Packaging Laminates Market scope & overview:

Packaging Laminates Market Size was valued at USD 6.4 billion in 2023 and is expected to reach USD 9.03 billion by 2031 and grow at a CAGR of 4.4% over the forecast period 2024-2031.

The packaging laminates market is thriving due to its extensive use in the booming food industry. Laminates offer superior strength, protection during transport, and extended shelf life for packaged foods, making them ideal for the growing demand for convenience. This rise in popularity is further fueled by the projected growth of the flexible packaging industry, particularly foil laminated pouches and multi-layered aluminum foil solutions. These innovative laminates cater to the need for better product protection and come in various types like BOPP and PET films.

Get more information on Packaging Laminates Market - Request Free Sample Report

Additionally, the shift away from traditional rigid packaging towards lightweight, flexible, and durable laminated pouches is a major trend. Manufacturers are constantly investing in R&D to create new solutions with extended shelf life and user-friendly features. Laminated cardboard is another popular option for its versatility across food, pharmaceuticals, and cosmetics industries. Laminated poly pouches offer excellent protection for various food and non-food items, while laminated food packaging solutions boast a wide range of colors, designs, and finishes that enhance product safety, visibility, and marketing appeal. Consumer convenience and attractive packaging drive growth, with some even paying extra for easy storage and longer shelf life.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing consumer interest in eco-friendly packaging will boost demand for laminated paper solutions.

-

The end-use industries are driving growth in the flexible packaging market.

While traditionally rigid containers like glass and metal were favored for their strength and protection, they can be fragile and bulky. As packaging has advanced, manufacturers have developed flexible laminated pouches that offer similar protection with the added benefits of being lightweight, flexible, and more durable. This shift reflects consumer preference for convenience and efficiency in packaging solutions.

RESTRAINTS:

-

Environmental concerns and stricter anti-plastic regulations threaten the laminate packaging market.

Growing public pressure and stricter regulations against plastic pollution are pushing for alternatives to laminate packaging, especially those with non-biodegradable components.

-

The ups and downs of raw material prices can squeeze laminate producers' profit margins.

OPPORTUNITIES:

-

Consumer goods packaging is experiencing a revolution with a surge in creative and user-friendly options.

Laminated food packaging presents a double advantage for both companies and consumers. With a wide variety of colors, designs, and finishes, it provides superior shelf appeal and grabs attention. But it's not just about looks - these laminates also offer superior protection and sealing, keeping food fresh and safe. Compared to bulky rigid options, laminated packaging is more versatile and can be customized with features for added convenience.

-

Public anxiety over plastic pollution is expected to propel the market for cellulose films derived from sustainable sources.

CHALLENGES:

-

Strict regulations governing food safety can add complexity and cost to laminate production.

-

Competition from Alternative Packaging Solutions can be challenging for traditional market.

The market is constantly innovating, with the emergence of sustainable packaging options like bioplastics, paper-based solutions, and edible coatings posing a threat to traditional laminates.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war is disrupting the Packaging Laminates Market. Over 300 major Western companies have exited the region, including packaging facility closures in both countries. Mondi, a major paper and packaging company, suspended operations in their Ukrainian plant and is revaluating their presence in Russia. This disruption to production and supply chains, along with potential long-term effects on businesses operating in the area is likely to impact the market.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown brought on by the pandemic could pose challenges for the Packaging Laminates Market. Brands may tighten spending and consumers may prioritize value, potentially leading to lower demand for premium packaging options. However, a bright spot emerges in the e-commerce boom. As online shopping thrives, there could be increased demand for functional and visually appealing packaging solutions for delivery and subscription boxes. This presents an opportunity for laminate producers who can offer cost-effective litho lamination solutions to cater to this growing segment.

KEY MARKET SEGMENTS:

By Material

-

Aluminum Foil

-

Paper & Paperboard

-

Plastic

-

PP

-

PE

-

PET

-

PA

-

Others (EVOH and PVC)

-

Aluminum foil dominating in the laminate packaging market. It excels at blocking light, air, moisture, and even nasty bugs, keeping food, drinks, and medications safe and fresh. This, along with its affordability, lightweight design, and eco-friendly nature, makes it a popular pick across various industries.

By Thickness

-

Up to 30 Microns

-

30 to 45 Microns

-

45 to 60 Microns

-

Above 60 Microns

The most popular type is between 30 and 45 microns with 33% market share. This is due to, it's strong enough to shield products from outside threats but still flexible enough to make packaging a breeze. That's why this middle-ground thickness reigns supreme in the laminate market.

By Packaging Format

-

Films

-

Pouches

-

Tubes

By End-use

-

Food & Beverages

-

Healthcare & Pharmaceuticals

-

Beauty & Personal Care

-

Homecare & Hygiene

Food & Beverages dominates the laminate packaging world, especially for convenient snacks and sweet treats. Laminates keep these goodies fresh and tasty, while also looking great on store shelves with bright colors and clear branding. With our busy lives demanding easy-to-grab food options, this trend towards laminate packaging for on-the-go consumption is only going to keep growing.

REGIONAL ANALYSES

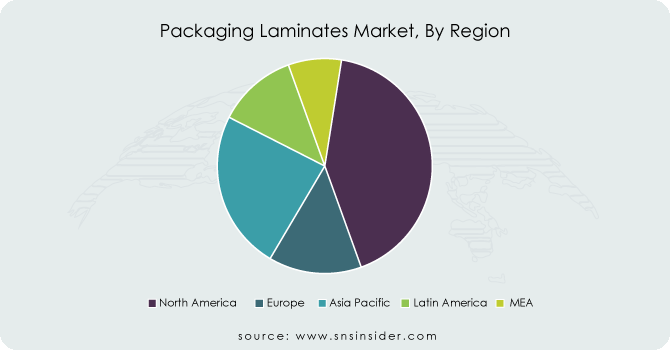

North America leads the pack in laminate packaging thanks to its booming food and beverage industry, craving for convenience food, and growing demand for flexible packaging options. With Canada being a major food exporter to the US, especially processed foods, the future looks bright for laminate packaging in this region. Canada is expected to grab a significant share of the market, contributing millions in revenue by 2034.

Europe trails closely behind North America in the laminate packaging game. Their strong food and pharmaceutical industries, along with a focus on eco-friendly and attractive packaging, drive demand. Germany holds the biggest market share within Europe, while the UK is experiencing the fastest growth. The UK's booming pharmaceutical industry, is a major contributor to this growth. Their focus on research and development, along with a rising need for high-quality packaging, fuels the demand for solvent less lamination techniques. The Asia-Pacific region is the rising market in laminate packaging. With booming populations, growing cities, and more money in people's pockets, the demand for packaged food and drinks is surging. This, combined with a preference for flexible and eco-friendly options, is fueling the laminate market. China currently leads the pack, but India is catching up fast.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Constantia Flexibles Group, Pro Ampac LLC, Coveris Packaging, Berry Global Inc., Andpak Inc., Montebello Packaging Inc., Kimac Industries, Amcor Plc, Elitefill Inc., Mondi Plc and other key players.

RECENT DEVELOPMENT

-

At the CPHI-PMEC India expo held in January 2024, UFlex, a Noida company specializing in flexible packaging, unveiled their newest innovation: a cold-form laminate with holographic effects designed specifically for the pharmaceutical industry.

-

TIPA debuted a home-compostable laminate in the US market in November 2023. This eco-friendly packaging solution is perfect for dry goods like snacks, bread, spices, and even packaged protein items like gummies, fruits, and granola.

-

Amcor brought its AmFiber™ Performance Paper packaging to the North American market in August 2023, marking a strategic expansion of their AmFiber product line.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.4 Bn |

| Market Size by 2031 | US$ 9.03 Bn |

| CAGR | CAGR of 4.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material [Aluminum Foil, Paper & Paperboard, Plastic (PP, PE, PET, PA, Others)] • By Thickness (Up to 30 Microns, 30 to 45 Microns, 45 to 60 Microns, Above 60 Microns) • By Packaging Format (Films, Pouches, Tubes) • By End-use (Food & Beverages, Healthcare & Pharmaceuticals, Beauty & Personal Care, Homecare & Hygiene) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Constantia Flexibles Group, Pro Ampac LLC, Coveris Packaging, Berry Global Inc., Andpak Inc., Montebello Packaging Inc., Kimac Industries, Amcor Plc, Elitefill Inc., Mondi Plc |

| Key Drivers | • Growing consumer interest in eco-friendly packaging will boost demand for laminated paper solutions. • The end-use industries are driving growth in the flexible packaging market. |

| Key Restraints | • Environmental concerns and stricter anti-plastic regulations threaten the laminate packaging market. • The ups and downs of raw material prices can squeeze laminate producers' profit margins. |