IoT Cloud Platform Market Size & Overview:

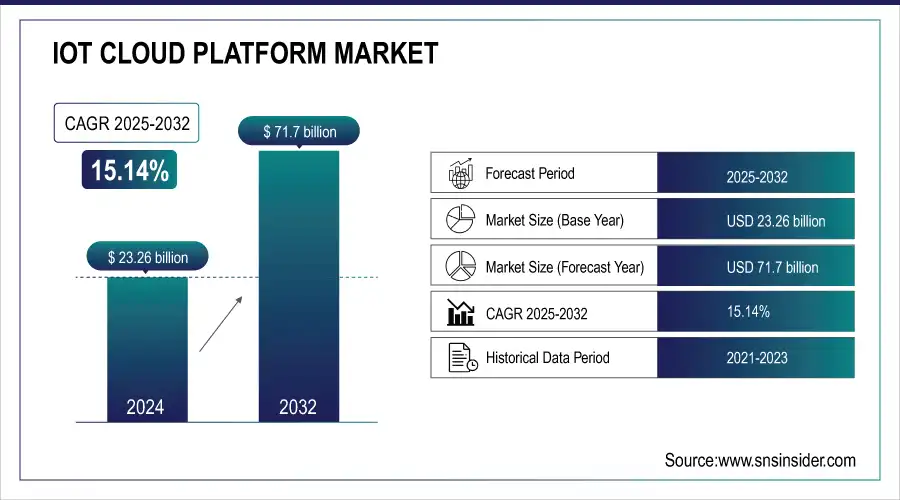

The IoT Cloud Platform Market was valued at USD 23.26 billion in 2024 and is expected to reach USD 71.7 billion by 2032, growing at a CAGR of 15.14% from 2025-2032.

To Get More Information on IoT Cloud Platform Market - Request Sample Report

Key Trends Shaping the IoT Cloud Platform Market

-

Edge Computing Integration: Processing data closer to devices to reduce latency and improve real-time decision-making.

-

Interoperability & Open Standards: Adoption of standardized protocols (e.g., MQTT, CoAP, HTTP) for seamless device and platform communication.

-

Security & Privacy Enhancements: Stronger measures for encryption, access control, AI-driven anonymization, and regulatory compliance.

-

AI & Analytics Integration: Leveraging machine learning and advanced analytics for predictive maintenance, anomaly detection, and operational optimization.

-

Deployment Flexibility: Shift toward hybrid, public, and private cloud options to balance performance, security, and compliance needs.

-

Industry Partnerships & New Platforms: Ongoing collaborations and product launches by major players to expand ecosystem capabilities.

-

Fragmented Competitive Landscape: Global tech giants dominate, but niche players focusing on vertical-specific IoT use cases are gaining traction.

The IoT Cloud Platform Market plays a critical role in the rapidly evolving IoT ecosystem by providing essential infrastructure for managing and analyzing data generated by connected devices. These platforms offer IoT-specific services such as device management, data processing, and analytics, seamlessly integrated into cloud environments. Furthermore, the growing focus on digital transformation and the implementation of Industry 4.0 practices have heightened demand for IoT cloud platforms that facilitate predictive maintenance, asset tracking, and remote monitoring.

IoT Cloud Platform Market Drivers:

-

Expanding use of IoT in healthcare generates massive data, requiring advanced cloud solutions for device management.

IoT use in healthcare has changed patient care dynamics and improved operational efficiency by making devices and technologies work together on cloud-based platforms. Different types of IoT devices such as wearables, connected imaging systems, and smart hospital equipment generate massive amounts of real-time data including patient vitals, diagnostic results, and treatment status. Such data is important for swifter decisions that lead to more proactive care. Nevertheless, managing those huge volumes of data requires intelligent IoT cloud platforms for securely storing, processing, and generating insights.

IoT cloud platforms enable healthcare providers to aggregate and analyze information from various devices with a scalable and interoperable data repository. These platforms maximize a positive patient outcome by allowing remote monitoring, early detection of diseases, and customized treatments based on data forecasts. In other words, smart wearables such as smartwatches or glucose monitors constantly measure health metrics and transfer them to cloud systems, so medical professionals can act fast if there is an abnormal change. This is particularly important for the way chronic diseases like diabetes and cardiovascular disease are managed. In addition, they ensure hospital efficiency by speeding up asset tracking, supporting predictive maintenance, and increasing effective operations. For instance, IoT sensors embedded into smart hospital beds can automatically detect the movement of a patient and make adjustments as needed, eliminating human interference. Similarly, the use of IoT data and predictive analytics can help schedule maintenance before equipment failure, reducing equipment downtime and ensuring continuous delivery of care.

5G networks will also accelerate the IoT cloud platform capabilities to a new level by facilitating faster and more reliable data transfer. Closing the gaps in healthcare accessibility, this advancement backs the real-time monitoring in remote areas. As the number of IoT-enabled devices in healthcare continues to grow, there will be an increasing demand for cloud platforms capable of efficiently processing vast amounts of data. These platforms will be essential for improving both health outcomes and operational efficiency across the healthcare sector.

-

Increased adoption of Industry 4.0 practices boosts demand for IoT platforms supporting predictive maintenance and remote monitoring.

-

Rising preference for flexible platforms that integrate with multiple cloud providers to avoid vendor lock-in.

Use of IoT Devices in Healthcare and Efficiency Improvements

|

IoT Device |

Use Case |

Efficiency Improvement (%) |

|---|---|---|

|

Wearable Health Monitors |

Continuous tracking of vitals |

30% (faster anomaly detection) |

|

Connected Imaging Systems |

Remote diagnostics |

25% (quicker diagnosis time) |

|

Smart Hospital Beds |

Automated patient monitoring |

20% (reduced manual workload) |

|

IoT-Enabled Ventilators |

Real-time performance tracking |

35% (fewer equipment failures) |

|

RFID Asset Trackers |

Inventory and equipment tracking |

40% (improved resource use) |

IoT Cloud Platform Market Restraints:

-

Dependence on reliable, high-speed internet hinders adoption in remote or underdeveloped regions.

As IoT cloud platforms require continuous, high-speed connectivity, its implementation is very limited in rural and underdeveloped parts of the world which are known for the lack of stable internet coverage. The many IoT devices create considerable real-time data that secures a strong network infrastructure to transfer simply to cloud platforms, as a way to process them for analysis. Data transmission may experience latency or even interruptions in areas where internet access is not well-established or slow, which will affect the functioning of the IoT system and the value of cloud-driven analytics. Applications like remote patient monitoring in healthcare or precision agriculture in rural locations rely on a continuous stream of data to deliver relevant insights as and when required. Reliable connectivity is crucial to enabling key features such as real-time monitoring, anomaly detection, and automated alerts; without it, the potential benefits that IoT solutions offer are diminished significantly. This limitation is particularly problematic for industries such as mining, oil and gas, or logistics that work in remote areas where the IoT Cloud platform could create the most operational improvements.

In addition, bad connectivity increases the latency, which is bad for time-sensitive applications like autonomous vehicles and smart grids. It not only creates disturbance in the operations but also poses a safety and reliability of the work environment. In developing areas, reliant on cheap and high-performing internet services, it is practically impossible for businesses to optimize the whole potential of these technologies in them, thus losing the chance of innovation and development.

To mitigate such problems, steps are being taken for low-earth orbit (LEO) satellite networks and filling in 5G infrastructure to close the digital gap and bring high-speed internet to under-connected regions. But those are costly solutions that take years to implement and are, to some degree, still a long way off from everyone having access to them.

Stable internet connectivity remains one of the key roadblocks in the scalability and accessibility of IoT solutions concerning reliance on the cloud platform space for the IoT platforms market. Solution: To address this issue, coordinated initiatives among governments, technology providers, and network operators have to be undertaken to improve internet infrastructure and enable equitable access so that underserved areas can benefit from the sweeping transforming effects of IoT cloud platforms.

-

High vulnerability to cyberattacks and data breaches deters adoption in sensitive sectors like healthcare and finance.

-

Significant initial investment in IoT infrastructure and cloud integration poses challenges for small and medium-sized businesses.

IoT Cloud Platform Market Segmentation Analysis:

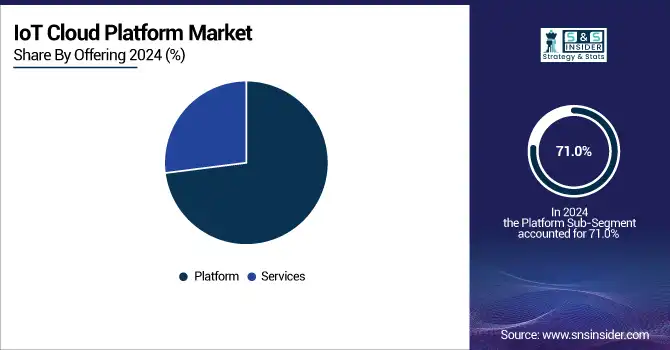

By Offering Platform Segment Leads with Integrated IoT Solutions, while the Services Segment is set for the Fastest Growth, driven by Remote Maintenance Demand

The platform segment led the market and held the largest revenue share of 71.0% in 2024 and is expected to continue dominating the market through the forecast period. The platform segment comprises device management, analytics, and connectivity & communication solutions. An IoT cloud platform unifies the capabilities of these IoT solutions and devices, enabling increased value for consumer and business applications. It is beneficial in minimizing risks and reducing operational and development expenses. It also helps in managing devices, sending communication, data flow, and running applications. As a result– segment growth owing to the rising amount of IoT-connected devices in various applications.

The service segment is expected to grow at the Fastest CAGR during the forecast period 2025-2032. The growth of this segment can be attributed to the rising demand for IoT cloud services to execute remote maintenance activities while keeping a watch on infrastructure health and business networks.

By Organization Size, Large Enterprises Drive Adoption with Heavy IoT Investments, While SMEs Poised for Rapid Growth Through Efficiency and Productivity Gains

In 2024, the large-size organization's segment accounted for the largest revenue share of 70.0%. Enterprises are investing heavily with the adoption of more IoT devices, and cloud platform-n-IoT-related services to manage their business. The increasing installation of IoT devices within the ambit of large enterprises is driving the growth of the segment.

However, the small and medium-sized organizations segment is projected to grow at the fastest CAGR during the forecast period. The segment growth is anticipated to propel owing to the increasing adoption of IoT devices in SMEs due to benefits including minimization of redundancies, efficiency improvement, real-time tracking, and productivity improvement.

By Application, Industrial Automation & Smart Manufacturing Dominate Adoption, While Healthcare Emerges as the Fastest-Growing Segment with Digital Health Transformation

The industrial automation and smart manufacturing segment accounted for the largest revenue share of 28.0% in 2024 and it is expected to maintain its dominance during the forecast period. IoT cloud platforms in industrial automation & smart manufacturing sector address device management challenges to enhance productivity and operations. It is also beneficial in architecting inexpensive, efficient, and responsive system designs.

The healthcare segment is expected to register the fastest growth rate during the forecast period. The rising demand for embedded sensors, increasing penetration of wireless devices, and rapid growth of healthcare IT are some of the factors expected to drive the IoT Cloud Platform market in healthcare applications over the next few years.

IoT Cloud Platform Market Regional Analysis:

North America IoT Cloud Platform Market Insights

In 2024, North America dominates the IoT Cloud Platform Market with an estimated share of 38%, driven by advanced infrastructure, early adoption of IoT-enabled solutions, and strong presence of global cloud providers. The region benefits from extensive digital transformation across industries, widespread 5G rollout, and robust R&D investments. These factors support rapid deployment of IoT cloud platforms, enabling seamless device connectivity, predictive analytics, and enterprise automation to improve efficiency and operational scalability.

Do You Need any Customization Research on IoT Cloud Platform Market - Enquire Now

-

United States Leads IoT Cloud Platform Market in North America

The U.S. dominates the regional market with the largest share, supported by strong enterprise IoT adoption, government-led digital initiatives, and leadership from cloud giants such as AWS, Microsoft, and Google. Expanding applications across industrial automation, healthcare, and smart cities further enhance growth. Investments in cybersecurity, AI integration, and scalable cloud ecosystems reinforce the U.S. leadership, making it the central hub for IoT cloud platform innovation and deployment in North America.

Asia Pacific IoT Cloud Platform Market Insights

Asia Pacific is the fastest-growing region in 2024, with an estimated CAGR, driven by rapid digitalization, industrial modernization, and government-backed smart city projects. Rising internet penetration, increasing data center capacity, and the proliferation of connected devices accelerate market growth. Enterprises across manufacturing, automotive, and consumer electronics are embracing IoT cloud solutions to optimize operations, reduce costs, and enhance real-time decision-making, positioning Asia Pacific as the most dynamic growth hub globally.

-

India Leads IoT Cloud Platform Market Growth in Asia Pacific

India dominates the Asia Pacific market due to large-scale digitization programs, strict data localization laws, and a rapidly growing cloud infrastructure ecosystem. Government initiatives such as Digital India, combined with surging investments from global cloud providers, are fueling adoption across sectors. High smartphone penetration, expanding 5G connectivity, and rising demand for connected healthcare, industrial IoT, and smart city solutions make India a key driver of IoT cloud platform growth in the region.

Europe IoT Cloud Platform Market Insights

In 2024, Europe holds a significant share of the IoT Cloud Platform Market, driven by strong industrial IoT adoption, regulatory support for digital transformation, and increased demand for cloud-based solutions. The region benefits from rising investments in smart manufacturing, energy management, and connected mobility. Adoption of hybrid and multi-cloud strategies, coupled with emphasis on secure, compliant IoT ecosystems, positions Europe as a stable and innovation-driven market for IoT cloud platforms.

-

France Dominates Europe’s IoT Cloud Platform Market

France leads the European market with the fastest growth potential, supported by favorable government technology policies, industrial modernization, and rapid adoption across healthcare and energy sectors. Enterprises are increasingly investing in IoT-enabled platforms to improve productivity, efficiency, and sustainability. Expansion of data centers, growing collaboration with global cloud providers, and a strong push for localized solutions reinforce France’s position as a leading driver of IoT cloud platform adoption in Europe.

Latin America and Middle East & Africa IoT Cloud Platform Market Insights

The IoT Cloud Platform Market in Latin America and the Middle East & Africa (MEA) is witnessing steady growth in 2024, driven by smart city projects, infrastructure modernization, and rising enterprise IoT adoption. Latin America benefits from growing urbanization, expansion of digital services, and increasing demand for industrial automation. Meanwhile, MEA shows strong momentum through investments in smart infrastructure, energy, and connected urban systems, positioning both regions as emerging markets with high future potential.

Regional Leaders in Latin America and MEA

Brazil leads Latin America due to rapid adoption of connected devices, digital transformation initiatives, and growing demand across manufacturing and urban sectors. In MEA, the United Arab Emirates (UAE) dominates, supported by its smart city vision, advanced ICT infrastructure, and strong demand for IoT-enabled solutions in energy, logistics, and luxury lifestyle sectors. Both Brazil and the UAE showcase high growth potential, paving the way for broader IoT cloud platform adoption in their respective regions.

Competitive Landscape IoT Cloud Platform Market:

Amazon Web Services (AWS)

Amazon Web Services (AWS), a subsidiary of Amazon, is the world’s leading cloud computing provider, offering a wide range of scalable infrastructure and platform services. Its portfolio includes computing, storage, analytics, IoT, AI/ML, and security solutions, empowering businesses of all sizes to innovate and scale globally. With a strong presence across industries, AWS supports digital transformation, edge computing, and IoT integration, making it a dominant player in the IoT cloud platform market worldwide.

-

Amazon Web Services (AWS) announced an enhancement to its IoT services with AWS IoT Core. The update, introduced in January 2024, improves the connectivity of billions of devices and increases support for real-time analytics in cloud environments. This new feature is expected to help organizations process vast amounts of data from IoT devices with greater speed and efficiency.

Microsoft

Microsoft, a global technology leader, delivers innovative cloud, software, and AI solutions to enterprises and consumers worldwide. Its Azure platform is central to its IoT cloud ecosystem, enabling secure device connectivity, edge intelligence, and advanced analytics. Through integrated offerings across Dynamics 365, Office 365, and Azure IoT services, Microsoft supports enterprise modernization, smart city initiatives, and industrial automation. With its strong enterprise partnerships and global presence, Microsoft continues to drive innovation and scale in the IoT cloud platform market.

-

Microsoft launched new IoT cloud services in February 2024, focused on Azure IoT Hub. These updates enhance the platform’s scalability and security, catering to the expanding need for industrial IoT deployments across sectors such as manufacturing and healthcare. The introduction of advanced edge computing capabilities aims to lower latency and enhance real-time data processing.

IoT Cloud Platform Market Companies:

The major key payers along with their products are

-

Amazon Web Services (AWS) – AWS IoT Core

-

Microsoft Corporation – Azure IoT Hub

-

Google Cloud – Google Cloud IoT Core

-

IBM Corporation – IBM Watson IoT Platform

-

Oracle Corporation – Oracle IoT Cloud Service

-

Cisco Systems – Cisco IoT Control Center

-

SAP SE – SAP IoT Platform

-

PTC Inc. – ThingWorx IoT Platform

-

GE Digital – Predix Platform

-

Salesforce – Salesforce IoT Cloud

-

Siemens AG – MindSphere

-

Intel Corporation – Intel IoT Platform

-

Hitachi Vantara – Lumada IoT Platform

-

Bosch Software Innovations – Bosch IoT Suite

-

Schneider Electric – EcoStruxure IoT Platform

-

Alibaba Cloud – Alibaba IoT Platform

-

Huawei Technologies – Huawei OceanConnect IoT Platform

-

Samsung Electronics – Samsung ARTIK Cloud

-

Arm Holdings – Pelion IoT Platform

-

ThingSpeak (MathWorks) – ThingSpeak IoT Analytics Platform

| Report Attributes | Details |

| Market Size in 2024 |

USD 23.26 Billion |

| Market Size by 2032 | USD 71.7 Billion |

| CAGR | CAGR of 15.14 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Platform, Service) • By Deployment Type (Public, Private, Hybrid) • By Application (Device management, Analytics management, Database management) • By Organization Size (Small & Medium Sized Organizations, Large Size Organizations) • By End-user (Industrial Automation & Smart Manufacturing, Smart Infrastructure, Automotive, Healthcare, Retail & E-commerce, BFSI, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Amazon Web Services (AWS), Microsoft Corporation, Google Cloud, IBM Corporation, Oracle Corporation, Cisco Systems, SAP SE, PTC Inc., GE Digital, Salesforce,Siemens AG, Intel Corporation, Hitachi Vantara, Bosch Software Innovations, Schneider Electric, Alibaba Cloud, Huawei Technologies, Samsung Electronics, Arm Holdings, ThingSpeak (MathWorks) |