Liver Biopsy Market Size & Overview:

To Get More Information on Liver Biopsy Market - Request Sample Report

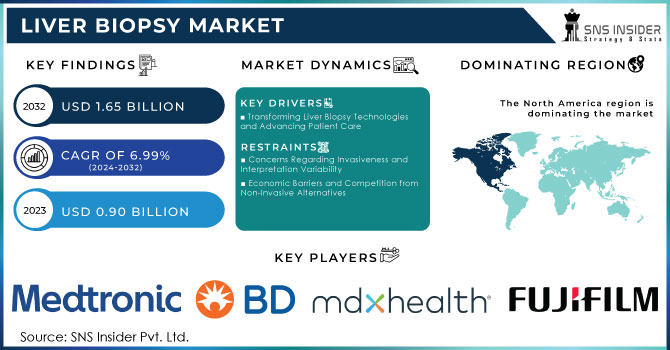

The Liver Biopsy Market size was valued at USD 0.90 billion in 2023 and is estimated to reach USD 1.65 billion by 2032, with a growing CAGR of 6.99% over the forecast period 2024-2032.

The development of liver disease and the rising number of biopsy procedures in the U.S. are expected to fuel growth in the liver biopsy market. According to the Centers for Disease Control and Prevention, around 3.9 million adults were diagnosed with liver disease in the U.S. Such alarming statistic highlights the urgent need for efficient diagnostic solutions; the diagnosis of different forms of liver diseases, including non-alcoholic fatty liver disease (NAFLD), viral hepatitis, and cirrhosis, requires fundamental importance of using liver biopsy systems.

Improving consciousness of diseases of the liver among patients as well as clinicians has increased the demand for new sophisticated diagnostic techniques. The demands for more minimal invasive processes also contribute to the further enhancement of requirements that need more precise and minimally invasive techniques, such as elastography and other imaging technologies that allow for more accurate diagnoses with minimal risks of potential complications from traditional biopsies. Patients also choose a mode of minimally invasive procedures due to less recovery time, and recent surveys revealed that more than 70% of patients prefer such treatments.

Major market players in developed countries are in the lead in terms of the worldwide liver biopsy market with their innovative products and services. They are not only improving their prospects in the developed regions but also penetrating developing nations along with emerging economies where the demand for advanced diagnostic solutions is growing rapidly. This strategic effort at innovation and expansion is critical to meet the increasing demand for effective management of liver diseases. However, despite its positive growth curve, the sectors still face certain problems. Major limitations of market growth are the high costs of diagnostic devices and instruments, especially in cost-sensitive areas. The costs may deter access to advanced liver biopsy technology, thus affecting patient care services and outcomes.

The market for liver biopsy has excellent growth potential in the future, with a peaking tendency on the grounds of the increasing prevalence of liver diseases, ever-increasing demand for innovative diagnostic techniques, and collaboration between researchers, clinicians, and technologists. Against this backdrop, cost-related challenges need to be addressed to ensure ultimate patient care and utilize the effective use of the market.

Market Trends in Liver Biopsy Technology:

| Trend | Description | Implications for the Liver Biopsy Market |

|---|---|---|

| Advancements in Imaging | Use of ultrasound, CT, and MRI for guidance | Improved accuracy and reduced complications |

| Liquid Biopsy Development | Non-invasive testing using blood samples | Potential to reduce the need for traditional biopsy |

| Automation in Biopsy Devices | Introduction of automated biopsy systems | Increased efficiency and standardization |

| Enhanced Patient Safety | New protocols and technologies for risk reduction | Higher adoption rates among clinicians |

| Telemedicine Integration | Remote consultation for biopsy interpretation | Broader access to specialists and reduced patient burden |

Liver Biopsy Market Dynamics

Drivers

-

Transforming Liver Biopsy Technologies and Advancing Patient Care

Several key market drivers are impacting the advancement of liver biopsy systems. Advances in technology including elastography and advanced imaging reduce invasiveness while improving diagnostic accuracy, thus making procedures less hazardous for patients. According to WHO research, over 844 million have chronic liver diseases, which makes very precise diagnostic equipment a necessity. Given that conditions such as fatty liver disease and viral hepatitis are increasingly causing a global burden, the awareness and subsequently the demand for the systems for liver biopsies make them indispensable for the diagnosing of the said conditions. Furthermore, the patients are in larger numbers requiring less invasive procedures that result in reduced recovery time, creating a compulsion for the healthcare provider to innovate. It has recently been reported that more than 70% of patients prefer minimally invasive diagnostic options. The regulatory bodies also aim for more accurate, reliable, and standardized diagnostic methods, thereby prompting innovation in liver biopsy technologies.

Interdisciplinary approaches to finding solutions to these needs are fostered by the collaboration of researchers, clinicians, and technologists. Furthermore, chronic liver diseases continue to increase their prevalence, and more and more patients are generating the need for the improvement of diagnostic tools. According to estimated figures, one in four adults suffers from non-alcoholic fatty liver disease. Financial benefits for healthcare providers with efficient and cost-effective solutions also aid in the continuous evolution of liver biopsy systems to ensure optimal patient care and outcomes. All these diverse drivers are transforming the current landscape of liver biopsy technologies.

Restraints

-

Concerns Regarding Invasiveness and Interpretation Variability

-

Economic Barriers and Competition from Non-Invasive Alternatives

Liver Biopsy Market - Key Segmentation

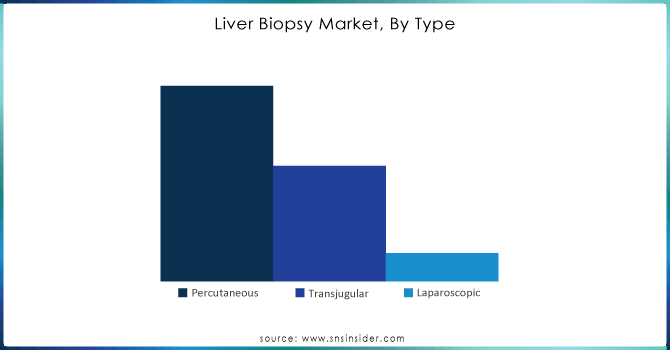

by Type

The percutaneous biopsy segment dominated the liver biopsy market, accounting for approximately 60% of the total market share in 2023. This technique is favored due to its minimally invasive nature, which allows for quick recovery and reduced patient discomfort. It utilizes imaging guidance to precisely target liver tissue, making it a preferred option for diagnosing liver conditions. Furthermore, advancements in imaging technologies have enhanced the accuracy and safety of percutaneous biopsies, contributing to its widespread acceptance.

The transjugular biopsy segment is projected to grow at the fastest rate, with an estimated growth rate of around 8% annually. This method is particularly beneficial for patients with coagulopathy or those at high risk of complications from percutaneous procedures. Its ability to obtain liver samples while minimizing bleeding risk makes it increasingly appealing to healthcare providers.

Do You Need any Customization Research on Liver Biopsy Market - Enquire Now

by Indication

The NAFLD segment held a significant share of the market, representing approximately 45% of the total indications for liver biopsy procedures in 2023. The rising prevalence of obesity and metabolic syndrome globally has contributed to the increased demand for diagnostic solutions related to NAFLD.

The autoimmune hepatitis segment is expected to grow the fastest, with a projected growth rate of 9% annually. As awareness of autoimmune diseases increases, more patients are being diagnosed, driving demand for accurate diagnostic methods such as liver biopsies.

by End User

The hospitals & Clinics segment was the largest in the liver biopsy market, accounting for about 70% of the market share in 2023. Hospitals and clinics are equipped with advanced diagnostic tools and skilled personnel, making them the primary locations for conducting liver biopsy procedures.

Diagnostic centers are emerging as the fastest-growing segment, with an estimated growth rate of 10% annually. The rise in outpatient diagnostics and the increasing focus on specialized facilities are propelling this growth. Diagnostic centers provide targeted services and can enhance access to liver biopsy procedures, making them an attractive option for patients and healthcare providers.

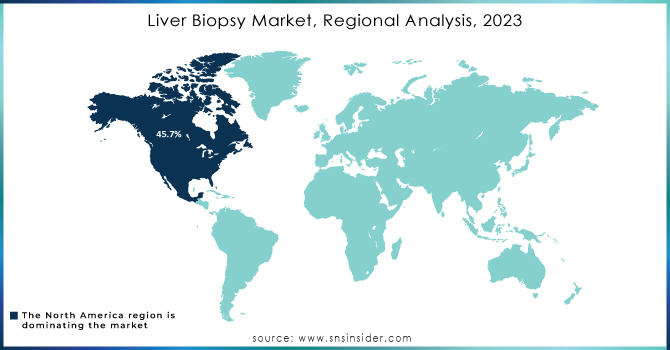

Liver Biopsy Market Regional Analysis

North America's liver biopsy market was the dominant region in 2023 with a 45.7% share because of technologically advanced health care in this region, which has an increasing population that suffers from liver diseases, such as alcoholic liver disease, as well as more healthcare spending. Government support for research and development initiatives will also fuel the expansion of this market. It is a major cause of mortality and morbidity in the Americas. The CDC reports that as many as 38,170 deaths were due to liver conditions in the year 2016, while nearly 6.10% of U.S. adults are reported to be diagnosed with some form of liver disease. Liver diseases accounted for approximately 4.5% of deaths in the United States in 2020, which further brings it to the forefront and highlights its crucial importance in public health.

Other significant markets in Europe include Germany, France, and the U.K., which are being fuelled by increased utilization of diagnostic services in tertiary care hospitals, the number of research and development activities related to chronic disease diagnosis, and the rise of new companies dealing with medical equipment. According to a 2022 report, nearly 30,000 deaths in the U.K. have been linked to liver disease, thereby depicting the same as an important health concern.

The Asia Pacific region is anticipated to grow with a high CAGR for the liver biopsy market, mainly due to the high growth rate of the healthcare industries in major economies such as China, Japan, and India. The regional market leader is Japan, driven by available technologies and increasing healthcare costs along with governmental support towards research. It is observed that nearly 25% of the population of Japan suffers from chronic liver diseases, such as hepatitis B and C. The country has a huge patient base suffering from chronic diseases and is witnessing substantial growth opportunities. The rapid advancement of healthcare technology and enhanced demand for superior-quality diagnostic devices are also likely to boost market growth in the region.

Key Players in the Liver Biopsy Market by Offering

1. Biopsy Devices and Instruments

-

Becton, Dickinson, and Company

-

C. R. Bard, Inc.

-

Argon Medical Devices, Inc.

2. Imaging and Guidance Technologies

-

Medtronic

-

Boston Scientific Corporation

-

Veran Medical

3. Diagnostic Solutions and Laboratories

-

Hologic, Inc.

-

Leica Biosystems

4. Innovative Technologies

-

Mauna Kea Technologies

-

Intact Medical Corp.

-

Fujifilm Medical Systems

5. Specialty and Emerging Players

-

RI.MOS.

-

INRAD Inc.

Recent Developments

Boston Scientific acquired Apollo Endosurgery in April 2023, expanding its portfolio of minimally invasive solutions for gastrointestinal disorders, including liver biopsies, which are crucial for diagnosing liver diseases.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.90 Billion |

| Market Size by 2032 | USD 1.65 Billion |

| CAGR | CAGR of 6.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Percutaneous, Transjugular, Laparoscopic) • By Indication (Non-alcoholic Fatty Liver Disease, Chronic Hepatitis B Or C, Autoimmune Hepatitis, Alcoholic Liver Disease, Others) • By End User (Hospitals & Clinics, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson, and Company, Cook Medical, R. Bard, Inc., Argon Medical Devices, Inc., Medtronic, Boston Scientific Corporation, Veran Medical, MDxHealth, Hologic, Inc., Leica Biosystems, Mauna Kea Technologies, Intact Medical Corp., Fujifilm Medical Systems, Sterylab, MOS, INRAD Inc. and Others |

| Key Drivers | • Transforming Liver Biopsy Technologies and Advancing Patient Care |

| Restraints | • Concerns Regarding Invasiveness and Interpretation Variability • Economic Barriers and Competition from Non-Invasive Alternatives |