roche Ltd: cobas Influenza A/B Test

-

SA Scientific Ltd: Rapid Influenza Test Kit

-

SEKISUI Diagnostics: QuickVue Influenza A+B Test

-

Thermo Fisher Scientific, Inc.: TaqMan Influenza A/B PCR Test

-

Hologic, Inc.: Panther Fusion Influenza A/B Assay

-

Siemens (Germany): CLINITEK Status+ for Influenza A/B

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China): MINDRAY Rapid Test for Influenza

-

Koninklijke Philips N.V. (Netherlands): Philips Respironics Influenza A/B Test

-

NeuroLogica Corp. (U.S.): CereTom for Infectious Disease Detection

-

Shimadzu Medical (India) Pvt. Ltd. (Japan): PCR Detection Systems for Influenza

-

GENERAL ELECTRIC (U.S.): GE Healthcare Diagnostic Imaging for Influenza

-

Quest Diagnostics Incorporated (U.S.): Quest Influenza A & B Test

-

Sysmex India Pvt. Ltd. (Japan): Sysmex Flu Test

-

Hitachi, Ltd. (Japan): Hitachi Medical Systems for Infectious Disease Testing

-

Canon Inc. (Japan): Canon Medical Influenza Testing Solutions

-

FUJIFILM Holdings Corporation (U.K.): Fujifilm Rapid Influenza Test

-

GenMark Diagnostics, Inc. (U.S.): ePlex Respiratory Pathogen Panel

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.49 Billion |

| Market Size by 2032 | USD 2.45 Billion |

| CAGR | CAGR of 5.69 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Test Kit and Reagents, Instruments, Others) • By Test (Traditional Influenza Diagnostic Tests , Molecular Influenza Diagnostic Tests) • By End User(Hospitals and clinic, Diagnostic Labs, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M Company, Abbott Laboratories, Becton, Dickinson and Company (BD), Meridian Bioscience, Inc., Quidel Corporation, F. Hoffmann-La Roche Ltd, SA Scientific Ltd, SEKISUI Diagnostics, Thermo Fisher Scientific, Inc., Hologic, Inc., Siemens (Germany), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Koninklijke Philips N.V. (Netherlands), NeuroLogica Corp. (U.S.), Shimadzu Medical (India) Pvt. Ltd. (Japan), GENERAL ELECTRIC (U.S.), Quest Diagnostics Incorporated (U.S.), Sysmex India Pvt. Ltd. (Japan), Hitachi, Ltd. (Japan), Canon Inc. (Japan), FUJIFILM Holdings Corporation (U.K.), GenMark Diagnostics, Inc. (U.S.) |

| Key Drivers | • Advances in Diagnostic Technologies Fuel Growth in Influenza Testing Market. • Surge in Aging Population Creates Growing Need for Advanced Influenza Diagnostics. |

| RESTRAINTS | •Addressing the Accuracy Gap in Rapid Influenza Testing: Sensitivity vs. Specificity Challenges •Overcoming Awareness and Training Gaps in Influenza Diagnostics to Improve Patient Care |