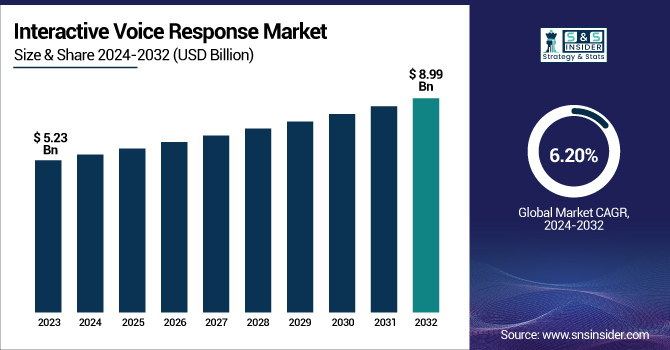

Interactive Voice Response (IVR) Market Size & Growth Analysis:

The Interactive Voice Response Market was valued at USD 5.23 billion in 2023 and is projected to reach USD 8.99 billion by 2032, growing at a CAGR of 6.20% from 2024 to 2032.

To Get more information on Interactive Voice Response Market - Request Free Sample Report

The growth is attributed to technological advancements in artificial intelligence; increasing adoption of artificial intelligence (AI) powered interactive voice response (IVR) systems, and the growing demand for automated customer service solutions.

Artificial intelligence (AI), natural language processing (NLP), and machine learning are integrated into IVR to empower self-services, accelerate the resolution of inquiries and enhance the customer experience. Cloud-based IVR solutions are being adopted with high rates, particularly by small and medium enterprises, due to their scalability and cost-effectiveness. In the U.S., the market was valued at USD 0.88 Billion in 2023 and is expected to reach USD 1.43 billion by 2032 with CAGR 5.56%. Driving IVR adoption are also the continued rollout of digital banking, e-commerce and healthcare services. These findings highlight a growing trend toward personalized, AI-driven IVR systems that promise to make customer interactions smoother, along with innovations in speech analytics and voice biometrics that enhance security and fraud prevention.

IVR System Market Dynamics:

Drivers:

-

Growing Adoption of Cloud-Based IVR for Scalable and Cost-Effective Customer Service

The rising adoption of cloud-based IVR is transforming customer service operations across industries by offering scalability, cost efficiency, and seamless integration with AI-driven technologies. Businesses are increasingly shifting to cloud-based IVR systems due to their low infrastructure costs, faster deployment, and remote accessibility. Cloud-based IVR offers scalability, requiring no expensive hardware and enabling enterprises to scale depending on demand (as opposed to traditional on-premise IVR solutions). Moreover, these solutions easily integrate with various CRM platforms, AI chatbots, and advanced analytics, allowing for personalized and automated customer interactions for businesses. Cloud IVR is being used by most industries such as banking, healthcare, retail, and telecommunications to improve customer engagement, use voice biometrics to enhance security, and streamline workflows. The global cloud-based IVR market is expected to grow significantly with the rise of digital transformation and remote work trends across organizations with an increasing dependence on AI and Omni channel communication.

Restraints:

-

Ensuring Security and Privacy in IVR Systems through Encryption and Biometrics

IVR systems process vast amounts of sensitive customer data, including personal details, financial transactions, and authentication credentials, making them prime targets for cyber threats. As hackers take advantage of the weaknesses in voice-based authentication, the risk of fraud, identity theft, and data breaches is a growing concern. IVR systems can be vulnerable to security breaches and fraud, resulting in financial losses and damage to brands and enterprise reputation when encryption, voice biometrics, and multi-factor authentication are weak or absent. There are also data regulations, such as GDPR, HIPAA, and PCI-DSS, that require companies to set-up data protection mechanisms that can be made complex easily. While they offer scalability, cloud-based IVR solutions can create security concerns due to remote data storage and third-party access risks. To counter these threats, organizations are proactively enhancing their IVR security using AI-based fraud detection tools, advanced encryption techniques, and real-time monitoring to safeguard IVR transactions, instilling confidence for customers when using automated self-service systems.

Opportunities:

-

Boosting IVR Adoption Globally Through Multilingual and Regional Language Support

As businesses expand globally, multilingual IVR solutions are becoming essential for enhancing customer engagement across diverse linguistic markets. Traditional IVR systems often struggle with language barriers, limiting accessibility for non-English speakers. By integrating regional dialects and multiple language options, companies can offer personalized and efficient customer service, improving user satisfaction. Industries such as banking, healthcare, and e-commerce benefit significantly by catering to diverse customer bases with localized IVR support. Advanced AI and natural language processing (NLP) enable real-time language detection and seamless translation, ensuring smooth interactions. As demand for cross-border services and international expansion rises, multilingual IVR adoption presents a major opportunity for businesses to enhance accessibility, reduce call drop rates, and strengthen their global presence.

Challenges:

-

Cloud-Based IVR Systems Rely on Stable Internet Connectivity for Seamless Performance

Cloud-based IVR systems rely heavily on stable internet connectivity, making them vulnerable to service disruptions, latency issues, and downtime in areas with poor network infrastructure. Cloud IVR is used mainly by businesses for customer support, banking transactions and healthcare services, and any breaks in this communication loop can affect user experience and operational efficiency. Many of these challenges are compounded by other technology issues, such as network congestion, bandwidth limitations, and cybersecurity threats. As enterprises, especially in the sectors requiring 24X7 real-time interactions with customers, do face disruptions, small outages can turn into missed calls and frustrated customers along with monetary losses.

Interactive Voice Response (IVR) Industry Segment Analysis:

By Deployment

The cloud-based IVR segment dominated the market with a 76% revenue share in 2023, driven by its scalability, cost-effectiveness, and seamless integration with AI and CRM platforms. Businesses across industries, including BFSI, healthcare, e-commerce, and telecom, are increasingly adopting cloud IVR to enhance customer service, automate call handling, and reduce operational costs. Unlike on-premise solutions, cloud IVR requires minimal hardware investment, offering faster deployment and remote accessibility. Additionally, AI-powered features like speech recognition, sentiment analysis, and predictive analytics are improving customer interactions, making cloud IVR the preferred choice. The growing trend of digital transformation and communication further fuels demand. As businesses prioritize flexibility, remote work solutions, and enhanced customer experience, the cloud IVR segment is expected to maintain its leadership in the coming years.

The on-premise IVR segment is the fastest-growing over the 2024-2032 forecast period, driven by industries prioritizing data security, compliance, and full system control. Sectors such as banking, healthcare, and government prefer on-premise IVR due to strict regulatory requirements and concerns over data privacy. Unlike cloud solutions, on-premise IVR operates without internet dependency, ensuring uninterrupted service even during network failures. Advancements in AI and automation are also enhancing its efficiency, making it a viable option for businesses handling sensitive customer interactions. While initial deployment costs are high, companies seeking customization and long-term cost benefits are increasingly investing in on-premise IVR. As cybersecurity concerns grow, businesses requiring enhanced security and compliance adherence are expected to drive sustained demand for on-premise IVR solutions.

By Enterprise Type

The large enterprise segment dominated the Interactive Voice Response (IVR) market with a 59% revenue share in 2023, driven by high call volumes, advanced automation needs, and strong financial capabilities to invest in AI-powered IVR solutions. Large enterprises in banking, telecom, healthcare, and retail rely on scalable, multi-channel IVR systems to handle customer interactions efficiently while reducing operational costs. The integration of cloud-based IVR, speech analytics, and natural language processing (NLP) enhances customer engagement and self-service capabilities, minimizing the need for live agents. Additionally, the focus on personalized customer experiences, compliance with data security regulations, and seamless CRM integration further strengthens IVR adoption. As enterprises continue digital transformation efforts, demand for intelligent, AI-driven IVR solutions will continue to grow in the coming years.

The Small and Medium Enterprise (SME) segment is the fastest-growing in the Interactive Voice Response (IVR) market from 2024 to 2032, fueled by increasing digital adoption, cost-effective cloud IVR solutions, and the need for enhanced customer engagement. SMEs are leveraging AI-powered IVR, automation, and self-service options to streamline operations, reduce costs, and improve customer satisfaction. The affordability and scalability of cloud-based IVR allow smaller businesses to implement advanced call management systems without heavy infrastructure investments. Industries like e-commerce, fintech, and healthcare startups are rapidly adopting IVR to handle high customer interaction volumes efficiently. As SMEs focus on expanding their digital presence, enhancing customer service, and optimizing business processes, the demand for customized, AI-driven IVR solutions is expected to surge throughout the forecast period.

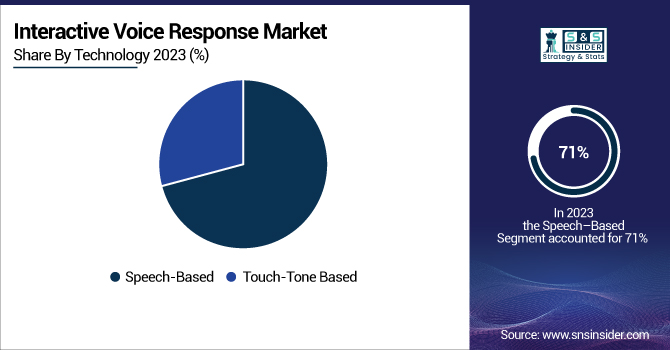

By Technology

The speech-based IVR segment dominated the Interactive Voice Response (IVR) market with a 71% revenue share in 2023, driven by its superior user experience, AI integration, and natural language processing (NLP) capabilities. Businesses across industries, including banking, healthcare, telecom, and retail, prefer speech-based IVR for its ability to understand complex queries, personalize interactions, and reduce caller frustration. Unlike traditional touch-tone systems, speech-based IVR enables faster, hands-free navigation, making it ideal for mobile users and accessibility-focused services. The integration of AI, machine learning, and voice biometrics enhances security, fraud detection, and customer satisfaction. As enterprises focus on automation, personalized self-service, and communication, speech-based IVR adoption is expected to grow further, maintaining its leadership in the market.

The Touch-Tone Based IVR segment is the fastest-growing in the Interactive Voice Response (IVR) market from 2024 to 2032, driven by its cost-effectiveness, ease of deployment, and widespread industry adoption. Many businesses, especially in emerging markets, small enterprises, and sectors with high call traffic like banking, utilities, and customer support centers, prefer touch-tone IVR due to its low implementation costs and compatibility with existing telephony systems. Unlike speech-based IVR, touch-tone systems do not rely on AI or voice recognition, making them more reliable in noisy environments and areas with limited internet access. The continued use of DTMF (Dual-Tone Multi-Frequency) technology ensures seamless integration with legacy infrastructure, further driving adoption. As businesses seek cost-efficient, scalable, and user-friendly IVR solutions, the demand for touch-tone IVR is expected to rise significantly in the forecast period.

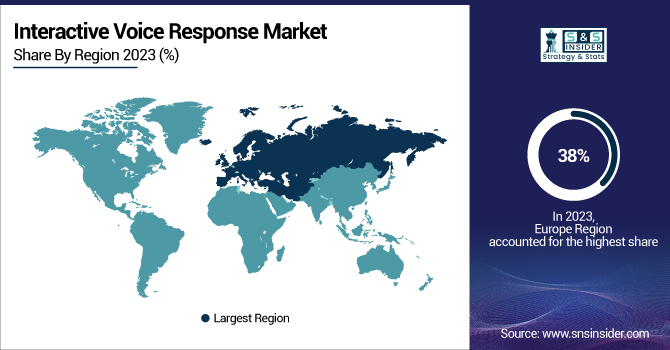

Interactive Voice Response Market Regional Outlook:

The Europe region dominated the Interactive Voice Response (IVR) market with a 38% revenue share in 2023, driven by high adoption of AI-powered IVR solutions, strong telecom infrastructure, and stringent data security regulations. Businesses in banking, healthcare, retail, and government sectors leverage advanced cloud-based IVR systems to enhance customer service and automate interactions. The General Data Protection Regulation (GDPR) has further accelerated the demand for secure IVR solutions with built-in voice biometrics and encryption. Additionally, the growing integration of natural language processing (NLP) and AI-driven automation has boosted IVR efficiency across industries. Countries like Germany, the UK, and France are leading in digital transformation, further fueling market expansion. As European enterprises continue to invest in personalized, AI-driven IVR systems, the region is expected to maintain a significant market position in the coming years.

The Asia-Pacific region is the fastest-growing in the Interactive Voice Response (IVR) market from 2024 to 2032, driven by rapid digital transformation, increasing smartphone penetration, and the rise of AI-driven customer service solutions. Countries like China, India, Japan, and South Korea are witnessing high adoption of cloud-based IVR across industries such as banking, e-commerce, telecom, and healthcare. The expansion of call centers, rising demand for multilingual IVR, and government initiatives promoting digitalization are further fueling market growth. Additionally, the cost-effectiveness of touch-tone IVR and advancements in AI-powered speech recognition are driving adoption. As businesses prioritize automation, self-service, and enhanced customer engagement, the Asia-Pacific IVR market is expected to see significant expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Interactive Voice Response Market are:

-

Nuance Communications Inc. (U.S.) – AI-powered IVR, speech recognition solutions, and voice biometrics

-

Avaya Inc. (U.S.) – Cloud-based IVR, omnichannel customer engagement solutions

-

Cisco Systems Inc. (U.S.) – Unified Contact Center IVR, cloud-based telephony solutions

-

Convergys Corporation (U.S.) – Customer service IVR, automated self-service solutions

-

AT&T Inc. (U.S.) – Network-based IVR, enterprise call center solutions

-

West Corporation (U.S.) – Cloud IVR, hosted contact center solutions

-

Genesys Telecommunication Laboratories Inc. (U.S.) – AI-driven IVR, omnichannel customer engagement platforms

-

Verizon Communications Inc. (U.S.) – Hosted IVR, automated call routing solutions

-

IVR Lab (U.S.) – Custom IVR applications, speech analytics

-

Aspect Software Parent Inc. (U.S.) – AI-driven IVR, workforce optimization solutions

-

24/7 Customer, Inc. (U.S.) – Conversational AI IVR, chatbot integration

-

inContact Inc. (U.S.) – Cloud IVR, automated call handling solutions

-

NewVoiceMedia (UK) – Intelligent IVR, cloud contact center platforms

-

Five9, Inc. (U.S.) – AI-driven IVR, virtual call center software

List of suppliers who provide raw material and component for Interactive Voice Response Market:

-

Qualcomm Inc. (U.S.)

-

Intel Corporation (U.S.)

-

Broadcom Inc. (U.S.)

-

Texas Instruments Inc. (U.S.)

-

Analog Devices Inc. (U.S.)

-

Microsoft Corporation (U.S.)

-

Google LLC (U.S.)

-

IBM Corporation (U.S.)

-

Amazon Web Services (AWS) (U.S.)

-

OpenAI (U.S.)

-

Nokia Corporation (Finland)

-

Ericsson (Sweden)

-

Huawei Technologies Co., Ltd. (China)

-

ZTE Corporation (China)

Recent Development:

-

September 30, 2024 – Nuance Communications is ending support for its on-premise contact center IVR solutions, with sales discontinued from August 9, 2024, and full support ending by June 2026, pushing customers toward Microsoft Azure and Dynamics 365.

-

July 10, 2024 – AT&T partners with Samsung to offer Same Unit Repair (SUR) at nearly 700 locations, enhancing same-day, in-warranty mobile phone repairs with AI-powered customer support tools.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 5.23 Billion |

|

Market Size by 2032 |

USD 8.99 Billion |

|

CAGR |

CAGR of 6.20% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Deployment Model (Cloud, On-premise) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Nuance Communications Inc. (U.S.), Avaya Inc. (U.S.), Cisco Systems Inc. (U.S.), Convergys Corporation (U.S.), AT&T Inc. (U.S.), West Corporation (U.S.), Genesys Telecommunication Laboratories Inc. (U.S.), Verizon Communications Inc. (U.S.), IVR Lab (U.S.), Aspect Software Parent Inc. (U.S.), 24/7 Customer, Inc. (U.S.), inContact Inc. (U.S.), NewVoiceMedia (UK), Five9, Inc. (U.S.) |