Chlorine Trifluoride Market Report Scope & Overview:

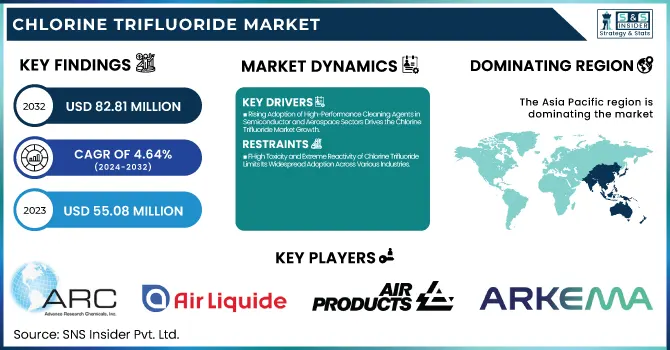

The Chlorine Trifluoride Market Size was valued at USD 55.08 Million in 2023 and is expected to reach USD 82.81 Million by 2032, growing at a CAGR of 4.64% over the forecast period of 2024-2032.

To Get more information on Chlorine Trifluoride Market - Request Free Sample Report

The Chlorine Trifluoride Market is expanding rapidly, driven by its use in semiconductor manufacturing, nuclear fuel processing, and industrial cleaning. Our report explores pricing trends and cost analysis, highlighting historical shifts and future projections shaped by supply-demand forces. A detailed import and export data (trade analysis) reveals key trading nations and regulatory barriers. Given its extreme reactivity, government regulations on handling, storage, and transportation are crucial, with compliance frameworks varying across regions. The market is further shaped by investment and funding trends, showcasing capital inflows and technological advancements. A cost-benefit analysis of different grades and forms evaluates economic feasibility, helping businesses make informed decisions. These insights offer a strategic edge in navigating the evolving market landscape.

Chlorine Trifluoride Market Dynamics

Drivers

-

Rising Adoption of High-Performance Cleaning Agents in Semiconductor and Aerospace Sectors Drives the Chlorine Trifluoride Market Growth

The increasing need for ultra-pure cleaning agents in high-tech industries, particularly in semiconductor manufacturing and aerospace applications, is significantly driving the Chlorine Trifluoride Market. With the miniaturization of electronic components and the demand for contamination-free environments, semiconductor fabrication facilities require highly efficient cleaning solutions that can remove stubborn residues without damaging surfaces. Chlorine trifluoride, known for its exceptional reactivity and ability to clean chemical vapor deposition (CVD) chambers, is gaining traction in this industry. Moreover, aerospace and defense sectors utilize chlorine trifluoride for cleaning propulsion systems and ensuring the integrity of critical components. Its ability to react with virtually all materials, including oxides, makes it an indispensable solution in high-precision industries. Additionally, stringent quality control standards in semiconductor fabrication have intensified the need for advanced cleaning agents, further propelling market growth. The increasing complexity of semiconductor devices and the push for higher manufacturing yields are expected to fuel demand for chlorine trifluoride as a preferred cleaning agent.

Restraints

-

High Toxicity and Extreme Reactivity of Chlorine Trifluoride Limits Its Widespread Adoption Across Various Industries

Despite its advantages in industrial cleaning, semiconductor manufacturing, and aerospace applications, the Chlorine Trifluoride Market faces significant limitations due to its extreme toxicity and highly reactive nature. Chlorine trifluoride is one of the most hazardous chemical compounds known, capable of reacting violently with nearly all materials, including glass, steel, and organic substances. This extreme reactivity poses severe risks in handling, transportation, and storage, requiring specialized containment measures and highly trained personnel. Even minor leaks or accidental exposure can lead to catastrophic consequences, including fires, toxic gas releases, and structural damage. Due to these risks, regulatory agencies enforce stringent safety protocols, which increase operational costs for industries utilizing chlorine trifluoride. The need for specialized storage containers, controlled environments, and emergency response mechanisms further adds to the complexity of working with this compound. Consequently, many industries are reluctant to adopt chlorine trifluoride despite its superior cleaning and etching capabilities.

Opportunities

-

Advancements in Safer Storage and Handling Technologies Improve Market Accessibility for Chlorine Trifluoride Applications

Innovations in safe storage and handling technologies are opening new avenues for Chlorine Trifluoride Market growth. Historically, the extreme reactivity and hazardous nature of chlorine trifluoride have limited its widespread industrial adoption. However, advancements in high-integrity containment systems, automated leak detection, and improved safety protocols are making it easier for industries to integrate chlorine trifluoride into their operations. Chemical manufacturers are developing specialized fluoropolymer-coated storage containers and advanced gas delivery systems that minimize the risk of accidental exposure. Additionally, research into safer transportation methods is enabling broader adoption across multiple industries. These technological advancements are reducing handling risks while ensuring regulatory compliance, making chlorine trifluoride a more viable option for semiconductor, aerospace, and specialty chemical applications.

Challenge

-

Supply Chain Disruptions and Raw Material Constraints Impact the Chlorine Trifluoride Market Growth

The Chlorine Trifluoride Market faces significant challenges due to supply chain disruptions and constraints in raw material availability. The production of chlorine trifluoride relies on the availability of fluorine and chlorine-based precursors, which are subject to market fluctuations and geopolitical influences. Disruptions in the supply of these raw materials, whether due to trade restrictions, environmental regulations, or production bottlenecks, can lead to price volatility and limited product availability. Additionally, transportation and storage challenges further complicate supply chain management, as chlorine trifluoride requires specialized containment and logistics solutions. The increasing global demand for high-purity industrial gases, coupled with unpredictable market conditions, poses a challenge for maintaining stable supply chains. Companies in the industry must develop robust supplier networks and invest in alternative production strategies to mitigate these risks.

Chlorine Trifluoride Market Segmental Analysis

By Grade

Electronic Grade dominated the Chlorine Trifluoride Market in 2023 with a market share of 65.2%. The rising demand for ultra-high-purity cleaning agents in semiconductor manufacturing has propelled this segment’s dominance. The Semiconductor Industry Association (SIA) reported a surge in global semiconductor sales, increasing the need for chlorine trifluoride in chamber cleaning processes. Additionally, initiatives like the U.S. CHIPS Act, which promotes domestic semiconductor production, have intensified the adoption of electronic-grade chlorine trifluoride. Leading chipmakers such as TSMC, Intel, and Samsung rely on this compound for its superior etching and cleaning properties in advanced node fabrication. Its ability to remove stubborn residues without damaging sensitive components has solidified its preference over industrial-grade alternatives.

By Form

Gas form dominated the Chlorine Trifluoride Market in 2023 with a market share of 50.3%. The gaseous state of chlorine trifluoride is widely preferred due to its ease of handling in semiconductor fabrication and industrial cleaning applications. Semiconductor manufacturing giants like ASML and Tokyo Electron utilize gaseous chlorine trifluoride for in-situ chamber cleaning, enhancing process efficiency and reducing downtime. Furthermore, safety measures outlined by organizations such as OSHA and the U.S. EPA have influenced the transportation and storage of chlorine trifluoride, favoring gas-based containment systems. Government-backed semiconductor expansion projects in the United States, South Korea, and Taiwan have further driven the demand for gaseous chlorine trifluoride as a critical industrial gas.

By Application

Semiconductor Manufacturing dominated the Chlorine Trifluoride Market in 2023 with a market share of 48.7%. The increasing demand for high-performance microchips and the rise of 5G, AI, and IoT technologies have driven significant investments in semiconductor fabrication plants. Companies like Intel, TSMC, and GlobalFoundries have expanded their production capacities, leading to a higher demand for chlorine trifluoride as an essential etching and cleaning agent. The Semiconductor Equipment and Materials International (SEMI) association has also highlighted the growing adoption of chlorine trifluoride in extreme ultraviolet (EUV) lithography and advanced process nodes. Additionally, government initiatives such as the European Chips Act and subsidies in Japan and South Korea have fueled semiconductor industry expansion, further strengthening the dominance of this segment.

Chlorine Trifluoride Market Regional Outlook

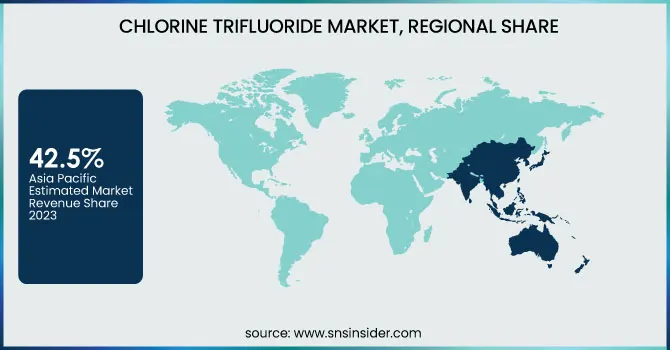

Asia Pacific dominated the Chlorine Trifluoride Market in 2023 with a market share of 42.5%. The region’s dominance is driven by its well-established semiconductor manufacturing industry, rapid industrialization, and growing investment in electronics and aerospace sectors. China, Taiwan, South Korea, and Japan lead in semiconductor fabrication, with companies like TSMC, Samsung, and SMIC driving the demand for chlorine trifluoride in wafer cleaning and etching processes. According to SEMI (Semiconductor Equipment and Materials International), China accounted for over 30% of global semiconductor equipment sales in 2023, reinforcing its reliance on high-purity gases like chlorine trifluoride. Taiwan’s semiconductor exports exceeded $170 billion in 2023, further fueling demand. South Korea, backed by Samsung and SK Hynix’s expansion, continues to push chlorine trifluoride consumption, with the government committing $450 billion for semiconductor growth by 2030. Additionally, Japan, home to key chemical manufacturers like Kanto Denka Kogyo and Tosoh Corporation, strengthens supply chains, ensuring Asia Pacific’s market leadership.

Europe emerged as the fastest-growing region in the Chlorine Trifluoride Market, projected to grow at a significant CAGR during the forecast period. The region’s accelerated growth is driven by the increasing semiconductor production, stringent environmental regulations promoting advanced industrial cleaning, and rising investments in aerospace and nuclear energy. Germany, France, and the Netherlands are key contributors, with Germany’s Infineon Technologies investing $5 billion in a new semiconductor plant to strengthen the domestic chip industry. The European Chips Act, with €43 billion in funding, further stimulates chlorine trifluoride demand for advanced node manufacturing. France, with aerospace giants like Airbus, is driving demand for high-purity gases in propulsion and rocket applications. The Netherlands, home to ASML, the world’s leading EUV lithography machine manufacturer, continues to expand its chlorine trifluoride consumption. Additionally, the European Union’s push for cleaner and efficient chemical processing strengthens its market trajectory.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Advance Research Chemicals, Inc.

-

Air Liquide S.A.

-

Arkema S.A.

-

Central Glass Co., Ltd.

-

Daikin Industries, Ltd.

-

Gujarat Fluorochemicals Limited

-

Hanwha Solutions Corporation

-

Kanto Denka Kogyo Co., Ltd.

-

Matheson Tri-Gas Inc.

-

Merck KGaA

-

Mitsui Chemicals, Inc.

-

Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso Corporation)

-

Praxair Technology Inc.

-

Shandong Dongyue Group

-

Showa Denko K.K.

-

SRF Limited

-

Tosoh Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 55.08 Million |

| Market Size by 2032 | USD 82.81 Million |

| CAGR | CAGR of 4.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Electronic Grade, Industrial Grade) •By Form (Gas, Liquid, Solid) •By Application (Semiconductor Manufacturing, Nuclear Fuel Processing, Rocket Propellant Systems, Industrial Cleaning, Chemical Processing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kanto Denka Kogyo Co., Ltd., Linde plc, Air Products and Chemicals, Inc., Air Liquide S.A., Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso Corporation), Central Glass Co., Ltd., Advance Research Chemicals, Inc., Merck KGaA, Daikin Industries, Ltd., Tosoh Corporation and other key players |