Real-time Location Systems (RTLS) Market Size:

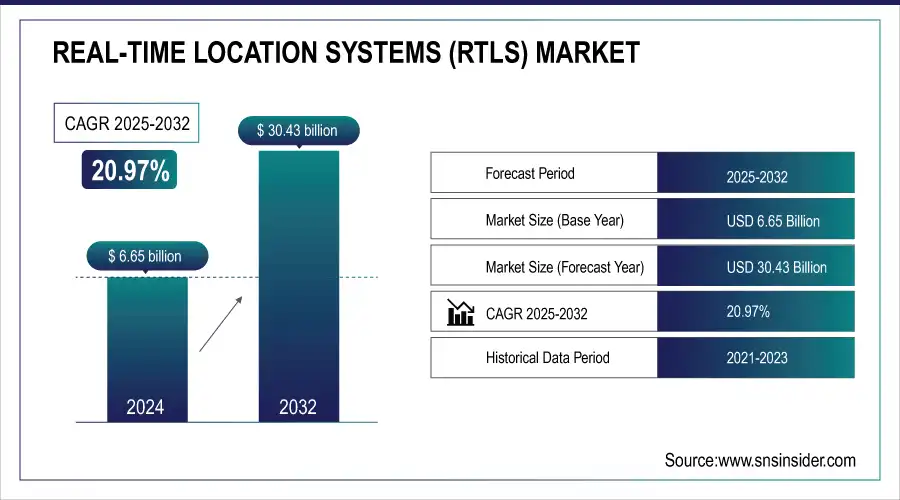

The Real-time Location Systems (RTLS) Market size was valued at USD 6.65 billion in 2024. It is estimated to reach USD 30.43 billion by 2032, growing at a CAGR of 20.97% during 2025-2032.

Real-time Location Systems (RTLS) have emerged as critical asset-tracking technologies across various industries. They facilitate the tracking and management of assets, personnel, and inventory with remarkable precision. The RTLS market is experiencing robust growth, driven by increasing demand for asset-tracking solutions in the healthcare, retail, manufacturing, and logistics sectors. In healthcare, for example, RTLS plays a pivotal role in managing medical equipment and improving patient flow. Recent reports reveal that 96% of healthcare providers plan to expand their use of RTLS to better monitor patients throughout treatment. Furthermore, 95% of facilities aim to leverage this technology for managing medical equipment, specimens, and supplies, with 83% looking to optimize workflows. Hospitals utilize RTLS to monitor the location of beds, wheelchairs, and critical medical devices, leading to improved resource utilization and reduced waiting times for patients. By ensuring that equipment is readily available and efficiently allocated, healthcare providers can enhance the quality of care while minimizing operational costs.

To Get More Information on Real-time Location Systems (RTLS) Market - Request Sample Report

Real-time Location Systems (RTLS) Market Size and Forecast:

-

Market Size in 2024: USD 6.65 Billion

-

Market Size by 2032: USD 30.43 Billion

-

CAGR: 20.97% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Real-time Location Systems (RTLS) Market Trends:

-

Integration of IoT and AI enhances real-time tracking, asset management, and predictive maintenance across industries.

-

Adoption of RFID, UWB, and BLE technologies improves location accuracy, operational efficiency, and workflow optimization in manufacturing, healthcare, and logistics.

-

Cloud-based RTLS platforms enable centralized monitoring, data analytics, and remote management of assets and personnel.

-

Increasing demand for workforce safety and social distancing compliance drives RTLS adoption in healthcare, construction, and industrial environments.

-

Mobile-enabled and wearable RTLS devices support real-time employee, patient, and asset tracking, enhancing operational visibility and productivity.

-

Integration with ERP and warehouse management systems enables automated inventory tracking, process optimization, and supply chain transparency.

-

Rising focus on reducing operational costs and preventing asset loss promotes investments in RTLS solutions across enterprises.

The retail industry is also adopting RTLS technology to optimize inventory management and improve the shopping experience. Retailers implement RTLS to track merchandise in real time, reducing stockouts and improving the accuracy of inventory levels. For example, Aisle411 has been developing solutions that enable retailers to guide customers through stores based on their shopping lists. This capability allows for better demand forecasting and efficient supply chain management, ultimately leading to increased customer satisfaction. Additionally, RTLS can be used to analyze customer behavior within stores, providing insights into shopping patterns and enabling personalized marketing strategies.

Real-time Location Systems (RTLS) Market Drivers:

-

Transforming Business Efficiency Through Real-Time Location Services Solutions.

In today's competitive business landscape, companies are always looking to streamline their operations and increase efficiency. RTLS solutions offer real-time visibility into all of a business's assets, personnel, and inventory. Consequently, companies can optimize their operations while reducing operational expenditures. Real-time tracking of the movement and whereabouts of assets, in turn, empowers companies to quickly spot bottlenecks, get rid of waste, and increase overall efficiency. For example, healthcare facilities can closely monitor the locations of medical equipment and personnel so that critical resources are nearby when required. Not only does this reduce the time it takes to locate equipment, but it also enhances patient care by ensuring that healthcare providers may quickly find and access the tools they need for treatment. Organizations are recognizing the benefits of improved operational efficiency and this drives the RTLS solutions market.

-

Enhancing Supply Chain Efficiency Through Real-Time Inventory Management with RTLS Solutions

Businesses must prioritize efficient inventory management to stay ahead in the market. RTLS solutions allow organizations to monitor inventory levels in real time, facilitating tracking of product location and movement across the supply chain. Having this level of visibility is crucial for minimizing stock shortages, decreasing surplus inventory, and enhancing the overall efficiency of the supply chain. RTLS technology can assist industries like retail and logistics by enabling organizations to track inventory levels in real-time, enabling informed decisions on replenishment and order fulfillment. This enhances customer satisfaction by guaranteeing products are accessible and lowers costs from holding too much inventory. Moreover, RTLS improves traceability and compliance through precise tracking of inventory movement. Organizations in industries like pharmaceuticals and food and beverage must follow strict regulatory standards for tracking products. RTLS solutions assist with compliance by offering in-depth information on the whereabouts and condition of inventory along the supply chain.

Real-time Location Systems (RTLS) Market Restraints:

-

Navigating the Challenges of Integrating RTLS Solutions into Existing Enterprise Systems.

Incorporating RTLS solutions into current enterprise systems can present a difficult and demanding task. Numerous organizations depend on different software and hardware systems for managing assets, controlling inventory, and analyzing data. RTLS must integrate smoothly with these systems to optimize its efficiency. The intricacy of integration may cause operational disruptions during implementation. Organizations could encounter difficulties in coordinating data formats, communication protocols, and user interfaces, leading to potential delays and higher expenses. Furthermore, the requirement for specific knowledge to handle the integration process can also create challenges, resulting in problems with resource distribution. Consequently, organizations might be cautious about implementing RTLS solutions due to concerns that the integration process could disrupt their operations and decrease productivity. The intricate process of integrating with current systems is a major obstacle to the expansion of the RTLS market.

Real-time Location Systems (RTLS) Market Segmentation Analysis:

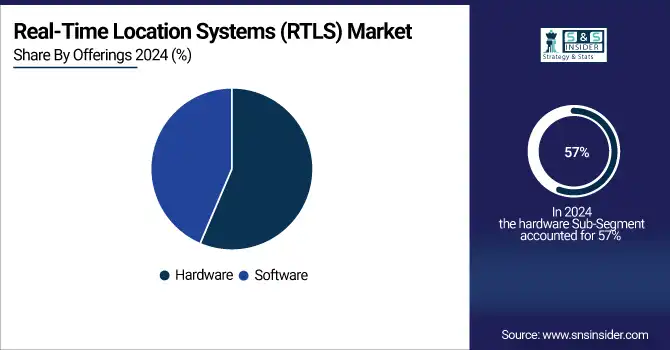

By Offerings, Hardware Leads the RTLS Market in 2024, While Software Emerges as the Fastest-Growing Segment

The hardware dominated the market with a 57% market share in 2024. This section mainly consists of different tracking tools like tags, sensors, and readers that enable precise tracking of assets, personnel, and inventory in buildings. Due to technological progress, hardware solutions now include RFID, infrared, and ultrasound features, improving their performance and dependability. Zebra's Zatar platform, for instance, combines RTLS hardware to track assets, enabling organizations to oversee equipment in real time, minimizing losses, and improving resource allocation.

The software is going to be the fastest-growing segment during 2025-2032, fueled by the growing demand for data analysis, visualization, and compatibility with current systems. This section includes software platforms that control, analyze, and report information gathered from physical devices. The software is vital in giving practical insights, boosting decision-making, and enhancing operational efficiency. For example, software solutions from GE Healthcare assist hospitals in increasing efficiency by monitoring equipment and staff, leading to enhanced patient care and operational effectiveness.

By Technology, Wi-Fi Dominates RTLS Market in 2024; Ultra-Wideband (UWB) Poised for Rapid Growth Through 2032

Wi-Fi technology led the RTLS Market in 2024 with a market share of over 35% because of its extensive use, infrastructure accessibility, and cost efficiency. Businesses use current Wi-Fi networks to implement RTLS solutions without needing to spend a lot more money. Wi-Fi-enabled RTLS systems seamlessly integrate with mobile devices and offer real-time data analytics, improving operational efficiency and decision-making. Zebra Technologies and other companies utilize Wi-Fi RTLS to enhance asset visibility in hospitals, resulting in improved patient management and resource allocation.

Ultra-wideband (UWB) is the most rapidly expanding sector in the RTLS industry and going to be the fastest-growing segment during 2025-2032, mostly because of its exceptional accuracy and precision for indoor tracking. UWB technology provides accurate location data with a level of detail of up to 10 centimeters, which is perfect for applications that need precise monitoring of belongings and staff. Its minimal energy usage and ability to resist disruptions caused by other wireless signals make it even more attractive in different industries. Zebra Technologies, for example, has also begun implementing UWB technology to provide real-time asset tracking and enhance workflow in complex settings, establishing UWB as a frontrunner in the upcoming phase of RTLS innovation.

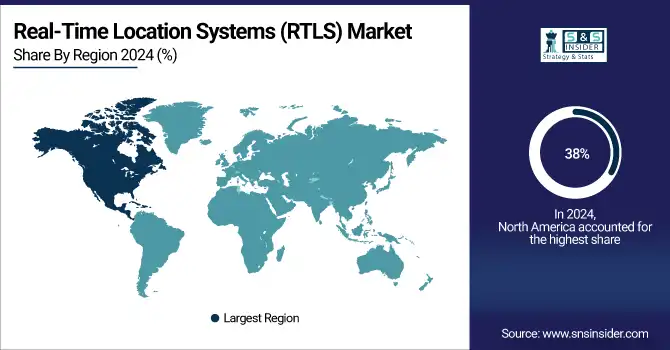

Real-time Location Systems (RTLS) Market Regional insights:

North America Dominates Real-Time Location Systems (RTLS) Market in 2024

North America holds an estimated 38% market share in 2024, driven by widespread adoption of IoT-enabled devices, advanced industrial automation, and healthcare modernization. This causes organizations to deploy RTLS solutions to enhance operational efficiency, asset tracking, and real-time monitoring of personnel and equipment across industries.

Do You Need any Customization Research on Real-time Location Systems (RTLS) Market - Enquire Now

-

United States Leads North America’s RTLS Market

The U.S. dominates due to extensive implementation of RTLS in healthcare, manufacturing, and logistics sectors. Hospitals increasingly rely on RTLS to track medical equipment, improve patient care, and optimize workflow efficiency. In industrial and warehouse environments, RTLS ensures precise inventory management, reduces asset losses, and enhances operational productivity. Strong government initiatives promoting smart infrastructure, combined with advanced IT ecosystems and early adoption of cutting-edge technologies, further reinforce the U.S. as the leading contributor to North America’s RTLS market growth.

Asia Pacific is the Fastest-Growing Region in RTLS Market in 2024

The region is expected to grow at a CAGR of 14.6% from 2025–2032, driven by rapid industrialization, smart manufacturing adoption, and growing healthcare infrastructure. This causes enterprises to invest in RTLS solutions for real-time monitoring, workflow optimization, and asset management.

-

China Leads Asia Pacific’s RTLS Market

China dominates due to its strong focus on Industry 4.0 initiatives, smart city development, and healthcare digitization. Manufacturing and logistics sectors increasingly adopt RTLS for asset tracking, inventory management, and operational efficiency. Hospitals leverage RTLS to monitor medical equipment, optimize patient flow, and ensure staff accountability. Large-scale government investments in IoT-enabled infrastructure, coupled with rapid urbanization and the expansion of industrial parks, drive RTLS adoption. China’s combination of technology development, regulatory support, and industrial growth positions it as the leading RTLS market in the Asia Pacific region.

Europe RTLS Market Insights, 2024

Europe is witnessing steady RTLS growth, driven by increasing industrial automation, digital healthcare adoption, and smart warehouse deployment. Germany’s emphasis on Industry 4.0, smart hospitals, and IoT-enabled manufacturing boosts RTLS deployment, causing accelerated market adoption across Europe.

-

Germany Leads Europe’s RTLS Market

Germany dominates due to its advanced industrial base, strong adoption of smart manufacturing practices, and focus on healthcare digitalization. Hospitals implement RTLS to track equipment and improve workflow efficiency, while factories leverage RTLS for real-time inventory monitoring and operational optimization. Government policies supporting Industry 4.0, coupled with investments in IoT and advanced automation, further strengthen Germany’s position as the leading RTLS market in Europe.

Middle East & Africa and Latin America RTLS Market Insights, 2024

The RTLS Market in these regions is growing steadily, supported by the modernization of healthcare facilities, industrial automation, and logistics operations. Countries such as the UAE, Saudi Arabia, Brazil, and Mexico are increasingly adopting RTLS for real-time tracking of assets, personnel, and inventory. Investments in smart infrastructure, IoT-based solutions, and industrial digitization drive RTLS adoption. International collaborations and technology integration programs accelerate market growth, while rising focus on efficiency, safety, and operational transparency further propel RTLS deployment across both regions.

Competitive Landscape for Real-time Location Systems (RTLS) Market:

Securitas AB

Securitas AB is a Sweden-based global leader in security services, specializing in manned guarding, electronic security, and remote monitoring solutions. With decades of experience, the company provides comprehensive real-time location and monitoring services across commercial, industrial, and public sectors. Securitas AB leverages advanced RTLS technologies to track personnel, assets, and operational workflows, enhancing safety, efficiency, and incident response. Operating through a network of regional offices, the company delivers integrated security and tracking solutions that ensure operational transparency, regulatory compliance, and risk mitigation. Its role in the RTLS market is critical, providing end-to-end location-based services for diverse global industries.

-

In 2024, Securitas AB expanded its RTLS capabilities by integrating advanced RFID and IoT-enabled monitoring platforms, improving asset visibility and personnel safety across industrial and commercial sites.

Zebra Technologies Corporation

Zebra Technologies Corporation is a U.S.-based leader in enterprise asset intelligence solutions, focusing on tracking, inventory management, and workforce optimization. The company designs and manufactures RTLS hardware such as sensors, tags, and readers, along with software platforms for real-time analytics and decision-making. Zebra’s solutions enable organizations to optimize asset utilization, reduce losses, and enhance operational efficiency across sectors like healthcare, logistics, and manufacturing. Its role in the RTLS market is significant, as it combines robust hardware with intelligent software platforms for seamless location tracking and management.

-

In 2024, Zebra Technologies launched enhanced RTLS software integrated with UWB and Wi-Fi tracking, enabling high-precision asset monitoring in hospitals and warehouses.

Aruba Networks

Aruba Networks, a U.S.-based subsidiary of Hewlett Packard Enterprise, specializes in network infrastructure and location-based services for enterprise environments. The company’s RTLS solutions leverage Wi-Fi and BLE technologies to provide real-time visibility of assets, personnel, and connected devices. Aruba’s platforms support operational optimization, safety monitoring, and workflow automation across industries such as healthcare, manufacturing, and retail. Its role in the RTLS market is pivotal, as it delivers scalable and reliable location intelligence solutions that integrate with existing IT networks to enhance operational efficiency and situational awareness.

-

In 2024, Aruba Networks introduced next-generation Wi-Fi RTLS solutions that improve indoor location accuracy, supporting hospitals and industrial facilities in real-time tracking initiatives.

Impinj, Inc.

Impinj, Inc. is a U.S.-based provider of RAIN RFID solutions and RTLS platforms, enabling real-time visibility of assets, inventory, and personnel across various industries. The company develops high-performance RFID tags, readers, and gateways, along with software for analytics and integration into enterprise systems. Impinj’s solutions support operational efficiency, supply chain management, and asset tracking, allowing organizations to reduce losses and improve decision-making. Its role in the RTLS market is essential, delivering precise and scalable location tracking solutions that meet the needs of retail, logistics, healthcare, and manufacturing sectors.

-

In 2024, Impinj expanded its RTLS offerings with advanced RFID-enabled platforms, enabling seamless integration with enterprise resource planning systems for enhanced operational visibility.

Real-time Location Systems (RTLS) Market Key Players:

-

Zebra Technologies Corporation

-

Aruba Networks

-

Impinj, Inc.

-

Savi Technology

-

TeleTracking Technologies, Inc.

-

CenTrak, Inc.

-

Ubisense Ltd.

-

Alien Technology, LLC

-

AiRISTA Flow, Inc.

-

Sonitor Technologies

-

Midmark Corporation

-

RFID Global Solutions

-

BlueCats

-

Versus Technology, Inc.

-

Tracelogic

-

Zebra Medical Vision

-

Sierra Wireless

-

ClearBlade

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.65 Billion |

| Market Size by 2032 | USD 30.43 Billion |

| CAGR | CAGR of 20.97% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offerings (Hardware, Software) • By Application (Inventory/Asset Tracking & Management, Personnel Locating & Monitoring, Access Control & Security, Environmental Monitoring, Yard, Dock, Fleet, & Warehouse Management & Monitoring, Supply Chain Management & Automation, Others) • By Technology (RFID, Wi-Fi, UWB, BLE, Infrared, Ultrasound, GPS, Others) • By Vertical (Healthcare, Manufacturing & Automotive, Retail, Transportation & Logistics, Government & Defense, Education, Oil & Gas and Mining, Sports & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Securitas AB, Zebra Technologies Corporation, Aruba Networks, Impinj, Inc., Savi Technology, TeleTracking Technologies, Inc., CenTrak, Inc., GE HealthCare Technologies Inc., Ubisense Ltd., Alien Technology, LLC, AiRISTA Flow, Inc., Sonitor Technologies, Midmark Corporation, RFID Global Solutions, BlueCats, Versus Technology, Inc., Tracelogic, Zebra Medical Vision, Sierra Wireless, ClearBlade. |