Infusion Pump Rental Market Report Scope & Overview:

Get More Information on Infusion Pump Rental Market - Request Sample Report

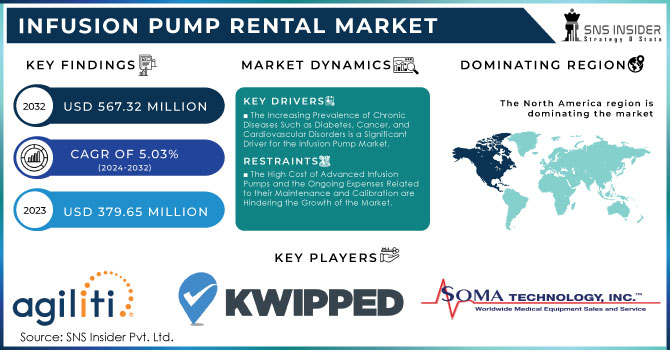

The Infusion Pump Rental Market Size was valued at USD 379.65 Million in 2023, and is expected to reach USD 567.32 Million by 2032, and grow at a CAGR of 5.03% Over the Forecast Period of 2024-2032.

The Infusion Pump Rental Market is growing due to the rise in the number of chronic diseases, an increase in demand for home healthcare, and huge investments by the governments in building healthcare infrastructure. The latest numbers shared by WHO and CDC on the global scenario of chronic diseases such as diabetes, cancer, and cardiovascular disease are staggering. An estimated 60% of adults in the US are believed to have one chronic disease and 40% of them have two or more. This in turn has led to a boost in the demand for the medical equipment designed for fighting these chronic diseases.

The infusion pump is extensively used to continuously provide medications during life-threatening conditions. Subsequently, the U.S. government increased healthcare spending by 5.4% over the previous year, a significant portion of which was granted to modernize medical equipment in hospitals and home healthcare devices. The cost-effectiveness of rentals is the other factor contributing to the market growth. Maintaining an infusion pump is costlier, which is why those in the healthcare sector prefer renting.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Prevalence of Chronic Diseases Such as Diabetes, Cancer, and Cardiovascular Disorders is a Significant Driver for the Infusion Pump Market.

-

The Growing Trend towards Home Healthcare, driven by an Aging Population and the Need to Reduce Hospital Stays, is Aiding the Infusion Pump Market Expansion.

Restraints:

-

The High Cost of Advanced Infusion Pumps and the Ongoing Expenses Related to their Maintenance and Calibration are Hindering the Growth of the Market.

-

The Infusion Pump Market Faces Challenges Related to Product Recalls and Failures, which can result from Technical Issues, Software Malfunctions, Or Design Flaws Limiting the Market Growth.

Opportunity:

-

Continuous Advancements in Infusion Pump Technology, such as the Development of Smart Pumps with Integrated Safety Features like Dose Error Reduction Systems (DERS) and Wireless Connectivity, are Driving Market Growth.

-

The Infusion Pump Market has Substantial Growth Potential in Emerging Markets, where Improving Healthcare Infrastructure and Increasing Healthcare Expenditure are Driving Demand.

KEY MARKET SEGMENTATION:

By Type

The market share of the Volumetric Pumps among the types of infusion pumps was 27.3% in 2023, which made it the leading segment. The high popularity of this type of pump is caused by the fact that volumetric pumps maintain high accuracy and reliability. In addition, these types of pumps are responsible for delivering large volumes of medication, nutrients, and blood products to the nee. In addition, modern intensive care units and emergency rooms cannot function efficiently without the application of safe pumps and the precise management of fluids that are crucial for patients’ lives.

Finally, the rental market of infusion pumps is dominated by volumetric pumps since their usage is highly popular in hospitals. As reported by the U.S. Department of Health and Human Services, the whole country faces tension towards the reduction of operational costs of hospitals. Indeed, the need to introduce modern technologies at a reasonable price rate is fully covered with the rental model of using pumps of various types. Moreover, the high position of volumetric pumps in the rental market is caused by their versatility. These types of pumps are applied in managing different types of infusions, from antibiotics to chemotherapy.

By Application

In terms of application, hospitals led the infusion pump rental market in 2023, holding a market share of 39.4%. As such, hospitals are the prime consumers of infusion pumps. This is because there is a growing number of people who require constant medication administration, for instance, people suffering from chronic conditions. Apart from that, those who need surgeries and especially critical care require infusion pump services. This is supported by the government’s statistics. CDC disclosed that the number of hospital admissions rose significantly over the past 30 years due to chronic diseases. Today, in the US, roughly 35 million people have to be hospitalized, and they cannot be adequately treated with the help of only a few infusion pumps. Thus, the demand for these pumps has steadily grown in such settings.

Furthermore, renting infusion pumps helps hospitals to be more flexible in terms of the number of units they can deploy. They can rent more during the months when the inflow of patients increases and less during the remaining period of the year. Therefore, hospitals are not required to invest in their units. Finally, the use of smart technologies has also affected the growth of the rental market. The majority of hospitals can now afford to use advanced infusion pumps that are all connected to a central system and monitored remotely.

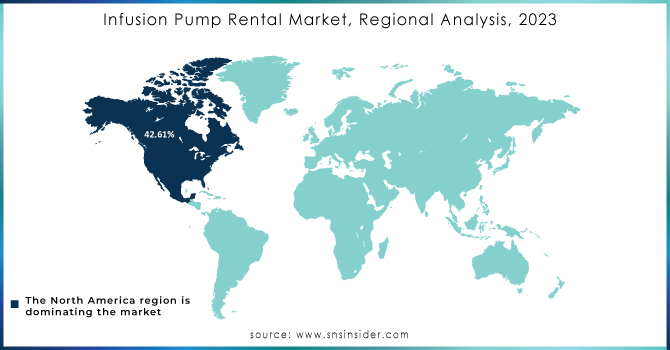

REGIONAL ANALYSIS:

In 2023, North America dominated the infusion pump rental market, with a market share of 42.61%. It was due to several reasons, such as a well-established healthcare infrastructure, high healthcare expenditure, and focus on adopting advanced medical technologies. According to the U.S. Census Bureau, in 2023, the US’s healthcare spending was nearly USD 4.3 trillion. This substantial spending was also on acquiring and maintaining medical equipment, including infusion pumps. The rental model was also popular in North America as hospitals and clinics increasingly sought to control costs while still having access to the latest medical technologies.

In addition, to the high incidence of aging populace in the region, more than 16% of the U.S. population was aged 65 and older, according to the U.S. Department of Health and Human Services. This has made the prevalence of chronic diseases more common in the region, further increasing the demand for infusion pumps. The regulatory environment in North America also Favors the rental market. In addition, flexible regulations such as California’s Medical Reimbursement Equipment Rental Act ensure that healthcare providers are encouraged to meet patient needs more efficiently and inexpensively through the rental of medical technology.

Need any customization research on Infusion Pump Rental Market - Enquiry Now

KEY PLAYERS:

The key market players are Agiliti Health, Kwipped, Med One, Soma Tech, Avante, Biomedix Medical, Portea, US Med-Equip, Venture Medical, Right Way Medical & Other players.

RECENT DEVELOPMENTS

-

In August 2023, ICU Medical, Inc. received FDA clearance for its Plum Duo infusion pump, meaning it will be available for customers in the US in early 2024.

-

In April 2023, Fresenius Kabi announced that its Ivenix Infusion System received an Innovative Technology contract from Vizient, Inc. The Innovative Technology contract will set terms for hospitals to evaluate and purchase the Ivenix Infusion System.

-

In August 2022, Becton Dickinson and Company’s Novum IQ Syringe Infusion Pump was approved by the FDA.

-

In March 2022, Fresenius Kabi received U.S. Food and Drug Administration approval for the wireless Agilia Connect Infusion System. It includes the Agilia Volumetric Pump and the Agilia Syringe Pump with the Vigilant Software Suite-Vigilant Master Med technology.

-

In January 2022, ICU Medical, Inc. acquired Smiths Medical, Inc. to increase its share in the infusion pump market by adding syringe pumps and ambulatory pumps to its portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 379.65 Million |

| Market Size by 2032 | US$ 567.32 Million |

| CAGR | CAGR of 5.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Volumetric Pump, Syringe Pump, Ambulatory Pump & Others) •By Application (Hospital, Emergency Center, Outpatient Surgical Center, Clinic, Home Health Care & Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agiliti Health, Kwipped, Med One, Soma Tech, Avante, Biomedix Medical, Portea, US Med-Equip, Venture Medical, Right Way Medical & Other players |

| Key Drivers | •The Increasing Prevalence of Chronic Diseases Such as Diabetes, Cancer, and Cardiovascular Disorders is a Significant Driver for the Infusion Pump Market. •The Growing Trend towards Home Healthcare, driven by an Aging Population and the Need to Reduce Hospital Stays, is Aiding the Infusion Pump Market Expansion. |

| RESTRAINTS | •The High Cost of Advanced Infusion Pumps and the Ongoing Expenses Related to their Maintenance and Calibration are Hindering the Growth of the Market. •The Infusion Pump Market Faces Challenges Related to Product Recalls and Failures, which can result from Technical Issues, Software Malfunctions, Or Design Flaws Limiting the Market Growth. |