IP Intercom Market Report Scope & Overview:

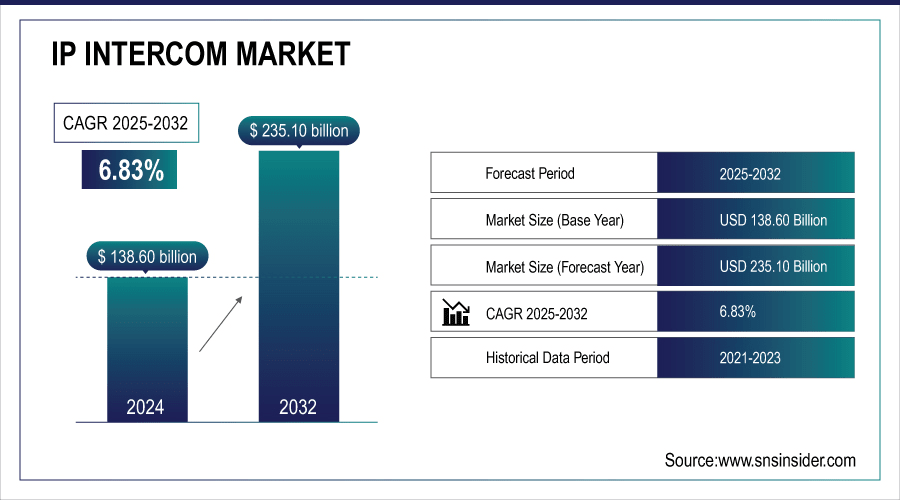

The IP Intercom Market size was valued at USD 138.60 Billion in 2024 and is projected to reach USD 235.10 Billion by 2032, growing at a CAGR of 6.83% during 2025-2032.

The IP Intercom market is growing rapidly, driven by demand for smart, networked communication solutions in residential and commercial buildings. Advanced devices now offer Wi-Fi 6 connectivity, high-performance hardware, premium touchscreens, and seamless integration with smart building systems. Enhanced security, energy efficiency, and compatibility with third-party applications boost adoption in luxury residences, multi-unit developments, and commercial facilities. Continuous technological advancements and expanding smart infrastructure are supporting the shift toward future-ready, user-friendly IP intercom solutions globally.

DNAKE has launched the H618 Pro, the industry’s first Android 15-based 10.1″ indoor monitor for IP intercom systems, offering next-gen Wi-Fi 6 connectivity, optimized performance with 4GB RAM/32GB ROM, a premium touchscreen display, and seamless integration with smart home and SIP-enabled devices for residential and commercial applications.

To Get More Information On IP Intercom Market - Request Free Sample Report

Key IP Intercom Market Trends

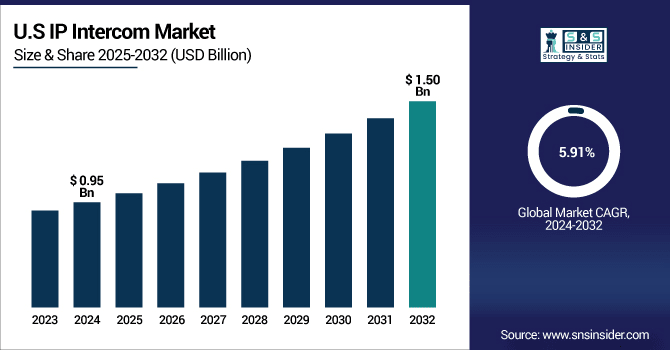

The U.S. IP Intercom market size was valued at USD 0.95 Billion in 2024 and is projected to reach USD 1.50 Billion by 2032, growing at a CAGR of 5.91% during 2025-2032. Rising demand for advanced communication solutions in residential, commercial, and institutional sectors, coupled with integration of IP-based technologies, enhanced security features, and smart building adoption, is driving market expansion and innovation across the United States.

The U.S. IP Intercom market Trends include the increasing adoption of IP-based communication systems for enhanced connectivity, integration with smart building and security solutions, growing demand for high-quality audio and video intercoms, cloud-based management platforms, and the shift toward scalable, networked solutions that support remote monitoring, automation, and improved user convenience across residential, commercial, and institutional applications.

IP Intercom Market Growth Drivers:

-

Rising Demand for Smart and Integrated Access Control Solutions

The IP Intercom market is driven by growing demand for secure and connected access systems. Adoption of advanced solutions enables integration with smart buildings, offering remote door and gate management, HD video, and two-way audio. These features enhance security, streamline operations, and modernize legacy infrastructure, supporting residential, commercial, and institutional applications, and driving overall market growth and technological innovation.

In Aug. 2025, The DoorBird D1812B IP Intercom provides secure access control with HD video and two-way audio, bridging legacy systems with modern smart buildings, and enabling remote management of doors and gates via the DoorBird app.

IP Intercom Market Restraints:

-

High Costs and Integration Challenges Restraining IP Intercom Market Growth

The IP Intercom market faces challenges due to high implementation and maintenance costs, which can limit adoption among cost-sensitive customers. Integration with existing legacy systems often requires specialized technical expertise, increasing complexity and development timelines. Compatibility issues, cybersecurity concerns, and the need for continuous software updates further hinder deployment. Additionally, varying regulatory standards and infrastructure limitations in certain regions slow market expansion and constrain widespread adoption of advanced IP intercom solutions.

IP Intercom Market Opportunities:

-

Upgrading Legacy Intercom Systems with IP Solutions

The growing demand for modern, scalable, and secure communication solutions presents a significant opportunity for the IP intercom market. Enhanced features such as VoIP support, HD-quality audio, two-way communication, and compatibility with existing infrastructure allow integrators to deploy cost-effective, flexible, and reliable systems. This trend drives adoption across commercial, industrial, and emergency communication applications, fostering innovation in audio-over-IP technologies and advanced in-building communication networks.

Barix launched the Annuncicom AHE-YA404 to modernize legacy analog intercom systems, offering VoIP SIP support, onboard amplification, and HDX-quality two-way audio for up to 16 stations, ensuring secure, scalable, and low-disruption upgrades.

IP Intercom Market Segment Highlights:

-

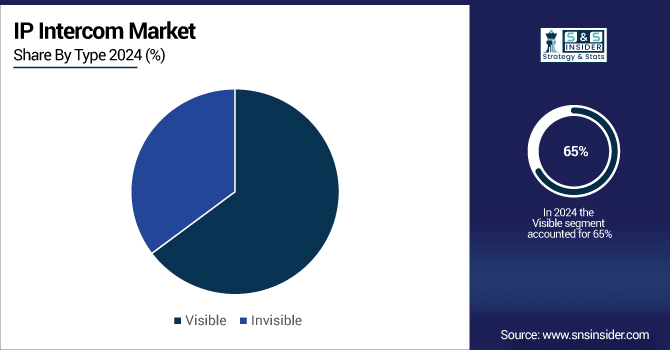

By Type – Dominating: Visible (65% in 2024), Fastest: Invisible (35.25% in 2024 to 36.75% in 2032, CAGR 9.10%)

-

By Application – Dominating: Commercial (34% in 2024), Fastest: Government (, CAGR 10.01%

-

By Technology – Dominating: IP-Based (Networked) (61% in 2024), Fastest: IP-Based (Networked) (CAGR 9.03%)

-

By Deployment – Dominating: Wired Deployment (40% in 2024), Fastest: Cloud/Network-Based Deployment (CAGR 10.30%)

IP Intercom Market Segment Analysis:

-

By Type, Visible Leads Market While Invisible Fastest Growth

Visible dominates the intercom market due to widespread adoption in commercial and residential installations, while Invisible shows the fastest growth, driven by rising demand for discreet, integrated communication solutions in smart buildings and security systems, highlighting the shift toward seamless, modern, and aesthetically optimized intercom technologies.

-

By Application, Commercial Dominate Communication-Enabled / IoT-Integrated IEDs Shows Rapid Growth

Commercial dominates the intercom market due to extensive deployment in offices, retail, and public spaces, while Communication-Enabled / IoT-Integrated IEDs show rapid growth, driven by rising demand for smart, connected, and automated communication solutions, reflecting the shift toward intelligent, networked, and efficient building management systems.

-

By Technology, IP-Based (Networked) Lead and Registers Fastest Growth

IP-Based (Networked) systems lead the market due to their scalability, remote management, and integration capabilities, while they also register the fastest growth as organizations increasingly adopt connected, cloud-enabled, and smart communication infrastructures to enhance security, monitoring, and operational efficiency across various applications and sectors.

-

By Deployment, Wired Deployment Lead While Cloud/Network-Based Deployment Grow Fastest

Wired deployment leads the market due to its reliability and established infrastructure, while cloud/network-based deployment is experiencing the fastest growth driven by the rising adoption of scalable, remote-access, and IoT-enabled solutions that enhance flexibility, monitoring, and real-time management across commercial, industrial, and residential applications.

IP Intercom Market Regional Highlights:

-

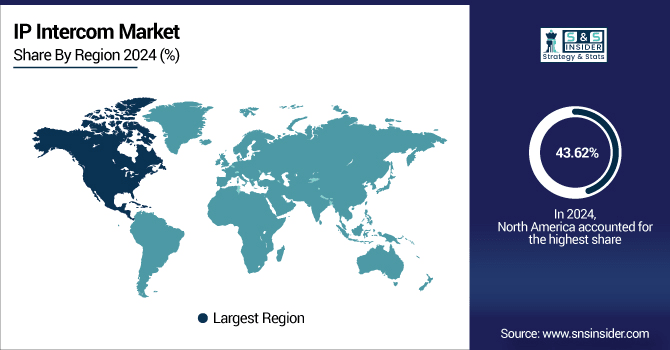

By Region – Dominating: North America (43.62% in 2024), Fastest: Asia-Pacific (25.99% in 2024 to 29.44% in 2032, CAGR 10.22%)

-

Europe: 18.40% → 19.78% (CAGR 9.51%)

-

South America: 7.20% → 7.89% (CAGR 9.78%)

-

Middle East & Africa: 4.80% → 4.11% (CAGR 6.42%, declining)

IP Intercom Market Regional Analysis:

North America IP Intercom Market Insights

The North America IP Intercom market is at the forefront globally, driven by rapid adoption of advanced IP-based communication systems, integration with smart building infrastructure, and rising demand for secure, scalable, and efficient access control solutions across commercial, industrial, and government sectors. This trend highlights the region’s emphasis on modernizing legacy systems and enhancing building automation and safety.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S IP Intercom Market Insights

U.S leads the Asia-Pacific IP Intercom market, driven by advanced technology adoption, smart building integration, and demand for secure access solutions.

Asia-Pacific IP Intercom Market Insights

Asia-Pacific is the fastest-growing IP Intercom market, driven by rapid urbanization, expanding smart building infrastructure, and rising demand for advanced communication solutions. Increasing adoption of cloud-based and networked intercom systems, integration with IoT devices, and emphasis on secure, scalable access control are fueling market growth. Technological advancements and government initiatives supporting smart cities further accelerate regional expansion.

-

China IP Intercom Market Insights

The china IP Intercom market is experiencing rapid growth, fueled by rising electric vehicle adoption and increasing demand for advanced communication systems.

Europe IP Intercom Market Insights

The Europe IP Intercom market is witnessing steady growth, driven by increasing demand for secure access control and modern communication solutions across commercial, government, and industrial sectors. Integration of IP-based technologies with legacy systems, rising adoption of smart building infrastructure, and the need for reliable, scalable intercom solutions are supporting market expansion, while technological advancements continue to enhance functionality and efficiency.

-

Germany IP Intercom Market Insights

Germany dominates the Europe IP Intercom market, leading adoption due to advanced smart building infrastructure, strong industrial and commercial demand, and early deployment of modern IP-based communication systems.

Latin America IP Intercom Market Insights

The Latin America IP Intercom market is expanding steadily, driven by growing adoption in commercial, government, and industrial sectors. Increasing urbanization, modernization of building infrastructure, and the need for enhanced security and communication systems are encouraging investments in IP intercom solutions. Integration with smart building technologies and rising awareness of remote monitoring capabilities further support market growth across the region.

Brazil IP Intercom Market Insights

Brazil leads the Latin America IP Intercom market, driven by rising smart building adoption, modernization of infrastructure, and growing demand for secure communication.

Middle East & Africa IP Intercom Market Insights

The Middle East & Africa IP Intercom market is growing steadily, fueled by increasing adoption of smart building technologies, modernization of legacy communication systems, rising security concerns, and demand for integrated audio-video solutions across commercial, government, and industrial sectors, supporting scalable, efficient, and secure IP-based intercom deployments throughout the region.

-

Saudi Arabia IP Intercom Market Insights

Saudi Arabia dominates the MEA IP Intercom market, fueled by smart building adoption, advanced security systems, and growing demand for modern communication solutions.

Competitive Landscape for IP Intercom Market:

RTS Intercom Systems, established in 1975, is a global leader in professional communication solutions, delivering innovative intercom and IP-based systems for broadcast, live events, and mission-critical operations. With over 50 years of experience, RTS is renowned for reliability, scalability, and cutting-edge technology that enhances collaboration and operational efficiency worldwide.

-

In April 2025, RTS Intercom Systems won two Best of Show awards and the Product of the Year at NAB 2025 for its NOMAD Wireless Intercom and RVOC, highlighting its 50-year legacy of innovative, high-impact communication solutions.

Hikvision, founded in 2001, is a global leader in AI-powered Internet of Things (AIoT) solutions, specializing in video surveillance, smart traffic management, and security systems. Renowned for innovation, Hikvision leverages advanced AI and deep learning technologies to deliver reliable, scalable, and intelligent solutions for safety and operational efficiency worldwide.

-

In July 2025, Hikvision unveiled a suite of next-generation traffic cameras and servers powered by its large-scale Guanlan AI models. These innovations aim to significantly improve detection accuracy, reduce false alarms, and enhance overall traffic safety. The new products include checkpoint cameras designed to monitor seatbelt and phone usage, and incident detection cameras that address issues like fallen objects and pedestrian detection. By leveraging advanced AI technology, Hikvision is setting new standards in intelligent traffic management.

IP Intercom Market Key Players:

Some of the IP Intercom Market Companies

-

RTS Intercom Systems

-

Axis Communications

-

Commend International GmbH

-

GAI-Tronics

-

TCS AG

-

Comelit Group S.p.A.

-

Hikvision

-

TOA Corporation

-

Koontech

-

Siedle

-

Panasonic Corporation

-

2N TELEKOMUNIKACE

-

Guangdong Anjubao

-

Bird Home Automation GmbH

-

Legrand S.A.

-

Fermax Electronica

-

Barix AG

-

Urmet

-

Canon Inc.

-

Aiphone Company Limited

| Report Attributes | Details |

| Market Size in 2024 | USD 3.15 Billion |

| Market Size by 2032 | USD 6.06 Billion |

| CAGR | CAGR of 8.53% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Visible and Invisible) • By Application(Commercial, Government, Industrial, Residential and Others) • By Technology/Type(IP-based (networked) and Analog/Legacy) • By Deployment(Wired Deployment, Wireless Deployment, Cloud/Network-Based Deployment and On-Premises Deployment) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | RTS Intercom Systems, Axis Communications, Commend International GmbH, GAI-Tronics, TCS AG, Comelit Group S.p.A., Hikvision, TOA Corporation, Koontech, Siedle, Panasonic Corporation, 2N TELEKOMUNIKACE, Guangdong Anjubao, Bird Home Automation GmbH, Legrand S.A., Fermax Electronica, Barix AG, Urmet, Canon Inc., Aiphone Company Limited |