Litigation Funding Investment Market Analysis & Overview:

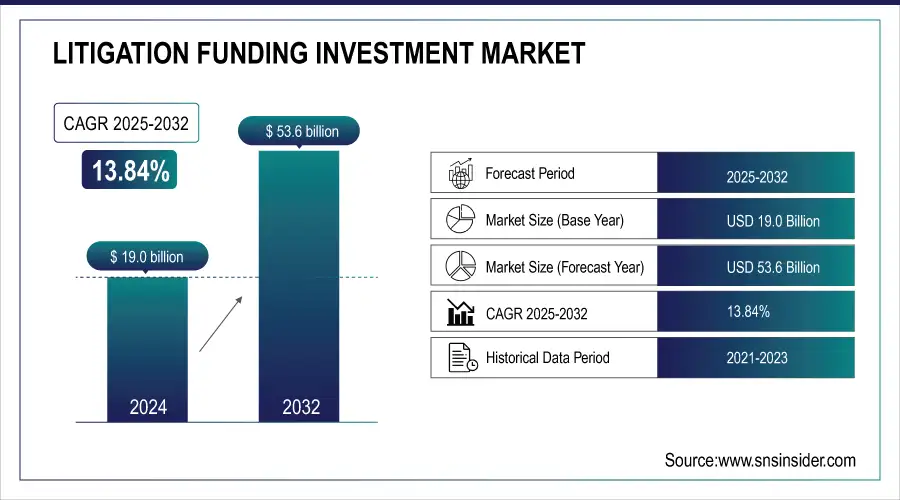

The Litigation Funding Investment Market size was valued at USD 19.0 billion in 2024 and is expected to reach USD 53.6 billion by 2032, growing at a CAGR of 13.84% during 2025-2032.

Litigation funding investment market growth is driven by the rise in litigation economic burden, rallying cognizance sharing, and buttressing legal productivity. The non-correlation and the ability of litigation funding to provide attractive returns notwithstanding other blustery conditions in capital markets, are attractive features that pull investors in. The growth is driven by an increase in the number of commercial litigation cases, supportive regulations in key regions, and widespread acceptance of litigation finance by law firms and corporations.

Litigation funding investment market analysis includes the growing participation from institutional investors and structural evolution of funding models, including portfolio financing and international arbitration support. The future growth is also augmented by emerging markets and technological advancements in legal analytics. Litigation Funding Investment Market trends indicate increasing demand around the world and leading towards truism within the investment space, followed by diversification of both niche and asset classes, individually and aggregate risk sharing mechanisms, with the outlook of high double-digit growth between 2025 to 2032.

To Get more information on Litigation Funding Investment Market - Request Free Sample Report

For instance, since early 2023, London’s commercial courts have seen lawsuits worth over £83 billion. The UK’s top 50 litigation firms reported £6.1 billion in revenue, a 48% rise over five years.

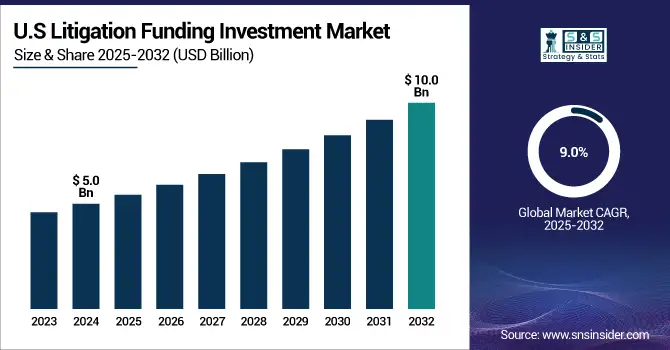

U.S. Litigation Funding Investment Market Highlights Investment into U.S. litigation funding has grown from approximately USD 5 billion in 2024 to USD 10 billion by 2032, with a robust average annual growth rate of 9%. The growth is driven by an increase in legal costs, greater commercial litigation, and firms and companies tapping more into third-party funding. And, enhanced AI and data analytics are further developing case assessment and risk control, driving market acceleration.

Litigation Funding Investment Market Dynamics :

Driver:

-

Rising legal costs and complex litigation are increasing demand for third-party funding as claimants seek financial relief.

With legal fees on the rise, particularly in complicated commercial and class action cases, businesses and individuals are increasingly turning to alternative sources of financing. There is tremendous demand for litigation funding, as it allows claimants with valid claims to proceed without the high upfront costs. The law firms benefit as well, in terms of cash flow preservation and risk sharing with funders. And the trend is especially pronounced in the U.S., UK, and Australia, where the legal climates are more favorable. The appeal of third-party funding solutions continues to rise, driven by the global and legal complexity of disputes leading to market growth across sectors and jurisdictions.

For instance, Large law firms increased their share of litigation financing commitments to 35% in 2023, up from 28% the previous year, suggesting a growing reliance on external funding to manage escalating legal costs.

Restraint:

-

Regulatory uncertainty and lack of standardization are limiting investor confidence and market expansion across regions.

The absence of universal global regulation and transparency in litigation funding continues to pose a challenge. Different legal frameworks in different jurisdictions create areas of uncertainty, especially regarding funder disclosure, ethics, and conflicts of interest. Litigation funding is still either viewed with scepticism or hampered by legal limitations in some areas, making it an unattractive proposition for investors. Vague operational rules lead to greater reputational risk and legal issues for funders. Without the broad, uniform policy, compliance will be a challenge for market participants; this creates potential roadblocks for growth over the long term, particularly in developing markets with less advanced legal systems.

Opportunity:

-

Advancements in legal tech and analytics are enabling more accurate case evaluation, attracting more funders to the market.

The proliferation of AI and legal tech has greatly improved the speed and efficiency with which litigation funders can evaluate cases, conduct due diligence, and assess risks. Funders use these tools to comb through incredibly large datasets, to better predict litigation outcomes, and to optimize their strategies for investing. This enhances profitability but also minimizes the risk of subjective judgments. Technology adoption will allow funders to broaden their portfolios with greater certainty and to branch out into new legal areas, like intellectual property and mass torts. These large avenues for growth are largely open because of this recent digital transformation, and especially for tech-enabled litigation finance platforms.

Challenge:

-

High litigation risk and lengthy legal processes are reducing funder returns and complicating investment timelines.

Litigation funding comes with a significant amount of risk as the legal outcomes are often unknown, and resolution may take years. Investing in a litigation funding firm is a highly speculative and risky investment since if the case that is funded does not win, the investor usually will receive nothing back. In addition, the legal process can take years, allowing time for many appeals and procedures to occupy capital for long stretches, impacting funder liquidity and return cycles. Achieving a high-risk profile while also building a sufficiently diversified portfolio through proper case selection is a difficult operational challenge faced not just by newbies but also by the more established players in this nascent space.

For instance, in 2023, the average duration of a litigation finance case was 24 to 36 months, with some extending up to 5 years. ROI for funders ranged from 15% to 30%, while institutional investors saw returns up to 70% annually.

Litigation Funding Investment Market Segmentation Analysis:

By Type

The commercial litigation segment dominated the market in 2024 and accounted for 42% of the litigation funding investment market share, as the business disputes, new rules and laws, along with complex contracts, increased. The segment enjoys high-value and frequent tussles between corporates, especially in the finance, technology, and energy sectors. Global trade continues to grow, and commercial litigation financing is one of the most important growth drivers.

International arbitration is anticipated to register the fastest CAGR from 2025 to 2032. Globalization, an increase in cross-border disputes, and the advantages of arbitration over court proceedings all fuel this growth. As demand returns to arbitration funding, the fastest-growing element of the litigation funding market, multinational corporations and international agreements are among those fueling the future demand.

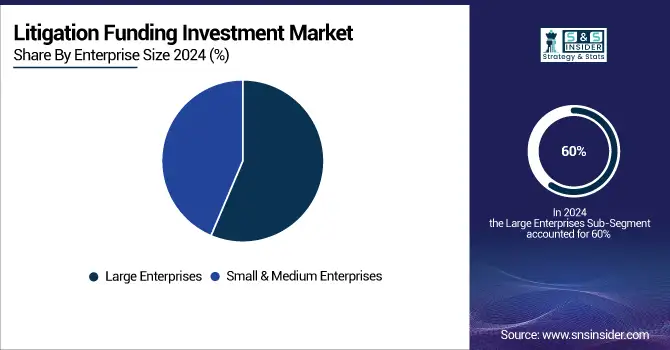

By Enterprise Size

In 2024, the large enterprise segment dominated the litigation funding investment market and accounted for 60% of revenue share, as they have extensive needs for litigation, more complex litigation, and are likely to have larger funding budgets. Comprising high-value disputes, allowing plaintiffs to preserve their cash flow, they are increasingly utilizing litigation funding. This segment will continue its steady expansion as multinational corporations embrace litigation finance strategies for their largest commercial cases.

The small and medium enterprises are expected to register the fastest CAGR during the forecast period. Litigation funding is a popular option among SMEs struggling with rising legal costs or having limited capital, as it allows them a way to fund legal resources without the financial burden. As more and more companies realize that they need access to legal support at a fraction of the cost, this trend will continue to grow, given that it allows SMEs to compete with larger firms in high-stakes litigation.

By End-Use

The BFSI segment dominated the litigation funding investment market and accounted for a significant revenue share in 2024, owing to the high volume of disputes that arise in it, including fraud, regulatory, and contractual disputes. With growing scrutiny on financial institutions requiring shorter and shorter payback times, legal funding offers an affordable solution. With the continuous occurrence of legal challenges, this sector is expected to continue its leadership position due to the high demand for funding.

The healthcare sector is anticipated to grow at the fastest CAGR during the period 2025-2032. With increasing medical malpractice claims, regulatory challenges, and claims involving pharmaceuticals. With the globalization of healthcare systems, litigation funding will be necessary on the part of hospitals and insurers, and healthcare professionals who wish to financially hedge against costly battles in the courts. This growth within the segment highlights the increased legal challenges present within this sector.

For instance, In 2024, Justpoint, a legal tech startup, secured $45 million in Series A financing and a $50 million line of credit to develop an AI-powered platform that analyzes medical records to identify harmful drugs and consumer products.

Litigation Funding Investment Market Regional Outlook

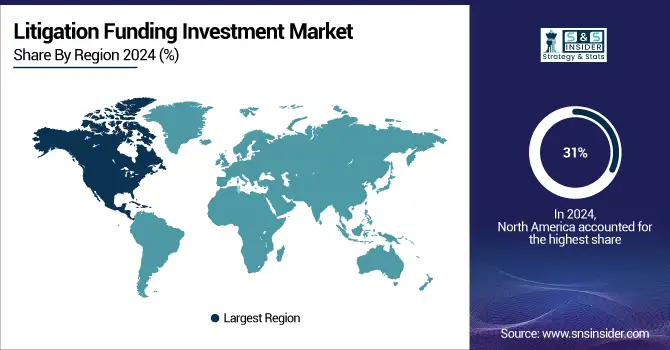

North America dominated the litigation funding investment market and accounted for 31% of revenue share in 2024, owing to its existing legal framework, high levels of litigation, and being the home of all of the major financial institutions. The U.S. especially remains a primary market with commercial disputes, class action suits, and an increasing understanding of litigation finance. This also meant that the region will remain at number one as its institutional investments and case funding steadily increase.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia-Pacific region is expected to register the fastest CAGR during the forecast period from 2025 to 2032, with the rise of the popularity of litigation funding in emerging market countries such as China, India, and Singapore. These include, but are not limited to, expanding economic activity, a burgeoning legal infrastructure, and increased business disputes. With the region's increased integration into global markets, demand for litigation finance will grow rapidly, making APAC the fastest-growing region.

In the Asia-Pacific region, China dominated the litigation funding investment market, which has a high level of commercial disputes, continued legal reform, and growing acceptance of third-party investment in arbitration. This growth is also being fueled by vibrant economic activity in the country and the expansion of a legal tech ecosystem.

For instance, in May 2024, Harvey launched its products on Microsoft Azure, providing general commercial access to its AI assistant and specialized models.

The growth of collective redress actions, escalating legal complexities and greater familiarity with third-party funding are driving expansion in Europe’s litigation funding market. AI and data are increasingly being harnessed to better assess risk, while dynamic developments in EU regulation are working to promote transparency and facilitate participation by investors in several different jurisdictions.

The UK dominated the litigation funding investment market in Europe, Due to the commercial maturity of its legal system, the volume of litigation and the clarity forged by the regulatory framework allowing third-party funding, The expansion is also driven by corporate US demand for portfolio funding solutions well as law firms looking to new funding structures for managing large scale commercial disputes.

Key Players

The major litigation funding investment market companies are Burford Capital, IMF Bentham, Harbour Litigation Funding, Omni Bridgeway, Therium Capital Management, Augusta Ventures, Woodsford Litigation Funding, Vannin Capital, Apex Litigation Finance, Longford Capital and others.

Recent Developments

-

In January 2024, Augusta Ventures agreed to a £25 million litigation funding facility with international law firm Pinsent Masons. This innovative arrangement offers clients the benefit of a dedicated facility at preferred rates, including a fast-tracked due diligence process and transparent commercial terms. Under the fair and transparent terms of the agreement, Augusta will fund the entire cost of pursuing the claim, including all lawyer and expert fees and any other costs.

-

In April 2024, Longford Capital Management, LP and Quinn Emanuel Urquhart & Sullivan, LLP announced a litigation financing offering for private equity (PE) firms and their portfolio companies. Under the terms of the deal, Longford committed up to $40 million in equity capital to Quinn Emanuel’s private equity clients involved in litigation, funding attorneys’ fees and litigation costs and monetizing the value of meritorious legal claims.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.0 Billion |

| Market Size by 2032 | USD 53.6 Billion |

| CAGR | CAGR of 13.84% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Commercial Litigation, Bankruptcy Claim, International Arbitration, Personal Injury) •By Enterprise Size (Large Enterprises, Small & Medium Enterprises) •By End-Use (Banking, Financial Services, and Insurance Sector (BFSI), Media & Entertainment, IT & Telecommunication, Manufacturing, Healthcare, Others (Travel & Hospitality)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Burford Capital, IMF Bentham, Harbour Litigation Funding, Omni Bridgeway, Therium Capital Management, Augusta Ventures, Woodsford Litigation Funding, Vannin Capital, Apex Litigation Finance, Longford Capital and others in report |