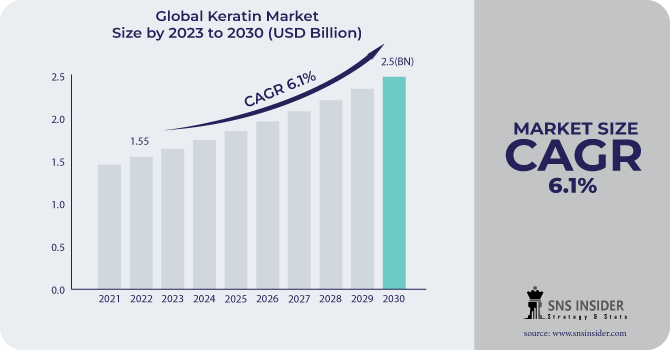

The Keratin Market size was valued at USD 1.55 billion in 2022. It is estimated to hit USD 2.5 billion by 2030 and grow at a CAGR of 6.1% over the forecast period of 2023-2030.

The growth of the keratin market is driven by the increasing demand for hair care products. Consumers are becoming more conscious about their appearance and are actively seeking products that can enhance the health and beauty of their hair. As a result, the demand for keratin-infused shampoos, conditioners, and treatments has increased. A significant trend in the keratin market is the rising demand for keratin treatments in salons. Keratin treatments, also known as Brazilian blowouts, have gained immense popularity among individuals seeking to achieve smooth, frizz-free hair. These treatments involve the application of keratin-infused products and heat to the hair, resulting in long-lasting straightening effects. The increasing demand.

Get More Information on Keratin Market - Request Sample Report

The hydrolyzed keratin dominated the keratin market with a revenue share of more than 50% in 2022. This versatile substance serves various purposes, such as acting as a humectant, nail conditioning agent, antistatic agent, and hair and biological additive. Its significance extends beyond cosmetic applications, as it plays a crucial role in the development of healthy tissues. Cosmetic and personal care companies incorporate hydrolyzed keratin into their products to enhance well-being, health, and beauty. For example, mascara may contain hydrolyzed keratin at concentrations of up to 0.2%, while bath soaps can have concentrations of up to 0.028%. Hair sprays, on the other hand, typically contain a maximum concentration of 0.059% hydrolyzed keratin.

Drivers

Increasing demand for hair care products

The growing awareness about hair health and the desire for lustrous, strong hair has led to a surge in the demand for keratin-based hair care products. Consumers are seeking effective solutions to combat hair damage caused by pollution, heat styling, and chemical treatments.

Rise in the demand for natural and organic products

With the increasing preference for natural and organic ingredients in personal care products, keratin, being a natural protein, has gained significant traction. Consumers are shifting towards products that are free from harmful chemicals and are seeking safer alternatives for hair care.

Restraint

High cost of keratin treatments

Keratin treatments can be expensive, making them less accessible to a wider consumer base. On average, the cost of treatment can range from $200 to $600. However, it is important to note that prices may vary depending on the salon. The cost of sourcing and processing keratin, along with the professional expertise required for application, contributes to the high price point of these treatments.

Limited availability of raw materials

Keratin is primarily sourced from animal by-products, such as feathers, horns, and hooves. The limited availability of these raw materials poses a challenge to the keratin market, as it restricts the production capacity and scalability of keratin-based products.

Opportunities

Technological advancement in the beauty salon industry

Growing demand for keratin in emerging markets

The increasing disposable income and changing lifestyles in emerging economies present a significant opportunity for the keratin market. As consumers in these regions become more conscious about their appearance and hair care, the demand for keratin-based products is expected to witness substantial growth.

Challenges

Intense competition from alternative hair care solutions

In the market, there exist alternative treatments and products that offer comparable benefits to keratin-based solutions. The availability of substitutes presents a potential challenge to the keratin market, as consumers might choose more cost-effective alternatives.

Before February 24th, 70% of the Russian cosmetics market was dominated by large international companies, primarily from the European Union and the United States. However, within just two months, by April 2022, the market had experienced a significant decline of 14% due to the departure of these major corporations. Consequently, the availability of retail products decreased by 25%. Fearing scarcity, consumers responded by stockpiling goods, resulting in a 3% increase in cosmetics purchases during the first half of 2022. Undoubtedly, the most striking impact of the conflict outbreak on the Russian cosmetics market was the drastic reduction in imports, which decreased by a staggering 80%. The Ukrainian cosmetics industry suffered severe consequences from Russia's invasion, leading to the suspension of production and closure of numerous businesses. This downturn in the cosmetic market also had a detrimental effect on the keratin market in both Russia and Ukraine.

The threat of a recession may cause some shoppers to reduce their spending on nonessential items, but this does not seem to apply to beauty essentials. The beauty industry in the United States also experienced significant growth, with high-end beauty brands witnessing a 15% year-over-year increase in revenue, surpassing $27 billion. The consistent or even increased demand for personal care products during an economic downturn is driving the need for keratin in the production of beauty items.

However, in some low-income level countries, the recession poses some challenges for the keratin market. The decreased demand for keratin-based goods may result in excess inventory, which strains the financial health of industry participants. The recession also hinders research and development efforts within the keratin market, as companies may have limited resources to allocate toward innovation and product improvement.

By Type

Alpha-Keratin

Beta-Keratin

By Product

Hydrolyzed

Others

By Application

Personal Care & Cosmetics

Food & Beverages

Healthcare & Pharmaceuticals

Others

Get Customised Report as per Your Business Requirement - Enquiry Now

North America dominated the keratin market with a revenue share of about 38% in 2022. This is attributed to the increasing usage of hair care and skin care products among individuals. Moreover, the presence of numerous small- and large-scale producers in the region has contributed to the growing awareness and demand for personal care products. Manufacturers in North America have adopted an integrated approach toward health and cosmetic products, recognizing the interconnectedness of various categories within the personal care industry. This strategic shift has further bolstered the market's growth. Among the countries in North America, the United States stood out as the leading exporter of hair products in 2022, with an impressive export value of nearly 1.7 billion U.S. dollars. This is attributed to the rising consumption of personal care products in the region. The flourishing retail industry, coupled with an increasing consciousness among individuals about safeguarding their skin and hair from dust and pollution, has fueled this demand. These factors play a pivotal role in driving the demand for keratin in North America throughout the forecast period.

Asia Pacific is expected to grow with the highest CAGR of about 6.5% and to be the largest region for the keratin market in the coming years. This growth is attributed to the soaring demand for hair care and styling products, as well as the increasing popularity of keratin treatments and other hair straightening procedures in countries like China, India, Japan, and South Korea. Moreover, the presence of global multinational companies in this region, coupled with the strong demand from end-use markets such as personal care & cosmetics, healthcare & pharmaceuticals, and food & beverages, further propels the keratin market. Furthermore, increasing consumption of personal care & cosmetic products that provide enhanced nutrition to the skin and hair is expected to drive the demand for keratin in the coming years. As a result, the Asia Pacific region is poised to witness substantial growth in the keratin market.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are BASF SE, Keraplast, Proteina, Rejuvenol, MakingCosmetics Inc., Hefei TNJ Chemical Industry Co. Ltd., Greentech, Keratin Express, Clariant, Kerline Srl, Roxlor, NutriScience Innovations LLC, and other key players are mentioned in the final report.

In March 2023, BASF Personal Care introduced a plant-based alternative called "Kerasylium™" at the prestigious in-cosmetics Global event. Kerasylium™ not only meets the requirements for vegan products but also showcases the innovative upcycling of a by-product that would otherwise be discarded as waste.

Recently, Rejuvenol Laboratories has introduced its latest achievement: the Ultra-Light Brazilian 24-Hour Keratin Treatment. This formula aims to significantly reduce application time while delivering weightless and visibly healthier hair.

| Report Attributes | Details |

| Market Size in 2022 | US$ 1.55 Bn |

| Market Size by 2030 | US$ 2.5 Bn |

| CAGR | CAGR of 6.1% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Alpha-Keratin and Beta-Keratin) • By Product (Hydrolyzed and Others) • By Application (Personal Care & Cosmetics, Food & Beverages, Healthcare & Pharmaceuticals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Keraplast, Proteina, Rejuvenol, MakingCosmetics Inc., Hefei TNJ Chemical Industry Co. Ltd., Greentech, Keratin Express, Clariant, Kerline Srl, Roxlor, NutriScience Innovations LLC |

| Key Drivers | • Increasing demand for hair care products • Rise in the demand for natural and organic products |

| Market Restraints | • High cost of keratin treatments • Limited availability of raw materials |

The Keratin Market was valued at USD 1.55 billion in 2022.

The expected CAGR of the global Keratin Market during the forecast period is 6.1%.

The Personal Care and cosmetics application segment dominated the Keratin Market with the highest revenue share in 2022.

The United States held the largest market share in the North America region in 2022.

Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Ukraine- Russia War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Keratin Market Segmentation, By Type

8.1 Alpha-Keratin

8.2 Beta-Keratin

9. Keratin Market Segmentation, By Product

9.1 Hydrolyzed

9.2 Others

10. Keratin Market Segmentation, By Application

10.1 Personal Care & Cosmetics

10.2 Food & Beverages

10.3 Healthcare & Pharmaceuticals

10.4 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Keratin Market by Country

11.2.2North America Keratin Market by Type

11.2.3 North America Keratin Market by Product

11.2.4 North America Keratin Market by Application

11.2.5 USA

11.2.5.1 USA Keratin Market by Type

11.2.5.2 USA Keratin Market by Product

11.2.5.3 USA Keratin Market by Application

11.2.6 Canada

11.2.6.1 Canada Keratin Market by Type

11.2.6.2 Canada Keratin Market by Product

11.2.6.3 Canada Keratin Market by Application

11.2.7 Mexico

11.2.7.1 Mexico Keratin Market by Type

11.2.7.2 Mexico Keratin Market by Product

11.2.7.3 Mexico Keratin Market by Application

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Keratin Market by Country

11.3.1.2 Eastern Europe Keratin Market by Type

11.3.1.3 Eastern Europe Keratin Market by Product

11.3.1.4 Eastern Europe Keratin Market by Application

11.3.1.5 Poland

11.3.1.5.1 Poland Keratin Market by Type

11.3.1.5.2 Poland Keratin Market by Product

11.3.1.5.3 Poland Keratin Market by Application

11.3.1.6 Romania

11.3.1.6.1 Romania Keratin Market by Type

11.3.1.6.2 Romania Keratin Market by Product

11.3.1.6.4 Romania Keratin Market by Application

11.3.1.7 Turkey

11.3.1.7.1 Turkey Keratin Market by Type

11.3.1.7.2 Turkey Keratin Market by Product

11.3.1.7.3 Turkey Keratin Market by Application

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Keratin Market by Type

11.3.1.8.2 Rest of Eastern Europe Keratin Market by Product

11.3.1.8.3 Rest of Eastern Europe Keratin Market by Application

11.3.2 Western Europe

11.3.2.1 Western Europe Keratin Market by Type

11.3.2.2 Western Europe Keratin Market by Product

11.3.2.3 Western Europe Keratin Market by Application

11.3.2.4 Germany

11.3.2.4.1 Germany Keratin Market by Type

11.3.2.4.2 Germany Keratin Market by Product

11.3.2.4.3 Germany Keratin Market by Application

11.3.2.5 France

11.3.2.5.1 France Keratin Market by Type

11.3.2.5.2 France Keratin Market by Product

11.3.2.5.3 France Keratin Market by Application

11.3.2.6 UK

11.3.2.6.1 UK Keratin Market by Type

11.3.2.6.2 UK Keratin Market by Product

11.3.2.6.3 UK Keratin Market by Application

11.3.2.7 Italy

11.3.2.7.1 Italy Keratin Market by Type

11.3.2.7.2 Italy Keratin Market by Product

11.3.2.7.3 Italy Keratin Market by Application

11.3.2.8 Spain

11.3.2.8.1 Spain Keratin Market by Type

11.3.2.8.2 Spain Keratin Market by Product

11.3.2.8.3 Spain Keratin Market by Application

11.3.2.9 Netherlands

11.3.2.9.1 Netherlands Keratin Market by Type

11.3.2.9.2 Netherlands Keratin Market by Product

11.3.2.9.3 Netherlands Keratin Market by Application

11.3.2.10 Switzerland

11.3.2.10.1 Switzerland Keratin Market by Type

11.3.2.10.2 Switzerland Keratin Market by Product

11.3.2.10.3 Switzerland Keratin Market by Application

11.3.2.11.1 Austria

11.3.2.11.2 Austria Keratin Market by Type

11.3.2.11.3 Austria Keratin Market by Product

11.3.2.11.4 Austria Keratin Market by Application

11.3.2.12 Rest of Western Europe

11.3.2.12.1 Rest of Western Europe Keratin Market by Type

11.3.2.12.2 Rest of Western Europe Keratin Market by Product

11.3.2.12.3 Rest of Western Europe Keratin Market by Application

11.4 Asia-Pacific

11.4.1 Asia-Pacific Keratin Market by Country

11.4.2 Asia-Pacific Keratin Market by Type

11.4.3 Asia-Pacific Keratin Market by Product

11.4.4 Asia-Pacific Keratin Market by Application

11.4.5 China

11.4.5.1 China Keratin Market by Type

11.4.5.2 China Keratin Market by Application

11.4.5.3 China Keratin Market by Product

11.4.6 India

11.4.6.1 India Keratin Market by Type

11.4.6.2 India Keratin Market by Product

11.4.6.3 India Keratin Market by Application

11.4.7 Japan

11.4.7.1 Japan Keratin Market by Type

11.4.7.2 Japan Keratin Market by Product

11.4.7.3 Japan Keratin Market by Application

11.4.8 South Korea

11.4.8.1 South Korea Keratin Market by Type

11.4.8.2 South Korea Keratin Market by Product

11.4.8.3 South Korea Keratin Market by Application

11.4.9 Vietnam

11.4.9.1 Vietnam Keratin Market by Type

11.4.9.2 Vietnam Keratin Market by Product

11.4.9.3 Vietnam Keratin Market by Application

11.4.10 Singapore

11.4.10.1 Singapore Keratin Market by Type

11.4.10.2 Singapore Keratin Market by Product

11.4.10.3 Singapore Keratin Market by Application

11.4.11 Australia

11.4.11.1 Australia Keratin Market by Type

11.4.11.2 Australia Keratin Market by Product

11.4.11.3 Australia Keratin Market by Application

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Keratin Market by Type

11.4.12.2 Rest of Asia-Pacific Keratin Market by Product

11.4.12.3 Rest of Asia-Pacific Keratin Market by Application

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Keratin Market by Country

11.5.1.2 Middle East Keratin Market by Type

11.5.1.3 Middle East Keratin Market by Product

11.5.1.4 Middle East Keratin Market by Application

11.5.1.5 UAE

11.5.1.5.1 UAE Keratin Market by Type

11.5.1.5.2 UAE Keratin Market by Product

11.5.1.5.3 UAE Keratin Market by Application

11.5.1.6 Egypt

11.5.1.6.1 Egypt Keratin Market by Type

11.5.1.6.2 Egypt Keratin Market by Product

11.5.1.6.3 Egypt Keratin Market by Application

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Keratin Market by Type

11.5.1.7.2 Saudi Arabia Keratin Market by Product

11.5.1.7.3 Saudi Arabia Keratin Market by Application

11.5.1.8 Qatar

11.5.1.8.1 Qatar Keratin Market by Type

11.5.1.8.2 Qatar Keratin Market by Product

11.5.1.8.3 Qatar Keratin Market by Application

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Keratin Market by Type

11.5.1.9.2 Rest of Middle East Keratin Market by Product

11.5.1.9.3 Rest of Middle East Keratin Market by Application

11.5.2 Africa

11.5.2.1 Africa Keratin Market by Country

11.5.2.2 Africa Keratin Market by Type

11.5.2.3 Africa Keratin Market by Product

11.5.2.4 Africa Keratin Market by Application

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Keratin Market by Type

11.5.2.5.2 Nigeria Keratin Market by Product

11.5.2.5.3 Nigeria Keratin Market by Application

11.5.2.6 South Africa

11.5.2.6.1 South Africa Keratin Market by Type

11.5.2.6.2 South Africa Keratin Market by Product

11.5.2.6.3 South Africa Keratin Market by Application

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Keratin Market by Type

11.5.2.7.2 Rest of Africa Keratin Market by Product

11.5.2.7.3 Rest of Africa Keratin Market by Application

11.6 Latin America

11.6.1 Latin America Keratin Market by Country

11.6.2 Latin America Keratin Market by Type

11.6.3 Latin America Keratin Market by Product

11.6.4 Latin America Keratin Market by Application

11.6.5 Brazil

11.6.5.1 Brazil Keratin Market by Type

11.6.5.2 Brazil Keratin Market by Product

11.6.5.3 Brazil Keratin Market by Application

11.6.6 Argentina

11.6.6.1 Argentina Keratin Market by Type

11.6.6.2 Argentina Keratin Market by Product

11.6.6.3 Argentina Keratin Market by Application

11.6.7 Colombia

11.6.7.1 Colombia Keratin Market by Type

11.6.7.2 Colombia Keratin Market by Product

11.6.7.3 Colombia Keratin Market by Application

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Keratin Market by Type

11.6.8.2 Rest of Latin America Keratin Market by Product

11.6.8.3 Rest of Latin America Keratin Market by Application

12. Company profile

12.1 BASF SE

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Keraplast

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Proteina

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Rejuvenol

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Making Cosmetics Inc.

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Hefei TNJ Chemical Industry Co. Ltd.

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Greentech

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Keratin Express

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Clariant

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Kerline Srl

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

12.11 Roxlor

12.11.1 Company Overview

12.11.2 Financials

12.11.3 Products/ Services Offered

12.11.4 SWOT Analysis

12.11.5 The SNS View

12.12 NutriScience Innovations LLC

12.12.1 Company Overview

12.12.2 Financials

12.12.3 Products/ Services Offered

12.12.4 SWOT Analysis

12.12.5 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Conformal Coatings Market size was valued at USD 950.5 million in 2022. It is expected to grow to USD 1480.99 million by 2030 and grow at a CAGR of 5.7% over the forecast period of 2023-2030.

The Silicone Fabrics Market Size was valued at USD 4.37 billion in 2022, and is expected to reach USD 7.41 billion by 2030, and grow at a CAGR of 6.8% over the forecast period 2023-2030.

Specialty Tapes Market Size was valued at USD 55.42 billion in 2023 and is expected to reach USD 90.55 billion by 2031 and grow at a CAGR of 6.3% over the forecast period 2024-2031.

The Biofertilizers Market size was USD 3.2 billion in 2023 and is expected to Reach USD 7.31 billion by 2031 and grow at a CAGR of 10.8% over the forecast period of 2024-2031.

The Insulating Glass Window Market Size was valued at USD 13.50 billion in 2022, and is expected to reach USD 22 billion by 2030, and grow at a CAGR of 6.3% over the forecast period 2023-2030.

The Offshore Drilling Fluid Market Size was valued at USD 7.83 billion in 2022 and is expected to reach USD 11.05 billion by 2030, and grow at a CAGR of 4.4% over the forecast period 2023-2030

Hi! Click one of our member below to chat on Phone