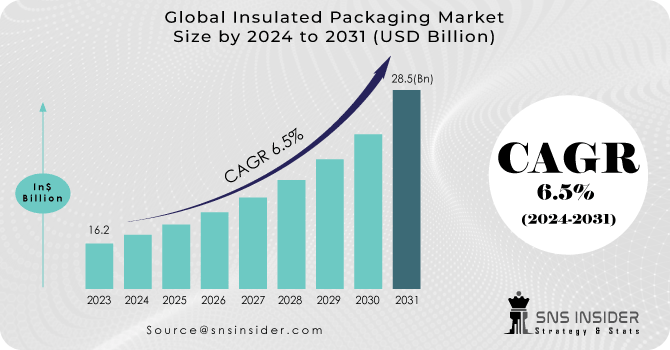

The Insulated Packaging Market Size was valued at USD 16.2 billion in 2023 and is expected to reach USD 28.5 billion by 2031 and grow at a CAGR of 6.5 % over the forecast period 2024-2031.

Consumers are increasingly opting for fresh, pre-packaged meals, delivered groceries, and prepared meal kits. This surge in demand for perishable goods necessitates temperature-controlled packaging to ensure food safety and maintain freshness during transport.

Get More Information on Insulated Packaging Market - Request Sample Report

For instance, a company like HelloFresh relies on insulated boxes with ice packs to deliver fresh ingredients directly to consumers' doorsteps. The meteoric rise of e-commerce has significantly impacted the insulated packaging market. Online grocery shopping and pharmaceutical deliveries require reliable temperature control to maintain product quality. Insulated packaging solutions ensure these items reach customers in optimal condition, minimizing spoilage and wasted food/medicine.

For example, companies like Amazon are investing in insulated packaging solutions made from recycled content to cater to the growing demand for sustainable e-commerce deliveries. also, the growing demand for biopharmaceuticals and other temperature-sensitive drugs necessitates robust cold chain logistics. Insulated packaging with advanced materials and features like temperature monitoring helps ensure the efficacy and safe transport of these life-saving medications. For instance, companies like FedEx offer specialized cold-chain packaging solutions for pharmaceuticals, employing insulated containers and temperature monitoring devices.

KEY DRIVERS:

The rise in the demand for temperature-sensitive products has given growth to the market

The rise of online grocery shopping and meal kit delivery services has created a massive demand for temperature-controlled packaging.

The expansion of cold chain logistics, including the storage and transportation of temperature-controlled goods, will have a direct impact on the insulated packaging market.

The growing demand for temperature-sensitive products such as pharmaceuticals, biologics, perishables and perishables has increased the need for insulated packaging solutions. Insulated packaging helps maintain the desired temperature range during storage and transportation, ensuring product quality and safety.

RESTRAINTS:

Rising raw material costs is restraining the market growth

Some insulated packaging solutions are reusable, while others are designed for single use.

Rising raw material costs such as insulation, polymers and specialty packaging components can put pressure on manufacturers of insulation packaging. Increased procurement costs for these materials can directly impact production costs, which can lead to lower profit margins for manufacturers. This can be difficult, especially for small businesses with limited pricing flexibility.

OPPORTUNITIES:

Expanding Pharmaceutical Market pose several Opportunities.

There are untapped opportunities for insulating packaging in emerging markets and industries.

The growing demand for biopharmaceuticals and other temperature-sensitive drugs is another Opportunity. These medications require strict temperature control during storage and transportation to maintain their efficacy. Insulated packaging solutions with advanced materials and phase-change technologies can ensure these life-saving drugs reach patients in perfect condition. For example, companies like FedEx offer specialized cold-chain packaging solutions for pharmaceuticals, employing insulated containers and temperature monitoring devices.

CHALLENGES:

Balancing cost efficiency for insulated packaging solutions can be a major challenge

The insulated packaging market is susceptible to fluctuations in raw material prices.

Fluctuations in the cost of oil, for instance, can impact the price of plastic-based insulated materials. Manufacturers need to find ways to optimize production processes and explore alternative, cost-stable materials to ensure affordability for businesses and consumers.

The conflict between Russia and Ukraine disrupted the supply chain and operations of the insulated packaging market. Conflicts lead to various trade restrictions, border closures and logistical challenges, which directly affected the flow of raw materials and finished products within the industry. Glass, plastic and other raw materials are required for the production of insulated packaging. The war caused a hike in the prices of raw materials. There are 50-65 manufacturers of glass and 300-400 manufacturers who supply raw materials to other nations in the Russian and Ukrainian markets. More than 70% of these factories have already resumed production. Almost all components for window production are produced in Ukrainian factories. This dispute may also affect the transportation and logistics operations of the thermal insulation packaging market. Border closures, checkpoints, and security measures can cause delays and bottlenecks in the movement of goods in affected areas. This can impact the timely delivery of raw materials to manufacturers and the distribution of finished insulated packaged products to customers. Businesses may need to find alternative transportation or incur additional costs for rush deliveries, which can affect their profit margins and overall competitiveness.

When economic conditions tighten, consumers tend to prioritize essential goods and cut back on discretionary spending. This can lead to a decrease in demand for certain products that rely heavily on insulated packaging. For example, restaurant takeout meals or premium grocery items delivered to your doorstep might become less frequent purchases. This translates to a decline in insulated packaging needed for these deliveries. During an economic slowdown, businesses across the supply chain may face tighter budgets. This can lead to cost-cutting measures that impact their use of insulated packaging. Companies might opt for less expensive, non-insulated options for specific products, even if it risks compromising quality or freshness. Imagine a bakery chain that usually delivers fresh pastries in insulated boxes. To save costs during a slowdown, they might switch to standard cardboard boxes, potentially impacting the quality of their delivered goods. Economic uncertainty can also lead businesses to delay investments in new technologies or infrastructure. This could impact the adoption of advanced insulated packaging solutions, such as those with temperature monitoring or longer-lasting insulation properties. For instance, a pharmaceutical company planning to implement a new cold-chain distribution system with high-tech insulated containers might postpone the project due to economic anxieties.

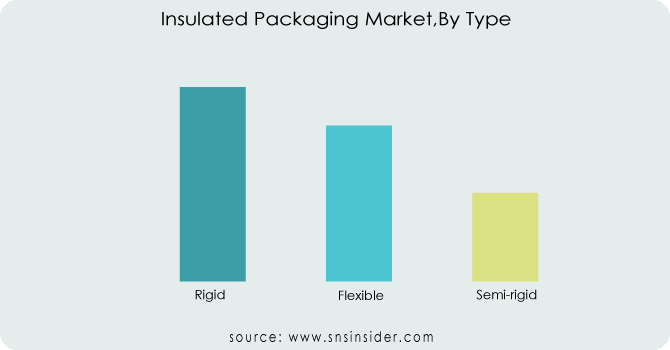

By Type

Rigid

Flexible

Semi-rigid

The rigid sector had the highest revenue share of 39.7%. Rigid packing products are made of paperboard, fiberboard, plastics, corrugated cardboard, and paper. The products are used to make stiff items including cases, trays, bottles, cans, cups, pots, and boxes. Rigid items are sealed with adhesives, staples, and tapes. The goods can be made with radio-frequency identification (RFID) and a variety of color printing options. The flexible category is predicted to increase at a 5.6% CAGR over the projection period. Flexible items are made using plastic films and plywood. Graphics are put into the packaging to make it appealing to consumers. Flexible packaging materials are sealed using pressure and heat. Plastic polymers are utilized to create flexible packaging items. Semi-rigid items are not flexible or rigid in nature. End-use products include folding cartons, lined cartons, aseptic cartons, and thermoformed containers. Semi-rigid IP goods are made from polypropylene and polyethylene. The items are lightweight, resistant to temperatures below freezing, and suited for refrigeration.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Product

Metal

Corrugated

Cardboard

Glass

Others

The corrugated cardboards segment had the highest revenue share of 27.7% in 2022. Corrugated cardboard consists of linerboard and fluted corrugated sheet. These components strengthen corrugated cardboard and enable it endure high levels of pressure. Corrugated cardboard is often made using flute lamination machines. The cardboards are quite strong in terms of impact, bending, tear, and burst resistance. Corrugated cardboard comes in a variety of flute types (A, B, C, E, etc.) with different thicknesses and wave patterns. This allows for customization based on the specific weight and protection needs of your product. For instance, delicate electronics might require a thicker double-walled construction with a finer flute type (E flute) for superior cushioning, while a book might be perfectly suited for a single-walled B flute offering a balance of protection and cost.

By Application

Pharmaceutical

Cosmetic

Industrial

Food & Beverages

Others

Based on Product, the food and beverage segment had the highest revenue share, at 26.1%. Insulated packaging (IP) for food and beverages prevents tampering, protects against physical damage, and maintains the nutritional value of the product. Food and beverage goods must be protected from temperature and pressure fluctuations because they are perishable and may become unusable by the time they reach their destination. The pharmaceutical segment is predicted to increase at the fastest rate of 6.1% over the projection period. Pharmaceutical intellectual property is subject to severe rules around the world because of its use in the healthcare sector and the harm it can do to patients owing to disparities. Regulatory agencies in this area assess issues such as patient safety, shelf life, migration of packaging products into the medicines, sterility, heat, moisture, and degradation of drugs by oxygen content.

North America boasts a well-established healthcare system with a strong emphasis on pharmaceuticals. This translates to a significant demand for insulated packaging to ensure the safe and effective transport of temperature-sensitive medications, vaccines, and biological samples. North America has rigorous food safety regulations mandating proper temperature control during transportation and storage of perishable food items. This creates a robust market for insulated packaging solutions that guarantee food safety and minimize spoilage. Busy lifestyles and a preference for convenience in North America fuel the demand for pre-packaged meals and meal-kit delivery services. These offerings require insulated packaging to maintain freshness and quality during transport, directly impacting the market. North America is a hub for innovation in packaging technologies. Manufacturers are constantly developing new and improved insulated packaging solutions with features like enhanced thermal performance, biodegradability, and tamper-evident closures. These advancements cater to the specific needs of various industries and contribute to market growth.

Eg. The United States: The U.S. healthcare and pharmaceutical industries are major drivers of demand for insulated packaging, with a growing focus on cold chain logistics for temperature-sensitive medications.

Asia Pacific region is dominating the Insulated Packaging Market. Across Asia Pacific, rapid urbanization and growing disposable incomes are leading to a surge in the consumption of packaged foods. Busy lifestyles and a growing preference for convenience are driving this trend. This translates to a massive need for insulated packaging to ensure the safety, freshness, and quality of these packaged foods during transport and storage. also, the pharmaceutical industry in Asia Pacific is experiencing phenomenal growth. This is due to factors like, Aging population, Rise of biopharmaceuticals, Expanding healthcare access. The rise of modern food retail chains across Asia Pacific is another significant driver. These chains often have extensive distribution networks that require insulated packaging to ensure the freshness and quality of perishable food items as they travel from warehouses to stores.

Eg. China's massive population and booming e-commerce industry create a huge demand for insulated packaging for food and pharmaceutical products.

India's growing middle class and expanding cold chain infrastructure are driving the demand for insulated packaging in the food and pharma sectors.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Insulated Packaging market are American Aerogel Corporation, Huhtamaki Oyj, Sonoco Products Company, Thermal Packaging Solutions, Insulated Products Corporation, Deutsche Post DHL, Amcor Ltd, Temper Pack, Exeltainer, and other players.

In April 2024, Eco-Friendly Focus, Sealed Air Corporation.

A major player in packaging solutions, announced a collaboration with BASF (a chemical giant) to develop next-generation, bio-based materials for insulated packaging. This partnership aims to create high-performance, compostable insulation solutions, addressing the growing demand for sustainable packaging options.

In February 2024, Collaboration for Pharmaceutical Cold Chain.

Sonoco Products, a manufacturer of rigid insulated containers, partnered with TempGuard Solutions, a cold chain logistics provider. This collaboration aims to offer comprehensive, temperature-controlled packaging solutions for the pharmaceutical industry, ensuring the safe and efficient transport of critical medications and vaccines.

| Report Attributes | Details |

| Market Size in 2023 | US$ 16.2 Billion |

| Market Size by 2031 | US$ 28.5 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Plastic, Wood, Glass, Metal, Others) • By Packaging Form (Rigid, Flexible, Semi-Rigid), • By Packaging Type (Box & Container, Flexible Blanket, Bags, Wraps, Others) • By Application (Cosmetic, Food & Beverages, Pharmaceutical, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | American Aerogel Corporation, Huhtamaki Oyj, Sonoco Products Company, Thermal Packaging Solutions, Insulated Products Corporation, Deutsche Post DHL, Amcor Ltd, Temper Pack, Exeltainer |

| Key Drivers | • The rise in the demand for temperature-sensitive products has given growth to the market • The expansion of cold chain logistics, including the storage and transportation of temperature-controlled goods, will have a direct impact on the insulated packaging market. |

| Market Restraints | • Rising raw material costs is restraining the market growth |

Ans. The Compound Annual Growth rate for Insulated Packaging Market over the forecast period is 4.85 %.

Ans. The Insulated Packaging Market size was USD 9.75 billion in 2023 and is expected to Reach USD 14.24 billion by 2031.

Ans. Asia Pacific region is dominating the Insulated Packaging Market due to the rapidly increasing consumption of packaged foods.

Ans. Rising raw material costs is restraining the market.

Ans. The rise in the demand for temperature-sensitive products has given growth to the market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Insulated Packaging Market, By Type

9.1 Introduction

9.2 Trend Analysis

9.3 Rigid

9.4 Flexible

9.5 Semi-rigid

10. Insulated Packaging Market, By Product

10.1 Introduction

10.2 Trend Analysis

10.3 Metal

10.4 Corrugated

10.5 Cardboard

10.6 Glass

10.7 Others

11. Insulated Packaging Market, By Application

11.1 Introduction

11.2 Trend Analysis

11.3 Pharmaceutical

11.4 Cosmetic

11.5 Industrial

11.6 Food & Beverages

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Insulated Packaging Market, By Country

12.2.3 North America Insulated Packaging Market, By Type

12.2.4 North America Insulated Packaging Market, By Product

12.2.5 North America Insulated Packaging Market, By Application

12.2.6 USA

12.2.6.1 USA Insulated Packaging Market, By Type

12.2.6.2 USA Insulated Packaging Market, By Product

12.2.6.3 USA Insulated Packaging Market, By Application

12.2.7 Canada

12.2.7.1 Canada Insulated Packaging Market, By Type

12.2.7.2 Canada Insulated Packaging Market, By Product

12.2.7.3 Canada Insulated Packaging Market, By Application

12.2.8 Mexico

12.2.8.1 Mexico Insulated Packaging Market, By Type

12.2.8.2 Mexico Insulated Packaging Market, By Product

12.2.8.3 Mexico Insulated Packaging Market, By Application

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Insulated Packaging Market, By Country

12.3.2.2 Eastern Europe Insulated Packaging Market, By Type

12.3.2.3 Eastern Europe Insulated Packaging Market, By Product

12.3.2.4 Eastern Europe Insulated Packaging Market, By Application

12.3.2.5 Poland

12.3.2.5.1 Poland Insulated Packaging Market, By Type

12.3.2.5.2 Poland Insulated Packaging Market, By Product

12.3.2.5.3 Poland Insulated Packaging Market, By Application

12.3.2.6 Romania

12.3.2.6.1 Romania Insulated Packaging Market, By Type

12.3.2.6.2 Romania Insulated Packaging Market, By Product

12.3.2.6.4 Romania Insulated Packaging Market, By Application

12.3.2.7 Hungary

12.3.2.7.1 Hungary Insulated Packaging Market, By Type

12.3.2.7.2 Hungary Insulated Packaging Market, By Product

12.3.2.7.3 Hungary Insulated Packaging Market, By Application

12.3.2.8 Turkey

12.3.2.8.1 Turkey Insulated Packaging Market, By Type

12.3.2.8.2 Turkey Insulated Packaging Market, By Product

12.3.2.8.3 Turkey Insulated Packaging Market, By Application

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Insulated Packaging Market, By Type

12.3.2.9.2 Rest of Eastern Europe Insulated Packaging Market, By Product

12.3.2.9.3 Rest of Eastern Europe Insulated Packaging Market, By Application

12.3.3 Western Europe

12.3.3.1 Western Europe Insulated Packaging Market, By Country

12.3.3.2 Western Europe Insulated Packaging Market, By Type

12.3.3.3 Western Europe Insulated Packaging Market, By Product

12.3.3.4 Western Europe Insulated Packaging Market, By Application

12.3.3.5 Germany

12.3.3.5.1 Germany Insulated Packaging Market, By Type

12.3.3.5.2 Germany Insulated Packaging Market, By Product

12.3.3.5.3 Germany Insulated Packaging Market, By Application

12.3.3.6 France

12.3.3.6.1 France Insulated Packaging Market, By Type

12.3.3.6.2 France Insulated Packaging Market, By Product

12.3.3.6.3 France Insulated Packaging Market, By Application

12.3.3.7 UK

12.3.3.7.1 UK Insulated Packaging Market, By Type

12.3.3.7.2 UK Insulated Packaging Market, By Product

12.3.3.7.3 UK Insulated Packaging Market, By Application

12.3.3.8 Italy

12.3.3.8.1 Italy Insulated Packaging Market, By Type

12.3.3.8.2 Italy Insulated Packaging Market, By Product

12.3.3.8.3 Italy Insulated Packaging Market, By Application

12.3.3.9 Spain

12.3.3.9.1 Spain Insulated Packaging Market, By Type

12.3.3.9.2 Spain Insulated Packaging Market, By Product

12.3.3.9.3 Spain Insulated Packaging Market, By Application

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Insulated Packaging Market, By Type

12.3.3.10.2 Netherlands Insulated Packaging Market, By Product

12.3.3.10.3 Netherlands Insulated Packaging Market, By Application

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Insulated Packaging Market, By Type

12.3.3.11.2 Switzerland Insulated Packaging Market, By Product

12.3.3.11.3 Switzerland Insulated Packaging Market, By Application

12.3.3.1.12 Austria

12.3.3.12.1 Austria Insulated Packaging Market, By Type

12.3.3.12.2 Austria Insulated Packaging Market, By Product

12.3.3.12.3 Austria Insulated Packaging Market, By Application

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Insulated Packaging Market, By Type

12.3.3.13.2 Rest of Western Europe Insulated Packaging Market, By Product

12.3.3.13.3 Rest of Western Europe Insulated Packaging Market, By Application

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Insulated Packaging Market, By Country

12.4.3 Asia-Pacific Insulated Packaging Market, By Type

12.4.4 Asia-Pacific Insulated Packaging Market, By Product

12.4.5 Asia-Pacific Insulated Packaging Market, By Application

12.4.6 China

12.4.6.1 China Insulated Packaging Market, By Type

12.4.6.2 China Insulated Packaging Market, By Product

12.4.6.3 China Insulated Packaging Market, By Application

12.4.7 India

12.4.7.1 India Insulated Packaging Market, By Type

12.4.7.2 India Insulated Packaging Market, By Product

12.4.7.3 India Insulated Packaging Market, By Application

12.4.8 Japan

12.4.8.1 Japan Insulated Packaging Market, By Type

12.4.8.2 Japan Insulated Packaging Market, By Product

12.4.8.3 Japan Insulated Packaging Market, By Application

12.4.9 South Korea

12.4.9.1 South Korea Insulated Packaging Market, By Type

12.4.9.2 South Korea Insulated Packaging Market, By Product

12.4.9.3 South Korea Insulated Packaging Market, By Application

12.4.10 Vietnam

12.4.10.1 Vietnam Insulated Packaging Market, By Type

12.4.10.2 Vietnam Insulated Packaging Market, By Product

12.4.10.3 Vietnam Insulated Packaging Market, By Application

12.4.11 Singapore

12.4.11.1 Singapore Insulated Packaging Market, By Type

12.4.11.2 Singapore Insulated Packaging Market, By Product

12.4.11.3 Singapore Insulated Packaging Market, By Application

12.4.12 Australia

12.4.12.1 Australia Insulated Packaging Market, By Type

12.4.12.2 Australia Insulated Packaging Market, By Product

12.4.12.3 Australia Insulated Packaging Market, By Application

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Insulated Packaging Market, By Type

12.4.13.2 Rest of Asia-Pacific Insulated Packaging Market, By Product

12.4.13.3 Rest of Asia-Pacific Insulated Packaging Market, By Application

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Insulated Packaging Market, By Country

12.5.2.2 Middle East Insulated Packaging Market, By Type

12.5.2.3 Middle East Insulated Packaging Market, By Product

12.5.2.4 Middle East Insulated Packaging Market, By Application

12.5.2.5 UAE

12.5.2.5.1 UAE Insulated Packaging Market, By Type

12.5.2.5.2 UAE Insulated Packaging Market, By Product

12.5.2.5.3 UAE Insulated Packaging Market, By Application

12.5.2.6 Egypt

12.5.2.6.1 Egypt Insulated Packaging Market, By Type

12.5.2.6.2 Egypt Insulated Packaging Market, By Product

12.5.2.6.3 Egypt Insulated Packaging Market, By Application

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Insulated Packaging Market, By Type

12.5.2.7.2 Saudi Arabia Insulated Packaging Market, By Product

12.5.2.7.3 Saudi Arabia Insulated Packaging Market, By Application

12.5.2.8 Qatar

12.5.2.8.1 Qatar Insulated Packaging Market, By Type

12.5.2.8.2 Qatar Insulated Packaging Market, By Product

12.5.2.8.3 Qatar Insulated Packaging Market, By Application

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Insulated Packaging Market, By Type

12.5.2.9.2 Rest of Middle East Insulated Packaging Market, By Product

12.5.2.9.3 Rest of Middle East Insulated Packaging Market, By Application

12.5.3 Africa

12.5.3.1 Africa Insulated Packaging Market, By Country

12.5.3.2 Africa Insulated Packaging Market, By Type

12.5.3.3 Africa Insulated Packaging Market, By Product

12.5.3.4 Africa Insulated Packaging Market, By Application

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Insulated Packaging Market, By Type

12.5.3.5.2 Nigeria Insulated Packaging Market, By Product

12.5.3.5.3 Nigeria Insulated Packaging Market, By Application

12.5.3.6 South Africa

12.5.3.6.1 South Africa Insulated Packaging Market, By Type

12.5.3.6.2 South Africa Insulated Packaging Market, By Product

12.5.3.6.3 South Africa Insulated Packaging Market, By Application

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Insulated Packaging Market, By Type

12.5.3.7.2 Rest of Africa Insulated Packaging Market, By Product

12.5.3.7.3 Rest of Africa Insulated Packaging Market, By Application

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Insulated Packaging Market, By country

12.6.3 Latin America Insulated Packaging Market, By Type

12.6.4 Latin America Insulated Packaging Market, By Product

12.6.5 Latin America Insulated Packaging Market, By Application

12.6.6 Brazil

12.6.6.1 Brazil Insulated Packaging Market, By Type

12.6.6.2 Brazil Insulated Packaging Market, By Product

12.6.6.3 Brazil Insulated Packaging Market, By Application

12.6.7 Argentina

12.6.7.1 Argentina Insulated Packaging Market, By Type

12.6.7.2 Argentina Insulated Packaging Market, By Product

12.6.7.3 Argentina Insulated Packaging Market, By Application

12.6.8 Colombia

12.6.8.1 Colombia Insulated Packaging Market, By Type

12.6.8.2 Colombia Insulated Packaging Market, By Product

12.6.8.3 Colombia Insulated Packaging Market, By Application

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Insulated Packaging Market, By Type

12.6.9.2 Rest of Latin America Insulated Packaging Market, By Product

12.6.9.3 Rest of Latin America Insulated Packaging Market, By Application

13. Company Profiles

13.1 MARKO FOAM PRODUCTS

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Huhtamaki Oyj

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Sonoco Products Company

13.3.1 Company Overview

13.3.2 Financial

13.3.3Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 DuPont

13.4.1 Company Overview

13.4.2 Financial

13.4.3Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Amcor plc

13.5.1 Company Overview

13.5.2 Financial

13.5.3Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Deutsche Post AG

13.6.1 Company Overview

13.6.2 Financial

13.6.3Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Innovative Energy Inc.

13.7.1 Company Overview

13.7.2 Financial

13.7.3Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

14.8 TP Solutions GMBH

14.8.1 Company Overview

14.8.2 Financial

14.8.3 Products/ Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

15.9 Cold Ice Inc.

15.9.1 Company Overview

15.9.2 Financial

15.9.3 Products/ Services Offered

15.9.4 SWOT Analysis

15.9.5 The SNS View

16.10 Ecovative LLC.

16.10.1 Company Overview

16.10.2 Financial

16.10.3 Products/ Services Offered

16.10.4 SWOT Analysis

16.10.5 The SNS View

17 Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

17.3.1 Industry News

17.3.2 Company News

17.3.3 Mergers & Acquisitions

18. Use Case and Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The E-commerce Logistics Market Size was valued at USD 385.52 billion in 2023 and is expected to reach USD 1892.01 billion by 2031, and grow at a CAGR of 22% over the forecast period 2024-2031.

The Screw Top Jar Market size was USD 582 million in 2023 and is expected to Reach USD 859.87 million by 2031 and grow at a CAGR of 5.0% over the forecast period of 2024-2031.

The Dairy Packaging Market size was USD 21.45 billion in 2022 and is expected to Reach USD 30.04 billion by 2030 and grow at a CAGR of 4.3 % over the forecast period of 2023-2030.

The Aluminium Caps & Closures Market size was USD 7.06 billion in 2023 and is expected to Reach USD 9.59 Billion by 2031 and grow at a CAGR of 3.9 % over the forecast period of 2024-2031.

In 2023, the Active & Intelligent Packaging Market size was USD 25.59 billion and is expected to reach USD 50.61 billion by 2031 and grow at a compound annual growth rate of 8.9 % over the forecast period from 2024 to 2031.

The Dual Flap Dispensing Closure Market size was USD 382.38 billion in 2023 and is expected to Reach USD 533.46 billion by 2031 and grow at a CAGR of 4.25 % over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone