Connected Worker Market Trends & Analysis:

Get More Information on Connected Worker Market - Request Sample Report

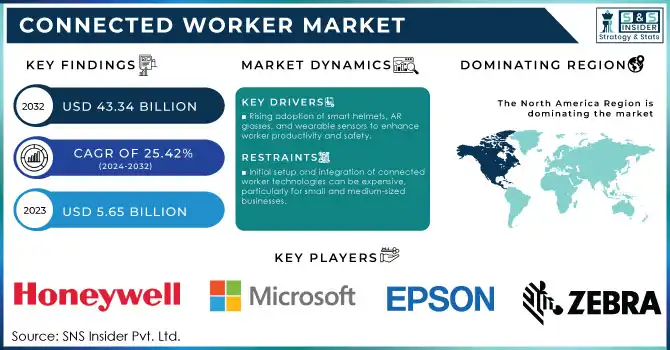

The Connected Worker Market was valued at USD 5.65 billion in 2023 and is expected to reach USD 43.34 billion by 2032, growing at a CAGR of 25.42% over 2024-2032.

Technological progress in wearable technologies, IoT, and Industry 4.0 innovations have complemented the wide expansion of the Connected Worker Market. With the integration of mobile apps, wearable devices, and IoT sensors, these solutions are changing how workforce productivity, safety, and real-time communication are defined. Ripples of demand are evident in manufacturing, construction, oil & gas, healthcare, and similar sectors as organizations prioritize optimization and overhauling safety protocols. Construction firms have also adopted smart helmets and wearable sensors that monitor health and fatigue to reduce accidents and minimize downtime when a worker becomes fatigued.

This is primarily driven by increasing workplace safety measures and regulations towards compliance. Governments and industry bodies are enforcing stricter safety regulations, forcing businesses to adopt connected solutions. Moreover, hazardous industries are using technologies such as AR-enables wearables for remote workforce management. AR-assisted smart glasses, for example, have improved the productivity of field workers in the oil & gas sector by more than 30% by providing real-time support and training. The gradual implementation of 5G networks is also one other essential growth catalyst for the market. Low latency and high bandwidth 5G enable enhanced functionality to connected worker platforms. For example, in manufacturing, 5G-enabled wearables have cut equipment downtime by a quarter via predictive maintenance. In addition, embedding AI and machine learning in these platforms provides insights in real-time on how the worker is working and encourages optimized task management.

Recent data underscore sectors of buoyancy in the market. According to a survey in 2023, over 40% of manufacturing companies worldwide are either using or planning to use connected worker technologies in the next two years.

The Connected Worker Market has huge potential and is quickly moving into the future with the support of technologies such as wearables, IoT, AI, and the growing focus on safety and efficiency. These advancements are augmented by changing regulatory requirements and an increasing adoption of 5G infrastructure, enabling efficient workforce management and transforming industries.

Connected Worker Market Dynamics

Drivers

-

Rising adoption of smart helmets, AR glasses, and wearable sensors to enhance worker productivity and safety.

-

Integration of IoT-enabled devices for real-time communication and operational efficiency.

-

Faster and more reliable connectivity enabling seamless data transmission and platform optimization.

Improved connectivity, and faster and more reliable connectivity are driving the growth of the Connected Worker Market as it allows smooth flowing of data and improves platform utilization. The launch of newer network technologies, especially 5G, has significantly changed how connected worker solutions work. LTE enables instant messaging platforms between wearables/sensors/mobile applications with minimal latency, allowing for seamless communication and continuous monitoring that has never been possible before with devices that can provide that same feature set. Such ability is crucial in the manufacturing, construction, oil & gas industry due to the need to make timely decisions regarding safety and efficiency. Wearables can be connected to central platforms providing real-time and/or health and environmental observation data with 5G connectivity which can respond immediately and conduct safe conditions.

5G provides the seamless connectivity needed to implement innovative technologies such as augmented and virtual reality (AR/VR). AR smart glasses can be connected via 5G to enable field workers in the oil & gas sector to provide real-time access to remote expert guidance, which increases problem-solving efficiency and reduces downtime by more than 30%. Likewise, driving forecasting in manufacturing, where 5G-enabled wearables aid predictive maintenance by communicating live equipment data, there has been a 25 percent reduction in unplanned downtime.

While this empowers real-time data transfer, faster connectivity also improves the scalability and efficiency of the connected worker platforms. Thousands of workers and devices can operate in concert, directing data flows that do not overwhelm the network, allowing for normal workflows, monitoring of all processes, and much more. That strong connectivity enables cloud-based solutions, where data available from different sites can be unified and analyzed to create actionable insights for maximizing worker performance and operational efficiency. The reality is that faster and more reliable connectivity is enhancing the Connected Worker Market by allowing for real-time data sharing, increasing the use of other disruptive technologies, and in the end providing a more scalable platform. With 5G networks available almost on a global scale, connected worker solutions are enhancing safety, productivity, and operational efficiencies in a broader range of industries. In addition to optimizing worker's efficiency, this transition is significantly altering the way workforces are managed, and the way an industrial work environment functions.

Restraints

-

Initial setup and integration of connected worker technologies can be expensive, particularly for small and medium-sized businesses.

-

The collection and transmission of sensitive data raise concerns about potential breaches and unauthorized access.

-

Workforce resistance to adopting new technologies or altering traditional work practices can slow the market's growth.

The growth of the Connected Worker Market is hampered as the workforce resists such new technologies. In several industries workers have grown used to existing methods and processes, and due to that, their response could be reluctant when it comes to connected worker solutions. Often including wearables, sensors, and AR (augmented reality), these technologies can necessitate a transition for workers, incorporating different workflows, finding new learning curves, and learning a new process to do the same tasks. New devices can also be quite difficult to use, and some staff could be fearful of the technology replacing them rather than helping them be more efficient.

For sectors such as manufacturing, construction, and oil & gas, where employees are accustomed to physical, manual work, the move to a more technologically-focused model is considered disruptive. For many workers, these technologies—particularly those that allow companies to monitor their performance instantaneously—may be seen as an intrusion into their independence or privacy. Furthermore, trepidation regarding new systems and system failures can intensify disbelief. In addition to the costs associated with using these technologies, the initial training and upskilling needed to utilize connected worker technologies efficiently can pose a significant hurdle, especially in environments where the labor force is not tech-savvy. Training requires time and resources, making it seem inconvenient, or an administrative burden, to employees who are already juggling with a heavy workload.

This resistance slows down the pace at which the market adopts the solution, as organizations are forced to wait until new solutions can be deployed, restricting the impact of connected worker platforms. Organizations need to articulate the benefits of connected worker solutions to employees to demonstrate how those solutions improve safety, productivity, and working conditions. Working through the implementation with workers and providing thorough training on how the technologies are to be used can alleviate worries, reduce resistance, and create a collaborative spirit to enable the successful use of connected worker technologies across an organization.

Connected Worker Market Segment Analysis

By Component

The hardware segment dominated the market and accounted for the largest share of 42.83% of the Connected Worker Market in 2023. This dominance can be attributed to the growing adoption of wearable devices, IoT sensors, and AR glasses that are necessary for real-time monitoring of worker health, safety, and performance. With companies in sectors such as manufacturing, construction, and oil & gas investing in internal devices to relieve worker productivity and safety, the hardware segment is thriving. The advanced wearable devices and IoT sensors will also witness an increase due to high connectivity and 5G gains; this segment is anticipated to remain ahead due to digitalization & safety regulation and operational efficiency trends aiding future industry growth.

The software segment of the Connected Worker Market is expected to grow at the highest CAGR during the forecast period. Such growth can be associated with the requirement for software platforms that provide real-time monitoring, analytics, and integration with wearables and IoT sensors platforms. Software solutions are being enhanced by advances in AI, machine learning, and big data into a more sophisticated level of technology that provides actionable insights into the performance and safety of the workforce. The move towards cloud-based platforms is also enabling many software to become more scalable and available. With the ongoing digitization of industries and increased focus on the data-driven decision-making process, the software segment is anticipated to grow rapidly in the coming years, owing to the technical innovations and efficiency it brings to operations.

By Deployment

The cloud segment dominated the market and represented a significant revenue share of 73.0% in 2023 due to its scalability, cost-effectiveness, and accessibility. The flexibility that a cloud-based platform provides with storing data and accessing it in real-time, along with integration with various IoT devices, wearables, and software solutions opens up a lot of possibilities. Cloud deployments allow organizations to process large amounts of data without the hassle of overseeing multiple locations, and are ideal for industries with numerous operational endpoints. With the growing trend of companies adopting remote work and digital transformation strategies, the cloud deployment segment will continue to grow. Market predictions indicate that cloud-bound connected worker solutions will see substantial growth due to 5G network rollouts, continued adoption of IoT sensors and devices, and a shift toward subscription models that offer companies a more efficient and agile solution.

On-premises segment is expected to register the highest CAGR during the forecast period. Industries like healthcare, government, and manufacturing that have high priorities for security, data control, and compliance push this growth. These sectors usually need tailor-made solutions that could be 100% managed at their own locations. Local requires help with increasing worries about data security and privacy, this segment is expected to witness rising adoption of on-premises deployments. The future growth will probably be driven by edge technologies that can complement on-premise systems with local processing capabilities providing real-time analytics.

Connected Worker Market Regional Landscape

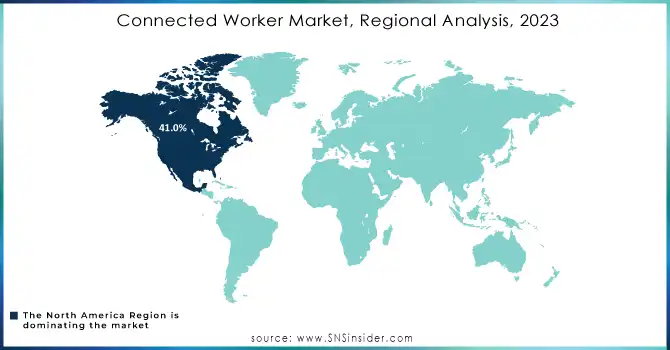

North America dominated the Connected Worker Market and represented a significant revenue share of more than 41.0% in 2023, driven by factors such as strong technological infrastructure, an increase in the adoption of digital solutions, and technologically advanced industries such as manufacturing, oil & gas, and healthcare. High adoption of connected worker technologies in industries is observed in the U.S. and Canada with wearables, IoT sensors, and AI-based technologies for improved safety, productivity, and workforce management. The regulatory pressure regarding workplace safety and operational efficiency in the region additionally boosts the market growth. North America remains on top of this trend, as investments in 5G networks, artificial intelligence (AI), and automation technologies continue.

The Connected Worker Market is expected to grow at the highest CAGR in the Asia-Pacific (APAC). Rapid industrialization, the adoption of Industry 4.0, and the growing manufacturing sector in countries like China, India, and Japan are driving this growth. With the workforce being vast and diverse, several APAC enterprises are gaining productivity, safety, and operational efficiency by adopting connected worker technologies. Moreover, the rapid expansion of digital infrastructure in the region, including 5G rollout and IoT adoption, is a strong basis for future growth. Manufacturing, construction, and logistics are a few industries that will continue to grow in APAC in the years to come. APAC will remain a hot spot with the digital transformation shift fuelled by innovation and an increasing need for workforce management solutions with regional dynamics until the end of the forecast period.

Need Any Customization Research On Connected Worker Market - Inquiry Now

Key Players

The major key players along with their products are:

-

Honeywell International Inc. - Honeywell Safety Suite

-

Microsoft - Microsoft HoloLens

-

PTC Inc. - Vuforia Augmented Reality Platform

-

Epson - Epson Moverio Smart Glasses

-

Zebra Technologies - Zebra Savanna

-

RealWear - RealWear HMT-1

-

Vuzix - Vuzix M400 Smart Glasses

-

Atheer - Atheer Air AR Platform

-

Taqtile - Manifest AR Platform

-

Librestream - Onsight AR Platform

-

Immersive Labs - Immersive Learning Platform

-

Google Cloud - Google Glass Enterprise Edition

-

Scope AR - Scope AR WorkLink

-

Upskill - Upskill Skylight

-

Samsung Electronics - Samsung Galaxy XCover Pro

-

Airbus - Skywise Connected Worker

-

Iris Automation - Casia Autonomous Drones for Worker Monitoring

-

Qualcomm - Snapdragon XR

-

Autodesk - Autodesk Construction Cloud

-

Honeywell Intelligrated - Intelligrated Robotics

Recent Developments in the Connected Worker Market

-

March 2024: ServiceNow acquired 4Industry, a partner specializing in manufacturing apps to improve shop floor efficiency. This acquisition will help ServiceNow enhance its Connected Worker platform by integrating new manufacturing-focused applications into its Now platform, aiming to create a robust connected worker solution for streamlining operations and boosting worker productivity.

-

March 2024: IFS announced the acquisition of Falkonry, a company specializing in industrial AI for predictive maintenance and anomaly detection. This move will expand IFS's capabilities in providing AI-powered insights to monitor and optimize industrial processes, thereby supporting the growing demand for predictive maintenance and data-driven decision-making in connected worker solutions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.65 Bn |

| Market Size by 2032 | US$ 43.34 Bn |

| CAGR | CAGR of 25.42% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Hardware, Software, Services)

• By Deployment (Cloud, On-Premises) • By End-Use (Manufacturing, Mining, Oil and Gas, Construction, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Microsoft, PTC Inc., Epson, Zebra Technologies, RealWear, Vuzix, Atheer, Taqtile, Librestream, Immersive Labs, Google Cloud, Scope AR, Upskill, Samsung Electronics |

| Key Drivers |

• Rising adoption of smart helmets, AR glasses, and wearable sensors to enhance worker productivity and safety.

• Integration of IoT-enabled devices for real-time communication and operational efficiency. • Faster and more reliable connectivity enabling seamless data transmission and platform optimization. |

| Market Restraints | • Initial setup and integration of connected worker technologies can be expensive, particularly for small and medium-sized businesses. • The collection and transmission of sensitive data raise concerns about potential breaches and unauthorized access. • Workforce resistance to adopting new technologies or altering traditional work practices can slow the market's growth. |