Urinary Tract Infection Testing Market Size Analysis:

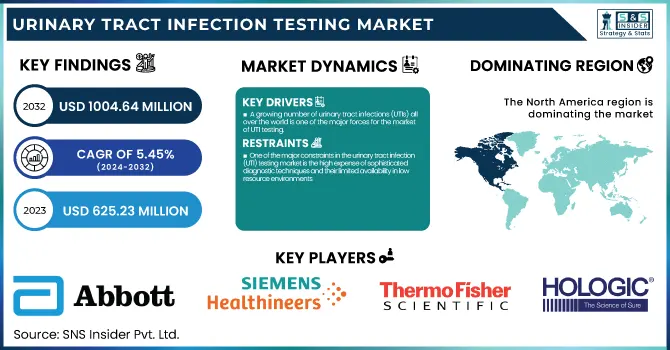

The Urinary Tract Infection Testing Market Size was valued at USD 625.23 million in 2023 and is expected to reach USD 1004.64 million by 2032, growing at a CAGR of 5.45% from 2024-2032.

To Get more information on Urinary Tract Infection Testing Market - Request Free Sample Report

The Urinary Tract Infection (UTI) Testing Market report offers insights into key statistical factors, such as the prevalence and incidence of UTIs within various regions, to highlight demographic differences. The report also discusses testing volume trends, with a focus on the move away from traditional culture-based technologies towards rapid diagnostic solutions. The report is also a step into prescription tendencies, outlining frequently prescribed antibiotics as well as treatment effectiveness affected by antimicrobial resistance. The adoption of rapid tests for UTIs is also given attention, discussing technological innovations. Finally, healthcare expenditure breakdown on UTI diagnostic and treatment in terms of government, commercial, private, and out-of-pocket spending is also provided.

The U.S. Urinary Tract Infection Testing Market size was USD 408.40 million in 2023 and is expected to reach USD 678.64 million by 2032, growing at a CAGR of 5.84% over the forecast period of 2024-2032.

The market is expanding due to the rising incidence of urinary tract infections (UTIs), particularly among women, elderly individuals, and patients with compromised immune systems. Increasing awareness about early diagnosis and the development of rapid and accurate diagnostic tests are driving demand. Additionally, technological advancements in point-of-care testing and home-based UTI test kits are contributing to market growth.

Urinary Tract Infection Testing Market Dynamics

Drivers

-

A growing number of urinary tract infections (UTIs) all over the world is one of the major forces for the market of UTI testing.

According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), UTIs make up close to 10 million healthcare visits a year in the United States alone, with more risk in females owing to their anatomical setup. Also, the World Health Organization (WHO) cites antimicrobial resistance (AMR) as a burgeoning issue requiring more accurate and speedy diagnostic platforms. Recent progress in UTI diagnostics, e.g., Quidel Corporation's rapid UTI test available since June 2024, facilitates faster identification of bacteria and antibiotic susceptibility tests in 45 minutes, bettering treatment guidelines. The increasing occurrence of repeat UTIs and growing demands for prompt identification equipment remain a strong force propelling the business of cutting-edge test kits.

-

Technology Evolution in Urinalysis and Molecular Diagnostic Techniques propelling the market growth.

The market for UTI testing is also enjoying rapid technological innovation in diagnostic techniques, providing greater accuracy, speed, and convenience. Conventional culture testing is increasingly being superseded by automated urinalysis systems and molecular testing, which provide quicker and more accurate results. In December 2023, Siemens Healthineers launched the Atellica UAS 60 Analyzer, which is an automated urine sediment analytical system that contributes to laboratory productivity with digital image analysis, mitigating the need for manual microscopy. Furthermore, PCR-based examinations and AI-aided diagnostics are becoming more popular, permitting quick identification of certain bacterial types and antibiotic resistance determinants. The integration of such advanced technologies in UTI diagnostics provides early disease diagnosis and personalized treatment strategies, hence driving the market.

Restraint

-

One of the major constraints in the urinary tract infection (UTI) testing market is the high expense of sophisticated diagnostic techniques and their limited availability in low-resource environments.

Conventional urine culture tests are relatively inexpensive but result in a delay of 24 to 48 hours, hindering treatment decisions. By comparison, newer molecular testing technologies like automated urinalysis analyzers and PCR-based diagnostics are faster, and more accurate but much more costly. For example, molecular-technology-based UTI rapid testing can be as much as 5–10 times more expensive than traditional systems, thus proving to be an unaffordable option for people in developing parts of the world. The prerequisite for sophisticated lab facilities and specially trained staff further restricts adoption in resource-poor or rural and developing regions. This barrier to cost inhibits the extensive adoption of advanced diagnostic solutions, hindering market penetration in cost-sensitive markets.

Opportunities

-

Increasing pressure for fast, affordable, and convenient UTI testing represents a significant opportunity for growth in point-of-care (POC) testing solutions.

Standard urine culture testing, up to 48 hours, too often postpones treatment decisions, allowing continued discomfort and complications. Point-of-care diagnostic instruments, like automated dipstick analyzers and molecular-based quick UTI tests, allow direct infection detection in minutes. Players such as Siemens Healthineers and Quidel Corporation are making investments in handheld UTI diagnostic systems reducing dependence on core labs. A rise in the use of telemedicine also accompanies the opportunity as self-test kits delivered at the door provide patient tracking from home. As infections of antibiotic-resistant form gain strength the world over, instant POC testing for inclusion of antimicrobial susceptibility evaluation will additionally help market growth to support more optimized treatment options.

Challenges

-

One of the primary challenges in the UTI test market is rising antimicrobial resistance (AMR), which challenges the efficacy and accuracy of existing testing methods.

Conventional diagnostics based on urine culture depend upon the detection of bacterial growth, but with evolving resistant strains, conventional treatments fall short, promoting recurrent infections as well as inaccurate diagnoses. More than 30% of E. coli UTIs worldwide are resistant to first-line antibiotics, complicating standard testing's ability to predict treatment. False negatives and inconclusive findings further complicate effective diagnosis, necessitating more advanced molecular tests that increase cost and complexity. As AMR increases, the demand for next-generation diagnostic tools with real-time resistance profiling is urgent, but widespread implementation remains a challenge due to infrastructure and affordability constraints.

Urinary Tract Infection Testing Market Segmentation Analysis

By Type

The Cystitis segment dominated the urinary tract infection testing market with a 43.25% market share in 2023 based mainly on its high frequency and recurring nature in individuals, particularly women. Clinically, it has been estimated that almost 50–60% of women have at least one occurrence of cystitis in their lifetime, with recurrent infection being common. The growing application of point-of-care (POC) tests, dipstick urinalysis, and urine culture testing drove market demand for cystitis diagnosis. Furthermore, market pressures such as increasing antibiotic resistance, dehydration, and catheter-associated infections among patients admitted to hospitals have increased the frequency of screenings. The extensive availability of quick-testing solutions, combined with rising awareness and early detection efforts, has also strengthened the market leadership of the cystitis segment.

The Pyelonephritis segment is experience to grow at the fastest rate during the forecast period with a 6.25% CAGR, influenced by growing numbers of complicated UTIs, antibiotic resistance, and better awareness about infections in kidneys. Pyelonephritis is a serious kidney infection that usually arises because of untreated or inadequately treated lower urinary tract infections (like cystitis). Based on health reports, inpatient admissions due to pyelonephritis have increased significantly, and subsequently, there has been a greater need for sophisticated laboratory tests such as urine culture, blood work, and imaging modalities. Increasing use of molecular diagnostic technologies and quick AST is improving early detection and treatment decisions. Moreover, the increasing aging population, increasing incidence of diabetes, and escalating healthcare spending in emerging economies are also propelling the segment's speedy growth in the UTI testing market.

By End Use

The Reference Laboratories segment dominated the urinary tract infection testing market with a 27.10% market share in 2023, mainly because of their high testing capacity, sophisticated diagnostic technologies, and wide service networks. These labs provide thorough urine culture tests, antimicrobial susceptibility testing (AST), and molecular diagnostics, providing precise and detailed results for UTI diagnosis. With growing antibiotic resistance, doctors and hospitals increasingly turn to reference labs for accurate identification of pathogens and targeted treatment protocols. The increasing trend among hospitals, clinics, and primary care physicians to prefer outsourced laboratory testing has further driven the segment's dominance. The presence of automated urine analyzers, PCR-based diagnostic tests, and AI-enabled laboratory workflows has boosted the position of reference labs in delivering quicker, more accurate, and high-throughput UTI testing solutions.

The Urogynecologists segment is anticipated to experience the fastest growth in the next forecast years on the back of rising awareness regarding repeat UTIs, growing cases of pelvic floor disorders, and the aging population. Specialists in urogynecology are trained to provide treatment for complex urinary tract infections, incontinence, and bladder dysfunction and therefore become instrumental in advanced UTI diagnosis and treatment planning. The growing incidence of recurrent UTIs in postmenopausal women, infections in pregnancy, and catheter-associated UTIs in the elderly has created a greater need for special diagnostics. Moreover, advancements in technology like non-invasive diagnostic devices, real-time PCR diagnostics, and point-of-care urine analysis are empowering urogynecologists to offer speedier and more customized care. With increased patient referrals, better diagnostic tools, and increased demand for specialized procedures, this segment is likely to witness significant growth over the forecast period.

Urinary Tract Infection Testing Market Regional Insights

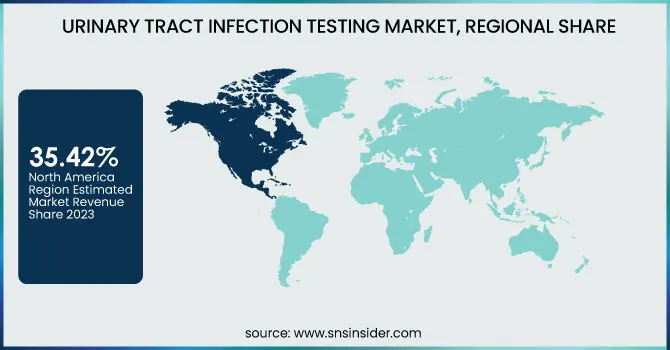

North America dominated the urinary tract infection (UTI) testing market with a 35.42% market share in 2023, mainly because of its sophisticated healthcare infrastructure, high level of awareness, and robust presence of major market players like Abbott, Becton Dickinson, and Siemens Healthineers. The growing incidence of UTIs, especially among women, the elderly, and diabetic patients, has created a high demand for rapid and precise diagnostic tools. As per the CDC, UTIs contribute to approximately 8 million healthcare visits each year in the U.S., making it a key area for diagnostic innovation. Moreover, favorable reimbursement policies, high usage of point-of-care (POC) diagnostic technologies, and government support for early disease detection also add to market leadership.

The Asia Pacific region is experiencing the fastest growth with a 6.65% CAGR in the UTI test market throughout the forecast period, fueled by high infection rates, expanding healthcare access, and an expanding geriatric population. China, India, and Japan are among the countries seeing a high increase in UTI cases, mostly attributed to inadequate sanitation, growing antibiotic resistance, and inadequate early diagnosis in rural populations. Based on the WHO, UTI cases due to antimicrobial resistance are increasing exponentially in Southeast Asia, which calls for more sophisticated diagnostic solutions. The growth of telehealth, government healthcare initiatives, and private investment in diagnostic centers is driving market penetration at a faster pace. Moreover, rising awareness, cost-effective diagnostics, and the presence of new entrants working on cost-efficient solutions are making Asia Pacific the most rapidly growing UTI testing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Urinary Tract Infection Testing Market Key Players

-

Abbott Laboratories (Uristat Relief Pak, UTI Test Strips)

-

Siemens Healthineers (CLINITEK Status+ Analyzer, Multistix 10 SG Reagent Strips)

-

Becton, Dickinson and Company (BD) (BD UTI ESwab Collection Kit, BD Phoenix M50 Automated Microbiology System)

-

bioMérieux SA (VITEK 2 Compact System, ChromID CPS Elite Agar)

-

Thermo Fisher Scientific Inc. (Sensititre ARIS 2X System, Remel Spectra UTI Agar)

-

Quidel Corporation (QuickVue UTI Test, Sofia 2 Fluorescent Immunoassay Analyzer)

-

Roche Diagnostics (Urisys 1100 Urine Analyzer, Combur-Test Strips)

-

Danaher Corporation (DxC 700 AU Chemistry Analyzer, KOVA-Trol Urinalysis Quality Control)

-

Hologic, Inc. (Aptima Urine Specimen Collection Kit, Panther System)

-

ACON Laboratories, Inc. (Mission UTI Urinalysis Reagent Strips, HealthyMe UTI Test)

-

Sekisui Diagnostics (Solaris UTI Test, OSOM UTI Test)

-

Bio-Rad Laboratories, Inc. (Uri-Trak 120 Urine Analyzer, Liquichek Urinalysis Control)

-

Cardinal Health (SureStep Urine Reagent Strips, CONSULT Urinalysis Analyzer)

-

Arkray, Inc. (AUCTION MAX AX-4030 Urine Analyzer, AUTION Sticks 10PA)

-

Siemens Healthineers (Atellica 1500 Automated Urinalysis System, CLINITEK Advantus Urine Chemistry Analyzer)

-

Beckman Coulter, Inc. (IRICELL Series Urinalysis Workcell, iRICELL3000 Automated Urinalysis System)

-

Sysmex Corporation (UF-5000 Fully Automated Urine Particle Analyzer, UN-Series Urinalysis Solution)

-

Meridian Bioscience, Inc. (ImmunoCard STAT! E. coli O157 Plus, TRU Legionella)

-

OraSure Technologies, Inc. (Intercept Oral Fluid Drug Test, Q.E.D. Saliva Alcohol Test)

-

Alere Inc. (Alere iCup Drug Screen, Alere Triage TOX Drug Screen)

Suppliers (These suppliers provide diagnostic reagents, laboratory instruments, and consumables essential for accurate urinary tract infection (UTI) testing, supporting clinical laboratories, hospitals, and point-of-care testing centers.) In Urinary Tract Infection Testing Market

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

Sigma-Aldrich Corporation

-

Beckman Coulter, Inc.

-

BD (Becton, Dickinson, and Company)

-

Roche Diagnostics

-

Siemens Healthineers

-

Bio-Rad Laboratories, Inc.

-

PerkinElmer, Inc.

-

Agilent Technologies, Inc.

Recent Development in the Urinary Tract Infection Testing Market

-

June 2024 – Quidel Corporation has launched a new, state-of-the-art rapid test for urinary tract infections (UTIs), the test being capable of identifying the causative bacteria and performing antibiotic susceptibility testing (AST) in only 45 minutes. The new test employs a single-use cartridge, boosting the efficiency and accuracy of UTI diagnosis.

-

December 2023 – Siemens Healthineers introduced the Atellica UAS 60 Analyzer, a small urine sediment analysis system that automates laboratory urinalysis processes. Through the use of full field-of-view digital imaging, the analyzer mimics manual microscopy, allowing laboratory staff to obtain quicker and more precise urine sediment analysis with less dependence on conventional manual procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 625.23 million |

| Market Size by 2032 | US$ 1004.64 million |

| CAGR | CAGR of 5.45% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Urethritis, Cystitis, Pyelonephritis) • By End Use (General Practitioners (GPs), Urologists, Urogynecologists, Hospital Laboratories, Reference Laboratories, Hospital Emergency Departments, Urgent Care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Siemens Healthineers, Becton, Dickinson and Company (BD), bioMérieux SA, Thermo Fisher Scientific Inc., Quidel Corporation, Roche Diagnostics, Danaher Corporation, Hologic, Inc., ACON Laboratories, Inc., Sekisui Diagnostics, Bio-Rad Laboratories, Inc., Cardinal Health, Arkray, Inc., Beckman Coulter, Inc., Sysmex Corporation, Meridian Bioscience, Inc., OraSure Technologies, Inc., Alere Inc., and other players. |