Latex Binders Market Analysis & Overview:

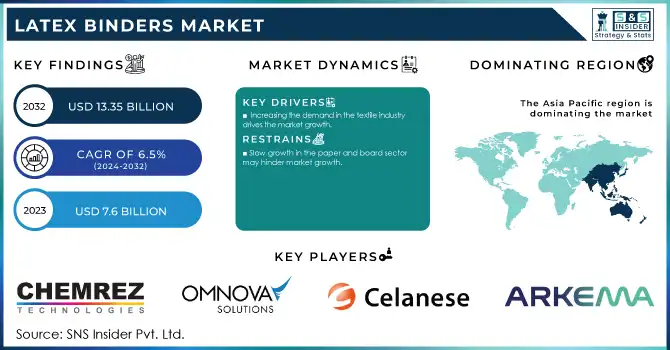

The Latex Binders Market size was USD 7.6 billion in 2023 and is expected to reach USD 13.35 billion by 2032 and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

Get More Information on Latex Binders Market - Request Sample Report

The global expansion of construction and infrastructure development is also a great impact on the growth for latex binders market. Rising urbanization and industrialization, especially in developing countries, has resulted in a number of residential, commercial and industrial construction initiatives. The demand for high-performance building materials is being driven by the fact that public and private sectors are investing massively in infrastructure development such as roads, bridges, airports, and smart cities. They also comply with high environmental standards, which is another reason that has led to a rising trend toward sustainable and energy-efficient buildings and buildings. The continued expansion of the building industry keeps a strong market path for latex binders over the future.

In 2023, BASF introduced a new range of sustainable latex binders tailored for the construction industry, emphasizing low-VOC formulations to meet stringent environmental standards. The company also expanded its production facility in Germany to cater to the growing demand for construction-grade binders.

The growing utilization of latex binders in paints and coatings, owing to their performance properties and minimum environmental impact nature is one of the key factors attributing to the market growth. Latex binders improve other important properties like flexibility, adhesion, durability, and water resistance of water-based paints, making them ideal for residential, commercial, and industrial uses. The demand for good quality paints and coatings has increased immensely due to the latest worldwide trend of construction and renovation accelerated by the various personalities inclined towards doing new aesthetic and psychedelic paint jobs, which are also low-VOC. Furthermore, latex binders are also favored for their ability to increase the spread ability and drying times of paints, thereby lowering the cost of the application.

The Environmental Protection Agency (EPA) reports that over 80% of new residential construction projects in the U.S. in 2023 adopted low-VOC paints, aligning with stringent environmental guidelines. This shift toward eco-friendly solutions has been a key factor in the increased adoption of latex binders, which are known for their low VOC content compared to solvent-based alternatives.

Latex Binders Market Dynamics

Drivers

-

Increasing the demand in the textile industry drives the market growth.

Increase in demand for latex binders from the textile industry is one of the major factors driving the market growth. They are an essential part of the process of producing nonwoven fabrics, textiles, and coatings and provide greater durability, flexibility, and wear and tear resistance than other products such as natural fiber. With the growing pace of textile business, particularly in the Asia-Pacific area, demand for high function materials is increasing. The latex binders are especially popular because are able to impart binding force, improve fabric properties and finished products appearance. Also, owing to rising demand from consumers for products that are durable along with environmentally friendly characteristics, they have also gained traction for use in manufacturing carpets, upholstery, and technical textiles. Changing environmental regulations and consumer preferences for greener products are also pushing the textile industry towards sustainable and water-based solution that is expected to bolster latex binder demand throughout the forecast period. It is a part of the global trend towards sustainable production methods that is a necessary condition for sustainable growth of the latex binder’s market in the textile industry.

Restraint

-

Slow growth in the paper and board sector may hinder market growth.

Slow growth in the paper & board sector is one of the restraining factors in the latex binder market owing to the fact that this industry is one of the major applications for latex binders. The paper and board industry utilizes latex binders for improved strength, coating quality, and durability of the finished product especially in coatings and surface treatments. But globally, other changes have contributed to stagnation in growth for the paper and board industry, including the digitalization of most communication and increased usage of electronic media, translating to less paper consumption. Also, increasing costs of raw materials like pulp & wood, change towards more sustainable and recycled paper solutions reduce demand for conventional paper products. Such a sluggish growth in paper and board industry sets a limitation for the growth of demand for latex binders in these applications, which in turn is expected to create a negative impact on the growth of overall market.

Latex Binders Market Segmentation

By Material Type

Latex held the largest market share around 28% in 2023. The versatility exhibited by these properties, including strong adhesion, flexibility, and resistance to water, makes them ideal for a wide range of uses, especially in the textile, paper, and adhesives industries. With long chains of hydrocarbon arm length which increases water solubility, the latex polymers used in latex binders are water-based and green, thus complying with high environmental standards, contributing to their growing adoption. The ability of these products to be used in green and sustainable formulations has been one of the key drivers for their dominance as many industries are now shifting towards green alternatives of solvent-based products. The demand for latex binders has been driven by the textile industry requiring durable and flexible coatings, along with the growing demand for nonwoven fabrics and technical textiles. Moreover, galvanized binders are economical, and easy to work with, due to which industries such as construction, and automotive are further making it the leading market.

By Form

Liquid held the largest market share around 65% in 2023. It is owing to their wide availability and application, usability, and excellent performance. Compared to dry latex binders which are typically used in a powder form, liquid latex binders provide benefits including ease of blending and rapid application for various industrial applications including textiles, paper and coatings. It helps provide uniform dispersion when mixed with other materials, thus improving overall product efficacy, and being a liquid, it offers an advantage. For instance, in textile applications, outstanding adhesion combined with flexibility makes liquid latex binders suitable for textile coatings as well as nonwoven applications. Moreover, liquid latex binders are more convenient to use and can be applied to high-volume production processes, such as this process for industrial applications, which is now being driven by global-high volume industries that require cost-effective, high-volume production of binding materials.

By Application

Paint and Coatings held the largest market share around 25% in 2023. It is due to high usage of latex binders for the manufacture water-based paints and coatings. Among latex binders, acrylic and styrene-butadiene latex are preferred due to their superior film formation, durability, and flexibility in the paint applications. These binders improve adhesion, water resistance and weatherability of paints, essential for interior as well as exterior applications. However, latex-based pans and coatings are relatively new, and with rising consumer demand for eco-friendly and low-VOC (volatile organic compound) property, demand for latex-based products continues to grow due to their inherent environmental safety related to solvent-based alternatives.

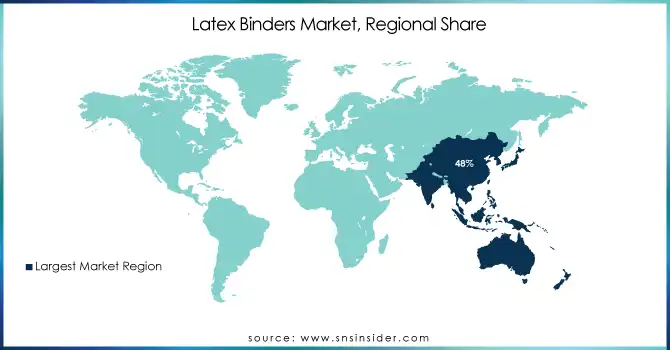

Latex Binders Market Regional Analysis

Asia Pacific held the largest market share around 48% in 2023. It is owing to rapid industrialization, large manufacturing base, and demand for eco-friendly products. Increasing demand for latex binder from construction, automotive, and the textile industries in the region, particularly in developing economies such as China, India, and Japan, is also expected to positively impact demand over the forecast period. The increasing demand for performance and sustainability in paints, coatings, adhesives, and textiles has resulted in significant growth in these sectors across these countries, thus driving the latex binders market. In addition, increasing demand for eco-friendly and low-VOC products across the Asia-Pacific region is expected to facilitate growth of water-based latex binders in another wide range of industries. Many of the world's leading latex binder manufacturers are situated in Asia-pacific benefitting the region a cost advantage which in turn, is serving the market to grow profusely. The dominance of Asia-Pacific in the global latex binders’ market can also be attributed to the rising population of the middle class and urbanization in countries such as China and India which are practicing a lifestyle that demands consumer goods needing high-quality coatings and adhesives.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Chemrez Technologies Inc. (Polyurethane Binders, Acrylic Emulsion Binders)

-

OMNOVA Solutions Inc. (Emulsion Binders, Styrene-Butadiene Latex)

-

Celanese Corporation (Vinyl Acetate Binders, Acrylic Polymer Binders)

-

Arkema (Styrene Butadiene Latex, Acrylic Emulsion)

-

Toagosei Co. Ltd. (Acrylic Latex, Styrene Butadiene Latex)

-

BASF SE (Dispersions for Paints, Acrylic Polymer Binders)

-

Wacker Chemie AG (Acrylic Binders, Silicone-based Binders)

-

Dairen Chemical Corporation (Vinyl Acetate Binders, Styrene Butadiene Latex)

-

VISEN Industries Limited (Acrylic Binders, Styrene Butadiene Latex)

-

Shandong Hearst Building Materials Co. Ltd. (Polyurethane Emulsion, Acrylic Latex)

-

Dow Chemical Company (Acrylic Binders, Styrene Butadiene Latex)

-

SABIC (Polyurethane Dispersions, Acrylic Emulsion)

-

Eastman Chemical Company (Acrylic Emulsion, Vinyl Acetate Binders)

-

Kraton Polymers (SBS Latex, Styrene Butadiene Copolymer)

-

Brenntag (Acrylic Binders, Styrene Butadiene Emulsion)

-

Huntsman Corporation (Vinyl Acetate Binders, Polyurethane Dispersions)

-

Lanxess (Styrene Butadiene Emulsion, Acrylic Binders)

-

Synthomer (Acrylic Latex, Styrene Butadiene Latex)

-

Michelman, Inc. (Polyurethane Dispersions, Acrylic Polymer Emulsions)

-

Azelis (Acrylic Emulsion Binders, Styrene-Butadiene Latex)

Recent Development:

-

In 2023: Chemrez launched a new range of environmentally-friendly acrylic latex binders designed for high-performance applications in paints and coatings, emphasizing low-VOC content to meet stringent environmental standards.

-

In 2022: OMNOVA expanded its product portfolio by introducing an advanced styrene-butadiene latex binder for the construction and automotive sectors, aimed at providing improved adhesion and durability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.6 Billion |

| Market Size by 2032 | US$ 13.35 Billion |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Pharmaceuticals, Construction, Textiles, Paints & coatings, Paper & boards ) • By Form (Powder, Liquid) • By Type (Polyurethane, Polyester, Vinyl acetate, Latex, Acrylic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin Americ |

| Company Profiles | Chemrez Technologies Inc., OMNOVA Solutions Inc., Celanese Corporation, Arkema, Toagosei Co. Ltd., BASF SE, Wacker Chemie AG, Dairen Chemical Corporation, VISEN Industries Limited, Shandong Hearst building materials co. ltd., and Others. |

| Drivers | • Increasing the demand in the textile industry drives the market growth. |

| Restraints | • Slow growth in the paper and board sector may hinder market growth. |