Biofertilizers Market Report Scope & Overview:

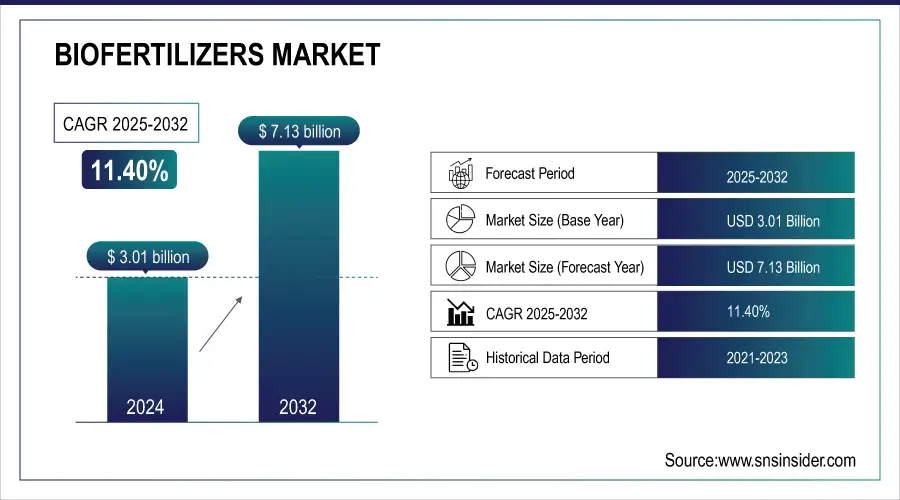

The Biofertilizers Market size was valued at USD 3.01 Billion in 2024. It is expected to grow to USD 7.13 Billion by 2032 and grow at a CAGR of 11.40% over the forecast period of 2025-2032.

Get E-PDF Sample Report on Biofertilizers Market - Request Sample Report

Biofertilizers contain living microorganisms that enhance plant growth by providing nutrients or stimulating growth, offering an eco-friendly alternative to synthetic fertilizers. Overuse of chemical fertilizers causes soil degradation, water pollution, and biodiversity loss, leading to eutrophication, harmful algal blooms, and hypoxic zones in water bodies, affecting aquatic life. Biofertilizers improve soil microbiology, nutrient cycling, and structure, increase crop yields, and reduce greenhouse gas emissions. Advances in microbial science, such as encapsulation and controlled-release technologies, protect microbes and optimize nutrient delivery over time. According to the FAO, these innovations make biofertilizers a scalable alternative, improving nutrient use efficiency by 20–30% compared to traditional fertilizers, while minimizing environmental impact.

Key Biofertilizers Market Trends

-

Rising adoption of biofertilizers in organic farming to meet increasing consumer demand for chemical-free produce.

-

Integration of multi-strain and consortia-based biofertilizers for enhanced nutrient efficiency and stress resistance.

-

Expansion of liquid and foliar biofertilizer formulations for easier application and faster crop response.

-

Growing use of biofertilizers in high-value crops like fruits, vegetables, and horticulture for yield improvement.

-

Strategic partnerships between biotech startups and agrochemical companies to expand distribution networks.

-

Increasing government incentives and subsidies promoting sustainable agriculture practices using biofertilizers.

-

Advancements in carrier materials to improve shelf-life and microbial viability under varied storage conditions.

-

Rising awareness of climate-smart agriculture driving adoption of biofertilizers to reduce carbon footprint in farming.

Biofertilizers Market Growth Drivers

-

Rising potential benefits of biofertilizers among Farmers

-

Rising government support for organic farming drives the market growth.

Governments worldwide are promoting organic farming to enhance environmental sustainability, support rural livelihoods, and meet growing demand for organic produce. Programs, subsidies, and certification support encourage farmers to adopt biofertilizers over synthetic inputs, improving soil health and biodiversity. For example, under the EU’s CAP reform in 2023, about €40 billion was allocated for eco-schemes, including organic management, aiming to expand organic farming to 25% of total agricultural land by 2030. Government aid covers certification costs and provides resources for transitioning from conventional to organic practices, driving demand for biofertilizers and other organic inputs, while reducing agriculture’s environmental footprint and fostering sustainable farming practices globally.

Biofertilizers Market Growth Restraints

-

High production costs associated with biofertilizers which hamper the market growth.

The high production cost of biofertilizers limits their adoption among small and medium farmers in developing countries. Producing biofertilizers requires cultivating microbial strains under controlled conditions, demanding advanced equipment and skilled labor. Techniques like encapsulation and controlled-release further increase manufacturing complexity and expenses to ensure stability and effectiveness. Unlike synthetic fertilizers, which benefit from economies of scale, biofertilizer manufacturers face challenges in scaling production without incurring extra costs to maintain quality and standards. These factors make biofertilizers comparatively expensive, restricting widespread use despite their environmental benefits and potential to improve soil health and crop yields in sustainable agricultural practices.

Biofertilizers Market Segment Highlights

-

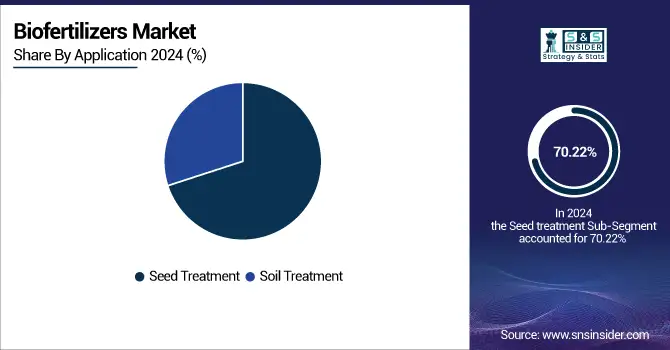

By Application

Seed treatment accounted for approximately 70.22% of the market in 2024. This method improves soil health and nutrient availability by introducing beneficial microbes before planting, enabling them to establish and enhance nutrient cycling. Biofertilizers applied during seed treatment increase soil porosity, structure, and nutrient content, particularly nitrogen and phosphorus, crucial for plant growth. They also promote microbial biodiversity and reduce chemical fertilizer dependence, supporting sustainable agriculture. Effective in restoring degraded soils and boosting crop productivity, seed treatment with biofertilizers has become the preferred application method, driving its dominance in the biofertilizers market globally.

-

By Product

The nitrogen-fixing segment accounted for about 44.23% of the market in 2024. Nitrogen is essential for plant protein and chlorophyll synthesis, but most crops cannot directly assimilate atmospheric nitrogen. Nitrogen-fixing biofertilizers contain beneficial bacteria that convert atmospheric nitrogen into plant-usable forms, reducing reliance on industrial nitrogen fertilizers. They are widely applied in legumes, cereals, and vegetables, delivering high yields efficiently. These biofertilizers are safe, eco-friendly, and do not harm soil technology or the environment. Their effectiveness, rapid action, and ability to enhance crop productivity sustainably have driven strong market adoption, positioning nitrogen-fixing biofertilizers as a vital tool in modern, environmentally responsible agriculture.

-

By Crop Type

The cereals and grains segment held roughly 40% of the market in 2024. Biofertilizers are essential for cereal and grain cultivation, enhancing growth, photosynthesis, and yield through phosphate-solubilizing bacteria and Azotobacter inoculation. Increasing global demand for oilseeds and pulses, such as soybean, sunflower, and groundnuts, has boosted biofertilizer applications in these crops. Innovations in microbiological research help determine the optimal composition of biofertilizers for wheat and other cereals. This combination of growing crop demand, technological advancements, and efficiency improvements is expected to drive substantial global market growth in the cereals and grains segment throughout the forecast period.

Biofertilizers Market Regional Analysis

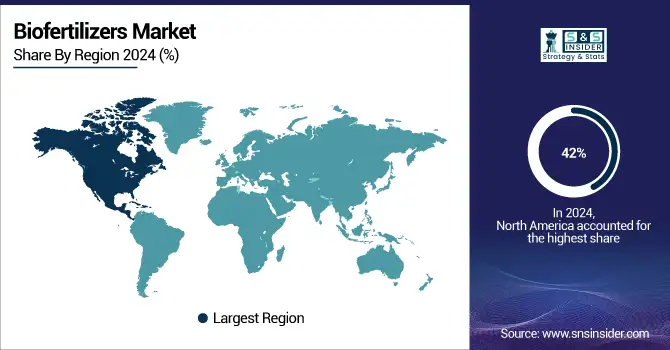

North America Biofertilizers Market Insights

North America held the largest market share around 42% in 2024. The largest and fastest-growing market is the United States, followed by Canada. The major reasons propelling the market include favorable government laws, an easy registration process, and a rising number of organic farms. Sinorhizobium, Azorhizobium, Allorhizobium, and others are the most common genera utilized as biofertilizers in North America. According to The World of Organic Agriculture, nearly 3.5 million hectares of farmland in North America will be managed organically by 2021. There were 2.3 million in the United States and 1.2 million in Canada.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Europe Biofertilizers Market Insights

During the forecast period of 2025 to 2032, the European market is estimated to develop at a CAGR of 11.9%. The European Union is constantly supporting biofertilizers since they are cost-effective, recommending farmers optimize the application of chemical fertilizers or replace them entirely or partially with eco-friendly fertilizers to achieve greater economic returns.

Asia Pacific Biofertilizers Market Insights

The Asia-Pacific market is predicted to grow at a 10.8% CAGR during the forecast period. China is the largest consumer of biofertilizers, followed by India and Japan. The biofertilizers market in India is predicted to rise, owing to increased farmer awareness of the benefits of biofertilizers on soil health, as well as the central government's attempt to organize the country's biofertilizers industry by bringing it under the authority of fertilizer laws.

Competitive Landscape for Biofertilizers Market:

Koppert Biological Systems Inc. was founded in 1967 and is headquartered in the Netherlands. Koppert Biological Systems specializes in sustainable agriculture solutions, focusing on biological crop protection, pollination, and soil health. Their offerings include beneficial insects, mites, nematodes, and microbial-based fertilizers. The company enhances plant growth naturally, promotes biodiversity, and reduces reliance on chemical fertilizers. Koppert serves growers globally, providing integrated solutions that improve productivity, soil fertility, and crop quality while supporting environmentally friendly farming practices.

-

In June 2025, Koppert partnered with Acadian Seaplants to expand biostimulant access, combining expertise in biological crop protection and marine-based nutrient solutions for enhanced crop performance.

Lallemand Inc. was established in 1917 and based in Canada, Lallemand Inc. is a global leader in yeast and bacteria-based solutions. Its plant care division develops biofertilizers, biocontrol agents, and biostimulants that enhance nitrogen fixation, phosphorus solubilization, and overall soil health. Lallemand focuses on sustainable agriculture, improving crop yield, and reducing environmental impact. Their solutions are applied across cereals, vegetables, and horticultural crops, supporting global food production with innovative microbial technologies.

-

In November 2023, Lallemand Plant Care partnered with New Edge Microbials to expand biological farm input solutions across North and South America and Europe.

BioConsortia was founded in 2014 and headquartered in the United States, BioConsortia develops advanced microbial agricultural solutions to improve crop yield and sustainability. The company uses genomics and directed selection to design microbial communities that enhance nutrient uptake, plant resilience, and soil health. Their portfolio includes biofertilizers for nitrogen fixation, phosphorus solubilization, and growth promotion in cereals, vegetables, and specialty crops. BioConsortia’s solutions reduce synthetic fertilizer dependency while boosting agricultural productivity.

-

In March 2025, BioConsortia secured Series E funding to accelerate commercialization of microbial solutions and expand their presence in global agriculture markets.

Pivot Bio was founded in 2014 and is based in the United States. Pivot Bio focuses on microbial nitrogen fertilizers to replace synthetic nitrogen inputs. Their engineered microbes provide crops with accessible nitrogen, enhancing yield and reducing environmental pollution. Pivot Bio’s solutions target maize, wheat, and other row crops, promoting sustainable farming and soil fertility. The company emphasizes innovation, crop-specific formulations, and scalable solutions to support environmentally responsible agriculture globally.

-

In June 2025, Pivot Bio reported record-breaking performance in 2024, delivering significant value to farmers while strengthening U.S. agricultural supply chains.

Biofertilizers Market Key Players

-

BioConsortia

-

Pivot Bio

-

Anand Agro Care

-

Chaitanya Biologicals Pvt. Ltd

-

BHOOJEEVAN ORGANICS PVT. LTD

-

Clean & Green Recycling Corp.

-

California Organic Fertilizers Inc.

-

Suståne Natural Fertilizer, Inc.

-

Nature Safe

-

Indogulf BioAg LLC

-

Benefert B.V.

-

Fertoz

-

Symborg Inc.

-

T. Stanes and Company Limited

-

Acadian Seaplants Limited

-

BioFert Manufacturing Inc.

-

Nurture Growth Bio-Fertilizer

-

Agri Organics

| Report Attributes | Details |

| Market Size in 2024 | US$ 3.01 Billion |

| Market Size by 2032 | US$ 7.13 Billion |

| CAGR | CAGR of 11.40% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025- 2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Nitrogen Fixing, Phosphate Solubilizing, Others) •By Crop Type (Row Crops, Horticultural Crops, Cash Crops) •By Application (Seed Treatment, Soil treatment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Koppert Biological Systems Inc., Lallemand Inc., BioConsortia, Pivot Bio, Anand Agro Care, Chaitanya Biologicals Pvt. Ltd, BHOOJEEVAN ORGANICS PVT. LTD, Clean & Green Recycling Corp., California Organic Fertilizers Inc., Suståne Natural Fertilizer, Inc., Nature Safe, Indogulf BioAg LLC, Benefert B.V., Fertoz, Symborg Inc., T. Stanes and Company Limited, Acadian Seaplants Limited, BioFert Manufacturing Inc., Nurture Growth Bio-Fertilizer, and Agri Organics |