Dairy Packaging Market Size:

Get More Information on Dairy Packaging Market - Request Sample Report

The Dairy Packaging Market was valued at USD 26.92 billion in 2023 and is expected to reach USD 39.84 billion by 2032, growing at a CAGR of 4.49% over the forecast period from 2024 to 2032.

The rising preference among consumers for convenience increases the demand for the dairy packaging market. Modern lifestyles require products that are easy to store, transport, and consume on the go. Innovations in packaging include single-serve packs, resealable cartons, and portable bottles. Dairy products like milk, yogurt, and cheese have become more convenient to use and swallow due to this good packaging. With consumers vying for more convenient, ready-to-use food options, packaging is key in meeting these needs, thus hastening the growth of the dairy packaging market.

Dairy products are highly perishable, and the shelf life is thus one of the critical considerations at both the production and consumption levels. Packaging technologies, including aseptic packaging and vacuum sealing, significantly help preserve the freshness of dairy products by preventing spoilage and extending the shelf life of dairy products. This is important in regions where refrigeration infrastructure may be insufficient or when transported distances are high. Packaging is influencing the growth of the dairy packaging market since it ensures that dairy products always have that freshness and are thus rendered safe for consumption, also reducing wastage and ensuring that products reach wider markets.

Technological innovations are transforming the dairy packaging market by introducing smarter, more efficient solutions. Packaging materials such as multi-layer plastics for enhanced barrier properties-are combined with active packaging technologies to stretch freshness and help meet evolving consumer demands. Integration of newer technologies such as smart packaging that tracks temperature and freshness is also increasing. These advancements ensure that dairy products reach consumers safely while maintaining high-quality standards. The dairy packaging market stands to gain from ever-evolving technology, providing smoother, cheaper, and consumer-friendly solutions.

Dairy Packaging Market Dynamics

Drivers:

-

Packaging preserves dairy products by preventing spoilage and extending freshness, driving demand in the dairy packaging market.

Packaging is one of the driving areas of preservation for the dairy industry because it prevents spoilage and provides freshness for dairy products. Since dairy products are highly perishable, they are prone to bacterial development, contamination, and deterioration by light, air, and temperature. Advanced packaging technologies, including vacuum sealing, modified atmosphere packaging, and aseptic packaging, help to achieve an ideal environment in which dairy products can be stored for an extended time. This not only ensures that products remain fresh and safe to use but also reduces waste; thus, packaging is essential to meet consumer demand and drive growth in the dairy packaging market.

-

Demand for well-designed and high-quality packaging is driven by the growing organized retailers and e-commerce channels in the dairy marketplace.

-

The growing popularity of plant-based dairy alternatives is creating new opportunities for specialty packaging specific to the needs of the dairy packaging market.

Restrain:

-

Strict environmental and food safety regulations increase production complexities and costs.

Strict environmental and food safety regulations are restraints for the dairy packaging market, as they pose significant operational challenges to manufacturers to comply with such regulations. Significant investment in research, testing, and certifications of materials that ensure food contact and eco-friendliness has to be carried out by manufacturers. Switching over to recyclable or biodegradable materials generally increases production costs and demands technological development. Additionally, different regulations in various regions make it challenging for global players and create region-specific solutions for various markets. This not only increases the cost of production but also slows down innovation and time-to-market, making it very difficult for smaller manufacturers to compete effectively.

-

Rising raw material costs challenge profitability for dairy packaging manufacturers.

-

Limited cold storage and logistical infrastructure in developing regions hinder market growth.

Dairy Packaging Market Segment Analysis:

By Material Type:

In 2023, the plastic segment dominated the dairy packaging market and accounted for 45% of the total market due to its versatility, durability, and excellent barrier properties which protect dairy products like milk, yogurt, and cheese from contamination and extend shelf life. Furthermore, its lightweight nature reduces transportation costs and carbon emissions, thus being both economically viable and environmentally friendly. In addition, innovations in biodegradable and recyclable plastics increase the appeal of this segment.

On the other hand, paper and paperboard segment is the fastest-growing segment during the forecast period. This growth is fueled by rising consumer demand for eco-friendly packaging. Paper and paperboard are biodegradable, and recyclable, and facilitate further growing use in dairy packaging through enhanced moisture resistance and strength.

By Product:

In 2023, the Rigid packaging segment dominated the market. This is because it can form a safe, tight barrier from sunlight, moisture, and oxygen entry into the packaging, thus avoiding contamination by food matter. In this respect, rigid materials are used favorably for milk, cheese, and yogurt products, which require strength to be protected during storage and transit.

On the other hand, Flexible packaging is the fastest-growing segment. Growth factors include increasing demand for lighter, thinner, and more compact packaging solutions. With increased convenience, portability, and innovation potential, consumer preference is seen to be shifting toward flexible packaging, which could, as of now, pass over rigid packaging.

By Packaging Type:

In 2023, the bottle and Cans segment dominated the market, primarily because of its ability to protect liquid dairy products such as milk, yogurt drinks, and cream. Bottles are normally made from materials like PET (polyethylene terephthalate), which offers protection against contamination, allows for lightweight packaging, and provides recyclability. Also, bottles come with user-friendly attributes, like resealable caps, which enhance consumer convenience. The dominance of the segment is partly ascribed to a growing need for single-serve and on-the-go dairy products.

Meanwhile, the bags and pouches segment is expected to witness the highest growth in 2023, led by the growing demand for flexible, low-cost packaging solutions. Bags and pouches are in demand for cheese, butter, and powdered milk; they find preference over rigid containers because bags and pouches offer flexibility, provide easy storage, and result in lighter packaging that reduces transportation costs and environmental burdens as well. Technological innovations in high-barrier pouches that guard against moisture, oxygen, and light further extend shelf life, while consumer preferences for eco-friendly options are propelling the bags and pouches market.

By application:

In 2023, the Milk segment dominated the market and accounted for 43% of the total market share because of increasing milk and milk-based products consumption like tea, coffee, chocolate, and protein shakes. Diversification of milk products, such as flavored milk, lactose-free milk, organic milk, and fortified options, can increase demand for certain types of packaging specifically designed for these categories. For consumers, it offers essential nutritional benefits, especially for bone health. With its natural form always highly in demand among consumers, the demand for milk packaging solutions continues to increase.

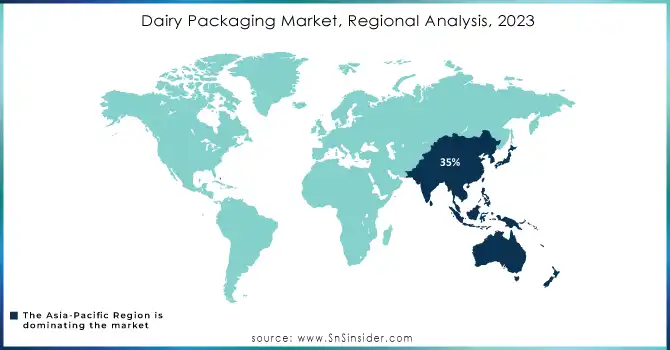

Dairy Packaging Market Regional Analysis:

In 2023, the Asia Pacific region dominated the market and accounted for the highest revenue share of 35%, mainly because of a rapidly growing population, rising disposable incomes, and a tremendous increase in dairy consumption in countries like China and India. The region is witnessing an increasing demand for both traditional and plant-based alternatives to dairy products, which further fuels the need for diverse packaging solutions. Attraction and efficiency, brought about by attractive and efficient packaging, contribute to the growth of the retail sector and e-commerce, thus indirectly boosting market demand.

North America is the fastest-growing region due to the High consumption of dairy products, including milk, cheese, and yogurt. It further benefits from technological leadership in packaging along with strict food safety regulations, such as that imposed by the U.S. FDA, to protect the safety and quality of dairy packaging. Constant innovation in materials and design supports North America's market position.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players:

-

Sidel

-

Greiner Packaging

-

Sonoco Products Company

-

Berry Global Inc.

-

Constantia Flexibles

-

DS Smith

-

Tetra Pak

-

Winpak LTD

-

Smurfit Kappa

-

Stanpac Inc

-

Alfipa

-

Sealed Air

-

Graham Packaging

-

AptarGroup Inc. (U.S.)

-

Silgan Holdings (U.S.)

-

WestRock

-

Nampack Plastics

Recent Development:

Sidel: In 2023, Sidel launched an ultra-compact, lightweight PET bottle that is intended for liquid dairy products, offering a compacted solution for manufacturers. It comes with capacities of 65 to 150 milliliters, suitable for items like drinking and probiotic yogurts. The mini-size bottle will help enhance convenience and efficacy as they will be easier to handle and transport while having the quality and freshness of the dairy products.

Arla Foods: To decrease plastic usage, Arla Foods collaborated with sustainable startup Blue Ocean Closures to design fiber-based caps for its milk cartons. The newly developed fiber-based caps are designed with sustainable raw materials and a thin barrier coating, manufactured using advanced vacuum press forming technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 26.92 Billion |

| Market Size by 2032 | US$ 39.84 Billion |

| CAGR | CAGR of 4.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Metal, Plastic, Glass, Paper & Paperboard) • By Product (Rigid, Flexible) • By Packaging Type (Boxes, Films & Wraps, Bottles & Cans, Bags & Pouches, Others) • By Application (Milk, yogurt, Cheese, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Eczacibasi-Monrol Nuclear Products, GE Healthcare, Jubilant Radiopharma, Canadian Nuclear Laboratories (CNL), Mallinckrodt Pharmaceuticals, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, LLC, Curium, Nordion Inc., Isotopen Technologien München (ITM) |

| Key Drivers | • Packaging preserves dairy products by preventing spoilage and extending freshness, driving demand in the dairy packaging market. |

| Restraints | • Strict environmental and food safety regulations increase production complexities and costs. |