IoT Insurance Market Report Scope & Overview:

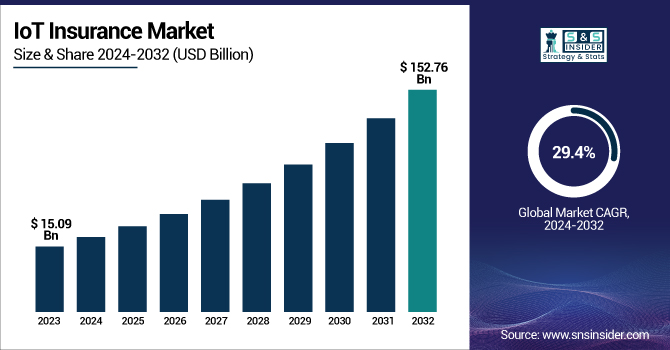

The IoT Insurance Market Size was valued at USD 15.09 Billion in 2023 and is expected to reach USD 152.76 Billion by 2032 and grow at a CAGR of 29.4% over the forecast period 2024-2032.

To Get more information on IoT Insurance Market - Request Free Sample Report

The market is evolving rapidly with the increasing use of connected devices and real-time analytics. Telematics is boosting usage-based insurance adoption while wearables are reshaping underwriting in health and life insurance. IoT automation has cut claims processing times by up to 30%, and predictive maintenance is lowering property claim frequencies. Customer satisfaction is rising through personalized, connected services. AI-integrated IoT is enhancing fraud detection, reducing false claims by up to 25%. These advances are streamlining operations and enabling dynamic pricing. Regulatory focus on compliance, data privacy, and cyber risks remains crucial as the market continues to innovate.

The U.S. IoT Insurance Market size was USD 4.14 billion in 2023 and is expected to reach USD 35.8 billion by 2032, growing at a CAGR of 27.13% over the forecast period of 2024–2032.

The U.S. IoT Insurance Market is witnessing significant growth, driven by the rising integration of connected devices across auto, health, and property insurance sectors. Insurers are leveraging real-time data to enhance risk assessment, personalize policies, and streamline claims processing.

In April 2023, Arity, a mobility and data analytics firm, entered into a partnership with Connected Analytic Services, LLC (CAS), an affiliate of Toyota. The collaboration is designed to deliver driving data from connected vehicles to auto insurance providers, supporting the creation and expansion of usage-based insurance (UBI) solutions.

The adoption of telematics and wearable technology is transforming traditional insurance models into more dynamic, usage-based offerings. Additionally, IoT-enabled automation is improving operational efficiency and customer engagement. As digital transformation accelerates, the market is expected to continue evolving with advancements in AI, data analytics, and cybersecurity solutions tailored for the insurance industry.

IoT Insurance Market Dynamics

Key Drivers:

-

Increasing Adoption of Connected Devices Across Insurance Sectors Drives Growth of the IoT Insurance Market

The growing penetration of IoT-enabled devices across automotive, health, and property insurance sectors is significantly fueling the IoT insurance market. Telematics devices in vehicles, wearable health trackers, and smart home sensors are providing insurers with real-time data that enhances risk assessment and underwriting processes. These connected devices allow for more accurate and dynamic pricing models, increasing personalization for policyholders and reducing losses for insurers. For example, usage-based insurance (UBI) is gaining traction in auto insurance due to insights collected from telematics on driving behavior.

Additionally, in health insurance, wearable devices are helping companies promote wellness and monitor conditions proactively. This data-driven approach leads to better customer satisfaction and operational efficiencies, which, in turn, drive overall market growth. The surge in connected consumer ecosystems and digital transformation in the insurance industry ensures that this trend will continue to be a major growth driver in the coming years.

Restrain:

-

Data Privacy and Security Concerns Significantly Restrain the Expansion of the IoT Insurance Market

The IoT insurance market faces a major restraint in the form of data privacy and cybersecurity risks. As insurers collect large volumes of sensitive personal data through connected devices such as health metrics, driving behavior, and home security information, they become more vulnerable to cyber threats and data breaches. Any unauthorized access or misuse of this information can lead to legal liabilities, reputational damage, and loss of customer trust.

Moreover, regulatory frameworks like HIPAA and GDPR impose strict compliance requirements, making it challenging for insurers to manage and secure the data responsibly. The fear of data misuse also makes many consumers hesitant to adopt IoT-based insurance models, potentially slowing down adoption rates. Unless insurance providers invest in robust cybersecurity infrastructure and transparent data policies, concerns over privacy and misuse of personal information will continue to act as a significant barrier to market expansion.

Opportunities:

-

Emerging Use of AI and Predictive Analytics with IoT Devices Creates Lucrative Opportunities in the Insurance Sector

The integration of artificial intelligence (AI) and predictive analytics with IoT technology is creating new and lucrative opportunities within the insurance industry. By combining real-time data from IoT devices with AI algorithms, insurers can generate predictive models that help forecast risk with greater precision, reduce fraudulent claims, and personalize insurance offerings.

For instance, in property insurance, smart sensors can detect anomalies like water leaks or fire hazards in advance, allowing insurers to mitigate potential damage and adjust policies accordingly.

In health insurance, AI-enabled wearables can identify early signs of illness, enabling preventive care strategies and improving overall health outcomes. This synergy not only enhances operational efficiency but also opens up avenues for innovative insurance products tailored to individual lifestyles. As technology matures and becomes more affordable, the adoption of AI-powered IoT solutions is expected to surge, offering insurers a competitive edge and customers more value-added services.

Challenges:

-

Integration Challenges with Legacy Insurance Systems Pose a Major Hurdle to IoT Insurance Market Growth

One of the key challenges facing the IoT insurance market is the integration of modern IoT infrastructure with traditional, legacy insurance systems. Most insurance companies still operate on outdated platforms that lack the flexibility and scalability required to support real-time data analytics and IoT integration. This creates technical and operational bottlenecks, preventing insurers from fully leveraging IoT’s capabilities for underwriting, claims processing, and customer engagement.

Additionally, interoperability issues between different devices, software platforms, and data formats can complicate system upgrades, increasing implementation costs and time. Many insurers also lack the in-house expertise to manage IoT deployment at scale, making the transition complex and resource-intensive. These integration challenges not only slow down innovation but also hinder the realization of IoT’s full potential in delivering personalized, dynamic insurance solutions.

IoT Insurance Market Segment Analysis

By Type

In 2023, the Life and Health Insurance segment captured the largest revenue share in the IoT insurance market due to increasing demand for personalized, real-time health monitoring and proactive risk management. The adoption of wearable devices such as fitness trackers and smartwatches has surged, allowing insurers to collect data on physical activity, heart rate, and sleep patterns. This data is leveraged to design dynamic insurance models and incentivize healthier lifestyles through rewards and discounts. Insurance providers like John Hancock have introduced interactive life insurance policies linked with fitness trackers, encouraging wellness behaviors.

Additionally, health insurers are deploying IoT-enabled remote patient monitoring systems, especially for chronic disease management, to reduce hospitalization and improve care quality. Product development in this segment has focused on integrating AI with IoT for predictive health risk analysis, enabling faster underwriting and claims processing. These innovations are not only improving operational efficiency but also boosting customer satisfaction and retention.

By Component

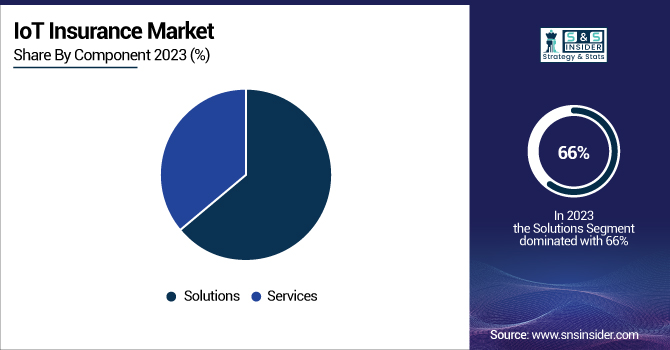

In 2023, the Solutions segment accounted for the largest share of the IoT insurance market revenue, contributing approximately 66%, driven by the rising demand for real-time data collection, analytics, and automation capabilities. IoT solutions comprise platforms, software, and infrastructure that help insurers manage connected device data and translate it into actionable insights for underwriting, risk assessment, and fraud detection. Major insurance players have invested heavily in developing proprietary IoT platforms or partnering with technology firms.

For example, insurance companies are launching customized solutions to monitor driving behavior in real time, enabling the rollout of usage-based insurance (UBI) products. Similarly, IoT platforms are being used to monitor building conditions in real estate insurance, preventing losses through predictive maintenance alerts.

The expansion of cloud computing and edge analytics further enhances these solutions, ensuring scalability and speed. Continued innovation in software tools that process and interpret massive volumes of IoT data is crucial to unlocking deeper personalization and efficiency in insurance offerings. The dominance of this segment highlights the importance of robust technological infrastructure as the backbone of a successful IoT-driven insurance ecosystem.

The Services segment is witnessing the highest growth in the IoT insurance market, with a projected CAGR of 30.7% over the forecast period. This growth is attributed to the increasing need for deployment, integration, consulting, and support services that help insurers effectively implement and manage IoT technologies. As insurance companies transition from traditional models to data-driven, tech-enabled processes, the demand for technical support, managed services, and IoT consulting is accelerating.

Additionally, as the volume and complexity of IoT data grow, there’s a strong demand for analytics-as-a-service and predictive modeling support. These services are instrumental in helping insurers realize the full potential of IoT investments, offering insights that drive customer engagement, reduce claim fraud, and enhance policy customization. The growing reliance on external experts and managed service providers signifies a fundamental shift toward collaborative and agile operating models in the insurance industry.

By End-use

The Automotive and Transportation segment dominated the IoT insurance market in 2023, accounting for 27% of total revenue, driven by the widespread adoption of telematics and vehicle connectivity. Insurers are increasingly leveraging IoT devices to collect real-time driving behavior data, such as speed, braking patterns, and distance traveled. This data is foundational for usage-based insurance (UBI) models, which are gaining popularity due to their ability to personalize premiums and reward safe driving.

Additionally, partnerships between automotive OEMs and insurers are leading to co-developed platforms that offer integrated insurance products at the point of vehicle sale. These developments are transforming automotive insurance into a highly dynamic, behavior-based system, increasing transparency and customer loyalty. As connected vehicle ecosystems continue to expand, the Automotive and Transportation segment is poised to remain a dominant force in the IoT insurance landscape.

The Healthcare segment is projected to grow at the highest CAGR of 32.1% over the forecast period, fueled by the integration of IoT devices in medical monitoring and personalized care. Wearable health tech, remote patient monitoring systems, and connected medical devices are revolutionizing how insurers assess risk and manage claims. These technologies provide continuous insights into patients' health conditions, allowing insurers to proactively adjust policies, detect early signs of chronic illnesses, and encourage healthier behavior. Insurance companies are increasingly collaborating with digital health firms to create wellness-based insurance plans that offer lower premiums for policyholders who maintain active lifestyles or meet health targets. Innovations such as connected glucose monitors and blood pressure devices are also being used for real-time alerts and preventive care. Insurers are rolling out programs that leverage these data streams to improve underwriting accuracy and reduce hospitalization costs.

Regional Analysis

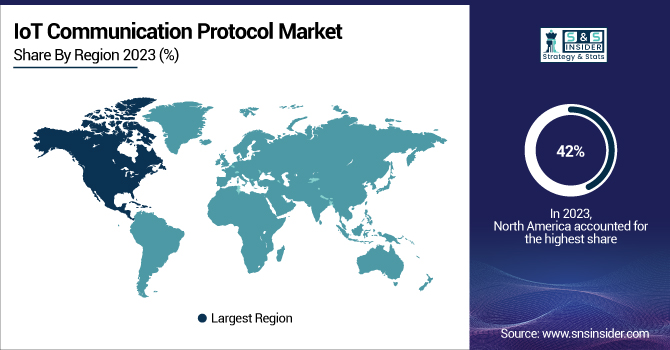

In 2023, North America held the largest market share in the global IoT insurance market, accounting for approximately 38% of the total revenue. This dominance is primarily driven by the region's advanced digital infrastructure, high adoption of smart technologies, and the presence of leading insurance and tech firms.

In the U.S., for instance, insurers are widely integrating telematics and connected devices into their service offerings. Auto insurance providers like Progressive and State Farm have introduced usage-based insurance (UBI) models that utilize IoT data from in-vehicle sensors to customize premiums based on driving behavior.

Moreover, health insurers are leveraging wearable fitness trackers to promote wellness programs and monitor policyholder health in real time. The region’s strong regulatory framework, high consumer awareness, and early adoption of AI, big data, and IoT technologies continue to support its leadership in the market. Collaborations between automakers, tech firms, and insurers are further reinforcing North America’s position as the core hub of innovation in IoT-based insurance solutions.

In 2023, Asia Pacific emerged as the fastest-growing region in the IoT insurance market, with an estimated CAGR of 31.1% over the forecast period. This rapid growth is fueled by the region's expanding middle class, increasing smartphone penetration, and rising demand for digital insurance services. Countries like China, India, and Japan are seeing a surge in the adoption of connected devices, especially in the automotive and healthcare sectors.

For example, insurance companies in China are integrating IoT sensors in vehicles to launch behavior-based insurance policies, while in India, health insurers are tying up with wearable tech providers to encourage preventive health care.

Governments across Asia Pacific are also promoting digital transformation through supportive policies and smart city initiatives, accelerating the use of IoT in risk assessment and claims management. As awareness grows and infrastructure develops, the region is expected to play a pivotal role in shaping the future of IoT-driven insurance globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Oracle Corporation (Oracle Insurance Policy Administration, Oracle IoT Cloud)

-

SAP SE (SAP Leonardo IoT, SAP S/4HANA for Insurance)

-

IBM Corporation (IBM Watson IoT Platform, IBM Cloud for Insurance)

-

Microsoft Corporation (Azure IoT Hub, Microsoft Cloud for Financial Services)

-

Intel Corporation (Intel IoT Platform, Intel SDO (Secure Device Onboard))

-

Telit Communications PLC (Telit IoT Platform, Telit deviceWISE for Insurance Telematics)

-

Capgemini SE (Capgemini Insurance Connect, Capgemini IoT Solutions for Insurers)

-

Cognizant (Cognizant Intelligent Insurance Operations, Cognizant IoT Assurance Platform)

-

Cisco Systems Inc. (Cisco Kinetic for Insurance IoT, Cisco IoT Threat Defense)

-

Accenture PLC (Accenture Connected Insurance Platform, Accenture IoT Insights)

-

Verisk Analytics Inc. (AIR Worldwide [catastrophe risk modeling], Verisk Telematics for Usage-Based Insurance)

-

Wipro Limited (Wipro HOLMES IoT, Wipro Insurance Analytics Suite)

-

Google LLC (Google Cloud IoT Core, Google Cloud for Insurance)

-

Synechron, Inc. (Synechron InsurTech Accelerator, Synechron IoT-Driven Insurance Solutions)

Recent Trends

-

June 2024: Oracle introduced the Oracle Health Insurance Data Exchange Cloud Service, designed to help health insurers simplify data exchange and reduce IT costs. This cloud-native solution enables seamless, real-time data exchange, supporting industry-standard formats like HIPAA X12 EDI. It enables insurers to create custom data mappings and validation rules, facilitating the quick onboarding of new partners and ensuring compliance with regulations.

-

August 2024: IBM's mainframe computers are experiencing renewed relevance in the AI era, particularly in industries like banking and insurance that require high-speed, real-time data processing. The integration of AI capabilities into IBM's mainframes allows for immediate analysis of transaction data, enhancing functions such as fraud detection and risk assessment, which are critical in the insurance sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.09 Billion |

| Market Size by 2032 | US$ 152.76 Billion |

| CAGR | CAGR of 29.40 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Type (Life and Health Insurance, Property and Casualty Insurance, Others) • By End-use (Automotive and Transportation, Healthcare, Agricultural, Retail and Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Intel Corporation, Telit Communications PLC, Capgemini SE, Cognizant, Cisco Systems Inc., Accenture PLC, Verisk Analytics Inc., Wipro Limited, Google LLC, Synechron, Inc. |