Solid State Lighting Market Size & Trends:

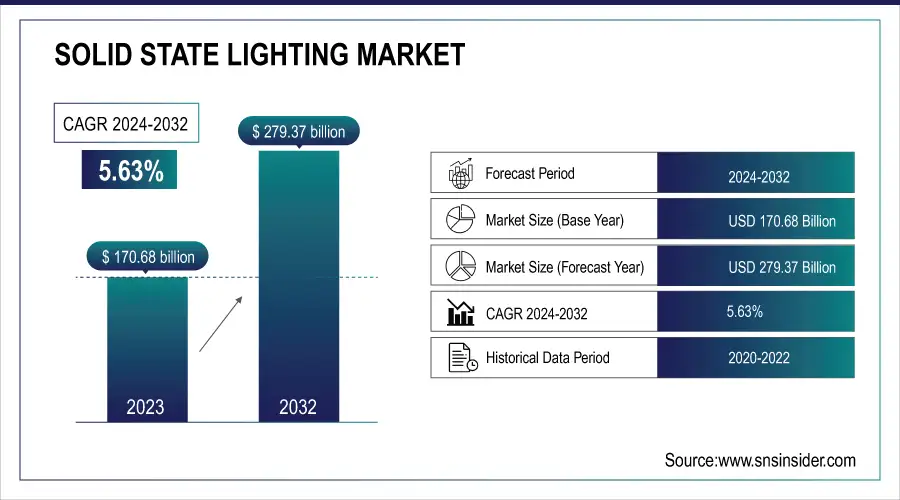

The Solid State Lighting Market size was valued at USD 170.68 Billion in 2023, and expected to reach USD 279.37 Billion by 2032, growing at a CAGR of 5.63% during 2024-2032. The solid state lighting market analysis highlights surging penetration and adoption rates in residential, commercial, and industrial sectors, driven by regulatory mandates, and the need for cost-effective and long-lasting lighting solutions are driving the market growth. Enhanced energy efficiency and improvement in sustainability metrics are primary criteria, wherein the adoption of solid-state lighting is expected to greatly reduce energy consumption and carbon emissions compared to legacy lighting technologies. Other advantages including improved product lifecycle or failure rate increased reliability, where current LED solutions offer longer operational life and lower maintenance cost.

Additionally, with the integration of energy-saving lighting in smart grids, and backup power solutions, there is a rising demand for disaster resilience and emergency backup use to improve safety and function in the wake of power outages and natural disasters. Due to these factors, the market is growing and solid-state lighting has become a driving force in the movement toward intelligent and sustainable lighting systems.

To Get more information on Solid-State & Other Energy-Efficient Lighting Market - Request Free Sample Report

Solid State Lighting System Market Dynamics:

Drivers:

-

Growing Adoption of Solid State Lighting for Sustainability Goals Propel Market Growth

With buildings responsible for 37%–40% of global energy consumption and CO₂ emissions, the need for sustainable solutions has never been greater. Light pollution has been one of the major contributors to the advancement of the solid-state lighting technologies as the governments across the globe have been putting policies in place for replacing older fixtures with more efficient lighting in order to decrease glare. The surging concentrations on eco-friendly and recyclable lighting products among both consumers businesses is boosting solid-state battery market growth.

When smart lighting is combined with IoT and automation, it takes energy optimization on a next level with remote monitoring and adaptive brightness control. Corporate sustainability initiatives and green building certifications will also facilitate this shift to solid-state alternatives, providing for long-term savings and environmental benefits. This solid state lighting market trend sets solid-state lighting as a major player in global carbon reduction and energy efficiency.

Restraints:

-

High-Precision Manufacturing Challenges in Solid State Lighting Impede Market Expansion

The manufacturing of solid state lighting technologies involves highly intricate processes, which need advanced materials, precision engineering, and specialized equipment, hampering the solid state lighting market growth. OLEDs, LEDs, and many other solid-state lighting solutions completely rely on the semiconductor fabrication techniques that require cutting-edge technology and controlled environments for ensuring efficiency and performance. The production process includes several stages, such as wafer processing, epitaxy, phosphor coating, and thermal management, that highly require substantial investment and expertise.

Moreover, for the purpose of maintaining uniformity in light output, color consistency and longevity presents technical challenges, as these types of defects in fabrication or materials can impact the overall efficiency. The surging requirement for automation, cleanroom environments, and strict quality control further adds to the manufacturing costs, making it a hurdle new market entrants.

Opportunities:

-

Breakthroughs in OLED & Micro LED Technology Driving Lighting Innovation are Providing Market Growth Opportunities

The rapid advancements in OLED (Organic Light-Emitting Diode) and MicroLED technologies are transforming the solid state lighting industry by presenting superior durability, efficiency, and design flexibility. OLED lighting provides uniform illumination, ultra-thin form factors, and flexibility, making it ideal for architectural, automotive, and display applications. Meanwhile, MicroLED technology boasts higher brightness, lower power consumption, and longer lifespan compared to traditional LEDs, positioning it as a game-changer in high-performance lighting and next-generation display panels.

These technologies enable seamless integration with smart lighting systems, enhancing energy management and sustainability. As R&D efforts continue, cost reductions and mass production improvements will further accelerate their adoption, expanding their role in diverse industries, from wearable devices to automotive lighting and large-scale commercial displays.

Challenges:

-

Effective Thermal Management for High-Power Lighting Efficiency Can Challenge Market Expansion

LEDs and MicroLEDs are high-power solid-state lighting solutions that produce a lot of heat during operation, leading to performance degradation, shortened lifetimes, and lowered efficiency. Degeneracy of heat to ensure that they function optimally requires effective thermal management. To tackle this challenge, they are developing new heat sink materials, active cooling systems, and novel thermal interface materials (TIMs). Smart lighting designs also utilize heat spreaders and specialized circuit layouts to improve heat dissipation. Poor thermal regulation can lead to color shifts, reduced luminous output, and premature failure, making it a critical challenge for manufacturers. As lighting applications expand into high-intensity and industrial settings, optimizing thermal solutions remains a key focus to ensure longevity and energy efficiency.

Solid State Lighting Market Segmentation Analysis:

By Technology

The Solid-State Lighting (SSL) segment held the largest market share, accounting for 46% of total revenue in 2023, and is projected to be the fastest-growing segment throughout the forecast period over 2024-2032. This growth is driven by the rapid adoption of LED, OLED, and MicroLED by users as they consume less energy, have a higher lifespan, reduced maintenance costs compared to conventional lighting solutions. The pressure from government regulations to deselect inefficient lighting and increasing demand for smart and connected lighting systems complements this. Moreover, Smart Lighting as a Service (SLaaS) solution helps incorporate SSL with IoT-based automation along with adaptive lighting controls, further driving efficiency and sustainability, making SSL the dominant and fastest-growing segment of the energy-efficient lighting market.

By Installation

The New Installation segment held the largest solid state lighting market share, accounting for approximately 54% of total revenue in 2023. This dominance is driven by the increasing demand for energy-efficient lighting solutions in new commercial, industrial, and residential construction projects. Governments are implementing strict energy regulations globally for the purpose of promoting the adoption of LED, OLED, and other Solid State Lighting technologies in newly built infrastructure.

Additionally, rapid urbanization, expansion of smart cities, and the rising focus on sustainable building solutions are fueling market growth. Businesses and developers are prioritizing advanced, long-lasting, and cost-effective lighting systems, further solidifying the new installation segment as the leading and fastest-growing category within the energy-efficient lighting market.

The Retrofit Installation segment is projected to be the fastest-growing category in the solid state lighting market over the forecast period 2024-2032. The growth can be attributed to the growing replacement of traditional lighting with energy-efficient lighting solutions in commercial, industrial, and residential spaces. Adoption of LEDs, OLEDs and smart lighting systems in existing infrastructure is being accelerated by government incentives, enforcement of strict energy efficiency mandates and rising awareness of the benefits of sustainability. Moreover, businesses and homeowners are working with providers to reduce long-term energy costs and gain greater environmental compliance through a variety of retrofitting projects that are the primary segment driving the market growth during the forecast period.

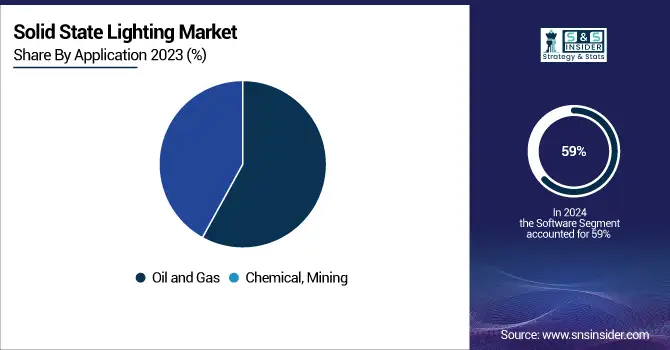

By Application

The Oil and Gas segment dominated the solid state lighting market, accounting for approximately 59% of total revenue in 2023. This dominance is driven by the industry's high demand for durable, energy-efficient lighting solutions in hazardous and remote environments. LEDs, OLEDs, and explosion-proof lighting systems are widely adopted to enhance worker safety, operational efficiency, and energy conservation in offshore platforms, refineries, and drilling sites. Moreover, stringent government regulations on energy efficiency and carbon emissions are pushing oil and gas companies to transition toward sustainable lighting solutions. The solid state lighting industry’s focus on reducing operational costs and minimizing environmental impact further fuels the demand for solid-state and energy-efficient lighting technologies, solidifying its market leadership.

The Chemical and Mining segment is the fastest-growing in the solid state lighting market during the forecast period 2024-2032. This rapid growth is fueled by the surging adoption of energy-efficient, explosion-proof, and durable lighting solutions in hazardous industrial environments. LEDs, OLEDs, and advanced Solid State Lighting technologies are being integrated into chemical plants, processing units, and mining sites to enhance worker safety, operational efficiency, and cost savings. Stricter regulatory standards for workplace safety and energy consumption further drive the shift toward long-lasting, high-performance lighting. Additionally, advancements in smart lighting and automation allow for remote monitoring and adaptive brightness control, making them ideal for harsh and high-risk industrial settings.

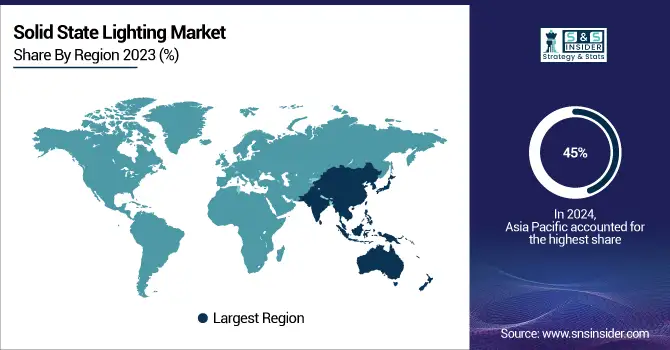

Solid State Lighting Market Regional Growth Insights:

The Asia Pacific region dominated the solid state lighting market, accounting for approximately 45% of the revenue share in 2023 owing to the fast-paced urbanization, industrial growth, and government support for energy-efficient lighting solutions in countries including China, India, Japan, and South Korea. The booming construction industry, growing number of infrastructure development projects, and increasing penetration of smart city implementations are showing exponential demand for LEDs, OLEDs, and other solid-state lighting technologies in the region. Moreover, government policies promoting energy conservation, incentives for LED adoption and restrictions on inefficient lighting solutions also fuel market growth. In upcoming years, Asia Pacific will dominate Imperial LED Main Panel Market due to technological development, increasing consumer awareness, and decreasing LED prices.

The Europe region is the fastest-growing market in the solid state lighting market over the forecast period of 2024-2032, driven by stringent energy efficiency regulations, government incentives, and the rapid adoption of smart lighting solutions. The European Union’s initiatives to phase out traditional incandescent bulbs and promote LED and OLED technologies have significantly boosted market demand. Additionally, the rise of smart cities, increasing investments in sustainable infrastructure, and a strong emphasis on reducing carbon emissions are fueling growth. Countries including Germany, France, and the U.K. are at the forefront of adopting advanced lighting solutions in both residential and industrial sectors. With continuous technological advancements and policy-driven energy transitions, Europe is set to experience robust market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Solid State Lighting Companies:

-

Wolfspeed Inc. (USA, Semiconductor & LED Solutions)

-

Energy Focus Inc. (USA, Energy-Efficient Lighting)

-

GE Lighting (USA, LED & Smart Lighting)

-

Koninklijke Philips N.V. (Netherlands, LED & Smart Lighting)

-

Mitsubishi Electric Corporation (Japan, Industrial & Commercial Lighting)

-

Osram Licht AG (Germany, Automotive & Specialty Lighting)

-

Samsung Electronics Co. Ltd. (South Korea, LED & Display Solutions)

-

Seoul Semiconductor Co. Ltd. (South Korea, LED Components & Modules)

-

Sharp Corporation (Japan, LED & Display Technology)

-

Toshiba Corporation (Japan, Industrial & Smart Lighting)

List of Suppliers Companies that supply raw materials and components for the lighting industry:

-

Plansee Group (Austria)

-

Nichia Corporation (Japan)

-

Supreme Components International (Singapore)

-

G.W.P. AG (Germany)

-

EURO METRICS (Europe)

-

Epistar Corporation (Taiwan)

-

Cree Inc. (USA)

-

Osram Licht AG (Germany)

-

Seoul Semiconductor (South Korea)

Solid State Lighting Market Trends:

-

On November 27, 2024, researchers from Chiba University achieved a breakthrough in optical cooling – They demonstrated that perovskite quantum dots embedded in a crystal lattice could reach temperatures 10 K below room temperature using anti-Stokes photoluminescence. This pioneering approach could revolutionize energy-efficient cooling technologies, though challenges remain in achieving near 100% emission efficiency and maintaining quantum dot stability under exposure to air.

Recent Development:

-

On March 5, 2025, Toshiba announced TLP5814H, a gatedriver photocoupler with SiC MOSFET compatible high safety functionality. Integrated active Miller clamp circuit enables system size reduction and higher reliability for use in high-voltage industrial designs.

-

On April 2, 2024, GE celebrates the launch of GE Aerospace and GE Vernova as standalone companies. This opens a new chapter of not just invention but world changing invention in aviation, energy, and health care the legacy of GE.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 170.68 Billion |

| Market Size by 2032 | USD 279.37 Billion |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (HID Lighting, Plasma, Induction Lighting, Solid-State Lighting, Fluorescent Lighting) • By Installation (New Installation, Retrofit Installation) • By Application (Oil and Gas, Chemical, Mining) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Wolfspeed Inc. (USA), Energy Focus Inc. (USA), GE Lighting (USA), Koninklijke Philips N.V. (Netherlands), Mitsubishi Electric Corporation (Japan), Osram Licht AG (Germany), Samsung Electronics Co. Ltd. (South Korea), Seoul Semiconductor Co. Ltd. (South Korea), Sharp Corporation (Japan), Toshiba Corporation (Japan). |