Laminated Glass Market Report Scope & Overview:

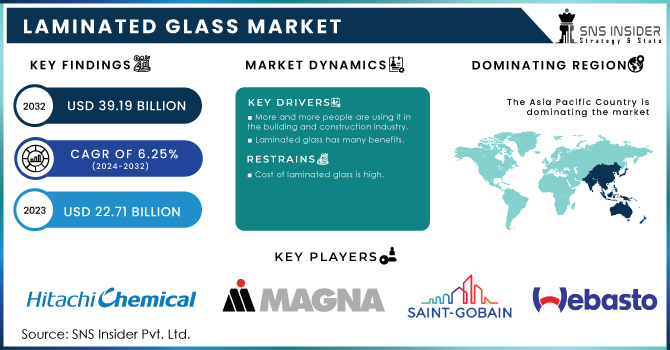

The Laminated Glass Market size was valued at USD 22.71 Billion in 2023 and is expected to reach USD 39.18 Billion by 2032, growing at a CAGR of 6.25% over the forecast period 2024-2032.

Get More Information on Laminated Glass Market - Request Sample Report

The laminated glass market is in a constant state of change because of technological advancement and the ever-increasing demand. Our market report emphasizes Technological Trends & Innovations, new materials, and new manufacturing processes. The report offers price trend analysis in terms of historical and future pricing and conducts an in-depth supply chain analysis. Sustainability practices have been put under the limelight in the Environmental Impact Assessment. The Investment Opportunities & Funding Landscape highlights sectoral growth potential. Along with these, the report offers Industry Benchmarks & Key Performance Indicators (KPIs) to help evaluate business performance and make strategic decisions by laminated glass firms.

Laminated Glass Market Dynamics:

Drivers

-

Growing Adoption of Energy-Efficient and Sustainable Construction Materials Fuels Laminated Glass

Market Expansion

Growing focus on sustainability, and energy-saving building materials boosts the laminated glass market. Laminated glass, specifically with energy-saving coatings and interlayers that guard against UV penetration, helps consume less energy by buildings. Its importance in gaining green building certification through LEED (Leadership in Energy and Environmental Design) is to ensure interior temperatures that minimize the consumption of artificial heating or cooling. With more stringent environmental regulations, demand for energy-efficient materials is increasing, and architects and builders are turning to laminated glass for windows, facades, and skylights. Consumers' increasing preference for eco-friendly products and investment in energy-efficient homes and offices also supports this market growth. With growing awareness of climate change and sustainability, laminated glass has become a critical material in the green building movement and is expected to expand further in the forecast period.

Restraints

-

High Production Costs and Manufacturing Complexities Hindering Widespread Adoption of Laminated Glass

High production costs and manufacturing complexities are some of the major restraints the laminated glass market is facing. It was glass laminated with a PVB or ionoplast polymer-based interlayer laminated from an extruded sheet, i.e. the final product requires additional laminated costs to achieve such a glass laminate. Moreover, the production process in terms of the tools required for production as well as the process of easily ensuring that the layers of glasses bond adequately is also an expensive matter. Due to these reasons, laminated glass is less economically appealing in comparison to regular glass because of its costliness in particular projects or because they are in developed countries where lower-cost concerns are on the consequently. The raw materials are expensive, as are the labor propelled during the creation process. These factors increase the pressure on the profitability of laminated glass manufacturers. While these developments may make laminated glass cheaper in the long term, costs remain an obstacle to the mainstream processing of laminated glass in price-sensitive markets.

Opportunities

-

Increasing Government Initiatives and Regulations Promoting Use of Laminated Glass in Safety and

Energy-Efficiency Standards

Increasing government initiatives and regulations, in terms of safety and energy efficiency, have been opening the gates for new laminated glass applications in almost every industry. The governments across the world have increased their benchmark standards for the safety of buildings, energy efficiency, and environment-friendly features. All these needs can be catered to with the properties of laminated glass. For example, laminated glass's ability to resist impact and prevent glass breakage reduces sound transmission and provides an excellent solution for applications requiring strict safety measures in both automotive and construction sectors. Moreover, building codes of many regions are changing toward more energy-efficient material usage, thereby opening the market for laminated glass in eco-friendly construction. These regulatory drivers are driving the use of laminated glass in both residential and commercial buildings, and therefore, are creating significant opportunities for manufacturers to expand their product offerings and reach a growing market segment.

Challenge

-

Competition from Alternative Glass Products and Materials Presents a Threat to Laminated Glass Market Growth

Competition with other glass products and materials like tempered glass, insulated glass, and traditional glazing solutions remains a significant threat for the laminated glass market. Such alternative glass products offer certain cost benefits because they can be manufactured at relatively lower production costs and may require less time for installation than laminated glass. For instance, laminated glass has the superior advantages of safety and sound absorption, whereas temper glass has high strength, making it used in locations where shatterproof is not primarily required. Another alternative challenge for the laminated glass market is developments in other materials, including plastic and polycarbonate, especially when weight reduction or lower cost is a priority. Manufacturers of laminated glass need to emphasize the superior safety features, energy efficiency, and other benefits that their products can assure in order to remain competitive in the market and fend off these forces.

Laminated Glass Key Market Segments:

By Glass Type

Standard laminated glass dominated and accounted for a market share of about 40% of the Laminated Glass Market in 2023. Such a dominant market position could be ascribed to the high demand for this product across several industries, mainly construction and automotive, because it helps ensure improved safety and sound insulation, thereby making it a preferred choice in building facade and window applications, as well as in the manufacturing of windshields for automobiles. Organizations such as the Glass Association of North America put a great focus on the fact that laminated glass does hold together in cases of shattering, thus causing less risk in terms of injuries. In the same line of thought, as the demand for energy-efficient, sustainable building materials is growing up, it seems that standard laminated glass remains the winner by following all standards and green certification requirements.

By Interlayer Material

The polyvinyl butyral (PVB) interlayer material segment dominated and held the largest share of about 60% in the Laminated Glass Market in 2023. PVB has good adhesion properties, excellent optical clarity, and UV resistance. These are a few attributes that make PVB an excellent interlayer for multiple applications within the automotive and construction industries. Its use is also encouraged by organizations like the International Glass Association, which emphasizes that PVB is a factor behind the improved safety and efficiency of laminated glass. Additionally, most countries have tight restrictions on safety, and PVB is widely used in vehicles, even more so in vehicle windshields as it has been integrated to prevent glass from breaking during accidents. Improvements in road safety standards across governments worldwide have played a major role in increasing the demand for PVB laminated glass.

By Thickness

In 2023, laminated glass having a thickness in the range of 6.1 mm to 10 mm accounted for approximately 35% of the market share. Such a thickness has gained much acceptance because it optimally balances between strength and weight, hence offering a range of applications in the construction and automobile sectors. In high-rise buildings and commercial setups, such as offices and showrooms, aesthetic appeal along with safety are usually required. The American Architectural Manufacturers Association recommends the use of mid-range thicknesses in energy-efficient buildings; thus, encouraging the benefits associated with thermal insulation and soundproofing. Considering the trend continues to grow concerning modern architectural designs, the 6.1 mm – 10 mm thickness is likely to remain favored by architects and builders for its versatility.

By Application

The windows and facades application segment dominated the Laminated Glass Market in 2023. With a share of 35%, mainly due to the increasing demand for aesthetic and energy-efficient building materials in residential and commercial constructions. Laminated glass is preferred for windows and facades as it offers higher strength, safety, and sound insulation while improving the energy conservation effect. Some of the famous organizations include the U.S. Sustainable Development by the Green Building Council stimulates laminated glass application in most green building constructions as it adds points to reaching the LEED level. A continued increase of urbanization that comes with mushrooming cities translates into the importance of aesthetically pleasing functional facades thus adding to this market.

By End-Use Industry

In 2023, the building and construction segment dominated and accounted for the highest market share of about 43%. The primary driving forces for demand in this sector are the aspects of safety, aesthetics, and energy efficiency associated with modern construction projects. Increasingly, laminated glass is used in residential buildings, commercial spaces, and infrastructure projects for enhancing structural strength and noise-free conditions. The National Association of Home Builders is an association that promotes high-performance building materials, including laminated glass. As sustainable construction practices continue gaining momentum and as regulatory standards strengthen, the demand for laminated glass is bound to increase due to the same reasons in the building and construction industry during the forecast period.

By Sales Channel

In 2023, the OEM sales channel dominated the laminated glass market, with a market share of around 60%. Laminated glass manufacturers have strong ties to original equipment manufacturers (OEMs), especially in the automotive and construction sectors, driving this dominance. OEMs are increasingly opting for laminated glass in their merchandise owing to its safety functionalities, sustainability, and aesthetic appeal. High-quality laminated glass is essential to passenger safety, according to industry bodies, including the Automotive Glass Replacement Safety Standards Council. Moreover, with developing countries and governments worldwide making policies to improve the performance and safety standards of vehicle manufacturers, the demand for laminated glass-composed vehicles through OEM is projected to reduce its usage loss in the market share ensuring a veteran standing in the market.

Laminated Glass Regional Analysis:

Asia Pacific dominated and accounted for the largest share of around 35% in 2023 of the Laminated Glass Market. It is driven by rapid urbanization and industrial growth in countries like China, India, and Japan. It leads both the production and consumption scale in the market driven by large constructions and various infrastructure development activities in China. Japan and South Korea boosted the automotive demand for laminated glass. Increasing disposable incomes and more energy-efficient building demand also facilitate market growth. In addition to these, various government regulations encouraging safety standards for construction and automobile applications have provided further momentum. Ongoing development in Asia Pacific's urbanization and automobiles can continue to see this region maintaining its position of dominance in laminated glass markets.

However, Europe is the second-largest region, which constituted 27% revenue share of the laminated glass market in 2023. Its demand is driven by the strength of the construction and automotive sectors, and strict regulations on energy efficiency and safety. Germany, France, and the UK are leading the way in sustainable construction, employing laminated glass more and more to provide insulation and safety. The European Union’s green deal and plans to cut its carbon will only further drive this market. Germany's automotive industry is one of the world leaders, and laminated glass is also widely used in windshields and safety at work. There is a growing demand and investment in eco-friendly construction projects across Europe, along with supportive regulations, making it a leading market for laminated glass in the construction and automotive industries.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

-

Saint-Gobain S.A. (Sustain® Glass, SGG Planitherm®)

-

AGC Inc. (Laminated Safety Glass, AGC Solar Control Glass)

-

Nippon Sheet Glass Co. Ltd. (Laminated Glass for Architecture, Laminated Glass for Automotive)

-

Central Glass Co. Ltd. (High-performance Laminated Glass, Acoustic Laminated Glass)

-

Sisecam Group (Toughened Laminated Glass, Solar Control Laminated Glass)

-

Taiwan Glass Industry Corporation (Laminated Glass for Architecture, Safety Laminated Glass)

-

Guardian Industries Corporation (SunGuard® Glass, Guardian Glass Laminated Glass)

-

Xinyi Glass Holdings Ltd. (Laminated Safety Glass, Solar Control Laminated Glass)

-

Fuyao Glass Industry Group Co. Ltd. (Automotive Laminated Glass, Architectural Laminated Glass)

-

Schott AG (Laminated Glass for Solar Panels, High-Temperature Laminated Glass)

-

Asahi India Glass Limited (AIS Laminated Glass, Safety Glass Solutions)

-

CGS Holdings Co. Ltd. (Laminated Glass for Building Facades, Solar Control Laminated Glass)

-

Fuyao Group (Automotive Laminated Glass, Solar Reflective Laminated Glass)

-

GUARDIAN GLASS LLC. (Guardian CrystalClear® Laminated Glass, Guardian Sunguard® Glass)

-

Saint-Gobain India Pvt. Ltd. (SGG Solar Laminated Glass, SGG Planitherm®)

-

KCC Corporation (KCC Laminated Glass, Solar Control Glass)

-

Press Glass SA (Press Laminated Glass, Insulating Laminated Glass)

-

Scheuten Glas Nederland B.V. (High-Performance Laminated Glass, Solar Control Laminated Glass)

-

Cardinal Glass Industries, Inc. (Cardinal Laminated Glass, Energy-efficient Laminated Glass)

-

Tecnoglass S.A.S. (Solar Control Laminated Glass, Energy-efficient Laminated Glass)

Recent Development:

January 2024: CMS Glass unveiled its revolutionary glass processing technology with life-changing mechanized solutions to achieve more in less time with fewer resources. Targeted at the architectural and automotive segments, it emphasizes increased production power.

December 2023: New Sapphire Tuff Laminated Glass by Sapphire Glass Solutions combines strength and beauty for the demanding applications of architecture. This new glass item has set a new trend in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.71 Billion |

| Market Size by 2032 | USD 39.18 Billion |

| CAGR | CAGR of 6.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Glass Type (Standard, Acoustic, Security, Solar Control) •By Interlayer Material (Polyvinyl Butyral (PVB), Ionoplast Polymer (SentryGlas), Ethylene Vinyl Acetate (EVA), Others) •By Thickness (Up to 6 mm, 6.1 mm – 10 mm, 10.1 mm – 15 mm, Above 15 mm) •By Application (Automotive Windshields, Windows & Facades, Skylights, Bank Security & ATM Booths, Residential & Commercial Buildings, Others) •By End-Use Industry (Building & Construction, Automotive & Transportation, Electronics, Healthcare, Others) •By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Saint-Gobain S.A., AGC Inc., Nippon Sheet Glass Co. Ltd., Guardian Industries Corporation, Xinyi Glass Holdings Ltd., Fuyao Glass Industry Group Co. Ltd., Schott AG, Asahi India Glass Limited, Central Glass Co. Ltd., Sisecam Group and other key players |