IoT in Construction Market Size & Overview:

To Get More Information on IoT in Construction Market - Request Sample Report

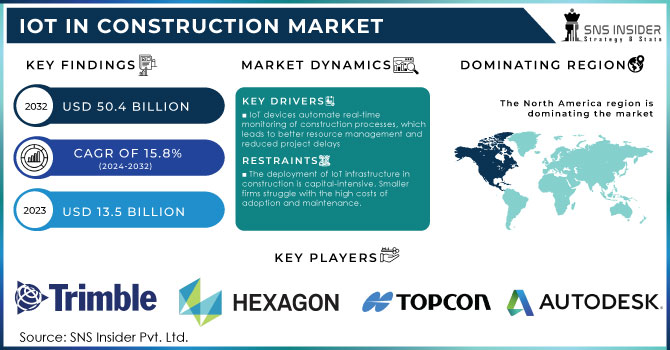

IoT In Construction Market Size was valued at USD 13.5 Billion in 2023 and is expected to reach USD 50.4 Billion by 2032, growing at a CAGR of 15.8% over the forecast period 2024-2032.

The IoT in Construction Market has been increasing rapidly as a result of technical innovation, the tendency towards automation, and enhanced investments in intelligent infrastructure. Governments display a substantial amount of effort throughout the world to promote the deployment of IoT in the construction sector. For instance, the 2023 report by the U.S. Department of Commerce reveals that the federal government of the U.S. has invested $1.2 trillion in infrastructure development. A proportion of this investment will be directed to the state’s infrastructure by the incorporation of IoT technologies. The European Union has invested approximately €750 billion too in smart city projects under the European Green Deal, with a substantial investment directed towards implementing advanced construction systems based on IoT technology. As per the report by the Ministry of Housing and Urban-Rural Development of the mentioned country, China is also involved in speeding up the smart construction pilots in over 100 cities. In the next five years, 70% of the new infrastructure projects in China will be based on IoT technology. The escalating global demands oriented towards sustainable development will result in strong growth in the industry as the deployment of IoT in projects will help minimize time wastage, enhance resource management, and ensure safety. As a result, the IoT in construction market is expected to see continuous growth throughout the forecast period.

To address these safety concerns, the integration of Internet of Things (IoT) technology into construction has become increasingly important. By utilizing smart wearables like smart glasses, wearable sensors, safety vests, wearable exoskeletons, and smart helmets, real-time safety management on construction sites is made possible. These devices enable active monitoring of workers' vital signs, such as breathing rate and heart rate, as well as their body's response to the work environment. By implementing IoT technology and wearable devices, construction companies can enhance safety measures and reduce the risk of accidents. The ability to monitor and analyze data collected from these wearable technologies provides valuable insights into improving safety protocols and preventing future incidents.

IoT in Construction Market Dynamics

Drivers

- IoT devices automate real-time monitoring of construction processes, which leads to better resource management and reduced project delays

- IoT-based wearable devices and sensors ensure worker safety, these technologies reduce onsite accidents by identifying hazards early.

One of the key drivers of the IoT in Construction markets is Improved Safety and Risk Management. The construction industry is by its nature dangerous, as accidents and other safety risks are not uncommon on construction sites. However, IoT technology is playing a critical role in creating innovative safety protocols that preserve the well-being of employees. For example, sensors, wearable devices, and drones can provide real-time data on the status of construction workers. IoT-enabled wearable devices collect information about the workers’ health indicators, such as their heart rate, body temperature, and level of fatigue, and raise an alarm when the condition of the employee reaches a critical level. In this way, the risk of traumatic accidents is minimized, as the employers cannot push the employees beyond their capacity with irreversible results such as a heart attack.

Furthermore, IoT sensors can be mounted on the safety gear of the construction worker or simply stationed at the construction site. They notify the workers when they are at risk of slipping or are in proximity to noxious substances on the site. Moreover, IoT-enabled sensors can monitor the structure of the construction site and any major deviations from its initial condition and behavior that warrant an evacuation of the individuals present on the site. According to the Occupational Safety and Health Administration, a study conducted in 2022 shows that IoT sensors create a proactive environment that allows the IoT operator to manage the risks even before they damage someone. In addition, the IoT has decreased the rate of workplace incidents by approximately 20 percent, the same was noted by Skanka, one of the major construction companies in the United States. Thus, IoT technologies prevent problems from escalating to injuries and fatalities. It also reduces the legal risk of hiring unsafe employees and project delays.

Restraints

-

The deployment of IoT infrastructure in construction is capital-intensive. Smaller firms struggle with the high costs of adoption and maintenance.

-

IoT devices generate vast amounts of sensitive construction data, Inadequate cybersecurity measures can lead to data breaches or loss.

Data security and privacy concerns are one major restraint in the IoT in the construction market. There is a high amount of data involved when it comes to IoT devices in a construction site. These IoT devices may be related to the status and progress of a certain project, the information about the machinery used in such a project, or the data regarding employees of a construction company. Since all devices in an IoT system are highly reliant on each other, it may not always be secure from cyberattacks. Unfortunately, many construction companies do not have any cybersecurity investments, meaning they could easily be breached, have data stolen, have the data accessed, or the whole system could even be hacked. If IoT systems are not properly secured, lots of sensitive data may e compromised. For example, the blueprints of a project, the financial information of a company, or the personal information of employees may be leaked. Moreover, IoT devices do not always have standardized security protocols, adding to data privacy complexity. Companies will need to invest in these areas more as IoT systems become more prominent in the construction secured.

- The High Initial Cost of Internet of Things (IoT) in the Construction Industry

While the Internet of Things (IoT) presents numerous benefits and potential cost savings in the construction sector, the initial investment required to implement this technology is substantial. For example, the Building Information Modeling (BIM) software utilized for 3D modeling can range from USD 3,100 to USD 5,200. Moreover, the software necessitates a significant amount of training to effectively utilize its capabilities. In addition to the software expenses, the costs associated with training and services are also considerable. It is worth noting that in certain countries, the wages provided to workers in the construction industry are significantly low. Consequently, construction companies may be hesitant to adopt IoT technology as it further increases the overall project costs. This reluctance stems from the belief that the benefits of IoT may not outweigh the financial burden it imposes.

IoT in Construction Market Segment Analysis

By component: Hardware dominated in 2023, Services to Experience Fastest Growth

In 2023, the hardware segment was the largest component in the IOT in construction market globally with accounted 55% share in 2023. The hardware segment is considered the largest one due to the massive use of IOT devices such as sensors, RFID tags, and connected construction rather construction equipment. The device is used to enable real-tie monitoring and data collection of construction sites. In addition, this hardware is encouraged by the government at a global level, since many countries are incorporating them in their initial smart infrastructure plans at a country level. For example, in 2023, the U. K’s Industrial Strategy Challenge Fund had awarded £170 million towards smart construction and IOT; for this to be implemented, there is an absolute need for the hardware for the exact innovation to take place.

Nevertheless, from 2024 to 2032, the services component is projected to grow by the highest CAGR. This is as a result of IOT-driven services such as remote monitoring, predictive maintenance, and real-time data analytics for the fast-growing and demanded services component. In addition, the hardware component is being encouraged by the government at a global level. For example, the U.S. government had funded the IOT-driven construction services in their country at a mass level through the U.S. Infrastructure Investment and Jobs Act. For this reason, the conventional model will change from not only hardware but also service-based models such as cloud-based IOT platforms.

By End-Use: Commercial Segment Led the Market in 2023

The commercial segment dominated and accounted for a high market share 68% of the IoT in the construction market in 2023. This is primarily owing to the rising number of such projects across the world amid governments’ focus on enhancing and modernizing urban infrastructure. In the U.S., commercial construction, such as smart offices, retail spaces, and multi-use commercial buildings, is experiencing a vast change with the implementation of IoT. According to the U.S. Census Bureau, the commercial construction spending in the U.S. reached $ 158 billion in 2023, and more than one-third of this incorporated IoT to enable energy management, various security systems, and operations automation, among other aspects. Moreover, in the European Union, government-led IoT smart city initiatives are expected to drive IoT adoption in the commercial real estate sector. The European Commission in 2023 stated that commercial property projects constituted over 40% of the smart infrastructure investments and were being increasingly designed to encompass sustainability and energy efficiency goals along with complete automation. In addition to the aforementioned aspects, the commercial sectors are also adopting IoT to cut down operational costs and comply with the smart and sustainable buildings government norms.

Regional Dominance

In 2023, North America became the leading region in the IoT in construction market. One of the major reasons for such a strong presence of the IoT technologies in the region is the U. S. which enjoys significant government investment in smart infrastructure and smart. In 2023, the total investment in the smart cities and smart infrastructure projects in the country reached over $500 billion according to the U. S. Department of Transportation’s 2023 report. Construction of smart highways, bridges, and buildings is currently underway in North America, which results in a higher demand for IoT technologies assets. In Canada, another market-leading country, the 2023 Smart Cities Challenge announced the investment of over CAD 300 million in the development of the IoT-enabled urban infrastructure. Furthermore, North America has a vast number of public-private partnerships focused on the innovation of the construction field, with the integration of the IoT technologies being one of the priorities. In addition, the region is advantaged by the significant government focus on infrastructure and construction resilience and sustainability, accompanied by a mature technology ecosystem. The overall dynamics in the region will allow it to remain the leading regional market through 2032.

Europe region is also expected to exhibit substantial growth with the largest incremental potential of all regional markets in the forecast period. One of the reasons is the significant technological advancement in the European market, and the stabilizing residential construction recovery in the region. However, the highest Compound Annual Growth Rate is projected for the Asia Pacific with a high increase in the adoption of IoT technologies in the construction sector, due to its overall adoption of advanced technologies and rapid urbanization, with strong construction industry expansions in China, India, Japan, and Singapore.

Do You Need any Customization Research on IoT in Construction Market - Enquire Now

Key Players

-

Trimble Inc. (Trimble Connect, SiteVision)

-

Hexagon AB (HxGN SmartNet, Leica ConX)

-

Topcon Corporation (MAGNET Enterprise, Sitelink3D)

-

Autodesk, Inc. (BIM 360, AutoCAD)

-

Oracle Corporation (Oracle Aconex, Oracle Primavera)

-

Siemens AG (MindSphere, Building X)

-

Caterpillar Inc. (Cat Connect, Cat VisionLink)

-

Procore Technologies, Inc. (Procore Construction Platform, Procore Analytics)

-

Komatsu Ltd. (KomConnect, Smart Construction Dashboard)

-

Hitachi Construction Machinery Co., Ltd. (ConSite, Solution Linkage)

-

Hilti Corporation (ON!Track, Hilti PROFIS Engineering)

-

ABB Group (ABB Ability, Smart Buildings)

-

Schneider Electric (EcoStruxure, Building Advisor)

-

Dassault Systèmes (3DEXPERIENCE, SIMULIA)

-

Bentley Systems, Inc. (SYNCHRO, ProjectWise)

-

Rockwell Automation, Inc. (FactoryTalk, Arena Simulation Software)

-

Microsoft Corporation (Azure IoT, Azure Digital Twins)

-

Johnson Controls International plc (Metasys, OpenBlue)

-

FARO Technologies, Inc. (FARO As-Built, FARO Focus Laser Scanner)

-

PlanGrid (Autodesk) (PlanGrid, Autodesk Build) and others

Latest Developments in the IoT in Construction Market

April 2024 – Microsoft Corporation unveiled its two key accelerators—an adaptive cloud approach and Azure IoT Operations and preview—at Hannover Messe to improve industrial transformation by the integration of IT and operational technology with open standards and unified data.

March 2024 – The U.S. Federal Highway Administration has released its IoT-enabled sensors into several national highway projects, annually monitoring the real-time integrity of transport assets and reducing accidents and maintenance costs. It was made possible by $300 billion allocated from the U.S. Federal Government’s Infrastructure Investment and Jobs Act.

July 2023 – The European Commission has developed the Smart Building Initiative as a part of its EU Green Deal, offering €200 million to provide existing 5000 commercial buildings with IoT for energy efficiency, security, and operations automation. Its aim is to bring 20% of the EU’s business premises into line with its ambitious sustainability goals by 2030.

| Report Attributes | Details |

| Market Size in 2023 | USD 13.5 Billion |

| Market Size by 2032 | USD 50.4 Billion |

| CAGR | CAGR of 15.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Application (Asset Monitoring, Fleet Management, Predictive Maintenance, Remote Operations, Safety, Wearables, Others) • By End-use (Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Trimble Inc., Hexagon AB, Topcon Corporation, Autodesk, Inc., Oracle Corporation, Siemens AG, Caterpillar Inc., Procore Technologies, Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Hilti Corporation, ABB Group, Schneider Electric, Dassault Systèmes, Bentley Systems, Inc., Rockwell Automation, Inc., Microsoft Corporation |

| Key Drivers | •IoT devices automate real-time monitoring of construction processes, which leads to better resource management and reduced project delays •IoT-based wearable devices and sensors ensure worker safety, these technologies reduce onsite accidents by identifying hazards early. |

| Market Restraints | •The deployment of IoT infrastructure in construction is capital-intensive. Smaller firms struggle with the high costs of adoption and maintenance. •IoT devices generate vast amounts of sensitive construction data, Inadequate cybersecurity measures can lead to data breaches or loss. |