Investment Banking Market Report Scope & Overview:

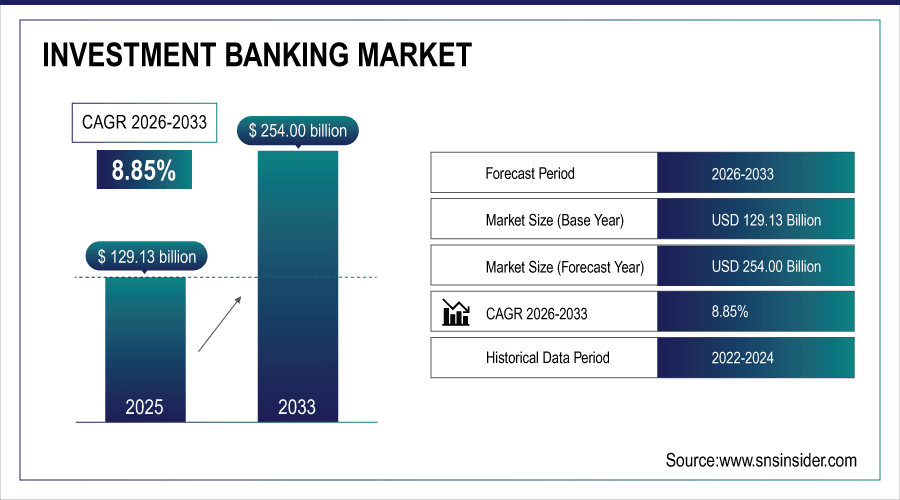

The Investment Banking Market Size was valued at USD 129.13 Billion in 2025 and is projected to reach USD 301.52 Billion by 2035, growing at a CAGR of 8.85% during the forecast period 2026–2035.

The Investment Banking Market analysis offers M&A advisory, capital raising, underwriting, and trading & brokerage services for corporates to high-net-worth individuals. Market Segmentation on the basis of transaction types and fee models, the market is bifurcated. Increasing global capital market activity, growth, corporate financing needs, and demand for specialty financial advisory services in all major regions vice market growth.

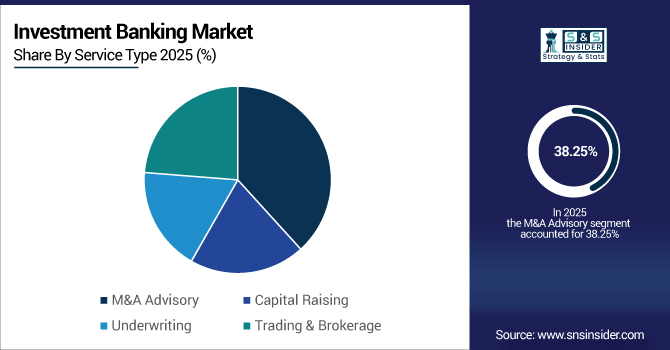

In 2025, the Investment Banking Market is expected to be dominated by M&A advisory, capital raising and underwriting services, which together account for nearly 58%. This dominance is attributed to growing corporate financing needs and capital market activities across the globe.

Market Size and Forecast:

-

Market Size in 2025: USD 129.13 Billion

-

Market Size by 2035: USD 301.52 Billion

-

CAGR: 8.85% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get More Information On Investment Banking Market - Request Free Sample Report

Investment Banking Market Trends:

-

The investment banking model is evolving beyond classic advisory, as digital platforms and freemium fintech products make access to deals more accessible than ever before.

-

Demand for M&A advisory, capital raising, and structured finance services continues to grow with globalisation and cross border transactions.

-

Technology-enabled trading and analytics are transforming underwriting and brokerage, for quicker decisions based on more data.

-

Alternative fee structures are getting taker, with performance-based and success fees beginning to look attractive among clients.

-

North America and APAC continue to be the main growth regions, supported by increasing requirements for corporate financing and active capital markets.

U.S. Investment Banking Market Insights:

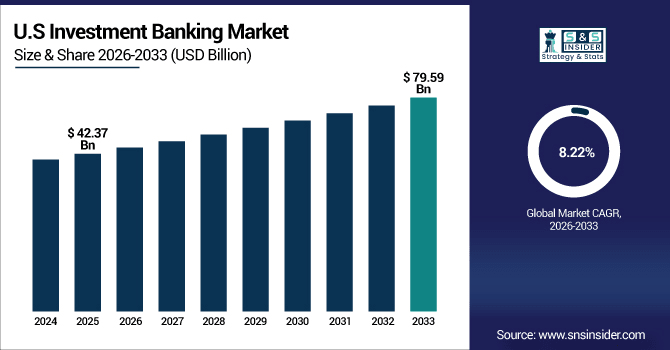

The U.S. Investment Banking Market is projected to grow from USD 42.37 billion in 2025 to USD 93.35 billion by 2035, registering a CAGR of 8.22%. M&A trends are strong, a shift to digital trading platforms and broad fintech adoption, and expansion driven from the corporate financing requirements across industries are the catalysts for growth

Investment Banking Market Growth Drivers:

-

Surging demand for high-value M&A deals and strategic financing is accelerating global investment banking growth.

The Investment Banking industry is growing worldwide, due to the higher demand for cross-border M&As, fundraising, and advisory services required to facilitate the growth of corporations. With increasing corporate financing needs, especially M&As, acquisitions and strategic investments, Global investment banking deal count is estimated to grow exponentially at for next 2025 Now this expansion – fueled mainly by digital, fintech adoption and complex financial solutions for corporates, governments and the billions of HNWI clients worldwide.

Increasing demand for cross-border M&A and strategic financing services propelled nearly 52% of global investment banking activities in 2025.

Investment Banking Market Restraints:

-

Regulatory complexities and stringent compliance requirements restrict investment banking operations and slow market expansion globally.

Stringent regulation frameworks and complex compliance requirements across regions are hindering the growth of the Investment Banking Market. 34.8 per cent of firms face increased limits on how they operate as a result of evolving regulations and reporting standards in place for the financial sector. Compliance costs and pressures in risk management lead to a reduction in deal making and advisory. These limitations affect smaller boutique banks to the greatest extent while causing global firms to contend with disparate requirements across regions, increased compliance headaches and operational challenges.

Investment Banking Market Opportunities:

-

Growing adoption of digital platforms and fintech solutions presents significant global investment banking market expansion opportunities.

Digital solutions and fintech adoption gains are fueling investment banking growth in all regions of the world. Notably, nearly 45% of new deals in 2025 were processed with either tech-driven advisory/ analytics of the transaction process or automated trading tools in a way to improve/enhance efficiency of the overall transaction process. The growing set of online financial tools and digital channels enables transaction execution to be smoother, and a larger number of clients to engage with, fintech services are expected to bolster market promotion and function over the next 13 years.

In 2025, innovation through digital platforms and fintech solutions represented approximately 42% of total investment banking transactions globally.

Investment Banking Market Segmentation Analysis:

-

By Service Type, M&A Advisory held the largest market share of 38.25% in 2025, while Trading & Brokerage is expected to grow at the fastest CAGR of 10.12%.

-

By Client Type, Corporates dominated with a 45.67% share in 2025, while High Net Worth Individuals are projected to expand at the fastest CAGR of 11.25%.

-

By Transaction Type, Equity accounted for the highest market share of 40.18% in 2025, while Structured Finance is projected to record the fastest CAGR of 10.50%.

-

By Fee Model, Success Fees held the largest share in 2025 with 35.44%, while Retainer Fees are expected to grow at the fastest CAGR of 10.78%.

By Service Type, M&A Advisory Leads While Trading & Brokerage Expands Rapidly:

The Investment Banking Market reached over 3,800 M&A deals globally in 2025 with M&A Advisory services leading the charge due to rising corporate financing needs, an increased number of cross-border transactions, and demand for consultancy. Given its experience, global footprint and strong online franchise, it continues to be the market leader in large- and mid-cap deals. Few tools of digital combating are the automated trade items, banking and brokerage services, and also expert systems gaining widely used with the top 1200 tech-motivated trading company’s development that will all the more rapidly increase and globally trend forced to dynamically improve the digital urges chase, analyze-driven trade solutions too.

By Client Type, Corporates Lead While High-Net-Worth Individuals Expand Rapidly:

More than 4,500 major financing and advisory transactions worldwide were done by corporates during the course of 2025 creating a monopoly of corporates over investment banking services. HNWIs are a rapidly growing breed, entering into over 900 customized wealth management and investment advisory deals. Rising awareness of the global wealth generation process, demand for corporate financing needs, and ever more advisory platforms on the net, boosts demand in both developed and emerging markets, strengthening the corporates edge as the HNWIs swiftly reach saturation level.

By Transaction Type, Equity Leads While Structured Finance Expands Rapidly:

In 2025, a record 2025 IPOs and follow-on offerings were completed globally, with equity transactions once again dominating international equity markets. Structured finance, with over 1,000 project financing and securitization deals executed globally, is booming. Structured solutions are becoming the preferred vehicle for strategic funding by corporates and governments (especially in Asia-Pacific and Latin America), mature markets are still seeing healthy activity in equity segments helped by technology-driven advisory, analytical tools and digital trading platforms that enable rapid decision-making.

By Fee Model, Success Fees Lead While Retainer Fees Expand Rapidly:

More than 3,200 transactions linked to completed advisory milestones in 2025 used "success fees" to dominate overall investment banking deals. In response to clients' need for constant strategic support, retainer fees are expanding rapidly, with over 1,100 long-term advisory contracts being signed worldwide. A flexible fees approach instigated by North America, Europe and Asia-Pacific markets, driven by ever more sophisticated deal making at the transaction level, increasing regulatory scrutiny and cross-border deals.

Investment Banking Market Regional Analysis:

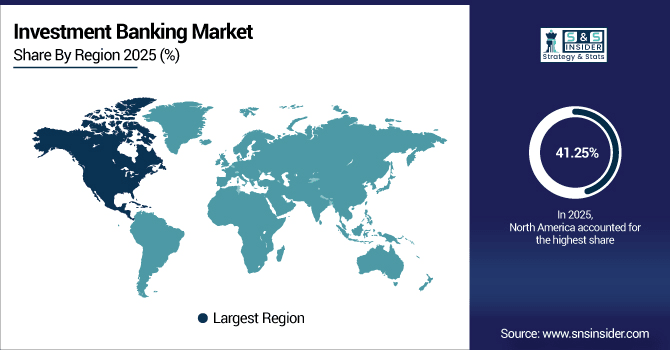

North America Investment Banking Market Insights:

North America dominated the Investment Banking Market in 2025 with a 41.25% share, reflecting its stronghold in global financial services. That abundance of capital in the U.S. and Canada for taking over English-speaking unicorns propelled more than 1,500 M&A deals in the region and a leap in capital-raising. Our prediction is not only for the region to retain its global investment banking expansion but become the base due to its strong corporate funding requirements, technology innovations in its trading platforms and cross-border advisory services

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Investment Banking Market Insights:

The U.S. accounted for over 1,500 M&A deals and 850 equity offerings by 2025 with more than 200 active investment banks present. With digital platforms registering nearly 2.1 million trades per day, and advisory services recording large spikes in demand. The fuel of growth is fintech adoption, growth in corporate financing need and opportunities for cross-border investment expansion.

Asia-Pacific Investment Banking Market Insights:

The Asia-Pacific Investment Banking Market is projected to grow at a CAGR of 9.85% during 2026–2035, owing to increasing corporate financing requirements supported by supported capital markets. China has continued to lead the way in mergers and acquisitions (M&A), with 1,234 transactions taking place in the region in 2025, catapulting it well ahead of the second placed Japan (200 deals). Supported by the utility of digital platforms and cross-border advisory services, over 700 equity offerings were made. The stable growth momentum of the region will be sustained by an expanding economy, adoption of fintech and increasing outbound investments.

China Investment Banking Market Insights:

China saw more than 500 MA transactions and 300 equity offerings in 2025 driven by strong domestic capital markets. Around 40 percent of the transactions were processed via digital trading platforms, while most of the rest were led by traditional banks. Rapid urbanisation, growing demand for tech-sector financing, continuing need for outbound investment and reforming regulatory landscape nationwide are driving the growth.

Europe Investment Banking Market Insights:

In 2025, M&A deals in Europe were more than 1,000 led by the UK with 320 and Germany at 280 then France on 200. This included over 500 equity offerings, from traditional banks and digital trading platforms. Advice and consulting for cross-border transactions firm The corporate demand for funding, the increasing capital markets, the regulatory reform in this region, and the rising need for specialized investment banking solutions of the region drive the growth of the market.

U.K. Investment Banking Market Insights:

In 2025, the U.K. saw more than 320 M&A deals and 180 equity offers, with the balance in advisory & structured finance services. Around 150,000 transactions were processed daily on the digital trading platforms, while traditional banks took care of the rest of the balance. We are fueling our expansion by your need for corporate financing, cross-county investments, and growing country-wide acceptance for fintech statement tools.

Latin America Investment Banking Market Insights:

In Latin America, 2025 registered more than four hundred M&A, of which Brazil invented almost (180), Mexico (120) and Argentina (60) This was assisted by advisory services in around 250 deals, while the balance was conducted via digital trading platforms. The expansion is driven by rising corporate funding needs, increasing cross-border investment and growing adoption of fintech-supported services throughout the region.

Middle East and Africa Investment Banking Market Insights:

In 2025, there were 150 M&A deals in Middle East & Africa; of those, advisory services powered 90 and digital platforms supported 60. Growth is fuelled by increasing needs for corporate financing, cross-border investments, growth of capital markets and adoption of fintech enabled solutions across the region.

Investment Banking Market Competitive Landscape:

J.P. Morgan dominates the investment banking market due to its extensive client base and strong international presence. In 2025, it completed over 175 deals across mid-cap and large-cap sectors. Its comprehensive advisory, M&A, and capital markets services, combined with a strong footprint in North America, Europe, and Asia-Pacific, make it a preferred partner for corporates, governments, and institutional investors worldwide.

-

In August 2025, J.P. Morgan launched the JPMorgan Equity and Options ETF (JOYT), expanding its suite for total return investors and income strategies.

Goldman Sachs — the top-ranked global mergers and acquisitions and advisory firm. In 2025, it did a number of high profile deals and outperformed in the market, especially in EMEA, where it also deepened its footprint in UK and Europe. Its power of complex cross-border translations, strategic advice, and institutional client relationships can maintain the continued dominance and immense influence over global capital markets that it wields.

-

In July 2025, Goldman Sachs introduced the Private Credit Collective Investment Trust, giving defined contribution plans access to private credit investments.

Morgan Stanley has been a leader in the market share of equity capital markets and advisory. It also closed over 139 ECM and advisory deals including large cross-border transactions in 2025. As a result of BMO's expansive wealth management platform and suite of advice-driven solutions, it has become the investment services provider of choice to institutional investors, high net worth individuals and corporates globally.

-

In September 2025, Morgan Stanley partnered with Zerohash to offer cryptocurrency trading on E*Trade, covering Bitcoin, Ether, and Solana.

Investment Banking Market Key Players:

-

J.P. Morgan

-

Goldman Sachs

-

Morgan Stanley

-

Bank of America Securities

-

Citigroup

-

Barclays

-

BNP Paribas

-

Santander

-

Societe Generale

-

Nomura

-

UBS

-

Deutsche Bank

-

HSBC

-

Crédit Agricole CIB

-

Macquarie

-

Itaú BBA

-

Lazard

-

Evercore

-

Moelis & Company

-

PJT Partners

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 129.13 Billion |

| Market Size by 2035 | USD 301.52 Billion |

| CAGR | CAGR of 8.85% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (M&A Advisory, Capital Raising, Underwriting, Trading & Brokerage) • By Client Type (Corporates, Governments, Financial Institutions, High Net Worth Individuals) • By Transaction Type (Equity, Debt, Structured Finance, Derivatives) • By Fee Model (Fixed Fees, Success Fees, Retainer Fees, Commission-Based) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | J.P. Morgan, Goldman Sachs, Morgan Stanley, Bank of America Securities, Citigroup, Barclays, BNP Paribas, Santander, Societe Generale, Nomura, UBS, Deutsche Bank, HSBC, Crédit Agricole CIB, Macquarie, Itaú BBA, Lazard, Evercore, Moelis & Company, PJT Partners |