Residential Hotel Market Report Scope & Overview:

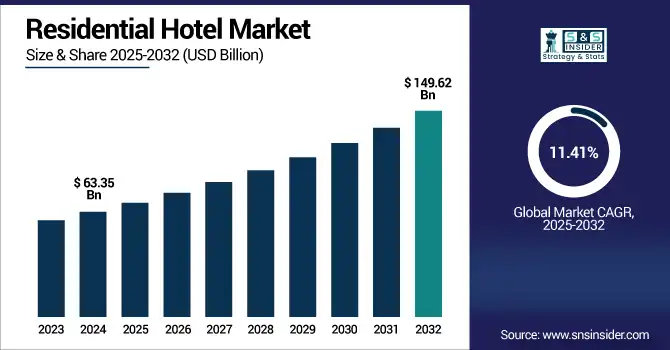

The Residential Hotel Market size was valued at USD 63.35 billion in 2024 and is expected to reach USD 149.62 billion by 2032, growing at a CAGR of 11.41% from 2025-2032.

To Get more information on Residential Hotel Market - Request Free Sample Report

The Residential Hotel Market growth is expanding due to rising demand for long-term, flexible stays from business travelers, digital nomads, and relocating professionals. Urbanization and preference for fully furnished spaces with hotel-like services and home-like comfort support growth. The hybrid work trend and extended corporate stays further boost demand. Steady occupancy is also driven by government staff, healthcare travelers, and trainees. Investments in upscale and midscale offerings, along with affordable economy options, are attracting a wider consumer base and sustaining market momentum

-

Supporting this trend, the UK alone hosts over 56,700 serviced apartments, generating approximately USD 1.55 billion in annual turnover from branded operators. Typical customers include 45% business travelers, 27% tourists, and 23% relocating professionals, with 59% of guests being domestic and 41% international.

-

Similarly, in the U.S., extended-stay hotels outperformed traditional hotels in March 2025, with supply up 3%, demand rising 2.1%, and growth across ADR, RevPAR, and room revenue despite a slight dip in occupancy. In Q4 2024, U.S. extended-stay RevPAR reached USD 85.52 per night, reflecting a 3% year-on-year increase.

These trends affirm the increasing institutional and consumer preference for residential hotel models worldwide.

The U.S. Residential Hotel Market size was valued at USD 17.23 billion in 2024 and is expected to reach USD 40.58 billion by 2032, growing at a CAGR of 11.30% from 2025-2032.

Growth in the U.S. Residential Hotel Market is driven by rising demand for extended stays among business travelers, remote workers, and relocating families, coupled with increased urban migration and a preference for flexible, amenity-rich, home-like accommodations

Market Dynamics

Drivers

-

Growing Demand For Flexible, Long-Term Stays Among Business Travelers And Digital Nomads Is Boosting Residential Hotel Market Expansion Globally.

The growth of remote work and higher area mobility has spurred strong demand for long-term stays essential at home & hotel hybrid style. More and more business travelers, digital nomads, or families relocating for a new job are looking for various amenities offered by furnished rentals such as kitchen, laundry, and Wifi. These hybrid lodging types are economical and flexible, with the ever-striving for balance in a modern life. As travelers seek increasingly bespoke, homely experiences, residential hotels are uniquely poised to capitalize on changing expectations as they experience accelerated growth in urban centers and commercial hubs around the globe, combining comfort with convenience.

-

As of 2024, approximately 35 million digital nomads are active globally, with 45% based in the U.S. In Madeira (Portugal), government estimates show digital nomads spend an average of USD 2,100 per month in local economies.

Restraints

-

High Operational And Maintenance Costs Reduce Profitability And Limit Expansion Possibilities For Residential Hotel Operators.

Residential hotels are capital-intensive and have high operating costs such as staff, utilities, maintenance and service delivery costs. With guest stays being longer, guests end up paying lower rates per night from a traditional hotel or other sources as well. Extended occupancy increases costs while frequent maintenance increases it even further. This cost structure makes scaling difficult, particularly as competition picks up in urban areas. Modest ROI and modest enthusiasm keeps developers from taking as many risks as they used to, while so many operators have to streamline operations just to stay alive, let alone profitable, as real estate prices continue to go up and both guests and owners expect more in the way of service and comfort over time.

Opportunities

-

Digital Platforms And AI-Driven Personalization Enhance Guest Experience And Operational Efficiency In Residential Hotels.

AI, IoT, and smart building systems have improved to support residential hotels with more personalized guest experiences and optimized operations. There are digital platforms that simplify contactless check-ins, dynamic pricing, and automated housekeeping, so everything runs like a well-oiled machine. AI powered analytics predict guest behavior to utilize rooms better which helps in increasing retaining guests. These technologies bring down manpower expenses while enhancing the quality of service. By adopting digital innovations, market leaders can set new standards for convenience, redefine luxury, appeal to the tech-savvy traveler, and create long-term brand loyalty amidst an increasingly fragmented hospitality landscape.

-

52% of hotel chains now use AI to personalize guest experiences, and 54% incorporate AI in loyalty programs. 82% of hotels invest in automation, and 38% report contactless check-in significantly reduces wait times.

-

AI chatbots handle 70% of customer inquiries, and AI-enabled room features boost guest satisfaction by 20%. Hilton has implemented digital room keys in over 80% of its properties, and its AI concierge "Connie" enhances personalized service

Challenges

-

Competition From Alternative Accommodations Like Serviced Apartments And Vacation Rentals Challenges Residential Hotel Market Share.

The rise of platforms such as Airbnb, coupled with the expansion of branded serviced apartments, puts additional competitive pressure on residential hotels by providing lower prices, bigger rooms and more location options. Because of this, consumers will always compare these alternatives with each other, forcing residential hotels to offer superior service or property-specific features. And in many markets, regulatory advantages for vacation rentals just make the gap even bigger. The need for operators to innovate, market and deliver more value in less time to remain competitive adds complexity and cost. Highly competitive urban markets challenge entry and scalability, which is especially true in high density or mature urban settings.

Segment Analysis

By Application

Travelers segment dominated the Residential Hotel Market with the highest revenue share of about 38% in 2024 due to rising demand for long-stay accommodations among leisure and lifestyle travelers seeking comfort, flexibility, and personalized services. This group increasingly prefers residential hotels for their home-like amenities, convenient locations, and cost efficiency during extended vacations or relocations. The growing trend of experiential travel and multigenerational trips also contributes to their consistent dominance across global markets.

Business Customers segment is expected to grow at the fastest CAGR of about 13.09% from 2025-2032 driven by rising global business travel, corporate mobility, and the expansion of project-based assignments. Companies increasingly prefer residential hotels for relocating employees or accommodating long-term consultants due to their cost-effectiveness, work-friendly amenities, and extended-stay convenience. The post-pandemic shift toward hybrid work travel and long-duration corporate stays further strengthens growth in this segment as firms seek flexible housing options.

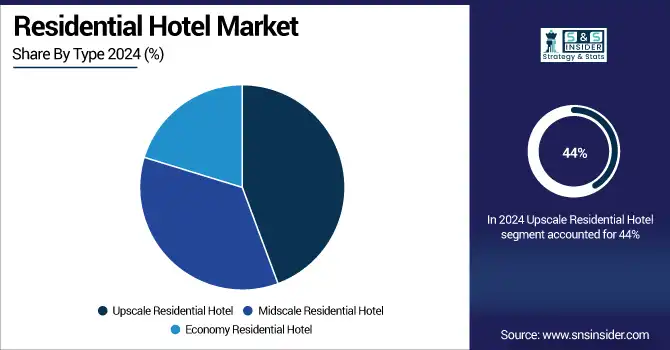

By Type

Upscale Residential Hotel segment dominated the Residential Hotel Market with the highest revenue share of about 44% in 2024 and is expected to grow at the fastest CAGR of about 12.61% from 2025-2032. This dominance is driven by strong demand from affluent travelers, executives, and expatriates seeking premium amenities, enhanced privacy, and prime city locations. Upscale offerings combine luxury living with long-stay benefits, attracting guests willing to pay for superior experiences. The segment’s projected rapid growth is fueled by increasing urbanization, rising disposable incomes, and a growing preference for boutique luxury stays that deliver both convenience and exclusivity.

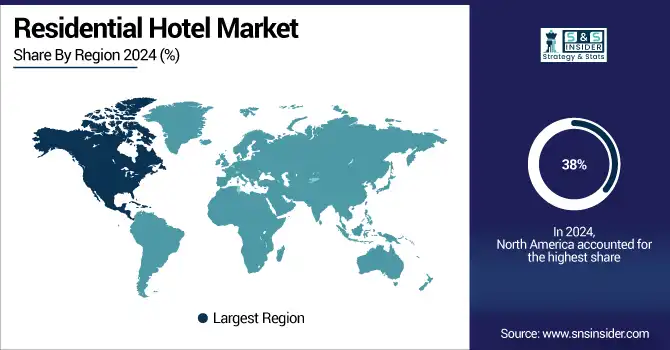

Regional Analysis

North America dominated the Residential Hotel Market with the highest revenue share of about 38% in 2024 due to its mature hospitality infrastructure, high business travel volumes, and strong presence of global hotel chains. The region benefits from a well-established extended-stay culture, particularly in the U.S. and Canada, where corporate mobility, relocations, and urban tourism fuel demand. Additionally, advanced service offerings and premium amenities have made residential hotels a preferred long-stay option.

The United States is dominating the Residential Hotel Market among the three, driven by high business travel demand, corporate mobility, and mature extended-stay infrastructure.

Asia Pacific is expected to grow at the fastest CAGR of about 13.79% from 2025–2032 due to rapid urbanization, expanding middle-class income, and booming intra-regional tourism. Increasing infrastructure development and foreign direct investment in countries like China, India, and Southeast Asia are driving business travel and long-term relocation needs. Coupled with rising digital nomadism and government-backed tourism initiatives, the region presents vast untapped potential for residential hotel operators targeting emerging urban centers.

China is dominating the Residential Hotel Market in Asia-Pacific, driven by rapid urbanization, domestic business travel growth, and expanding long-stay hospitality infrastructure.

Europe holds a strong position in the Residential Hotel Market due to high tourism, strong corporate travel, and growing preference for extended stays. Its mature hospitality infrastructure and consistent demand across urban centers support sustained market performance.

The United Kingdom is dominating the Residential Hotel Market in Europe due to strong corporate travel, urban tourism, and a well-developed extended-stay hotel network.

Middle East & Africa and Latin America are emerging markets in the Residential Hotel sector, driven by growing tourism, urbanization, and infrastructure development. Increasing international events, business travel, and long-stay demand are gradually boosting regional market potential and investment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Residential Hotel Market Companies are Hilton Worldwide, Hyatt Hotel, Marriott International, InterContinental Hotels Group (IHG), Choice Hotels International, Accor Hotels, Four Seasons Hotels, Omni Hotels & Resorts, InTown Suites, Motel 6.

Recent Developments:

-

Hilton Worldwide (2025): Opened first property under new brand targeting traveling workers 89 suites focused on long stays and flexible workspaces highlighting growth in workforce-centric residential hospitality.

-

Hilton Worldwide (2024): Launched WALDORF ASTORIA branded residences in Downtown Dubai, first standalone residences outside USA, with NABNI Developments and designs by Carlos Ott Architects luxury residential expansion.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 63.35 Million |

| Market Size by 2032 | USD 149.62 Million |

| CAGR | CAGR of 11.41% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Upscale Residential Hotel, Midscale Residential Hotel, Economy Residential Hotel) • By Application (Travelers, Business Customers, Trainers and Trainees, Government and Army Staff, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hilton Worldwide, Hyatt Hotel, Marriott International, InterContinental Hotels Group (IHG), Choice Hotels International, Accor Hotels, Four Seasons Hotels, Omni Hotels & Resorts, InTown Suites, Motel 6 |