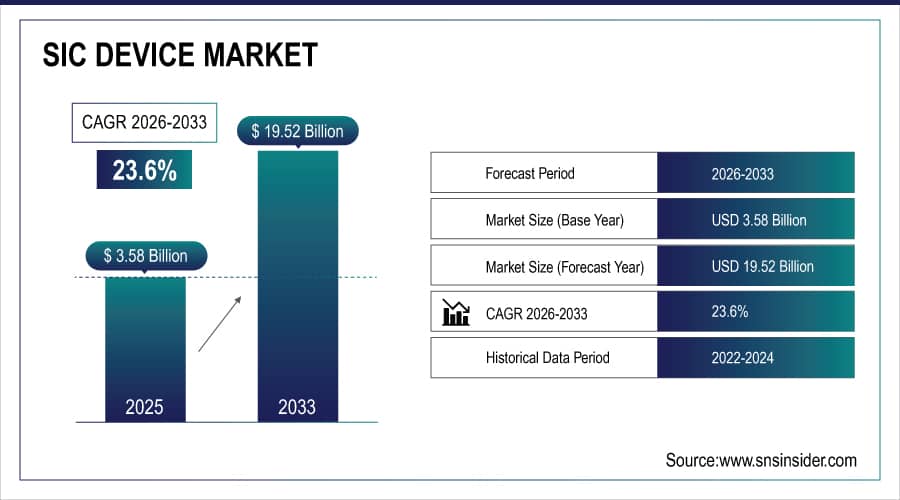

SiC Device Market Size Analysis:

The SiC Device Market size was valued at USD 3.58 billion in 2025E and is expected to grow at a CAGR of 23.6% to reach USD 19.52 billion by 2033.

The Silicon Carbide devices market has been witnessing a considerable growth rate due to the increasing requirement for highly efficient power electronics in various industries. The SiC Device are more beneficial than the traditional silicon-based devices regarding performance at high temperature, high voltage, and high speed. Thus, the growing usage of SiC switches, power ICs, Schottky diodes, and power modules in the automotive, renewable energy, industrial, and telecommunications industries has contributed to the market growth.

To Get More Information On SiC Device Market - Request Free Sample Report

The U.S. Department of Energy’s Office of Electricity launched the American-Made Silicon Carbide Packaging Prize which will award $2.25 million in February 2024. The prize is a competition that encourages participants to put forward, design, construct, and test SiC Device or silicon carbide semiconductor packaging prototypes, to make them work more productively in high-voltage applications, such as energy storage. It forms part of the American-Made Challenges program and will help to further cooperation between the DOE National Labs, the U.S. entrepreneurs and innovators, and the private sector.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 3.58 Billion

-

Market Size by 2033 USD 19.52 Billion

-

CAGR of 23.6% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Key SiC Device Market Trends:

-

Accelerated adoption of SiC devices in renewable energy, particularly in solar and wind power inverters and converters.

-

Superior voltage resistance and high-performance efficiency of SiC in extreme operating conditions driving wider deployment.

-

Rising global investments in renewable energy infrastructure to reduce fossil fuel dependence and combat climate change.

-

Increased government support through R&D funding, tax rebates, subsidies, and grants for SiC technology adoption.

-

Collaborative initiatives between governments, research organizations, and industry players to advance SiC applications in automotive, energy, and manufacturing.

SiC Device Market Growth Drivers:

-

Advancements in Renewable Energy

The renewable energy sector, particularly solar power and wind power, is growing at an accelerated rate as the world turns towards sustainable energy solutions. Utilized in power converters and inverters, SiC Device are driving this expansion by streamlining multiple aspects of power transformer use. SiC inverters do not suffer from higher energy losses alone, as they boast better voltage-resistance capabilities and greater workability placed in extreme circumstances. Furthermore, the current worldwide trend of pouring resources into renewable energy to counteract climate change and lessen our reliance on fossil fuels will likely drive the demand for SiC Device even higher.

-

Supportive Government Policies and Investments

Various governments globally have started to see different purposes of SiC technologies and try to use them to promote energy efficiency and reduce carbon emissions. Many governments throughout the world have started to implement and support various research and developments of SiC Device. This includes financing of research processes and implementation of SiC Device in such fields as automotive, energy, and manufacturing. The government uses various incentives, such as tax rebates, subsidies, and grants to promote it. The governments benefit from less carbon emissions and strive to use collaborative initiatives with the help of research organizations and companies.

SiC Device Market Restraints:

-

The availability of replacement materials like gallium nitride

Gallium nitride is expected to replace silicon carbide due to manifold electrical properties and performance benefits over the latter. The bandgap of GaN is much broader and allows the fabrication of devices that operate at higher voltages and temperatures. Its electron mobility is also greater and, thus, the switching speed is increased. Such devices put to waste less energy. Furthermore, GaN elements are physically smaller and lighter. As such, they are irreplaceable in electric vehicles, solar technology, and telecommunication applications.

SiC Device Market Segment Analysis:

By Product

The power semiconductors segment led the market with a market share of 60% in 2025E. SiC Device have several fundamental qualities such as wide band gap, which makes them a good option for power semiconductors. It also helps in lowering the size of the equipment and makes it more dependable for higher voltages and switching frequencies.

The optoelectronic devices segment is estimated to have a faster CAGR in the forecast period. The growth of this segment can be attributed to the rising application of silicon carbide in high-energy lighting and laser devices. Moreover, silicon carbide is also being widely used in optoelectronic devices including light-emitting diodes, solar cells, photodetectors, and telescopes due to its higher thermal stability.

By Component

The power module segment dominated the market in 2025E with more than 30% of the market share. SiC power modules are used in high-power applications distinguished by the characteristics of the resulting compound blocks. SiC power modules, unlike silicon in classic modules, have a larger bandgap. It leads to higher heat, voltage, and switching levels, meaning less energy lost on resistance and higher efficiency, as well as the possibility of making a smaller and lighter system. Such modules are used in electric vehicles, renewable energy systems, and various other applications.

The FET/MOSFET transistors segment is to show significant growth during the forecast period 2026-2033. The major advantages of silicon carbide FET/MOSFET include higher thermal conductivity, higher critical breakdown field, and a wider band gap. They also increase the current density, reduce the thickness of the device and on-state resistance, and reduce leakage/power loss at high operating temperatures.

By Wafer Size

The 1 inch to 4 inches segment dominated the market in 2025E with a market share of over 44.0%. These silicon carbide devices can be manufactured on large scales, which makes them cost-effective. The demand is expected to remain inclined toward industrial applications. These wafers help in reducing the equipment dimensions and the resultant noise. This will ensure the establishment of prolific opportunities for the growth of the segment over the forecast period.

The 10 inches & above segment is expected to have the fastest CAGR over the forecast period, owing to the commercial scale manufacturing of silicon carbide wafers. The wafers ensure the fabricating of Gallium Nitride devices, which include power devices and LEDs.

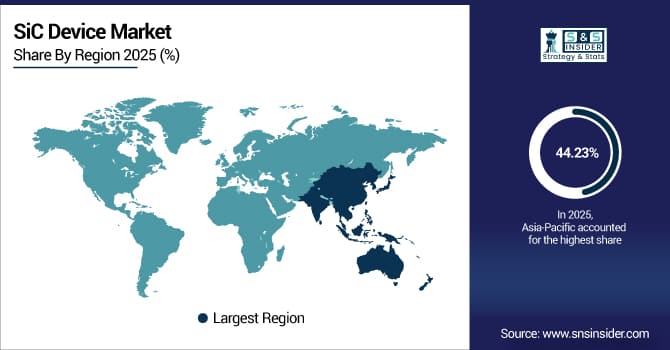

SiC Device Market Regional Analysis:

Asia Pacific SiC Device Market Insights

Asia Pacific held the largest market share of 44.23% in 2025E. This dominance is due to the deployment of SiC Device in end-use industries like consumer electronics, automotive, as well as medical. The demand for SiC Device will be driven by the number of power device manufacturers in the region, especially in Asia. As a high percentage of discrete devices are imported from the region, high demand for SiC Device is likely to increase the value of this market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America SiC Device Market Insights

North America is to grow at a faster CAGR during 2026-2033. The growth of this region is attributed to the presence and concentration of prominent players such as Gene Sic Semiconductor with an established customer base. Additionally, the concentration of these prominent players in this region encourages power electronics manufacturers to better adopt innovative SiC Device with advanced efficiency. Moreover, leading regional players are also implementing strategic initiatives, encouraging the growth of this region.

Europe SiC Device Market Insights

Europe’s SiC device market is expanding steadily, supported by strong renewable energy initiatives, electrification of transport, and government-backed carbon reduction targets. Growing demand for efficient power electronics in automotive, industrial, and energy sectors drives adoption. Strategic collaborations, R&D investments, and supportive EU regulations further enhance SiC technology deployment across advanced applications.

Latin America (LATAM) and Middle East & Africa (MEA) SiC Device Market Insights

LATAM and MEA SiC device markets are gaining traction, fueled by rising renewable energy projects, infrastructure modernization, and gradual adoption of EV technologies. Government initiatives to diversify energy sources, reduce dependency on fossil fuels, and improve grid efficiency are boosting SiC integration. Opportunities exist in solar power, oil & gas, and emerging smart infrastructure applications.

SiC Device Companies are:

-

Fuji Electric Co., Ltd

-

Infineon Technologies AG

-

Microchip Technology Inc.

-

Mitsubishi Electric Corporation

-

Renesas Electronics Corporation

-

ROHM Co., Ltd

-

Toshiba Electronic Devices & Storage Corporation

-

Wolfspeed, Inc.

-

STMicroelectronics N.V.

-

Texas Instruments Incorporated

-

Littelfuse, Inc.

-

GeneSiC Semiconductor Inc.

-

SemiQ, Inc.

-

Alpha & Omega Semiconductor Limited (AOS)

-

UnitedSiC (now part of Qorvo, but still active under Qorvo brand)

-

IXYS Corporation (part of Littelfuse, still manufacturing)

-

Power Integrations, Inc.

-

SK Siltron Co., Ltd

Competitive Landscape for SiC Device Market:

Renesas Electronics Corporation is a leading global semiconductor manufacturer advancing the SiC device market with high-performance solutions for automotive, industrial, and renewable energy applications. The company focuses on SiC MOSFETs and modules that deliver superior energy efficiency, thermal management, and reliability. Leveraging strong R&D, partnerships, and a wide product portfolio, Renesas supports the transition to electric vehicles, clean energy systems, and smart infrastructure, positioning itself as a key player in power electronics innovation.

-

In July 2023 – Renesas and Wolfspeed signed a ten-year wafer supply contract was signed, access to high-quality SiC wafers for power semiconductor production, the amount of 2 billion USD, starting from 2025.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.58 Billion |

| Market Size by 2033 | USD 19.52 Billion |

| CAGR | CAGR of 23.6% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Optoelectronic Devices, Power Semiconductors, Frequency Devices) • By Component (Schottky Diodes, FET/MOSFET Transistors, Integrated Circuits, Rectifiers/Diodes, Power Modules, Others) • By Wafer Size (1 inch to 4 inches, 6 inches, 8 inches, 10 inches & above) • By End-use (Automotive, Consumer Electronics, Aerospace & Defense, Medical Devices, Data & Communication Devices, Energy & Power, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Coherent Corp., Fuji Electric Co., Ltd, Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, ON Semiconductor Corp., Renesas Electronics Corporation, ROHM Co., Ltd, Toshiba Electronic Devices & Storage Corporation, Wolfspeed, Inc., STMicroelectronics N.V., Texas Instruments Incorporated, Littelfuse, Inc., GeneSiC Semiconductor Inc., SemiQ, Inc., Alpha & Omega Semiconductor Limited, UnitedSiC (Qorvo), IXYS Corporation, Power Integrations, Inc., SK Siltron Co., Ltd. |