Live Cell Encapsulation Market Report Scope & Overview:

To Get More Information on Live Cell Encapsulation Market - Request Sample Report

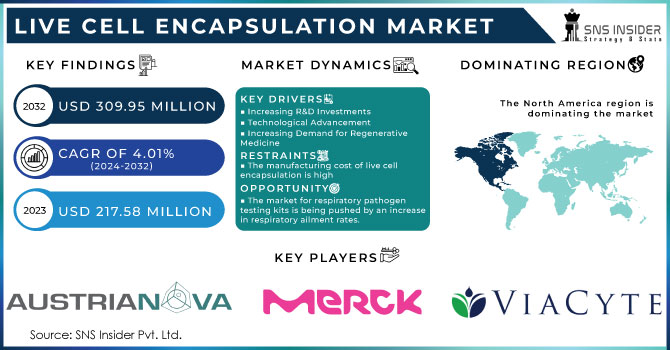

The Live Cell Encapsulation Market Size was valued at USD 246.78 Million in 2023 and is expected to reach USD 336.52 Million by 2032, growing at a CAGR of 3.51% over the forecast period of 2024-2032.

The Live Cell Encapsulation Market is rapidly evolving, driven by innovations in therapeutic delivery and regenerative medicine. The clinical trials pipeline is expanding, with several therapies advancing through various phases, indicating increasing confidence in encapsulation technologies. Material preferences are shifting, with natural polymers like alginate leading but synthetic options gaining ground for their stability. Our report examines cost reduction trends, highlighting how these advancements make therapies more accessible and scalable. The commercialization timeline differs across regions, with North America taking the lead in quick market access. Additionally, a regulatory landscape comparison explores the impact of country-specific frameworks on product approvals and market entry, offering an in-depth view of how global regulations shape the market’s growth trajectory.

The US Live Cell Encapsulation Market Size was valued at USD 69.76 Million in 2023 with a market share of around 66% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Live Cell Encapsulation market is experiencing robust growth, driven by increasing demand for advanced drug delivery systems and regenerative medicine. Factors such as strong government support through agencies like the National Institutes of Health (NIH) and FDA approvals for encapsulation-based therapies are fueling this expansion. Biotech innovations from leading companies such as ViaCyte, Inc. and Sigilon Therapeutics are propelling advancements in cell therapy for diabetes and other chronic conditions. Additionally, increasing collaborations between academic institutions and industry players further stimulate market progress, ensuring continuous development in encapsulation technologies and their clinical applications.

Market Dynamics

Drivers

-

Rising Adoption of Encapsulation in Rare Genetic Disorders for Long-Term Therapeutic Efficacy Across Pediatric and Adult Populations

The live cell encapsulation market is witnessing increased demand from therapeutic strategies aimed at rare genetic disorders that require sustained biological intervention. The technology enables long-term delivery of therapeutic cells without the need for repeat procedures or immunosuppressants, which is especially critical for pediatric and adult populations dealing with lifelong conditions like lysosomal storage diseases or congenital enzyme deficiencies. In the United States, organizations such as the National Organization for Rare Disorders have highlighted the role of advanced cell-based delivery in minimizing systemic complications while enhancing treatment consistency. Companies like Sigilon Therapeutics are actively exploring encapsulated cell constructs for continuous protein secretion in such rare conditions. This driver underscores a fundamental shift in treating complex genetic illnesses, moving from traditional drugs to encapsulated regenerative systems designed to integrate with patient physiology and provide long-term therapeutic results with fewer hospitalizations and improved quality of life.

Restraints

-

Ethical and Legal Barriers in Cell Source Procurement Especially from Embryonic and Donor-Derived Origins

The use of embryonic and donor-derived cells for live cell encapsulation faces growing ethical and legal scrutiny, which poses a significant restraint on research and commercialization. In the United States, legislation such as the Dickey-Wicker Amendment limits federal funding for studies involving the destruction of embryos, thereby impacting embryonic stem cell encapsulation projects. Additionally, donor-derived cells often require complex legal frameworks for donor consent, data protection, and biobank compliance. These ethical constraints can delay or entirely restrict the use of otherwise viable therapeutic cell lines. Furthermore, public perception plays a key role in shaping market dynamics, with resistance from religious or bioethical groups influencing policy decisions and investment flows. While autologous and induced pluripotent stem cell alternatives are emerging, they are currently costlier and technologically demanding. Until clear ethical guidelines and sourcing innovations mature, ethical and legal procurement hurdles will continue to limit the full-scale deployment of encapsulated therapies.

Opportunities

-

Increasing Focus on Personalized Medicine to Create Patient-Specific Cell Encapsulation Therapies for Better Outcomes

The rising trend of personalized medicine presents a significant opportunity for the live cell encapsulation market, particularly in tailoring treatments based on a patient’s genetic and immunological profile. Encapsulating patient-derived cells minimizes the risk of immune rejection and offers a more precise treatment response. With advancements in gene editing tools like CRISPR and innovations in single-cell sequencing, cells can now be customized before encapsulation to match specific therapeutic targets. Institutions like the Stanford Center for Personalized Medicine are exploring encapsulated autologous therapies for disorders such as Parkinson’s disease and hormone imbalances. Moreover, personalized encapsulation aligns well with the shift toward value-based healthcare in the United States, where therapies are judged on outcome metrics. As biomanufacturing platforms become increasingly modular and automated, the commercial feasibility of patient-specific capsules is improving. This personalized approach could redefine treatment paradigms in chronic and rare diseases by offering safer, long-acting, and highly targeted interventions.

Challenge

-

Limited Long-Term Stability of Encapsulated Cells in Complex Physiological Environments Impacts Therapeutic Reliability

Ensuring that encapsulated cells remain viable and functional over extended periods within the body remains a critical challenge for long-term therapeutic success. Once implanted, these encapsulated constructs must survive complex physiological environments that include immune surveillance, metabolic stress, hypoxia, and fluctuations in temperature and pH. Over time, even the most biocompatible materials can degrade, impacting permeability, protective functions, and ultimately, therapeutic efficacy. Studies supported by the United States National Institutes of Health have reported reduced functional output of encapsulated cells after several weeks in vivo, particularly in inflammation-prone areas such as the pancreas or spinal cord. Furthermore, the limited vascularization around the implant site restricts nutrient and oxygen supply to the encapsulated cells, accelerating apoptosis or dormancy. These stability issues necessitate either repeated procedures or the development of advanced encapsulation matrices that mimic native tissue support. Until these technological advancements are realized, long-term stability will remain a roadblock to widespread clinical acceptance.

Segmental Analysis

By Polymer Type

Natural Polymers dominated the Live Cell Encapsulation Market in 2023, holding a market share of 58.2%. Among natural polymers, alginate emerged as the leading subsegment due to its superior biocompatibility, gel-forming ability under mild conditions, and minimal immunogenicity. Alginate’s prominence is reinforced by its extensive use in clinical and preclinical studies, especially in islet cell encapsulation for diabetes treatment. Organizations such as the Juvenile Diabetes Research Foundation (JDRF) have invested heavily in research programs involving alginate-based encapsulation to protect pancreatic islets in type 1 diabetes patients. For instance, studies funded by JDRF and trials by companies like ViaCyte and Sigilon Therapeutics have demonstrated promising results using alginate capsules for stem cell-derived therapies. Furthermore, government-backed research institutions such as the National Institutes of Health (NIH) continue to fund studies focused on natural polymers due to their non-toxic, biodegradable nature, making them ideal for translational medicine applications.

By Method

Microencapsulation dominated the Live Cell Encapsulation Market in 2023 with a market share of 51.5%. This method remains the most widely adopted due to its ability to encapsulate individual or small clusters of cells, offering better diffusion of nutrients and oxygen, essential for cell viability. Microencapsulation is particularly effective in therapies like cell-based insulin delivery and cancer immunotherapy, where precise control over cell-environment interactions is required. Companies like Living Cell Technologies have developed microencapsulated cell-based implants for neurodegenerative conditions such as Parkinson’s disease. Additionally, government-funded initiatives in countries like the United States and Germany support microencapsulation techniques in regenerative medicine. The method’s scalability, coupled with advancements in electrospray and microfluidics technologies, further strengthens its commercial and clinical viability. Moreover, the European Science Foundation (ESF) has acknowledged microencapsulation's potential in therapeutic delivery systems, particularly due to its reduced immune response and improved cell survival post-implantation.

By Application

Drug Delivery segment dominated the Live Cell Encapsulation Market in 2023 with a market share of 50.3%. This segment continues to lead due to the increasing demand for site-specific and sustained delivery of therapeutic agents via encapsulated cells. Drug delivery using encapsulated cells is pivotal in managing chronic diseases such as cancer, diabetes, and autoimmune disorders, where continuous administration of biologics is required. For example, BioTime Inc. and Sigilon Therapeutics have been at the forefront of developing encapsulated cell therapies for continuous protein or hormone release. The U.S. Food and Drug Administration (FDA) has granted multiple Investigational New Drug (IND) approvals for encapsulated drug delivery platforms, signifying regulatory support and commercial potential. Moreover, increased collaborations between academic institutions and biotech companies such as the partnership between Harvard University and Sigilon have led to novel innovations, reinforcing drug delivery as the key application area. Its dominance is expected to continue as personalized and precision medicine evolves further.

Regional Analysis

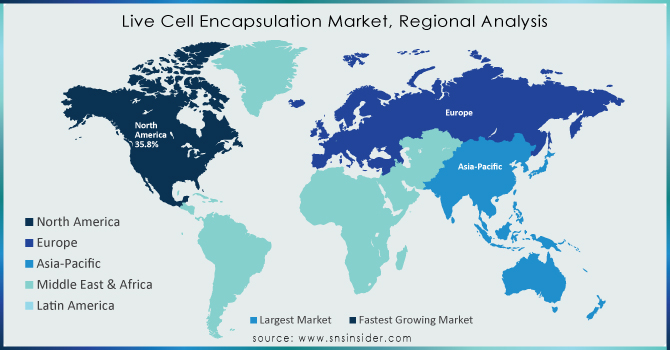

North America dominated the Live Cell Encapsulation Market in 2023 with a market share of 42.7%, primarily driven by advanced healthcare infrastructure, strong R&D investments, and regulatory support. The United States emerged as the leading country within this region due to significant clinical trial activities, rising prevalence of chronic diseases, and the presence of major biotech firms such as ViaCyte, BlueRock Therapeutics, and Sigilon Therapeutics. The National Institutes of Health (NIH) and the Department of Health and Human Services (HHS) have provided consistent funding to foster research in cell-based therapies and biomaterials. Moreover, the U.S. FDA’s relatively favorable stance on cell therapy products has accelerated the commercialization pipeline. Canada also contributes notably with institutions like Toronto General Hospital Research Institute and the University of British Columbia, which are actively engaged in live cell encapsulation research. The high rate of innovation, supportive regulatory frameworks, and growing clinical applications make North America the clear leader in this market.

Asia Pacific emerged as the fastest-growing region in the Live Cell Encapsulation Market with a significant CAGR during the forecast period of 2024 to 2032. This rapid growth is fueled by increasing investments in biotechnology, expanding healthcare infrastructure, and rising prevalence of chronic diseases across major countries such as China, India, Japan, and South Korea. China is taking significant strides through government programs like the Made in China 2025 initiative, which promotes innovation in biomedicine and regenerative therapies. The Chinese Academy of Sciences and startups such as Biocytogen are conducting advanced research in encapsulation-based cell therapies. Meanwhile, Japan’s regenerative medicine sector, supported by the Japan Agency for Medical Research and Development (AMED), has propelled research into stem cell encapsulation and therapeutic applications. India is emerging with biotech hubs in Bangalore and Hyderabad, hosting institutions like CCMB and NIBMG, which collaborate with global companies to accelerate clinical studies. Increasing collaborations, favorable regulatory changes, and a large patient base are positioning Asia Pacific as the next frontier for expansion in this space.

Do You Need any Customization Research on Live Cell Encapsulation Market - Enquire Now

Key Players

-

Altucell, Inc. (Altucell Diabetes Therapy, Altucell Encapsulation Platform)

-

AUSTRIANOVA (Cell in a Box, Bac-in-a-Box)

-

Beta-O2 Technologies, Inc. (BetaAir, Bioartificial Pancreas)

-

Defymed (MailPan, ExOlin)

-

Diatranz Otsuka Ltd. (DIABECELL)

-

Gloriana Therapeutics (GT-022, GT-031)

-

Living Cell Technologies Ltd. (NTCELL, DIABECELL)

-

Neurotech Pharmaceuticals, Inc. (NT-501, NT-503)

-

Sernova Corporation (Cell Pouch, Cell Pouch System)

-

Sigilon Therapeutics, Inc. (SIG-001, SIG-005)

-

ViaCyte, Inc. (PEC-Encap, PEC-Direct)

-

PharmaCyte Biotech Inc. (CypCaps, Cell in a Box)

-

Kadimastem (IsletSource, AstroRx)

-

Atelerix Ltd. (Alginate Gel Preservation System)

-

Cellectis (UCART19, UCART123)

-

Evotec SE (Induced Pluripotent Stem Cell Platform, Pancreatic Islet Cell Therapy)

-

Orgenesis Inc. (Cell Pouch System, Bioxomes)

-

Seraxis, Inc. (SR-01, Islet Cell Therapy Platform)

Recent Developments

-

December 2023: Encellin secured $9.9M funding led by Khosla Ventures to advance its cell encapsulation platform for endocrine disorders, focusing on Type 1 Diabetes. The company aims to develop its Encapsulated Cell Replacement Therapy (EnCRT) and expects Phase 1 clinical trial data in the coming year.

-

October 2023: PharmaCyte Biotech provided an update on its Cell-in-a-Box® technology, advancing encapsulation methods for chronic diseases, including cancer and diabetes. The company plans to expand the platform’s clinical applications to enhance targeted drug delivery and improve patient outcomes.

-

June 2023: Eli Lilly acquired Sigilon Therapeutics, boosting its capabilities in cell therapies and encapsulation technologies. This acquisition aims to enhance Lilly’s cell-based treatments for chronic diseases, notably Type 1 Diabetes, using Sigilon’s innovative therapeutic delivery technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 246.78 Million |

| Market Size by 2032 | USD 336.52 Million |

| CAGR | CAGR of 3.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Polymer Type (Natural Polymers [Alginate, Chitosan, Cellulose, Others], Synthetic Polymers) •By Method (Microencapsulation, Macroencapsulation, Nanoencapsulation) •By Application (Drug Delivery, Regenerative Medicine, Cell Transplantation, Probiotics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AUSTRIANOVA, Sigilon Therapeutics, Inc., ViaCyte, Inc., Living Cell Technologies Ltd., Diatranz Otsuka Ltd., Sernova Corporation, Neurotech Pharmaceuticals, Inc., Gloriana Therapeutics, Beta-O2 Technologies, Inc., Defymed and other key players |