Isoparaffin Solvents Market Growth Analysis

Get E-PDF Sample Report on Isoparaffin Solvents Market - Request Sample Report

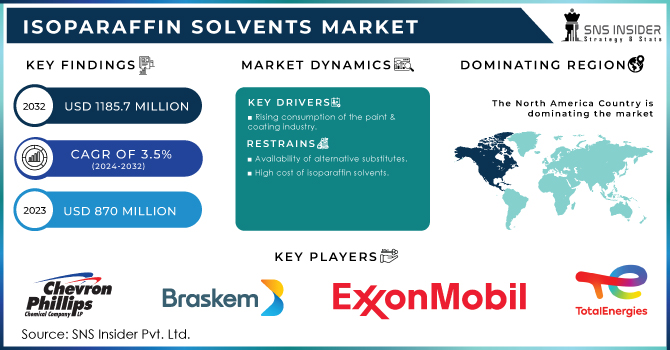

The isoparaffin solvents market size was USD 900.45 Million in 2024 and is expected to Reach USD 1185.72 Million by 2032 and grow at a CAGR of 3.50% over the forecast period of 2025-2032.

Demand for isoparaffin solvents is rising across cleaning, industrial, and personal care sectors due to their excellent solvency, low odor, low toxicity, and compatibility with various agents. They are widely used in industrial cleaning, degreasers, and household products, offering residue-free performance without damaging material integrity. The U.S. EPA notes that cleaning and maintenance sectors account for ~40% of solvent use, highlighting demand for safe, compliant options. In personal care, isoparaffins serve as carriers in deodorants, skincare, and cosmetics, valued for their neutral, non-irritating properties. With growing consumer preference for hypoallergenic and non-toxic products, the FDA estimates the U.S. cosmetics and personal care industry exceeds USD 100 billion annually, supporting increased demand for safe, versatile solvents like isoparaffins across industrial and consumer markets.

Isoparaffin Solvents Market Trends

-

Rising adoption of bio-based isoparaffin solvents as sustainable alternatives to traditional petroleum-derived solvents.

-

Increasing use in electronic cleaning applications due to non-conductive and low-residue properties.

-

Expansion in automotive coatings and adhesives driven by improved evaporation control and surface finish quality.

-

Growing incorporation in industrial inks and paints for enhanced spreadability and low VOC emissions.

-

Rising preference in pharmaceutical formulations as safe, low-toxicity carriers for active ingredients.

-

Emergence of custom-blended isoparaffins tailored for specific industrial and consumer applications.

-

Increasing regulatory compliance pressure promoting low-odor, low-VOC solvent formulations.

-

Integration in advanced degreasing and metal cleaning processes due to high solvency and thermal stability.

Isoparaffin Solvents Market Drivers

-

Rising consumption of the paint & coating industry

Consumption of paints and coatings products is on the rise owing to the growth in construction, automotive, and industrial applications. With global urbanization and infrastructure development on the rise, especially within emerging natural markets, that has resulted in huge demand for paints and coatings that provide protection, an aesthetically pleasing appearance, and other functional properties. For example, in the construction sector, coatings serve both decorative and protective purposes, preventing surfaces from being adversely affected by moisture, UV exposure, and corrosion. Likewise, high-performance coatings for vehicle durability and aesthetics are a significant segment in the automotive industry, and coatings for extreme operating conditions are an essential commodity in the industrial sector. In addition to this, an increasing demand for novel items like eco-friendly and VOC-compliant coatings can urge manufacturers to shift to more advanced forms. Moreover, industry has responded with innovation and a broader range of sustainable coatings due to government regulations encouraging environmental compliance fuelling consumption. Combined, these aspects highlight the increasing role of paints & coatings across several industries, which continue to support the growth of this market.

According to data from the U.S. Bureau of Economic Analysis, the construction sector in the United States contributed approximately USD 1.8 trillion to the GDP in 2022, reflecting the robust demand for building materials, including paints and coatings. Furthermore, the global automotive industry is projected by the International Organization of Motor Vehicle Manufacturers (OICA) to produce over 92 million vehicles annually by 2025, further driving demand for high-performance coatings.

Isoparaffin Solvents Market Restraints

-

Availability of alternative substitutes.

-

High cost of isoparaffin solvents.

Isoparaffin solvents are derived from petroleum-based naphtha, making them inherently expensive. The complex production process further increases costs, while chemical reactions during manufacturing release harmful gases and pollutants, posing environmental and health risks. In contrast, substitutes such as paraffin are widely available, easier to produce, and require less costly raw materials, resulting in a lower-priced alternative. Moreover, smaller personal care and cosmetic companies, constrained by tight budgets, are increasingly using isoparaffin solvents despite the high cost. These businesses prioritize solvent performance and safety, balancing affordability with effectiveness, which sustains demand even amid cheaper, simpler alternatives in the market.

Isoparaffin Solvents Market Segment Highlights

-

By Application

The paints & coatings segment held the largest market share of around 43% in 2024. Due to its functionality and aesthetics enhancement role to the surfaces, paints and coatings fire the largest market share all across the industries. The painting and coating industry is a major end-user industry in the construction industry as paints and coatings protect buildings and other infrastructures against environmental damage, including corrosion, ultraviolet (UV) exposure, and moisture, thus increasing the lifespan of materials and structures. The same is true in the automotive sector, where coatings are used for appearances, wear, chemicals, and extreme weather. Moreover, special coatings that provide heat resistant, anti-microbial, and anti-slip properties are extensively used in the industrial sector, especially in manufacturing and food processing & healthcare-related settings.

Isoparaffin Solvents Market Regional Analysis

North America Isoparaffin Solvents Market Insights

North America dominated the paints and coatings market with a 44% share in 2024, driven by developed infrastructure, strong demand from end-use industries, and supportive regulatory frameworks promoting quality and sustainability. High commercial and residential construction, particularly in Central and South Florida, fuels demand for heavy-duty, weather-resistant coatings. The region’s automotive, aerospace, and electronics sectors also require advanced coatings for durability, performance, and safety. Regulatory measures from the U.S. EPA and Canada’s Environmental Protection Act encourage low- or zero-VOC, environmentally friendly formulations. Growing consumer preference for sustainable products further boosts market growth, making North America a key and attractive market for paints and coatings.

Europe Isoparaffin Solvents Market Insights

Europe’s isoparaffin solvents market is expanding steadily, driven by demand from industrial cleaning, personal care, and coatings sectors. Strong regulatory frameworks, including REACH regulations, enforce strict chemical safety and environmental standards, encouraging manufacturers to adopt low-toxicity, low-VOC solvents. High demand from automotive, electronics, and pharmaceutical industries for high-performance and safe solvents supports market growth. The trend toward sustainable and bio-based products is also prominent, as European consumers increasingly prefer eco-friendly personal care and household products. Continuous innovation and a focus on green chemistry further strengthen Europe’s market position, making it a key region for high-quality isoparaffin solvent applications.

Asia Pacific Isoparaffin Solvents Market Insights

Asia Pacific's growth is due to rapid industrialization, growing manufacturing sectors, and expanding automotive, electronics, and personal care markets. Countries like China, India, and Japan are driving demand through increasing construction, industrial cleaning, and chemical processing activities. The region benefits from cost-effective production and raw material availability, making solvents more accessible for industrial and personal care applications. Rising awareness of product safety and environmental compliance is pushing manufacturers toward low-toxicity, low-odor solvents. Additionally, the growth of cosmetics, skincare, and household products further fuels demand, positioning Asia Pacific as a major growth hub for isoparaffin solvent consumption and innovation.

Latin America Isoparaffin Solvents Market Insights

Latin America’s isoparaffin solvents market is growing steadily, supported by expansion in industrial cleaning, coatings, and personal care sectors. Brazil and Mexico are leading contributors due to industrialization, increasing automotive production, and a growing middle-class population driving cosmetic and household product demand. Regulatory frameworks are evolving to improve environmental compliance, encouraging the use of low-toxicity and low-VOC solvents. The market also benefits from relatively lower production costs and availability of raw materials. Increased focus on sustainability and eco-friendly solutions is influencing solvent selection in both industrial and consumer applications, positioning Latin America as an emerging market for safe and high-performance isoparaffin solvents.

Middle East & Africa Isoparaffin Solvents Market Insights

The Middle East & Africa isoparaffin solvents market is witnessing growth due to rising demand from construction, automotive, and industrial cleaning sectors. Rapid urbanization and infrastructure development, particularly in Gulf countries, drive the need for high-performance coatings and solvents. Industrial cleaning applications in oil, gas, and manufacturing sectors further boost market growth. Regulatory awareness and environmental considerations are gradually influencing solvent formulations toward safer, low-toxicity options. Additionally, increasing demand in personal care and cosmetics markets, especially in the UAE, South Africa, and Saudi Arabia, is promoting solvent adoption. Strategic investments and technology transfer from global players are strengthening the region’s isoparaffin solvent market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Competitive Landscape for Isoparaffin Solvents Market:

Chevron Phillips Chemical Company was founded in 2000 and is headquartered in The Woodlands, Texas. Chevron Phillips Chemical Company specializes in petrochemical products and polymers. Their Soltrol line of isoparaffin solvents, including Soltrol 100, 170, and 130, is are high-purity, low-odor solvent used in industrial cleaning, coatings, and aerosol propellants. These solvents are known for their selective solvency and low toxicity.

-

In May 2025, Chevron Phillips Chemical Company released an updated Safety Data Sheet for Soltrol® 125 Isoparaffin Solvent, providing detailed hazard classifications and safety precautions.

ExxonMobil Corporation was established in 1999 and is headquartered in Irving, Texas. ExxonMobil is a multinational oil and gas corporation. Their Isopar series, including Isopar™ M, V, and E, are high-purity synthetic isoparaffinic hydrocarbon solvents used in applications such as metalworking, industrial cleaning, and consumer products. These solvents are characterized by their narrow boiling ranges and low aromatic content.

-

In July 2025, ExxonMobil Chemical updated the technical datasheet for Isopar M, highlighting its low aromatic content and suitability for various industrial applications.

Shell Global, founded in 1907 and headquartered in The Hague, Netherlands, is a global energy company. Their isoparaffin solvents, including ShellSol™ TD and ShellSol™ TM, are synthetic hydrocarbon solvents used in applications such as paints, coatings, and cleaning products. These solvents are known for their low odor and narrow boiling ranges.

-

In June 2025, Shell Chemicals released an updated product datasheet for ShellSol TM, emphasizing its low odor and suitability for surface coatings and printing inks.

Isoparaffin Solvents Market Key Players

-

Chevron Phillips Chemical Company (Soltrol 130, Soltrol 145)

-

Braskem S.A. (IsoSolve, IsoPura)

-

Exxon Mobil Corporation (Isopar M, Isopar G)

-

TotalEnergies SE (Total Isane IP 140, Total Isane IP 160)

-

Idemitsu Kosan Co. Ltd (Isoparaffin H, Isoparaffin L)

-

Royal Dutch Shell plc (ShellSol D60, ShellSol T)

-

INEOS (Isopar E, Isopar K)

-

Luan Group (LuanSol IP, LuanSol MS)

-

RB Products (Isopar RC, Isopar HC)

-

Mehta Petro Refineries Ltd (Mehtol IP, Mehtol MC)

-

Neste Oyj (Neste Renewable Isoparaffins, Neste MY)

-

SK Global Chemical Co., Ltd. (SK Solvent S, SK Solvent L)

-

Dow Chemical Company (Dowanol DPnB, Dowanol PnP)

-

HCS Group (Haltermann Carless) (HCS Isopar N, HCS Isopar M)

-

DHC Solvent Chemie GmbH (DHC Isopar H, DHC Isopar L)

-

Petrochem Carless Ltd (Petrosol H, Petrosol M)

-

LyondellBasell Industries (Lyondell Isopar L, Lyondell Isopar V)

-

Sasol Limited (Sasol Solvents P, Sasol Solvents M)

-

Calumet Specialty Products Partners, L.P. (Calumet Penreco, Calumet Hydrocal)

-

Cepsa Química (Cepsa EcoSolv IP, Cepsa SolvFlex)

| Report Attributes | Details |

| Market Size in 2024 | US$ 900.45 Million |

| Market Size by 2032 | US$ 1185.72 Million |

| CAGR | CAGR of 3.50% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Metalworking, Paints & Coatings, Agrochemicals, Cleaning, Pharmaceuticals and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Chevron Phillips Chemical Company, Braskem S.A., Exxon Mobil Corporation, TotalEnergies SE, Idemitsu Kosan Co. Ltd, Royal Dutch Shell plc, INEOS, Luan Group, RB Products, Mehta Petro Refineries Ltd, Neste Oyj, SK Global Chemical Co., Ltd., Dow Chemical Company, HCS Group (Haltermann Carless), DHC Solvent Chemie GmbH, Petrochem Carless Ltd, LyondellBasell Industries, Sasol Limited, Calumet Specialty Products Partners, L.P., and Cepsa Química |